onurdongel/E+ via Getty Images

The official line for the midstream part of the oil and gas industry is that the midstream part of the business will not be growing. But Enterprise Products Partners (NYSE:EPD) management never got the memo. Therefore, the common units will offer investors both income with growth in the future. Mr. Market generally has not given these units credit for any growth despite the latest results. That will likely change as the recovery proceeds and management keeps a steady growth pace in the future.

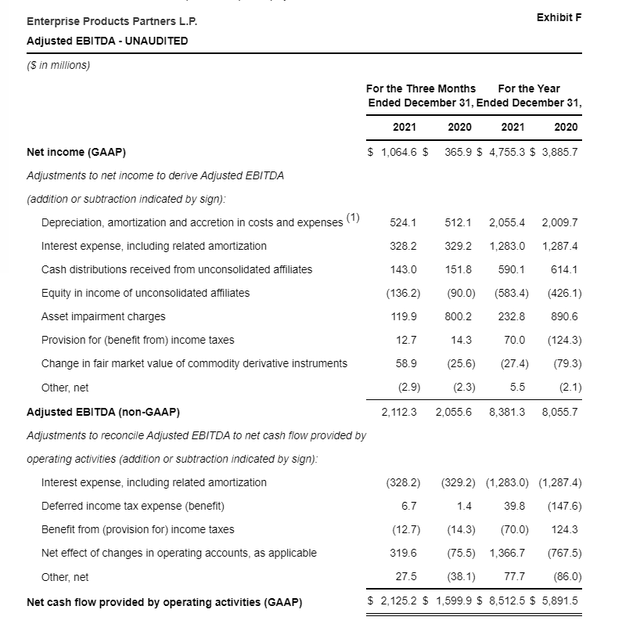

Enterprise Products Partners Calculation Of Adjusted EBITDA And Cash Flow (Enterprise Products Partners Fourth Quarter 2021, Earnings Press Release)

The adjusted EBITDA clearly demonstrates year-over-year growth. That is further proven by the increasing cash flow from operating activities shown below. The effect of changes in operating accounts definitely magnifies the implied growth rate. But even without that change, there is cash flow growth and EBITDA growth.

The rate is fairly decent for a large company where the cyclical upstream industry served is in the recovery stage. Midstream companies typically have fairly steady earnings when compared to the more volatile upstream part of the industry. Therefore, any recovery is likely to also include some forward progress as the remaining capital projects from the last boom begin operating at capacity.

Much of the midstream industry still has some idle or excess capacity. The take-or-pay contracts usually provide an earnings floor (as opposed to guaranteeing earnings parity with the past). So, there will be more progress for both cash flow and earnings as excess capacity continues to be used.

There is talk about more capacity needs in some basins within two years. Given that such capacity needs to be planned and built ahead of time, those talks are likely to begin sometime this year. Once actual plans are made to begin construction, the market will have a very visible sight for resuming midstream growth. That will likely result in higher valuations throughout the industry.

Investors can take advantage of the current market perception by investing in well managed companies now. Then all that has to happen is that the industry will grow when the appropriate time in the upstream cycle is reached. Such an investor receives appreciation from the revaluation by the market of what was previously believed to be an income only investment. That same investor will likely receive a generous distribution while waiting for that revaluation.

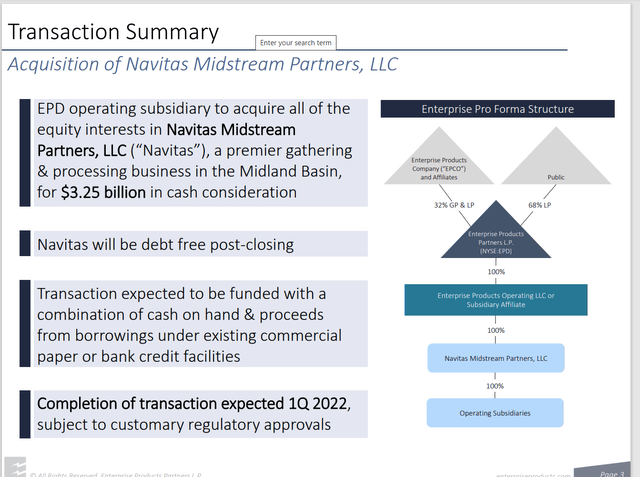

Enterprise Products Partners Acquisition Of Navitas Midstream Partners LLC (Enterprise Products Partners Corporate Presentation Of Navitas Acquisition)

In the meantime, management has opened up another pathway to grow the business. The recently completed Navitas Midstream acquisition was clearly not part of the company valuation before the announcement. Yet growth by acquisition is one of the ways this partnership has grown throughout its history.

The company has one of the highest credit ratings in the midstream business. Therefore, management is well positioned to shop for bargains. The low debt means that management can offer to purchase acquisitions like this one for cash. That is often a considerable advantage over competitors that need to use stock because their financial leverage is higher.

Oftentimes, Mr. Market will not give a superior management like this one credit for finding a way to grow when “there is no growth”. Instead, in the eyes of the market, if there “is no growth”, then in the eyes of the market no companies will grow no matter how good the management.

Rarely is superior management part of the enterprise valuation. Instead, the market values what can be readily seen or is highly visible. The idea that good managements will continue to surprise on the upside while poor managements will continue to cost investors well into the future is a foreign concept to Mr. Market. Therefore, as was the case here, the stock price will adjust to the acquisition and a shareholder who purchases units when “nothing is going on” often benefits from the inevitable favorable announcement.

As a result, the company will grow the business both from excess capacity being used and the addition of Navitas. That is likely to result in a very un-midstream-like growth rate of 10%. Furthermore, the financial leverage ratio remains low after the transaction. Therefore, management is in a position to grab another accretive deal should one present itself.

The bonus to all of this is that management increased the distribution by an amount more than expected. Should this acquisition work out better than expected, there could be another distribution increase before the end of the year. The same possibility exists if there is another accretive acquisition.

The key here is that this management has had superior results throughout the history as a public partnership. It is very reasonable to expect superior results in the future. The financial results shown this quarter demonstrate that the superior management is still in place with no deterioration.

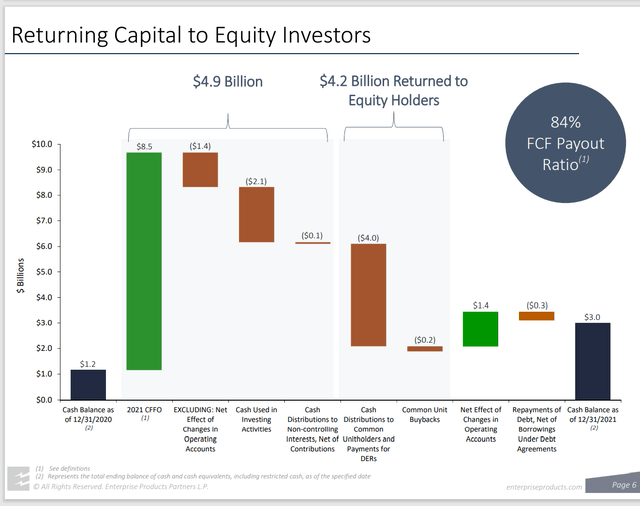

Enterprise Products Partners History Of Returning Capital To Shareholders (Enterprise Products Partners Fourth Quarter 2021, Corporate Earnings Slide Presentation)

Another major growth difference going forward will likely be the compounding of reinvested earnings. Throughout the industry, the debt and equity markets no longer permit periodic equity and debt offerings to finance growth projects. Now there is a demand for a significant amount of earnings and cash flow to be reinvested in the business. In the long run, the lack of shareholder dilution and lower borrowing costs that result from this strategy should result in additional long-term growth.

That means that midstream returns in the double digit range from some growth and the distribution are very reasonable. Since the midstream industry is often regarded as the utility business of the oil and gas industry, these companies can appeal to income investors.

This company does issue a K-1. So, investors are advised to diligently research the differences of a partnership like this and a typical utility company. The financially strong midstream companies like this one have a fair amount of safety with a well-covered distribution.

This company has been raising the distribution for more than two decades. So, for many investors this is a “sleep well at night” stock. The thing that investors need to get used to is that midstream stocks often follow upstream stocks down when there is a commodity price downturn despite the steady earnings.

There is always a risk that good management could deteriorate in the future or that management makes a poor acquisition. Maybe a capital project does not achieve the profit goals envisioned at the time of the project. However, this is a large company that tends to make small (conservative) acquisitions. Therefore, any one poor outcome is likely to be met with superior outcomes from the diversification. In the meantime, the very solid history combined with extremely low midstream leverage (and a very high midstream debt rating) should appeal to a wide range of investors.

Be the first to comment