Brett_Hondow/iStock Editorial via Getty Images

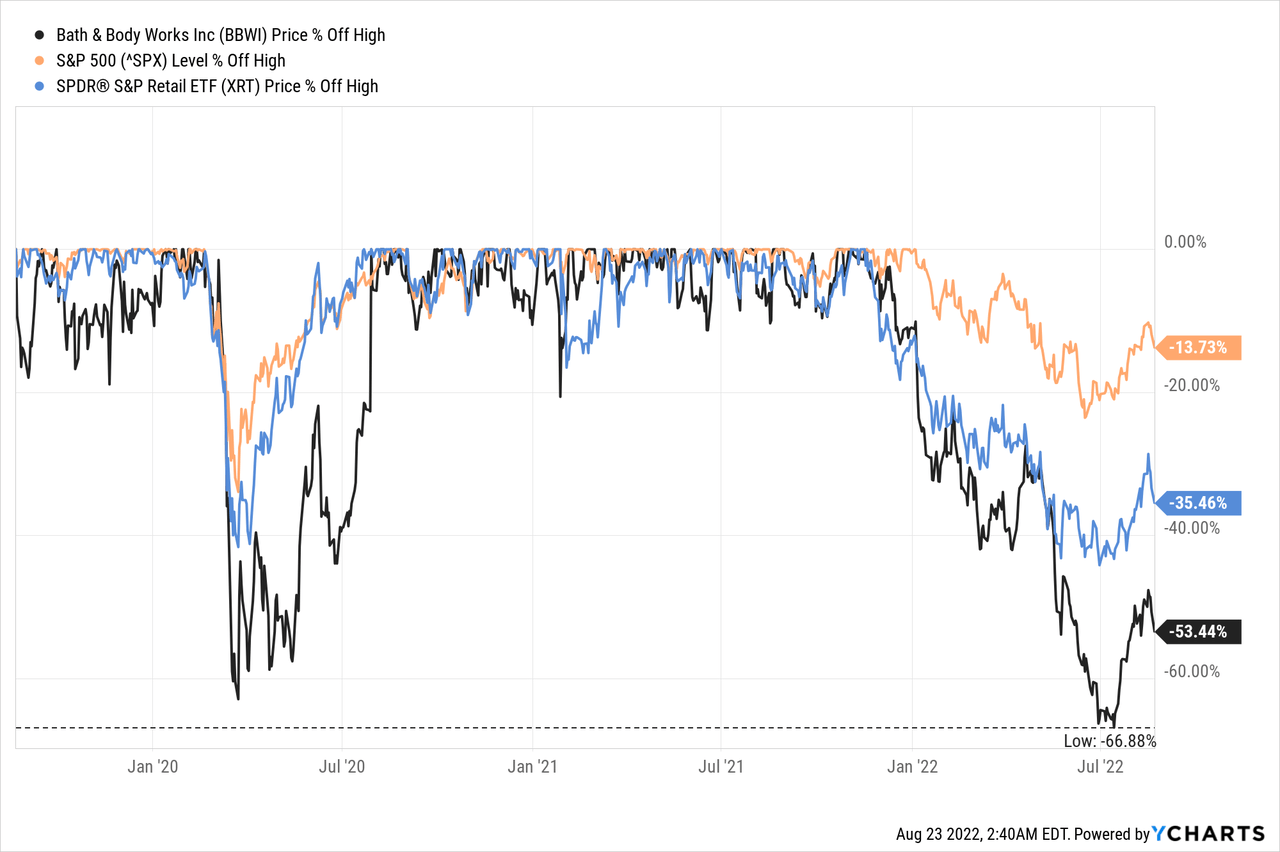

In my last article about Costco Wholesale Corporation (COST) I already wrote that retailers were hit rather hard during the last (or current – depending on the perspective) bear market and the S&P Retail ETF (XRT), which can be seen as a representation of the retail sector declined much steeper than the broader S&P 500 (SPY).

And when looking at individual companies it might not be surprising that the stocks of some retailer declined much steeper than the broader market (or the retail sector). One of the famous examples is Target (TGT), which lost half of its previous value in the last few months. Another example is Bath & Body Works (NYSE:BBWI), which declined as steep as 66% since the end of 2021. And when a stock is losing two thirds of its previous value, we must ask the question if we have a bargain on our hands. The stock recovered a little bit in the last few weeks but is still trading more than 50% below its previous high.

Business Description

Before we try to answer the question in more detail if Bath & Body Works is a good investment, we should offer a short business description again as the business changed quite a bit since my last article was published in April 2021. Bath & Body Works was one of two main business segments of the company previously known as L Brands (and trading under the ticker “LB”) with the second business segment being Victoria’s Secret (VSCO). In 2020, management announced its plans to sell Victoria’s Secret to a private equity firm, but the deal fell through, and the company announced in 2021 that L Brands will spin off the business into a new company, which had its IPO in July 2021. And finally, L Brands changed its name to Bath & Body Works, Inc.

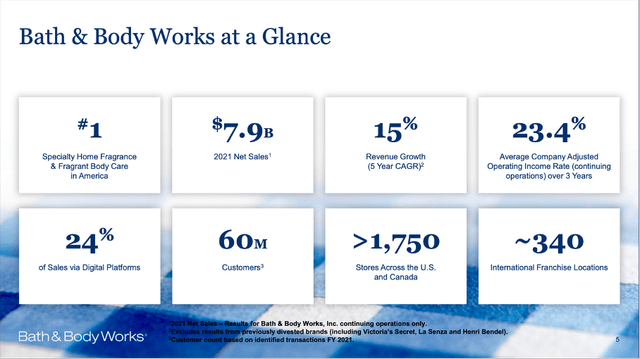

Bath & Body Works Investor Presentation June 2022

Bath & Body Works, which can now be described as a global leader in personal care and home fragrance (it is #1 in specialty home fragrance and fragrant body care in America) is generating about $7.9 billion in annual sales and is operating about 1,670 locations in the United States and about 100 locations in Canada. Additionally, the company is operating more than 360 international franchise locations.

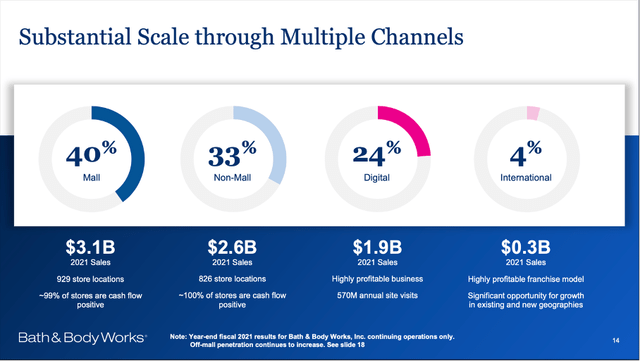

The company is also trying to shift towards direct sales and in fiscal 2021 about $1.9 billion in revenue stemmed from digital sales (about 24% of total sales) and the company had 570 million annual visits for its site. However, in fiscal 2020 direct sales accounted for 31% of total sales and were $2,004 million. The explanation might be the lockdowns in 2020 which forced many customers to shopping online, but the same customers might have returned to the stores in 2021. Management is certainly continuing its multi-channel strategy and BOPIS (Buy Online, Pickup in Store) is now available in more than 1,200 stores (an increase of 500 compared to just one quarter earlier).

Bath & Body Works Investor Presentation June 2022

And Bath & Body Works is also trying to increase its off-mall penetration – not only by focusing on digital sales but also by opening new locations outside of malls.

Growth Initiatives

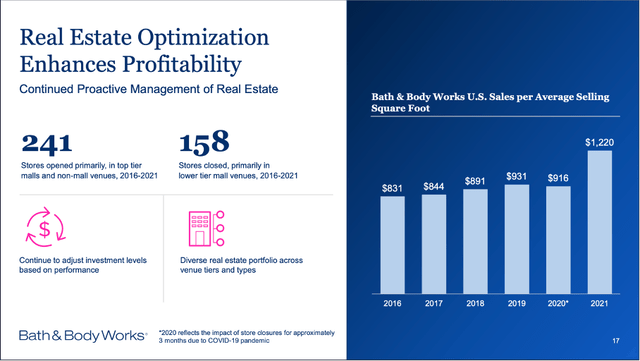

These are also two of the strategies two ensure growth in the years to come. In the last few years, the company was optimizing its real estate portfolio and between 2016 and 2021, the company opened 241 stores primarily in top tier malls and non-mall venues while closing 158 stores in lower tier mall venues. And this seems to have a positive effect as the U.S. sales per average selling square foot was between $831 and $931 in the years from 2016 to 2020 (with continuous improvements over the years), but in 2021 it increased to $1,220.

Bath & Body Works Investor Presentation June 2022

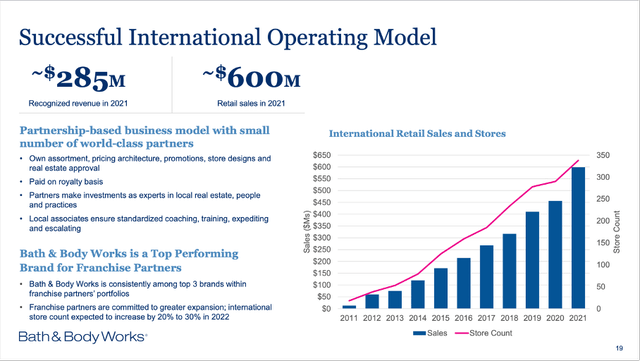

Aside from optimizing the real estate portfolio, Bath & Body Works is focusing on growing its international business. In the last six months, it opened 32 stores and closed only one store (increasing the number of international stores by 9.2% in only six months). For the full year 2022, the company is planning to close only 4 to 7 stores but will open 69 to 95 new stores (an increase of 20% to 28% in a single year). Right now, most of the stores are either located in the Middle East (171 stores at the end of 2021) or in Asia (87 stores at the end of 2021).

Bath & Body Works Investor Presentation June 2022

And when looking at the mid-term targets for the business (three-to-five-year financial targets), management is expecting total sales as well as operating income to grow in the mid- to high-single digits.

Bath & Body Works Investor Presentation June 2022

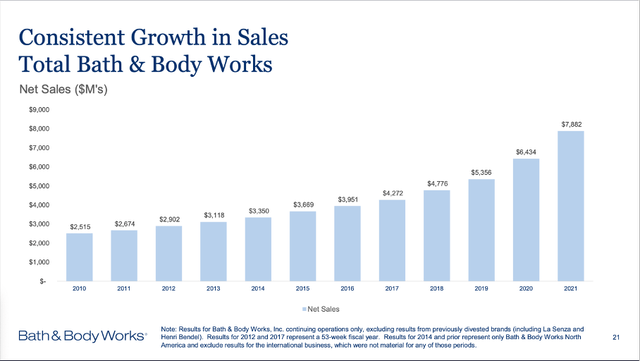

And when looking at the past decade, Bath & Body Works could increase its net sales with a solid pace. Between 2010 and 2021, revenue increased with a CAGR of 10.94% and especially in the last two years the company reported growth rates above 20%.

Bath & Body Works Investor Presentation June 2022

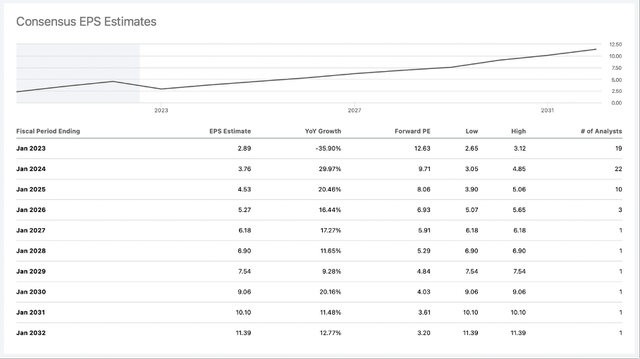

While management is expecting Bath & Body Works to increase in the mid-to-high-single digits, analysts are even more optimistic for the years to come. For fiscal 2023 till fiscal 2026, analysts are expecting growth rates between 15% and 30% and until fiscal 2031 earnings per share are expected to grow with a CAGR of 9.71% (although estimates after fiscal 2025 are based on only one analyst).

All in all, growth rates in the mid-single digits (or even mid-to-high single digits) seem realistic for the years to come.

Second Quarter Results

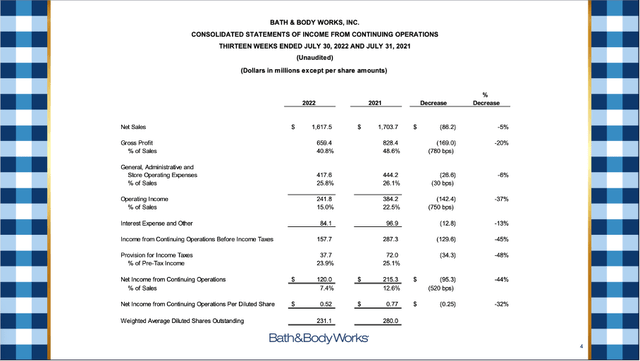

But when looking at the second quarter results for fiscal 2022 we are not getting the impression of a high growth company as top and bottom line had to report declining numbers. Net sales declined from $1,704 million in Q2/21 to $1,618 million in Q2/22 – a decline of 5.0% year-over-year. Operating income also declined 37.0% year-over-year from $384 million in the same quarter last year to $242 million this quarter. And net income per diluted share declined even 61.2% year-over-year from $1.34 in Q2/21 to only $0.52 in Q2/22.

Bath & Body Works Q2/22 Presentation

Of course, we must put these numbers in perspective. When looking at the top line (and when looking at growth in the last two years), it is not surprising if growth is slowing down a bit. In fiscal 2020 net sales increased 20.1% YoY and in fiscal 2021 net sales increased even 22.5% YoY. After several quarters of high growth rates, it is not alarming when growth is stalling a bit. Additionally, Bath & Body Works is also facing price pressures like most other businesses and when looking at the bottom line, we should not ignore $0.57 earnings per share from discontinued operations in the same quarter last year.

Bath & Body Works Q2/22 Presentation

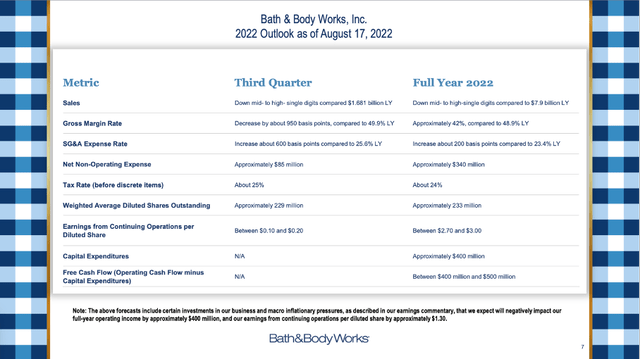

And when looking at the full-year guidance, the company is expecting sales to decline in the mid-to-high-single digits compared to fiscal 2021 sales. Diluted earnings per share from continuing operations are expected to be between $2.70 and $3.00 while earnings per share from continuing operations in fiscal 2021 were $3.94 (total EPS were $4.88). Free cash flow is expected to be between $400 million and $500 million.

Recession

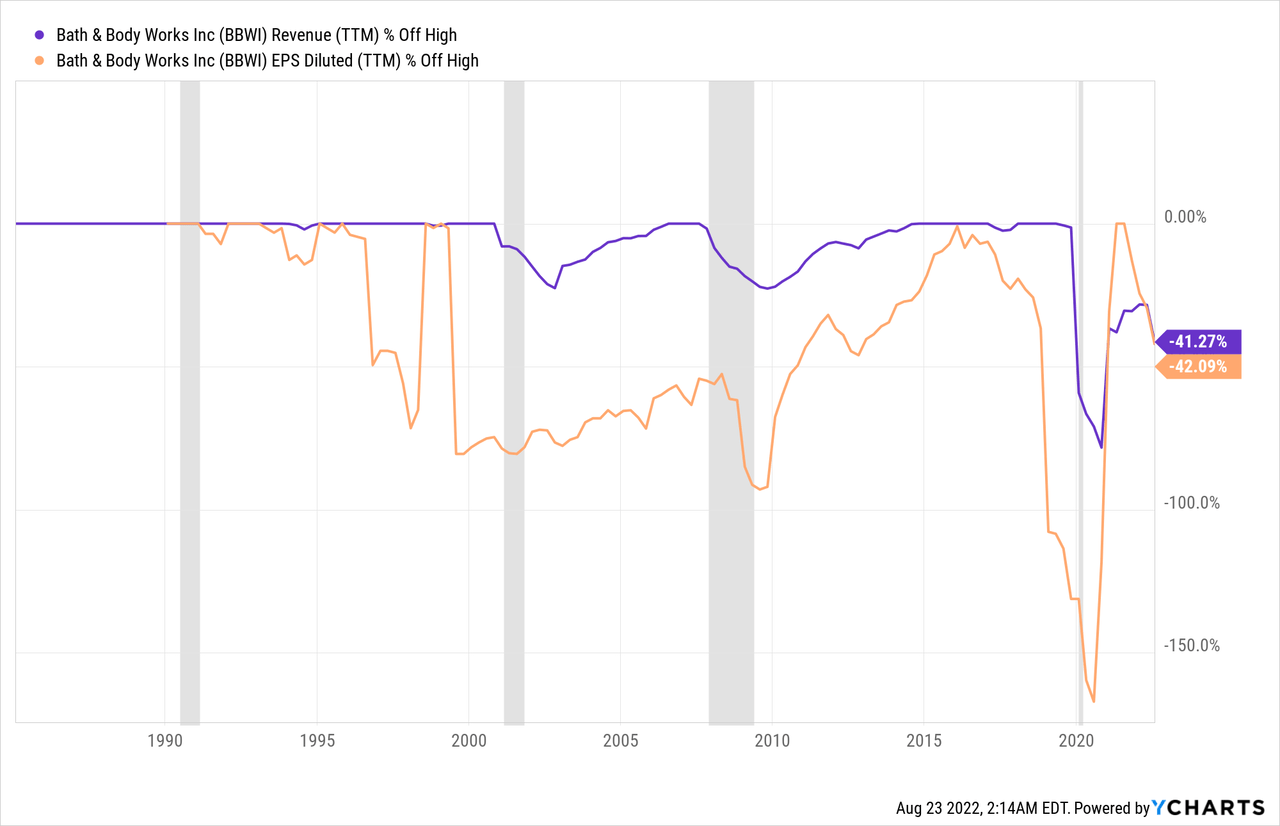

When looking at the second quarter results, Bath & Body Works is already struggling. However, the company could struggle even more in the years to come. Right now, it seems likely that the U.S. economy will enter a recession in the next few quarters and specialty retailers, which are selling non-essential items suffer quite hard in such times.

During the last few recessions, Bath & Body Works (or: L Brands) was clearly affected and revenue as well as earnings per share declined. And while we could argue that the lockdowns during the last recession had a huge negative impact on revenue (as well as earnings per share), revenue also declined in the two recessions before. And while the decline it not so obvious for earnings per share (as the fluctuations in the past decades were higher), the number contracted as well.

When looking at previous results, we should not forget that Victoria’s Secret was still part of the business and contributed a huge part to the top line. And I would argue that Victoria’s Secret might be affected more by a potential recession than Bath & Body Works. Personal care and home fragrance products might be seen more as essential products and are probably purchased during a recession as well as during economic expansions. On the other hand, there seems to be cheaper alternatives for many Bath & Body Works products (including body creams, body lotions, liquid hand soap or candles) as they are rather expensive. And when the disposable income is declining (which is typical during a recession), customers are cutting non-essential items or are looking for cheaper alternatives.

At this point, we must assume Bath & Body Works being affected in a negative way by the next potential recession and must take that into account when analyzing the business.

Economic Moat?

When deciding whether a stock could be a good long-term investment or not, a potential economic moat plays an important role. And management seems to see its Beauty Park as a strategic advantage for the business. Due to its Beauty Park, the company can control its channels of distribution and has vertically integrated supply chain management, which is certainly a valuable asset. This is enabling Bath & Body Works to control costs better and control the quality of the products.

Beauty Park Overview Presentation

And one of the most important advantages is the fact, that Bath & Body Works is able to develop and launch products within 12 to 14 months. It is also able to bring the products to the distribution centers within a few weeks (instead of a few months) due to the short ways within Beauty Park. Products must be transported only a few miles instead of thousands of miles across the country.

This could be a strategic advantage and could even generate a wide economic moat for the business as it might lead to cost advantages that other competitors are not able to duplicate. And while I see the potential for an economic moat around the business, I remain a bit sceptic if Bath & Body Works is more than just a retailer. And if we have an economic moat around the business, the question remains how strong that moat is as I don’t see the concept of Beauty Park being impossible to copy for a competitor.

Intrinsic Value Calculation

One of the final steps to determine if a company is a good investment is a look at the stock price and determining an intrinsic value for the stock. And as always, I will use a discount cash flow calculation to calculate a price I would be willing to pay for the stock right now. As basis for our calculation, we can take the free cash flow according to guidance (midpoint of guidance will be $450 million). And when using 231.1 million in outstanding shares and take a discount rate of 10%, the company must grow its free cash flow about 5% annually from now till perpetuity to be fairly valued. And at a first glance, this seems like realistic assumptions for the business.

But in my opinion, we must modify our assumptions a little bit. First, I would assume a lower free cash flow for fiscal 2023 due to the likelihood of a recession. When looking at past performance, a further decline seems likely, and I would assume $300 million in free cash flow for fiscal 2023. And for fiscal 2024 and 2025 we assume an improving business again and calculate with $470 million FCF in fiscal 2024 and $650 million in fiscal 2025 (these numbers are the result of analysts’ assumptions for these two years minus capital expenditures of $400 million). When calculating with these numbers, we get an intrinsic value of $57.20 for Bath & Body Works and the stock can be seen as undervalued right now. And when looking at the free cash flow generation in the past, $450 million in annual free cash flow also seems rather low.

Conclusion

For the years to come, I don’t have much doubt that Bath & Body Works will be able to grow. However, if a serious competitor should enter the field, it might be difficult for the company to defend itself – for example if a competitor should offer cheaper price and a similar quality. A wide economic moat is usually protecting a company from such a scenario, but I don’t know how strong the moat of Bath & Body Works actually is. Without doubt, the company has an established brand name (but the brand name is probably not enough to generate a moat). And cost advantages could lead to an economic moat, but I have my doubts how wide that moat actually is.

In my opinion, L Brands is undervalued right now as we can expect the business to grow with a solid pace in the years to come. Nevertheless, we should not ignore the potential missing moat and risk of growth rates suddenly slowing down.

Be the first to comment