alvarez/E+ via Getty Images

EOG Resources (NYSE:EOG) is a large energy company that has continued to perform well with a market capitalization of more than $70 billion. The company has a unique portfolio of low cost assets, and as we’ll see throughout this article, it’ll be able to use those assets to generate substantial and growing returns.

2021 Performance

EOG Resources had impressive performance in 2021, supported by the company’s strong asset portfolio.

The company generated a record $5.5 billion in FCF at $68 WTI. That’s a strong almost 8% FCF yield at WTI prices well below current prices, showing the strength of the company’s asset portfolio. The company managed to double its regular dividend, retire $750 million in bonds, and return $2.7 billion in cash to shareholders, showing its overall financial strength.

The company has a substantial portfolio of what it’s calling “Double Premium Wells”. The company has managed to replace 170% of the wells drilled here, with substantial cost reductions, lowering well costs by 7%. We expect the company to continue to improve efficiency, while moving through overall shareholder returns.

2022 Potential

Throughout 2022, EOG Resources sees the potential to generate substantial shareholder returns.

EOG Resources 2022 – Investor Presentation

The company expects to be able to generate $6.4 billion in 2022 FCF at $80 WTI. That’s still substantially below current prices of roughly $107 / barrel WTI. The company’s current dividend commitment is $1.7 billion, or a 2.4% dividend yield. The company has announced a $600 million special dividend in March, taking the dividend to at least 3.4% temporarily.

The company expects production to return to pre-COVID-19 levels already, and is targeting flat costs in a high inflation environment with lower cash operating costs.

Assets

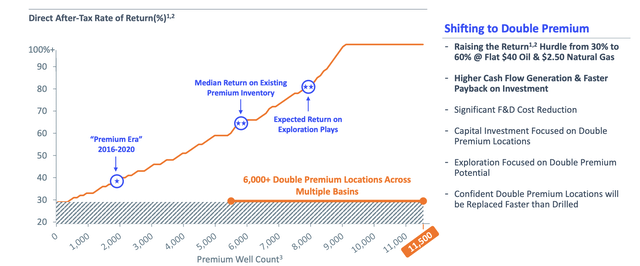

EOG Resources has one of the strongest asset portfolios in the company, as evidenced through its growing “Double Premium wells”.

EOG Resources Double Premium – Investor Presentation

EOG Resources has moved well past the after-tax rate of return during its premium error with 6000+ double premium locations having a 60% return standard. The company has managed to replace these wells faster than it’s been drilling them, although it hasn’t been drilling them at the maximum possible speed.

The company’s anticipated 2022 capital budget of $4.5 billion, versus 2021 capex of $3.9 billion, should enable the company to continue modestly growing production and generating increasing shareholder returns.

Improving Financials

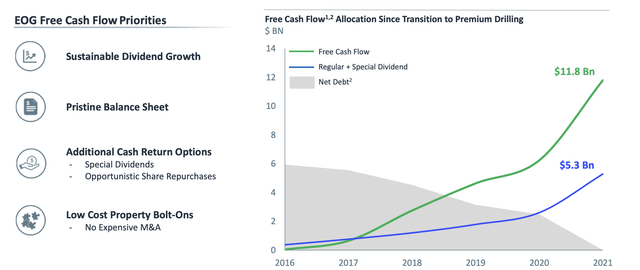

The company has significantly improved its overall financial position.

The company has gone from $6 billion in debt roughly 5-years ago to current net debt of roughly $0. The company has been able to increase its regular+special dividend substantially, now that it’s balance sheet can no longer be improved significantly. The company now has minimal interest expenditure obligations now.

The company is continuing to look at low cost property bolt-on opportunities, which we expect will enable increased shareholder returns.

Shareholder Returns

Putting this all together, EOG Resources has the ability to generate substantial shareholder returns.

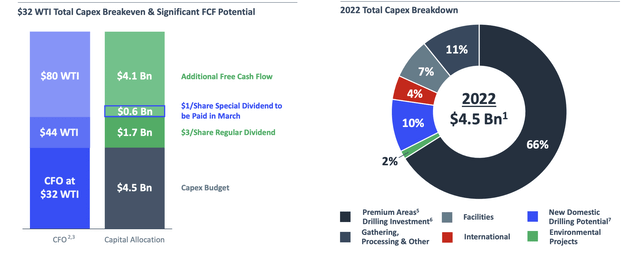

EOG Resources Shareholder Returns – Investor Presentation

At $80 WTI, the company expects $6.4 billion in FCF. The company has already allocated $0.6 billion for its special dividend and $3 billion for its regular dividend. After that, the company still has $4.1 billion in FCF. That’s on top of current dividends of ~3.5%. At current WTI prices, that’s more like $6.5 billion in additional FCF.

That’s enough for the company to comfortably generate double-digit shareholder rewards, highlighting the strength of the asset portfolio. This also helps highlight how EOG Resources is a valuable investment. The company has a $5 billion share repurchase authorization that it could completely finish throughout the year.

That unparalleled financial strength helps highlight the company as a valuable investment.

Thesis Risk

The largest risk to our thesis is WTI prices. The company has a low $32 / barrel WTI breakeven, however, prices have clearly dropped below this level before. The company, like most others, saw its production drop in 2020, which required substantial additional cash flow to recover. Given how volatile prices are, those risks are worth paying close attention to.

Conclusion

EOG Resources is a strong investment. The company has one of the lowest breakevens in the industry at $32 / barrel WTI which includes its capital spending budget that it’s increased by 15% YoY. The company has announced a special dividend, and with no net debt, it can continue generating strong overall shareholder returns.

EOG Resources can comfortably generate double-digit shareholder returns. The company has a 3.5% dividend yield with the special dividend and still has enough, at current prices, to repurchase roughly 7% of its outstanding shares. After that the company will still have almost $2 billion remaining, showing the strength of its financial position, and highlighting the company as a valuable investment.

Be the first to comment