gorodenkoff/iStock via Getty Images

EPAM Systems (NYSE:EPAM) is an advanced software engineering company specializing in software developments, platform engineering, software design, and other related services. The company is located in Pennsylvania but has branches across the globe, where it can supply its wide range of products across the many different growing segments of the Software Industry. The company has made some recent acquisitions that add to its large portfolio, and the publicly traded company was added to the S&P 500 at the end of the last year.

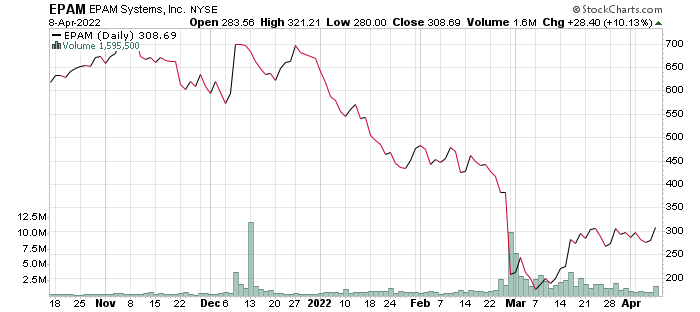

stockcharts.com

The question is, what level of optimism is reasonable when it comes to the margin of growth? We will look at how the company has performed over the years and why, despite reaching significant milestones in 2021, there is still room for a lot of growth in the coming years.

Industry Overview

Today, software and information technology are among the most valuable industries in business. It offers services becoming ever more crucial for operations and solving emerging challenges. The global software products market is set to grow at a compound annual growth rate (CAGR) of 11% until 2025. The market was close to reaching a trillion in 2021, reporting approximately $968 billion, and could reach $1.5 billion by the end of the forecast period. Contributing to this growth is a wide range of software products that can do almost anything when it comes to management and control. Whether this is in Software-as-a-Service (SAAS), Machine Learning (ML) and Artificial Intelligence (AI), analysis, cost management tools, and much more, the pandemic accelerated the transition for more tech-based work, resulting in an exponential rise in products to meet remote work, apart from the emerging web 3.0 that in and of itself will carry the industry forward into a new era.

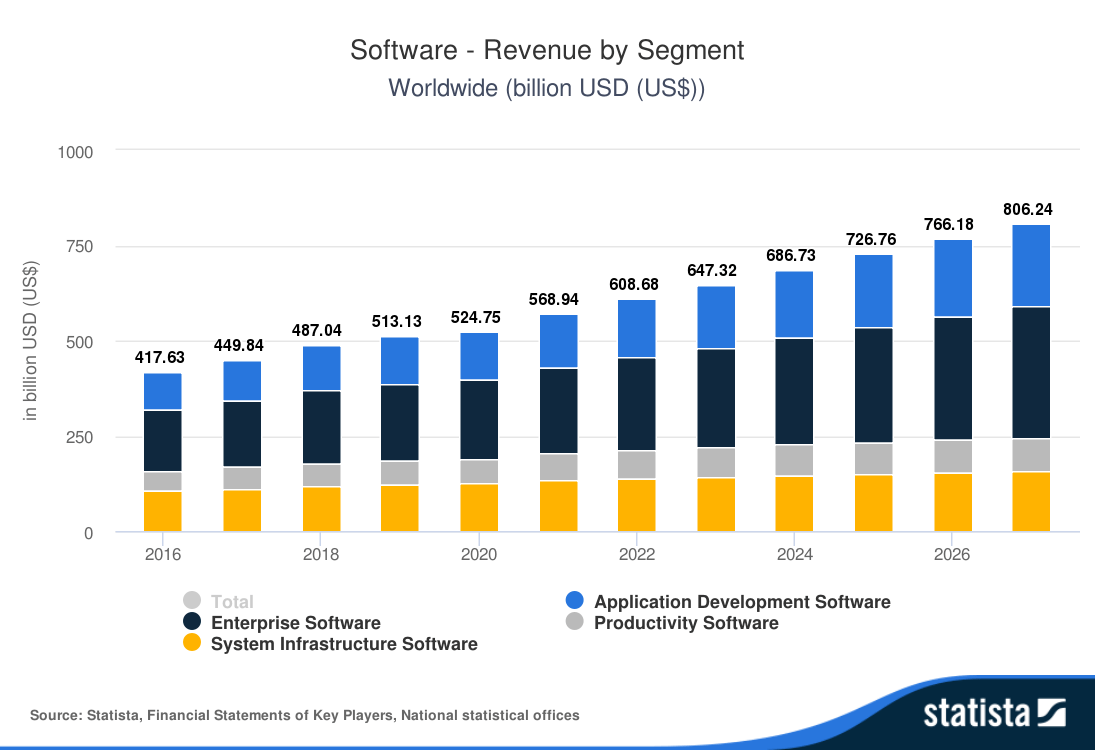

statista.com

Enterprise software remains the largest segment in the Software market, with an estimated market volume of $243.3 billion in 2022. This is followed by the Application Development Software Segment, which is right up EPAMs alley, at a comparatively close estimate of $153.5 billion estimated revenue by the end of the year. Historically, this segment has grown to overtake the System Infrastructure Software segment and could achieve annual revenue of $217 billion by 2027. The company is also well placed to benefit from the largest market in the world.

At an estimated revenue of $303 billion in 2022 alone, the United States accounts for about half of the industry’s global revenue. EPAM’s growth was rewarded by its addition to the S&P 500 at the end of 2021. This came from the removal of Kansas City Southern an industrials company, which was acquired by Canadian Pacific Railway Limited (CP). So how did the company perform throughout 2021, which warranted its inclusion in the S&P 500?

Recent Financials

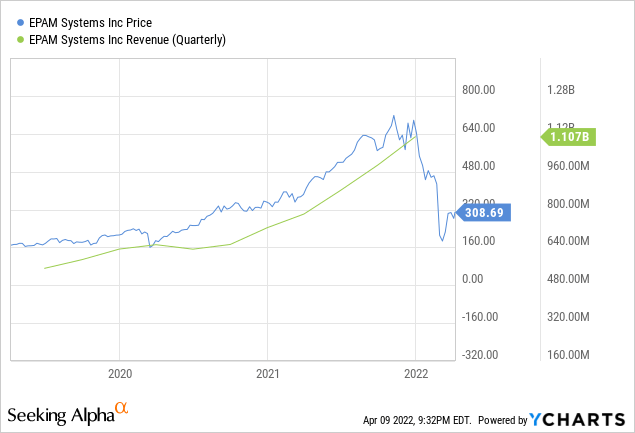

ycharts.com

EPAM closed the final quarter of 2021 with a 54.1% increase compared to the same quarter in 2020. The total reported revenue for the fourth quarter was $1.107 billion, breaking through the billion-dollar mark for the first time in a single quarter, and up to $384 million from the previous quarter. That took the yearly total to approximately $3.758 billion, rising 41.3% annually, with the company almost matching its entire 2020 revenue by the end of the third quarter. For the coming year, the company will be looking to break past $5.15 billion, at a 37% growth rate. Measuring how realistic this figure is will largely depend on how the company is forecasting sales throughout the year. The expected first-quarter revenue for 2022 is around $1.18 billion, marking an incredible year-on-year increase from the $781 million reported in the first quarter of 2021. Contributing to this optimistic growth are the many acquisitions EPAM made throughout the past year. These include various software development companies, digital consulting companies, and cybersecurity companies from countries across multiple continents. The company started in 2022 with the purchase of Enginiety; a company focused on providing engineering solutions to the e-commerce sector, further expanding EPAM’s portfolio. These acquisitions exemplify how much area EPAM covers in the software industry and how its diversified portfolio will be pivotal in continued revenue growth.

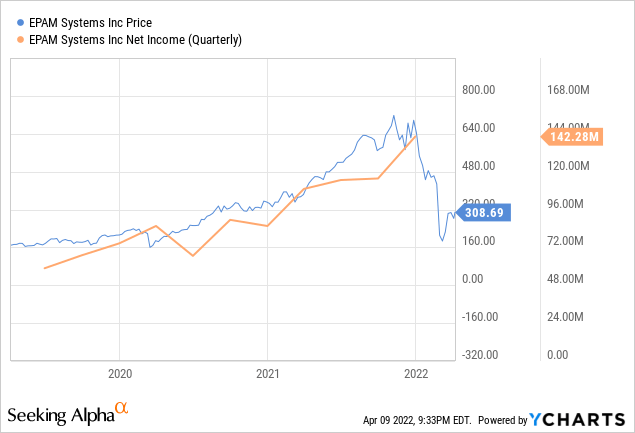

ycharts.com

Net income rose to $142 million in Q4. It also marked a 47.9% growth from the same quarter in the previous year. Interestingly enough, however, was the company’s reduced expenses during this quarter, which saw figures drop from -$11,395 million to -$1.362 million in the space of a single quarter. These reduced expenses resulted in a leap in net income applicable to shareholders from $115.7 million in the third quarter to $142.3 million by the final quarter. Even when the company incurred massive expenses, it can be considered an overall positive as these funds most likely went into further investments and general company development. This all resulted in an annual increase in net revenue applicable to shareholders from $327 million in 2020 to $482 million in 2021. This growth is encouraging, considering the number of purchases made, which would have made a decline explainable, given that the company starts to reap the benefit of those investments in the near future.

Risks and Outlook

EPAM recently made a drastic decision to withdraw not just the first-quarter guidance for 2022 but guidance for the entire year was scrapped due to the ongoing Russia-Ukraine crisis. The company cited that the conflict has created regional instability and could impact the company’s earnings, especially in Europe, which will see most of the consequences negatively affecting business in that area. However, that impact is minimal, and the company’s operations in other regions of the globe will ensure that business is steady. Prior to this announcement, the company had expected a total annual revenue worth $5.15 billion with a growth rate of at least 37%, including net income worth up to 14.5% of that revenue amount. That figure is now expected to take a slight hit. Though there is no clear indication of just how much EPAM has readjusted its expectations, it is safe to assume that it will be negligible. Growth margins will still be substantial by the end of the year, assuming the current crisis does not become even more critical.

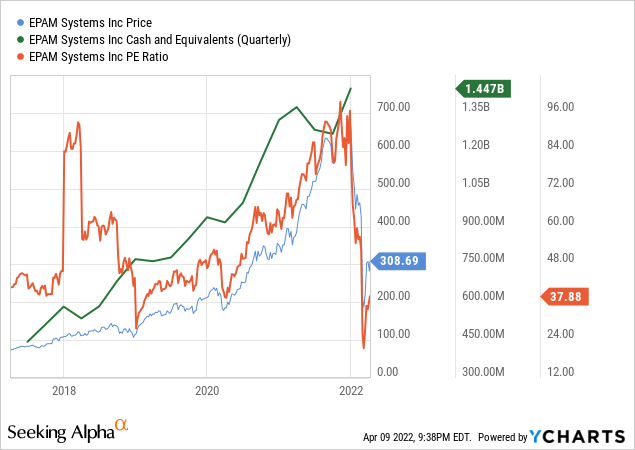

ycharts.com

The company’s cash and cash equivalents and restricted cash totaled nearly $1.5 billion by the end of 2021. This represented a not so insignificant increase from the $1.324 billion reported in 2020 and equivalent to about the total annual revenue the company is making at the moment. The company’s quarterly earnings per share all surpassed the estimated figures in 2021, and while these might take a slight hit as indicated, they are still expected to maintain positive numbers and growth throughout the year. The company’s Price/Earnings Ratio of 37.88 in 2022 is phenomenal, at a 2.63% growth rate in 2022, adding to its overwhelmingly positive financial outlook.

Conclusion

There remains little doubt that EPAM will continue to experience growth and turn a profit for the next few years to come. A diversified portfolio that taps into the wealth of reserves to be found in all sectors of the software engineering industry will keep the company afloat so long as it can maintain the quality of its products. From an investor’s perspective, however, a portfolio with a bullish stance on EPAM will undoubtedly be all that is needed to capitalize on this growth.

Be the first to comment