EKKAPHAN CHIMPALEE

Since its founding in 2014, Enthusiast Gaming (NASDAQ:NASDAQ:EGLX) has been focused on building a behemoth gaming platform. The company has embarked on a series of increasingly ambitious acquisitions to increase its total addressable market and boost revenue growth. It has often taken on debt and dilution to fund these buyouts. The results have been hyper revenue growth set against rapidly dwindling cash and equivalents as cash burn remains sticky and common shares collapse on the back of the market greatly discounting unprofitable companies.

Indeed, the company has had an extremely aggressive acquisition strategy of mainly digital media assets across the gaming space. However, historically weak gross margins and unprofitability have exacerbated the retracement of its shares. The last year for equity investors in high-growth companies has broadly been abysmal. Rapidly spiking inflation has seen the Fed respond with increasingly hawkish rate hikes as the prospect of a full-blown global recession further dampens investor sentiment.

Revenue Ramps Up As Gross Profit Hits Record

Enthusiast last reported earnings for its fiscal 2022 second quarter which saw revenue come in at C$51.1 million, up 38% from the year-ago period as gross profits surged to a new high of C$15.3 million. This was up 91% from the comparable year-ago quarter and came on the back of gross margins of 30%, an 840 basis points increase over the year-ago figure. Bears would be right to argue that the strong revenue numbers have been partially driven by a strategy of aggressive acquisitions, including that of Addicting Games, U.GG, and Tab. However, the company saw a 111% increase in direct sales. This reached $9.3 million, up from $4.4 million in the year-ago quarter. Further, subscription revenue of $3.5 million was up 75% year-over-year as paid subscribers rose to reach 258,000 from 155,000. Price increases also played a marginal role in the subscription revenue increase.

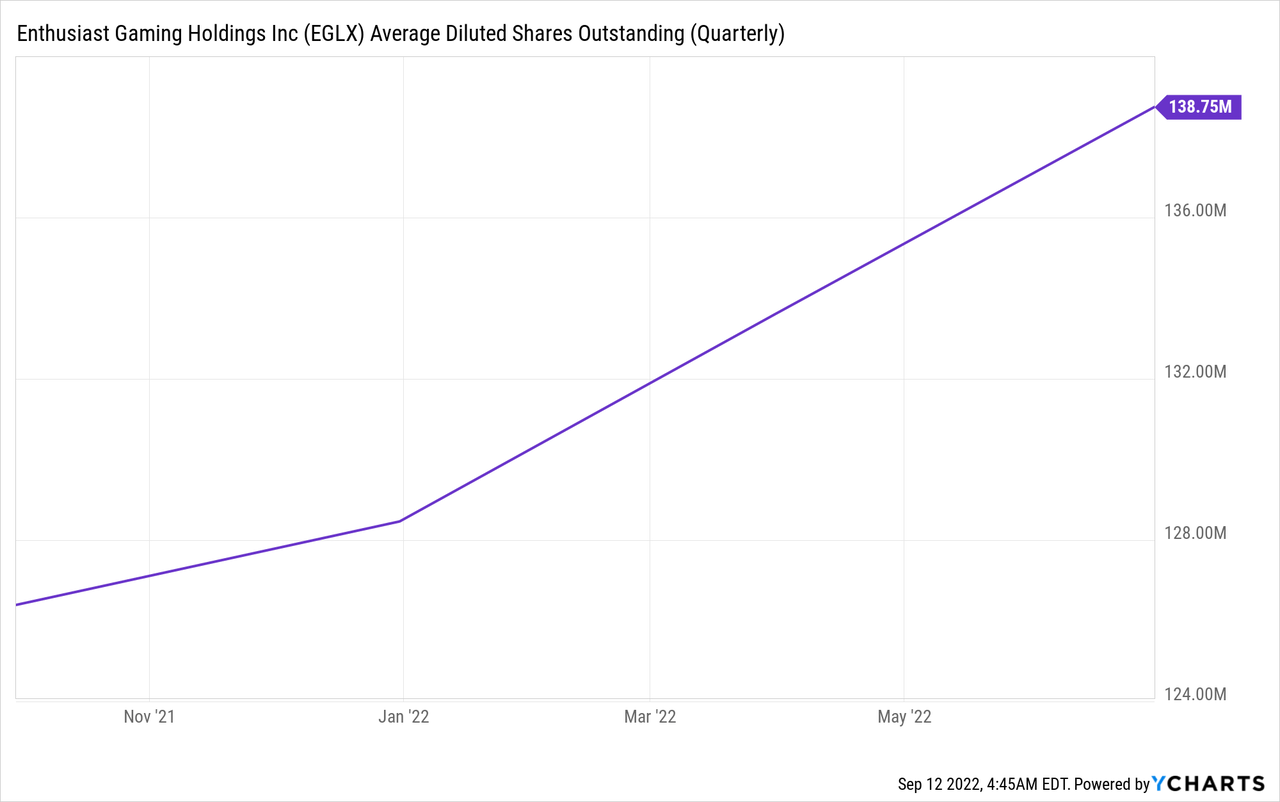

A core concern from previous bearish commentary on Enthusiast was the company’s ability to continue funding operations with cash burn as entrenched as it was. This had a negative impact on cash and equivalents, necessitating the company to embark on dilutive equity raises to maintain going concern status and expand cash available for acquisitions.

Average diluted shares outstanding have risen over the last year, albeit not at an entirely unsustainable pace. Dilution in itself is not a reason to avoid shares, especially if it helps strengthen the underlying business and expand the overall TAM.

Most surprising perhaps was the small move to positive free cash flow during the quarter. The company generated positive cash from operations of $1.8 million, signaling to the market that it is able to sustain itself. This was nonetheless futile against a broader market collapse that has seen shares decline from a 52-week high of $4.74 to $1.27 as of writing this article. The company is well on track for C$200 million in annual revenue this fiscal year as gross margins expand even further. Hence, we could see gross profits of at least C$65 million this year with a marginal level of positive operating cash flow.

Enthusiast Pushes Into Web3 As Project GG Remains In The Dark

Enthusiast Gaming was broadly elusive when asked about Project GG, its subscription-based social network for gamers, during its last earnings call. Management responded with commentary that they still felt strongly about it and are taking a cautious approach to its development.

What felt odd was the push into Web3 as it seems as though management is jumping on top of the latest VC/investment fad. Web3 has been derided by its critics as having very questionable value for its users and an overall limited use case beyond financial speculation. The company is partnering with Coinbase (COIN) to allow players to earn crypto rewards on EV.IO, its popular first-person shooter game.

The collapse of Enthusiast’s common shares has now placed its forward price to sales multiple at 1.22x, a significantly constrained multiple for a company still growing revenue at well over double digits with gross margins improving on both a sequential and year-over-year basis. The huge departure from a previously double-digit multiple has been much a result of the broader macro context as it has been a lack of communication around Project GG and whether the company can secure access to cheaper long-term capital if cash burn returns in the quarters ahead. Clarity around these would likely set the stage for a re-rating of the company’s common shares.

Enthusiast’s future is bright as gaming continues to be a core part of global culture and should do relatively well even in a recession. However, I’d hold off from recommending the shares as a buy as the near-term outlook is likely to still be dominated by continuously torrid macro conditions.

Be the first to comment