Scott Olson

I’m going to be transparent here. EPR Properties (NYSE:EPR) is the largest position in my income strategy and I’m still buying shares. I first came across the company amidst the absolute chaos and uncertainty posed during the early months of 2020 when the full depth and breadth of the coming pandemic were still yet to be understood and equities were selling off like we were facing the end of the world. The bears then, as seemingly right as they are now, were adamant that stay-at-home orders would come to form critical pillars of the post-pandemic zeitgeist. This would see the experiential economy that up until March 2020 had generated revenue and FFO that powered total returns for EPR in excess of the broader market permanently become toxic. I stated in my inaugural coverage; EPR Properties, Wrecked By COVID-19, Is A Strong Buy, that the market was unfairly pricing in a widespread bankruptcy of its tenants and the selloff to $16 per share made no sense.

Indeed, there was some luck involved with this call as the trading phenomenon of early 2021 brought about the rise of meme stocks and swept up the company’s largest tenant AMC (AMC) into a rally that would see the theatre chain raise large amounts of liquidity to stay afloat against the chaos wrought by the pandemic. The rise of the retail traders, or APEs as they call themselves, helped save AMC and likely rescued a material level of FFO for EPR Properties. To be clear here, EPR would have been in a significantly more difficult position than it is now had the APEs not risen. Hence, I understand the apprehension of bears to invest in a company whose largest tenant was saved by APEs.

The Regal bankruptcy has represented a flash in the pan for the bears as the common shares of EPR dived to new lows on the back of it. But the recent third quarter earnings have rendered this all to be a lot of fracas over an unfortunate but broadly immaterial event.

Regal’s Paying Rent And Investments Continue To Stack Up

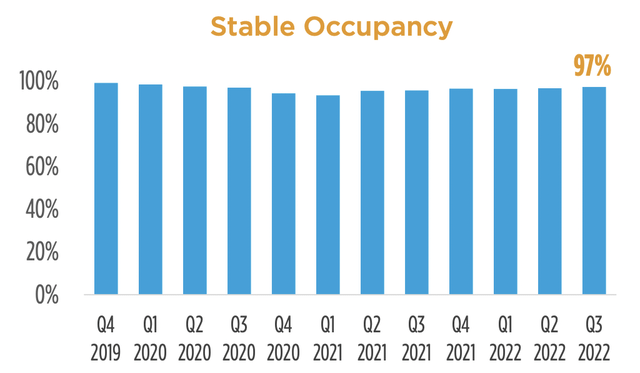

EPR’s earnings for its fiscal 2022 third quarter saw total revenue come in at $161.4 million, up 15.6% from the year-ago quarter and a beat of $5.97 million on consensus estimates. Rental revenue came in at $140.47 million and was up from $123 million in the year-ago quarter as occupancy rates remained steady at 97%.

EPR Properties

The company was able to collect $4.5 million of deferred rent owed during the quarter, including all rent and deferral payments from Regal for July and August. However, with Regal’s chapter 11 bankruptcy being initiated in September, the theatre chain failed to make rent payments for the last month of the third quarter. The impact of this on rental revenue was mitigated by scheduled rent increases and income from acquisitions and developments completed over the last year. Regal resumed rent and deferral payments for all 57 of its leases with EPR from October and November. Whilst there can be no certainty that further rent payments will be made, chapter 11 has affected just one month of rent with no closures so far. Regal is set to emerge from chapter 11 proceedings in the first quarter of 2023.

Adjusted EBITDA came in at $129.1 million, up from $120.32 million in the year-ago quarter, and meant adjusted FFO at $1.22 was a beat on consensus estimates and was an increase from $0.92 in the year-ago period. EPR expects FFO to come in at $4.50 to $4.68 for the full year, up from a prior range of $4.50 to $4.60.

The Everything Of EPR Bears

Amidst uncertain times, the health of a company’s balance sheet becomes the foundation and arbiter for its ability to create long-term alpha. EPR’s balance sheet remains strong, with $160.8 million in cash and equivalents and no borrowings on its $1 billion unsecured revolving credit facility. This places the company in a great position to not only maintain its dividend payout, but to seize further acquisition opportunities to grow the size of its investment portfolio.

Total investments exited the quarter at $6.6 billion with 356 properties in service. This was bolstered by experiential investment spending of $82 million including the acquisition of a former conference center in Murrieta, California which will be redeveloped into a natural hot springs resort. EPR, without raising more capital, expects to spend an additional $250 million on experiential development and redevelopment projects over the next two years.

We know everything from the bearish thesis. That streaming will wipe away theatres. That the company’s assets will get stranded against the new digital-only era of movie watching. That the dividend is too high despite this an opportunity and only being due to the sudden downward movement from $55 to the mid $30s on the back of the Regal bankruptcy. With Netflix (NFLX) now set to release Glass Onion: A Knives Out Mystery in selected AMC and Regal theatres later this month and with two blockbuster movies to end the year coming up, bears are about to lose everything from their vision of a derelict future. I continue to be long EPR’s common share and expect a reversal to recent highs once the market realizes nothing has fundamentally changed.

Be the first to comment