John Moore/Getty Images News

Intro

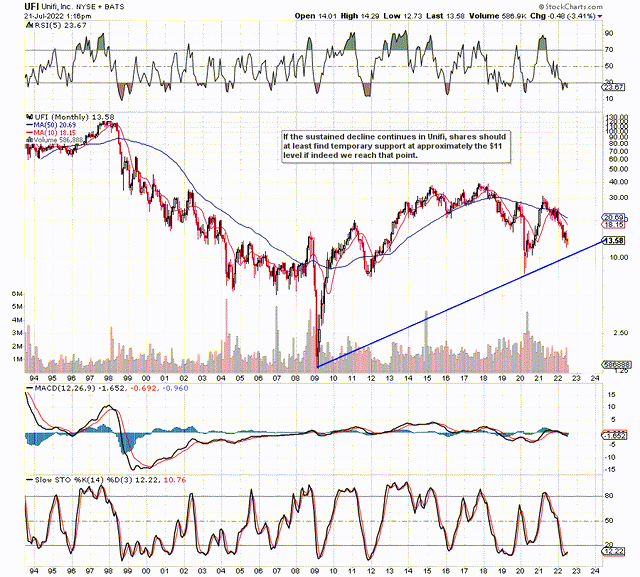

If we look at a technical chart of EnerSys (NYSE:ENS) (Electrical Equipment & Parts Outfit), we can see that shares have been making lower lows for the best part of 12 months now. Although share-price action has been very encouraging over the past week, (which looks to be leading to a crossover of the deeply oversold MACD indicator), investors must remember that the down-cycle trend-line depicted below needs to be taken out to the upside for EnerSys to return to bull market mode. The bullish divergence in the RSI momentum indicator is prompting that shares should at least test that upper resistance trendline in this present upmove.

Shares at present are battling to remain above their 10-week moving average, so it will be interesting to see if the stock´s momentum can continue over the next couple of weeks.

EnerSys Shares Deeply Oversold (Stockcharts.com)

Strong Fundamentals

Management strongly believes that shares of EnerSys offer strong value at present levels. Close to $170 million of stock was bought back over the past four quarters, with almost $42 million being bought back in the most recent fourth quarter alone. Buybacks have continued in the first quarter of fiscal 2023, and there is plenty of scope for strong buybacks to continue given the approved $170+ million which will most likely be remaining at the end of Q1 this year.

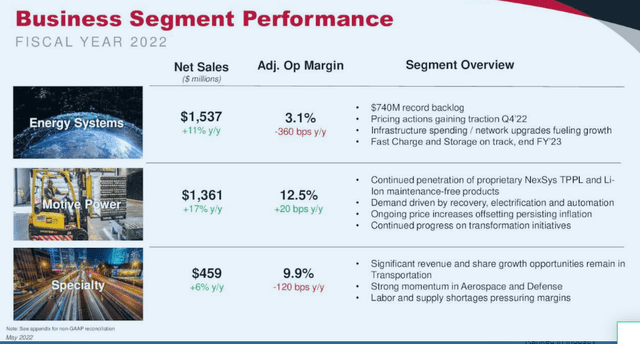

Obviously, the stock’s valuation as well as the huge surge in demand across all of the company’s segments remain strong calling cards in EnerSys. It was encouraging to see Energy Systems growth in Q4 (18%) actually outpacing this segment´s overall growth rate in fiscal 2022 (11%). Although this segment reported a drop in adjusted operating margin for the fiscal year, margins are improving sequentially as pricing initiatives on the back end are beginning to correlate with the significant inflation we have seen on the front end in recent times. Motive Power, on the contrary, did not have an adverse trend on the margin side in fiscal 2022 due to a favorable mix and sustained pricing actions. In the Specialty segment, EnerSys’ TPPL technology is expected to continue to gain traction in the transportation space with defense and aerospace also not to be dismissed.

ENS Business Segment Performance Fiscal 20222 (Company Website)

Shares of EnerSys trade with a book multiple of 1.74 and a sales multiple of 0.71. The company’s 5-year averages for these multiples are 2.35 & 1.10, respectively. Suffice it to say, EnerSys’ valuation as well as the quality of the company´s backlog should shield the stock from meaningful declines if indeed a global recession is around the corner.

Nevertheless, here are some areas which the market will be zoning in on in the upcoming Q1 2023 earnings report (expected August 10) and beyond.

Cash Flow

Off a starting base of almost $144 million in net profit in fiscal 2022, EnerSys’ operating cash flow actually came in at -$65.6 million over the past four quarters. Now, this trend has been par for the course across a range of industries of late due to supply chain headwinds as companies build up their working capital on their balance sheets. For EnerSys, this means having sufficient cash ($400 million at the end of Q4-2022) in case of further supply shocks but more importantly sufficient amounts of inventory (Lithium cells, etc.) to keep customers serviced ($715 million). Accounts receivables rose by just over $129 million in fiscal 2022 to now come in at $779.2 million.

Now, when a company is not generating cash but yet wants to keep cash and inventory levels particularly elevated, then those resources have to come from somewhere. Long-term debt increased by $274 million in fiscal 2022, and although a significant percentage of this cash went towards share buybacks, debt is presently being used to keep working capital elevated.

Return On Capital

Given EnerSys’ gross margins only come in around the 22% mark, it needs to be able to turn over its capital quickly in order for the market to take the stock´s ultra-low valuation any way seriously. Although elevated amounts of working capital can turn out to be a major benefit in recessionary periods, the market wants to see sustained earnings growth in order to price shares higher. Although the first quarter of fiscal 2023 is expected to report a small bottom-line loss, Q2’s earnings are expected to grow by over 20% compared to the same period of 12 months prior. The market will want to see similar trends in Q3 and beyond to ensure capital investment can meet guidance for this fiscal year.

Conclusion

Therefore, to sum up, unfortunately, the market remains uninterested in EnerSys’ record backlog and very strong demand across all three of its segments at present. Nevertheless, interest should come when we break through the downcycle trendline which should coincide with some sound quarterly earnings beats in fiscal 2023. We look forward to continued coverage.

Be the first to comment