Nazar Rybak/E+ via Getty Images

Enerplus Corporation (NYSE:ERF) is a relatively well-known independent exploration and production company that boasts fairly substantial assets in the United States and Canada. There are certainly some reasons to like this company right now as it has a relatively low debt load and some opportunities to profit from the current high energy price environment that is likely to continue for some time. In addition, the company’s valuation has become much more reasonable since the last time that I looked at it and it is now, in fact, somewhat undervalued when compared to many of its peers. When we combine this with the company’s potential to deliver forward growth, there may be reasons to consider making an investment in the company.

About Enerplus Corporation

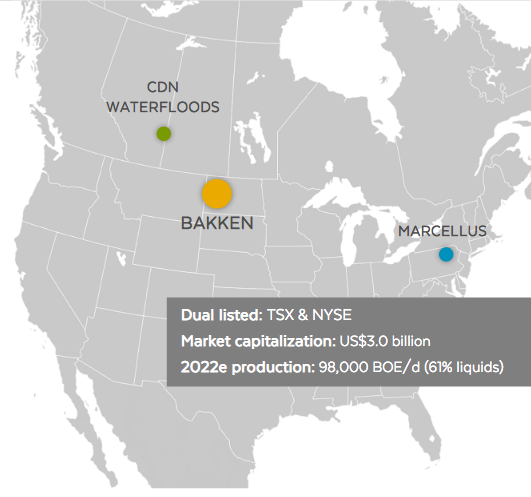

As mentioned in the introduction, Enerplus is a mid-sized independent Canadian exploration and production company that boasts operations in both Canada and the United States. Perhaps surprisingly for a Canadian company, its largest center of production is in America’s Bakken shale play.

Enerplus Investor Presentation

The one thing that we note here is that Enerplus has a great deal of diversity across the three regions in which it operates. Most notable, the Bakken shale is most often targeted by those companies that are interested in producing crude oil while the Marcellus shale is typically considered to be a natural gas play. This would suggest that Enerplus produces a relatively balanced mix of products. This is mostly true as about 39% of the company’s production consists of natural gas with the remainder being liquids.

This is something that is fairly nice to see as the fundamentals for crude oil and natural gas are somewhat different. We saw this during the 2020 energy price crash that sent crude oil prices to their lowest levels in a generation, albeit temporarily. This was caused by the fact that the primary use of crude oil is the transportation of goods and people, which was greatly curtailed during the lockdowns. Natural gas, meanwhile, is mostly used for space heating and cooking food, which were still needed during the lockdowns. This helped the demand for natural gas hold up much better than the demand for crude oil during that time, which was reflected in the price action of the two commodities. The fundamentals of the two products are also somewhat different going forward, as we will see in a bit. Thus, the fact that Enerplus has exposure to both commodities allows it to benefit from the relative strengths of each and is overall a plus for investors.

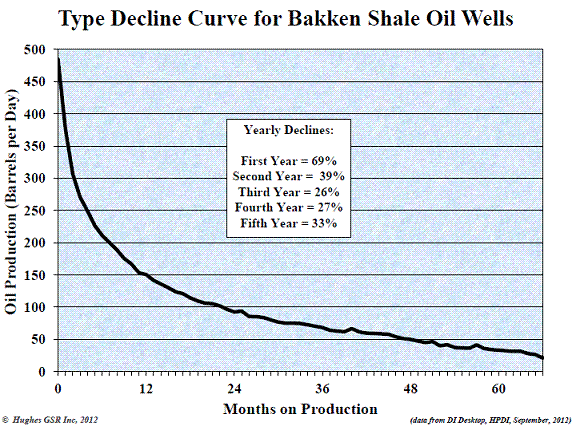

The fact that Enerplus’s largest center of production is the Bakken shale is something of a mixed blessing, however. As I pointed out in a previous article, one of the biggest problems with shale oil production is that the wells have an incredibly high decline rate. In fact, in some areas of the Bakken, a well’s output will be down by 80% in only two years.

Econbrowser.com

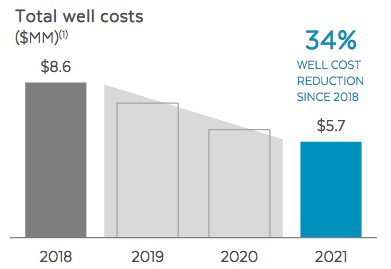

The problem with this is that it forces an upstream company to continuously drill new wells in order to maintain, let alone grow, its output. This is an expensive proposition. Enerplus has overall been doing an excellent job at keeping its costs down, though, by using a variety of methods. Over the 2018 to 2021 period, the company has managed to reduce the costs of drilling a well in its Bakken shale acreage from CAD$8.6 million (US$6.82 million) to CAD$5.7 million (USD$4.52 million) on average.

Enerplus Investor Presentation

It should be fairly obvious what effect reducing its costs would have. Naturally, the company’s cost reductions are some of the factors that allowed it to become free cash flow positive in 2020, albeit barely. It managed to grow its free cash flow in 2021 on the back of rising crude oil prices.

|

FY 2021 |

FY 2020 |

FY 2019 |

FY 2018 |

|

|

Levered Free Cash Flow |

359.3 |

42.2 |

(47.0) |

(36.5) |

|

Unlevered Free Cash Flow |

375.3 |

55.2 |

(31.0) |

(19.6) |

(all figures in millions of U.S. Dollars)

As free cash flow is the money left over after the company pays all its bills and makes all capital expenditures, this is essentially the money that is available to reward stockholders. Therefore, investors should appreciate the fact that the company has now begun to generate some cash that it can use to reward them. It has certainly begun to do that as Enerplus paid out CAD$154 million (US$122.08 million) through dividends and share buybacks in 2021. It plans to continue to do that over the course of 2022. Indeed, the company has already stated its intention to buy back at least 10% of its common stock by July.

Enerplus plans to continue growing its free cash flow over the course of 2022 and has already guided for CAD$500 million (US$396.35 million), which would obviously be a significant increase over the 2021 figure. Today’s high crude oil prices will help with this, particularly as they will almost certainly stay strong over the rest of this year. In addition to benefiting from the high prices, Enerplus is also planning to grow its production somewhat, although it will be a modest increase. The company has budgeted CAD$370 million to CAD$430 million (US$293.30 million to US$340.86 million) in capital spending, which it expects will allow it to produce an average of 95,500 to 100,500 barrels of oil equivalent per day over the course of 2022. This represents a 3.80% to 9.24% increase over the 92,000 barrels of oil equivalents per day that the company produced on average in 2021.

This is a departure from the current policy that many of its peers have expressed about simply maintaining production instead of growing it. As we can clearly see, though, Enerplus’s plans are quite modest considering how substantially crude oil prices have gone up over the past eighteen months. It should be fairly obvious why this production increase should prove to have a positive impact on Enerplus’s cash flow. After all, it will give the company more products to sell and earn revenue from, thus taking advantage of today’s high energy prices. Enerplus has not stated exactly what it intends to do with this surplus cash flow relatively to 2021, but the company’s track record suggests that it will likely be some combination of dividends and stock buybacks, which should be appealing to any investor.

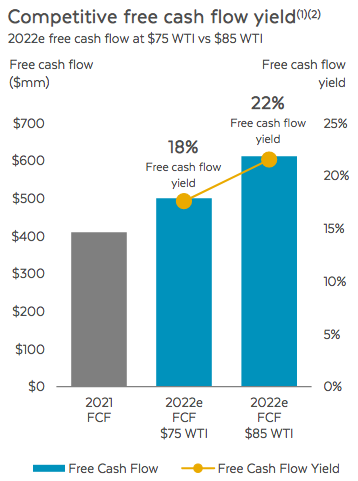

We can see further evidence of Enerplus’s ability to provide a return to its shareholders by looking at its free cash flow yield. This is admittedly not a metric that many shareholders look at, even though it is one of Warren Buffett’s favorite figures to use when evaluating a company for investment. As is the case with any other measure of yield, the free cash flow yield is calculated by dividing the free cash flow per share by the company’s share price so it allows us to compare two investments that have different share prices. Enerplus currently has a very solid free cash flow yield compared to many other companies. In fact, if the price of West Texas Intermediate crude oil remains above $85 per barrel, Enerplus should be able to deliver a free cash flow yield of 22%.

Enerplus Investor Presentation

As we will see later in this article, there are certainly some reasons to expect that crude oil prices will indeed average at least $85 per barrel over the remainder of this year. Thus, Enerplus is quite well positioned to deliver a very respectable return to its shareholders. This is doubly true given the shareholder-friendly actions that it is engaging in, as we have already discussed. This is certainly something that should appeal to any investor that is looking to maximize returns.

Another nice thing about Enerplus is that the company appears to be employing relatively little debt in its financial structure. This is the result of the very sizable amount of free cash flow that the company was able to generate over the past year. It is also a very solid improvement compared to the last time that I covered the company, as Enerplus’s debt load was one of the concerns that I expressed about the company. We can see the company’s relatively low debt load by looking at its leverage ratio (defined here as net debt-to-adjusted funds from operations). This ratio essentially tells us how many years it would take the company to completely pay off its debt if it were to devote all of its pre-tax cash flow to this task. As of December 31, 2021, Enerplus had a leverage ratio of 0.9x, which is a fairly low ratio for the oil and gas industry.

This is quite nice to see because it should help to keep Enerplus’s risks down compared to its peers. The use of debt can be somewhat riskier for an oil and gas company than for a firm in many other industries due to the effect that commodity price volatility can have on the cash flows of these companies. The fact that Enerplus has such a low ratio should position the company quite well to weather through pretty much any decline in commodity prices, which is obviously a very nice thing for risk-averse investors. This is particularly true for those that are planning to stay invested for a long period of time.

Macro-Economic Fundamentals

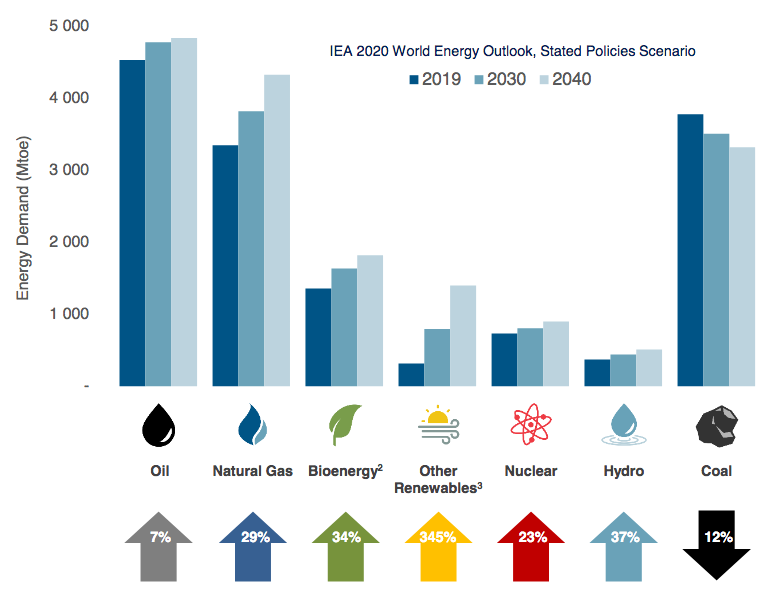

As stated numerous times throughout this article, oil and gas prices will likely remain elevated for quite some time, which should prove to be a very real benefit for Enerplus. The biggest reason for this projection can be found in the basic laws of economics. In particular, the demand for these resources is likely to grow much faster than the supply. As I have pointed out many times before, the International Energy Agency projects that the global demand for crude oil will grow by 7% and the global demand for natural gas will grow by 29% over the next twenty years.

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

This admittedly may be somewhat surprising given the push that we are seeing in many Western nations to reduce the consumption of fossil fuels, but nevertheless the analysis will likely prove correct. This is mostly because renewables are not nearly reliable enough to support the electric grid on their own and emerging nations will likely deliver significant economic growth over the period. It is unlikely that the growth of oil and gas production will keep up with this demand growth, however. One of the biggest reasons for this is that the energy industry has been chronically underinvesting in production capacity and infrastructure since 2015, a problem that was made worse by the events of 2020. In fact, Moody’s states that the various upstream producers in aggregate must increase capital spending by $542 billion in order to avoid a supply shock.

It seems highly unlikely that the industry will actually do this. A major reason for that is that the industry has been under a great deal of pressure from government officials, politicians, and others to improve the sustainability of its operations. The energy industry has also been under pressure from shareholders to improve its returns since the sector has generally lagged the market over much of the past decade. This is why we are seeing companies like Enerplus focus more on free cash flow generation than on production growth. Thus, we have a situation in which the demand for oil and gas is poised to grow much more rapidly than the supply. The laws of economics tell us that this should cause prices to rise.

Valuation

As stated in the introduction, Enerplus appears to have a much more reasonable valuation than the last time that we looked at it. This is despite the stock climbing a remarkable 148.34% over the past year.

Seeking Alpha

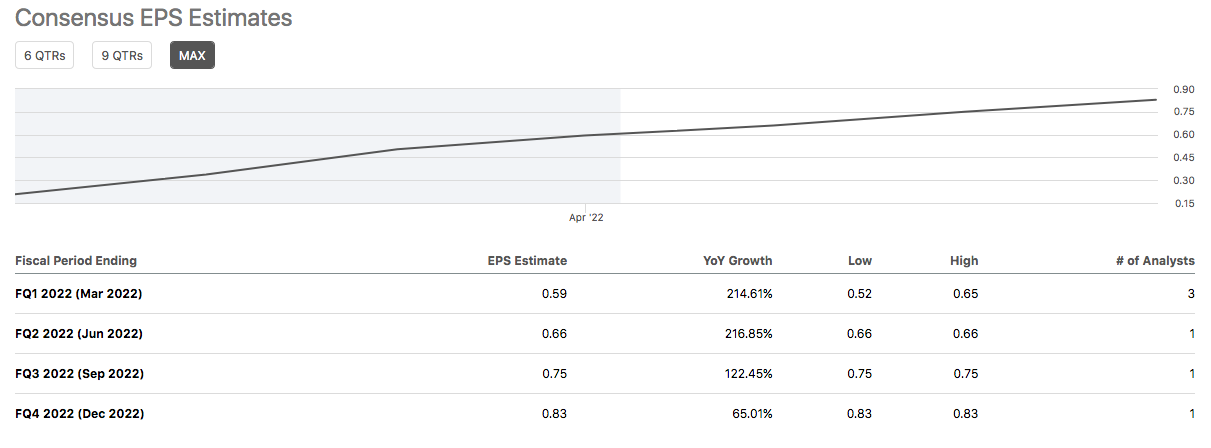

We can see the company’s reasonably attractive valuation by looking at its forward price-to-earnings ratio. This ratio essentially tells us how much we have to pay today for each dollar of earnings over the next year. As of the time of writing, analysts expect Enerplus to earn $2.76 per share in 2022, which represents a significant amount of earnings growth over its 2021 earnings.

Seeking Alpha

This gives the stock a forward price-to-earnings ratio of 4.89 at the current price. This would be a remarkably low ratio in any market, but it is particularly low in today’s overheated market that typically sees companies boasting substantially higher valuations. Here is how Enerplus’s valuation compares to some of its peers.

|

Company |

Forward P/E Ratio |

|

Enerplus |

4.89 |

|

Diamondback Energy (FANG) |

6.64 |

|

Continental Resources (CLR) |

6.88 |

|

Devon Energy (DVN) |

8.87 |

|

Pioneer Natural Resources (PXD) |

9.66 |

|

EOG Resources (EOG) |

8.91 |

As we can see here, many of the independent exploration and production companies actually have remarkably low valuations given today’s market and the high prices for crude oil and natural gas. However, Enerplus looks relatively cheap compared to them. When we combine this with the company’s strong finances, attractive free cash flow yield, and the company’s intentions to grow its production over the next year, we can clearly see that the company is worth considering at the current price.

Conclusion

In conclusion, there is a great deal to like about Enerplus today. In particular, the company’s strong free cash flow positions it very well to reward its investors in a big way over the coming months, which the company has outright stated that it intends to do. Enerplus also sports a reasonably attractive balance sheet with low leverage and yet still appears to be undervalued at the current price. Overall, this company looks like a winner.

Be the first to comment