metamorworks/iStock via Getty Images

Results Summary for 3Q22

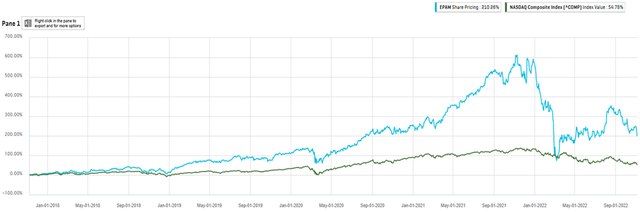

EPAM Systems, Inc. (NYSE:EPAM) had another very good quarter and has put to rest any fears the market may have had regarding its business model due to the Ukraine invasion. EPAM had a high percentage of IT staff in the Ukraine, Russia, and Belarus that is now far more balanced across markets in Latin America, India, etc. I am updating my estimates to incorporate 3Q22 results and 4Q22 guidance while reducing 2023 margins on macro headwinds. In addition I reduced the fair P/E target multiple to 25x vs 35x on higher for longer risk free / Fed rates. See my previous note for more depth and background on EPAM.

EPAM vs NASDAQ performance (Created by Capital IQ)

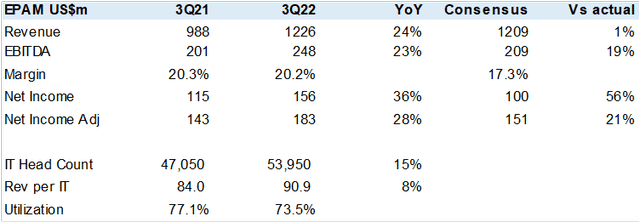

3Q22 Results showed very good pricing power with revenue per IT head count up 8% despite a still low utilization rate. EPAM staff in Ukraine continue to be impacted by the war while new hires and additional geographic locations need time to scale up. Nonetheless, margins are solid on lower opex and the company beat consensus. Main drivers where the travel and health care segments. EPAM guided for revenue of US$1.2bn in 4Q22 and EPS of US$2.6-2.7.

EPAM 3Q22 Results (Created by author with data from EPAM and Capital IQ)

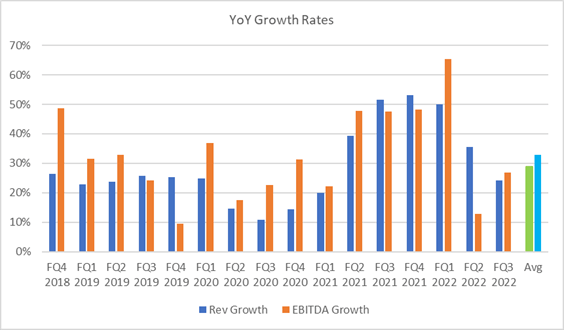

In the chart below, one can see the high levels of Revenue and EBITDA growth that EPAM has delivered. Below 10% growth rates are an exception to the norm, with the 5-year average at 29% and 32%, respectively.

EPAM Quarterly YoY Growth Rates (Created by author with data from EPAM)

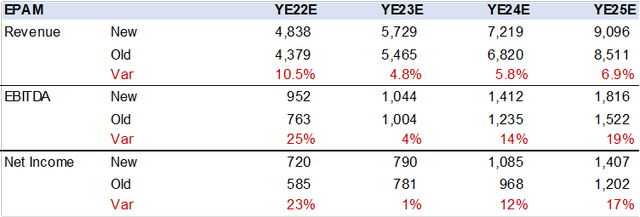

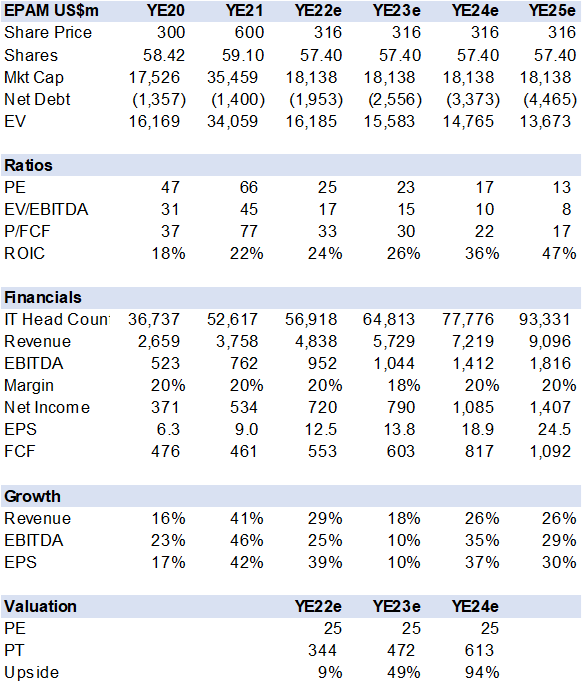

Updated Estimates

On the back of 3Q22 results and management comments on the call, I updated full year 2022 estimates that had assumed a larger Ukraine impact on revenue and costs. At the same time, 2023 forecast have been dialed back on macro headwinds. EPAM mentioned consumer companies beginning to look at technology to reduce cost vs. improve sales. While experience has shown that the software solution, engineering, strategy and innovation providers are in greater demand when companies are faced with disruptions, few enterprises are exempt from some sort of impact of a general global macro slowdown.

Thus, my estimates are below company comments for YE23 with revenue growing 18% and opex pressure hurting margins. I then assume higher growth in YE24 forward.

EPAM Estimates Changes (Created by author with data from EPAM)

Valuation

While EPAM has traded at an average forward P/E of 29x since its IPO in 2012, I am using 25x to value the stock. There are not many companies that can consistently grow over 20% with significant free cash flow generation in a very large and growing market. The stock has greatly incorporated a slower growth YE23 in my view.

Valuation and Financial Summary (Created by Author with data from EPAM)

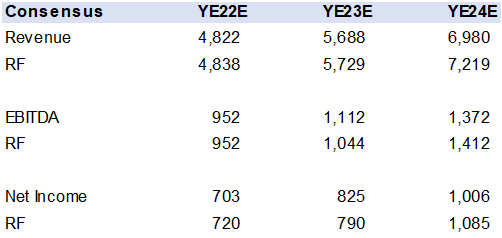

Consensus

Given the contract nature of the business model, results have a high degree of visibility. My estimates are greatly in line with consensus.

Consensus Estimates vs Author (Created by author with data from EPAM and Capital IQ)

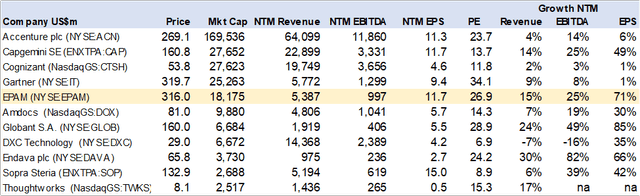

Consensus Peer Comps

Global Consensus Peer Comps (Created by author with data from Capital IQ)

Conclusion

EPAM is a high growth structural partner for companies seeking digital transformation, big data, machine learning to innovate, drive demand and become more productive. Valuation looks attractive relative to growth and free cash flow, with a YE23 price target of US$472 +49% upside potential.

Be the first to comment