Ryan McVay/DigitalVision via Getty Images

Introduction

In this article, I take a look at the ProShares UltraShort FTSE Europe ETF (NYSEARCA:EPV) (hereinafter referred to as the “Fund“). The FTSE Developed Europe All Cap Index (hereinafter referred to as the “Index“) is a market capitalization weighted index representing the performance of large, mid- and small-cap companies in Developed European markets, including Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, the Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland and the United Kingdom.

Per the Fund’s website, the Fund’s investment objective is as follows:

ProShares UltraShort FTSE Europe seeks daily investment results, before fees and expenses, that correspond to two times the inverse (-2x) of the daily performance of the FTSE Developed Europe All Cap Index®.”

For the next 4-6 months, I am bullish on the Fund and have been using it to hedge my long European stock exposure (which consists of international funds in my retirement accounts, including SGOVX). I currently own the Fund, as well as other short exposure ETFs, including (QID), (SJB) and (RWM).

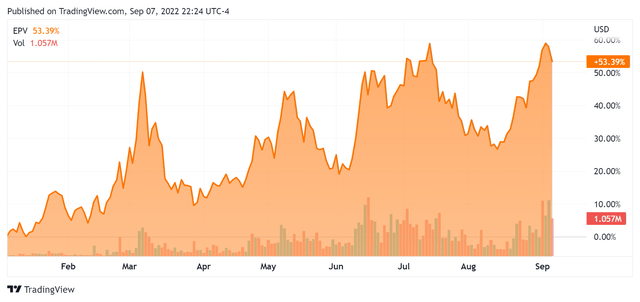

All of these ETFs have been very successful year-to-date. As of September 7, 2022, the Fund is up more than 50%.

The Buy Rationale

Of course, after such a large gain in 2022 for the Fund and corresponding losses for long-only funds, investors are “hoping” a bottom is in place in the European equity markets. In this regard, I think investors are underestimating how strong this recession is likely to be, and also underestimating how much further the recession has to go in Europe, where interest rates were just raised by 75 basis points. If the U.S.’s Federal Reserve Bank has been behind the curve on inflation (it’s not transitory after all!), then European central bankers are likely even further behind the curve on inflation.

In addition to rising interest rates, I do not think the markets have fully priced in the adverse effects that the energy crisis will have on the earnings of European companies. As has been widely noted, the West’s proxy war with Russia and Putin’s response to the West’s sanctions have resulted in soaring consumer electricity prices in Europe. A cold and dark recession for Europe appears to be nigh (if not already at hand), exacerbated by the continent’s dependence on Russian natural gas. (See “All-In Podcast,” for a great discussion.)

There is likely no quick fix to Europe’s energy problems as the continent seems to have undervalued energy independence (in favor of the Green agenda) and, as a result, higher energy prices will increase input costs and reduce company profits. Many European manufacturers have recently shut down plants, continuing a process that started in the spring of 2022. The energy crisis will likely only get worse in the winter, which is coming soon.

If that wasn’t bad enough, disruptions in the supply of food and materials due to the Ukraine War and China’s Covid shutdowns are likely to further slow the European economy. Further, as the Chinese and U.S. economies slow, European exports (an important component of European public company profits) to those countries will likely decline; indeed, this is, in my view, a deepening global recession that will likely hit Europe hardest. Things will likely only get worse as the Fed (and the ECB) increase rates into this global recession.

In my view, hedging equity exposures, including, and in particular, European equity long exposure, makes sense in the current environment; the Fund is a vehicle to do so. Other ETF options to short broad European equity markets are scarce (if non-existent), at least in the U.S., but there are plenty of international short ETF products for investors desiring to go that route. I’m utilizing the Fund, however, because I want to specifically short European equites.

Basics

- Ticker: EPV

- CUSIP: 74348A434

- Inception Date: 6/16/09

- Expense Ratio: 0.95%

- Gross Expense Ratio: 1.48%

- NAV Calculation Time: 4:00 p.m. ET

- Distributions: Quarterly

Top Holdings

Vanguard FTSE Europe (VGK) Swap Goldman Sachs Int’l 85.42%

Vanguard FTSE Europe (VGK) Swap Ubs Ag 59.55%

Vanguard FTSE Europe (VGK) Swap Societe Generale 34.70%

Vanguard FTSE Europe (VGK) Swap Citibank Na 20.46%

Vanguard FTSE Europe (VGK) Swap Morgan Stanley & Co. Int’l Plc 0.36%

Total 200.49%

*Holdings as of 2022-08-31 (per Seeking Alpha)

Owning EPV is different than shorting a single stock outright; that process (shorting a single stock) involves borrowing shares to sell and then, in the best case scenario, buying them back to cover the position after the price has decreased. Hence, your gain or loss is equal to the difference between the price you shorted at and the price at which you cover said short. I have nothing against shorting single stocks, although it does involve borrowing the shares on margin and margin rates are currently rising. Avoiding margin, coupled with a desire to avoid individual company risk, have led me to the Fund.

As can be seen from the top holdings listed above, EPV enters into swap agreements to position the Fund to benefit from declines in the Index, and the Fund has entered into these derivative contracts with large international banks. While holding contracts with the largest names in investment banking may reduce risk, the Lehman Bros. bankruptcy proved otherwise (and investors should keep counterparty risks – the risk that the party on the other side of the trade complies with the terms of the swap agreement – in mind). In addition to counterparty risks, an investor in the Fund takes on the risk that the Fund will not track the relevant index and otherwise meet its return objectives. Indeed, the Fund highlights that:

Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return, and ProShares’ returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks.”

(Emphasis Supplied.)

Because of counterparty and index tracking risks, the Fund is not, in my view, appropriate for long holding periods. Other risks, including the leveraged nature of the Fund, are outlined in the Fund’s Prospectus.

Concluding Thoughts

For the reasons note above; namely, (1) inflation, (2) rising rates, (3) the Ukraine War and the related energy crisis, (4) the China Covid lockdowns, and (5) the overall global economic slowdown, if not global recession, I am very bearish on Europe. I am hedging my long European equity exposure via the Fund.

In my view, the Fund is a buy on pullbacks and I expect to trade around a core position. I added to my Fund position on 9/12/2022 near $15/share (and just prior to my submitting this article).

Cheers!

Be the first to comment