knowlesgallery/iStock Editorial via Getty Images

Several months ago, we said we no longer recommended investing in Micron (NASDAQ:MU). Since then, the company’s share price has dropped more than 23%, or triple the drop of the S&P 500 (SPY). The purpose of this article is to focus on Micron’s future growth potential while determining the ideal entry point for the company. Despite being a volatile stock, it’s beginning to become a more interesting investment.

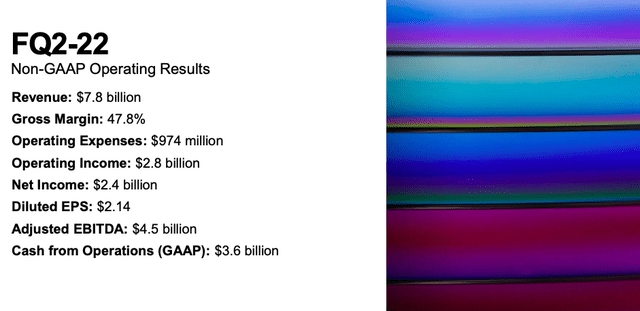

Micron FQ2 2022 Results

Micron had reasonably strong FQ 2022 results, but it continues to invest heavily in growth.

Micron achieved revenue of $7.8 billion with a strong 47.8% gross margin. The company had $974 million in operating expenses and $2.4 billion in net income. The company had incredibly strong cash from operations ($3.6 billion) but FCF for the quarter was a mere $1 billion as the company has continued to invest heavily in the business.

The company is continuing to guide for a midpoint of $11.5 billion in capital spending in 2022, meaning we expect FCF for the year will remain in the $4-5 billion range. That’s a roughly 6% FCF yield on the company’s $80 billion market cap. The company also has a $6 billion net cash position that it seems to be currently maintaining.

The company expects to see growth in line with the industry through 2022; however, it expects to see better-than-industry cost reductions which could potentially enable margins to expand some.

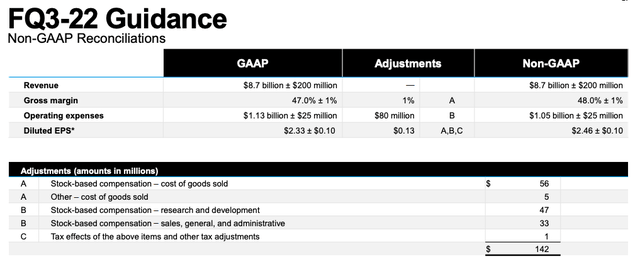

Micron 2022 Guidance

The company’s continued 2022 guidance shows continued strength.

Micron expects reasonable revenue growth with margins remaining roughly constant. Operating expenses will increase, but overall EPS will remain strong. The company has been using roughly 50% of its FCF for share buybacks implying for the year it’ll be able to repurchase roughly 3% of its outstanding shares in the market.

The company’s dividend is modest (~0.5%) implying roughly 3.5% direct shareholder rewards. These are still quite low.

The Cyclical Markets

The RAM markets are very cyclical. They have substantial capital requirements as seen through the company’s plan to spend more than $11 billion in capital spending.

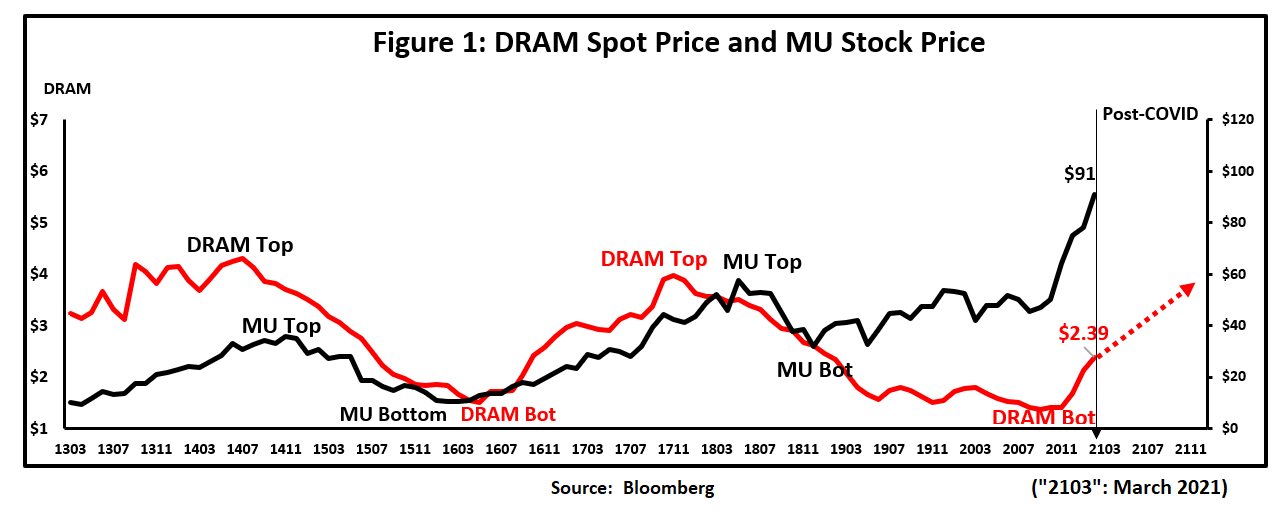

Micron Investor Presentation

The above graph shows the volatility in DRAM prices (along with volatility in Micron’s stock price). Of course, this doesn’t go to the present day but it gives you an idea of how Micron is susceptible to the volatile movement of the commodity prices. Now it’s worth noting that that susceptibility is going down for several reasons.

(1) Oligopoly

As companies leave the industry, it’s increasingly becoming less competitive, which means less capital overspending and less oversupply. The increased oligopoly in the industry supports the company’s strength.

(2) Capital Spending

Capital spending is becoming more modest. That’s because the industry is calming down. The company still needs to invest heavily to continue its growth, but as stated it expects better than industry average cost reduction.

However, it’s worth noting that Micron remains a much more cyclically volatile stock versus most other stocks.

Our Entry Point

The company is currently trading at a 6% FCF yield. In our view, an ideal entry point is a 7-8% FCF yield implying a $54-61 per share range to begin investing. That’s still additional weakness from the current level; however, it implies that an entry point could be coming up. At that level the company could generate market-matching shareholder rewards while still investing.

The company’s investments could enable the company to provide that FCF with market beating growth, helping to justify its valuation and overall shareholder returns. We expect, with the industry’s overall growth, this entry point will enable long-term market beating returns for investors.

Thesis Risk

The risk to the thesis is two-fold.

The first is volatility in the DRAM markets. Prices tend to be very volatile and they could go down even further. That could hurt the company’s continued FCF given its high capital spending requirements, which would hurt the company’s ability to provide continued shareholder returns.

The second is the opposite. DRAM prices could go up significantly, increasing the company’s cash flow and share prices, resulting in the company’s stock never hitting our entry point. That would mean that investors would miss out on the current prices and resulting shareholder rewards.

Conclusion

Micron has a unique portfolio of assets. The company is one of the leaders in DRAM production, which is essential to our modern day standard of living. As the oligopoly continues, the company’s new technology becomes increasingly more valuable, which has the potential to increase margins even further and shareholder returns.

The company’s continued struggle remains capital obligations. The company needs to spend heavily to maintain its market share and continue growth. The company has minimal remaining FCF, which means a roughly 3.5% shareholder yield and 6% FCF yield. We see a viable entry point at a 7-8% yield, however, there are some risks.

Let us know your thoughts in the comments below.

Be the first to comment