maybefalse/iStock Unreleased via Getty Images

Investors in Alibaba (NYSE:BABA) received reassurance and psychological support from Charlie Munger in 2021 who doubled down on Alibaba despite growing concerns over the e-Commerce firm’s overseas stock listing and slowing topline growth. A new filing from the Daily Journal Corporation (DJCO) last week showed that Charlie Munger cut his Alibaba stake in half in the last quarter. Although the Daily Journal Corporation slashed its stake in the Chinese e-Commerce firm, I believe Alibaba remains one of the most promising investments in FY 2022!

The Daily Journal Corporation Reduces Its Investment In Alibaba

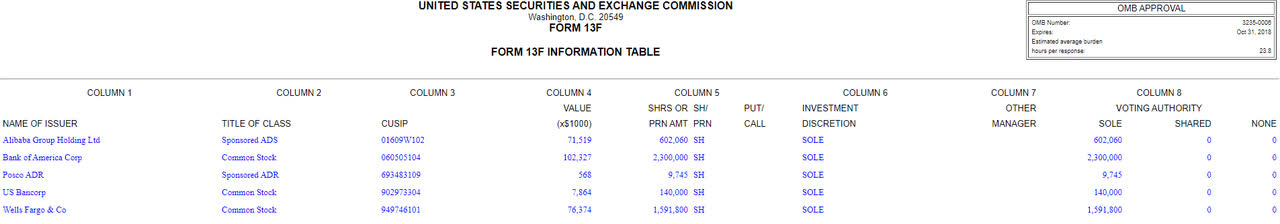

A new 13F regulatory filing with the Securities and Exchange Commission, made last week, showed that the Daily Journal Corporation, which is overseen by Charlie Munger in his capacity as Chairman, sold more than 300 thousand shares of Alibaba’s American depositary shares in the last quarter. The portfolio, however, continued to consist of only five positions: Bank of America (BAC), Wells Fargo (WFC), Alibaba, U.S. Bancorp (USB) and POSCO (PKX).

SEC Edgar

In the previous quarter, the Daily Journal Corporation increased its stake in the Chinese e-Commerce business by 99% to 602 thousand shares, resulting in a total Alibaba investment value of about $72 million. Charlie Munger last year was a lone Alibaba bull and I reasoned at the time that the Alibaba purchase was a bullish sign for shareholders that stuck by Alibaba despite an accelerating regulatory crackdown and valuation headwinds.

Focus On Free Cash Flow And Massive Share Buybacks

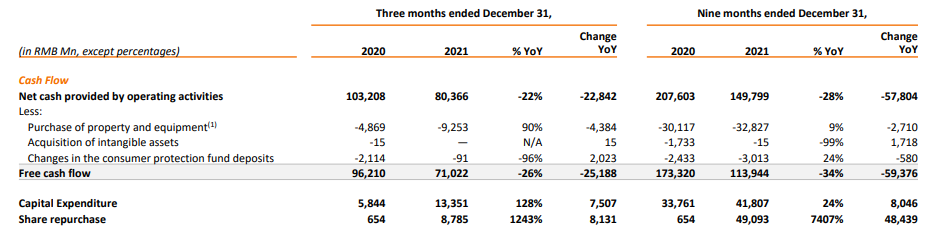

Alibaba’s investment value is represented by its considerable free cash flow. Although Alibaba’s free cash flow in 2021 was impacted by a record fine, the e-Commerce firm generates billions of dollars quarterly in free cash flow that the firm uses to invest in its e-Commerce/logistics segments as well as cloud business.

Alibaba’s free cash flow just in the last quarter was 71.0B Chinese Yuan which calculates to $11.1B. This was the free cash flow in just one quarter! However, Alibaba’s Q4’21 free cash flow dropped off 26% year-over-year due to investments in user growth, its international expansion and the rolling out of new services for Alibaba’s merchant base.

Alibaba

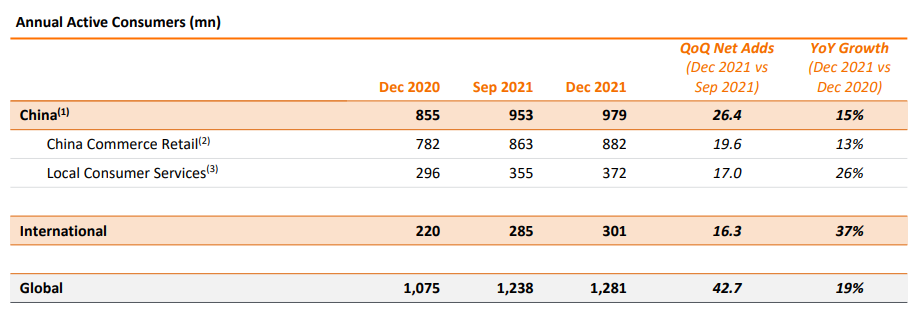

Alibaba is not only using its free cash flow to invest in its various businesses, but the company also repurchases a ton of its shares in the market… which is a good use of capital considering how undervalued shares of Alibaba have become over the last year. In the first nine months of 2021, Alibaba repurchased 49.1B Chinese Yuan ($7.7B) worth of ordinary shares.

The e-Commerce firm also spent more money on share repurchases than on capital expenditures… a sign that Alibaba’s management views shares of Alibaba as deeply discounted. Additionally, management recently announced a $25B share buyback to take advantage of the depressed share price to buy back even more shares. At current prices, a $25B share repurchase could reduce Alibaba’s share count by up to 10%.

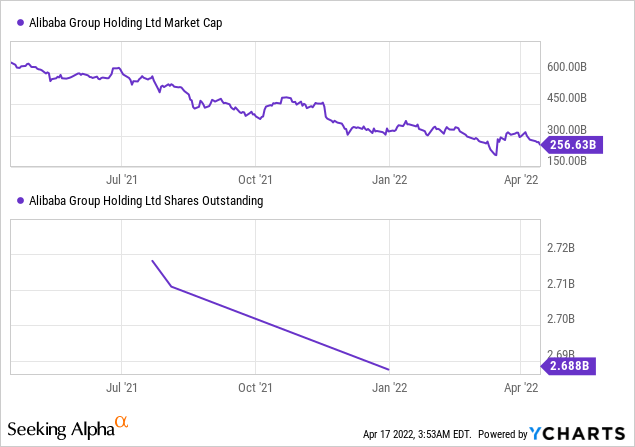

Alibaba’s E-Commerce Business Provides Stable Basis For Growth

Alibaba’s massive user base is the firm’s core asset that drives free cash flow growth. The company is the largest e-Commerce firm in the world based on customer accounts and Alibaba added 42.7M new customers globally to its ecosystem just in the last quarter, bringing total customer accounts to 1.28B. I believe Alibaba could close in on 1.85B customer accounts by FY 2025 if the firm maintains current customer acquisition rates.

Alibaba

Alibaba’s platform/account growth is driven chiefly by strong customer acquisition rates outside the Chinese market. Alibaba’s international commerce operations – represented by brands such as Lazada (SE Asia), trendyol (Turkey), daraz (Pakistan) and AliExpress (Alibaba’s cross-border e-Commerce platform) – have seen massive growth in recent years. Alibaba’s international e-Commerce brands added 16.3M new accounts to their platforms in the last quarter, showing 37% year-over-year growth. About 38% of all new customer accounts came from Alibaba’s international e-Commerce brands. Alibaba will continue to develop its e-Commerce ecosystem rapidly in the coming years and the large size of Alibaba’s merchant platform as well as huge international customer base are supporting the firm’s free cash flow growth going forward.

Cloud Business Provides Growth Opportunity

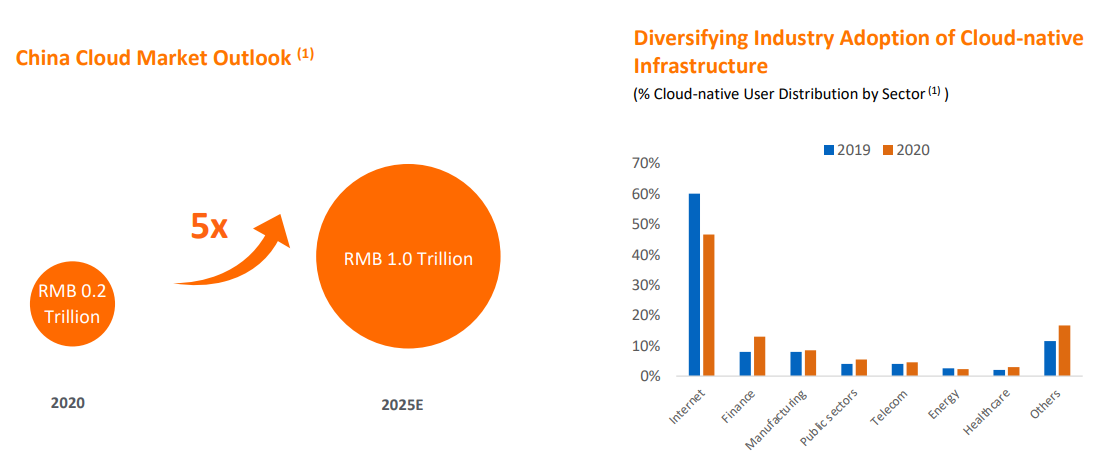

Alibaba is not resting on its e-Commerce success, however, and is investing in businesses that promise exponential growth in the future. One such business is the firm’s cloud segment. While currently accounting for only a small share of Alibaba’s revenues, the market opportunity in the cloud industry is extremely attractive as more companies require storage, security, data management and application services that are provided by cloud companies like Alibaba. Projections call for a quintupling of the Chinese cloud market to 1T Chinese Yuan ($160B) by FY 2025.

Alibaba

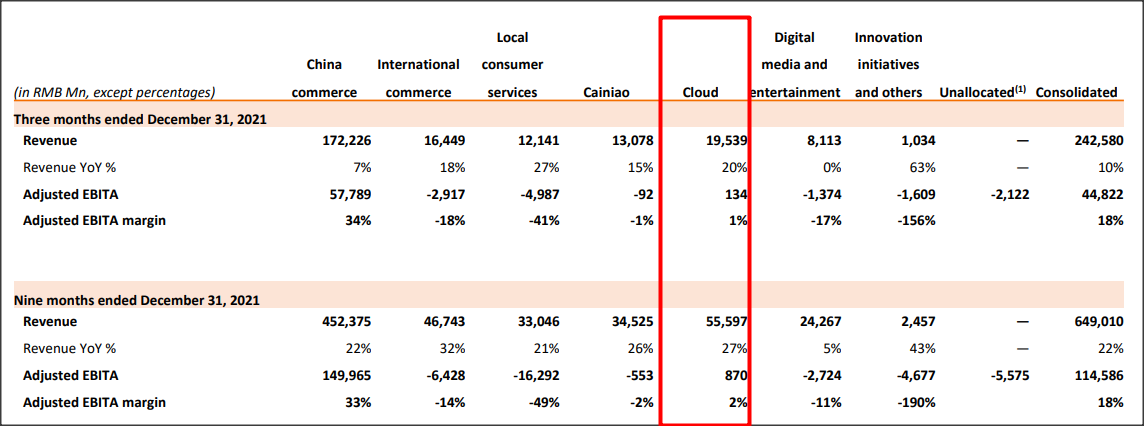

Due to strengthening demand from financial and telecommunication industries, revenue growth in Alibaba’s cloud business exceeded Alibaba’s e-Commerce revenue growth by a considerable margin (20% vs. 7%) in the last quarter. Alibaba’s cloud operations are now a $12B annual business. The cloud segment has a 9% revenue share now and I believe it could increase to 15-20% by FY 2025.

Alibaba

Cheap P-FCF, P-E Ratios

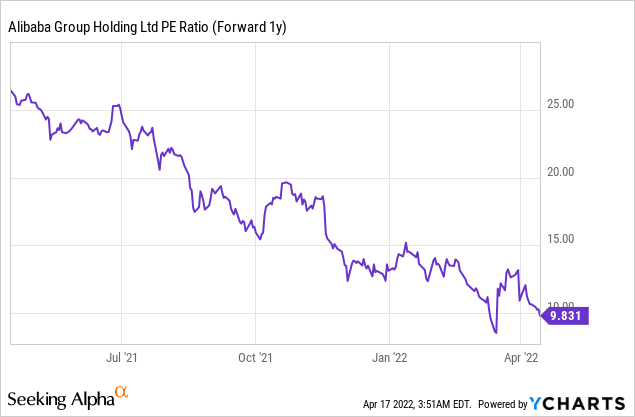

I don’t know the exact reasoning behind Charlie Munger’s sale of Alibaba, but it can’t be the firm’s valuation. Alibaba’s free cash flow and earnings remain deeply undervalued. Due to Alibaba’s recent slide in market value, shares of Alibaba are currently valued at 7 X free cash flow expected for FY 2023 ($28B) and at 10 X earnings…

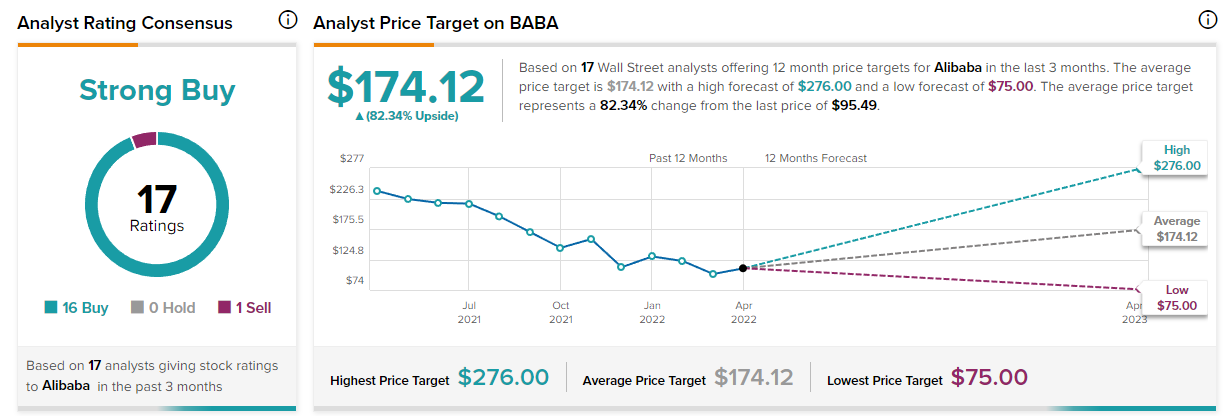

The majority of analysts also believe that Alibaba represents deep value, with the average price target being $174.12, implying an 82% upside.

TipRanks

Risks With Alibaba

Alibaba’s biggest commercial risk, as I see it, is a slowdown in topline growth and increasing competition in the domestic e-Commerce market. Stronger competition in the e-Commerce sector, in which Alibaba still generates more than 70% of its revenues, poses challenges for the firm going forward.

I don’t believe that regulatory or delisting risks are reasons not to buy Alibaba. China’s regulators recently made concessions to their U.S. counterparts and said they would allow Chinese auditors to share their audit papers with the Public Company Accounting Oversight Board, a precondition to keep ADR shares of Chinese companies listed in the U.S. For that reason, I recently suggested that the change in the regulatory landscape is a game-changer for Alibaba’s shareholders.

Final Thoughts

Although Charlie Munger has sold half its stake in Alibaba, I believe there are more reasons that speak for Alibaba than there are reasons that speak against the company. I believe the Chinese e-Commerce business continues to represent strong value at today’s discounted valuation, based off of free cash flow and earnings.

While Alibaba faces topline risks as competition heats up in China, Alibaba remains a deeply profitable, fast-growing e-Commerce brand that is diversifying away from its core business and could generate $7B in quarterly free cash flow next year. Alibaba, despite Charlie Munger’s partial departure, remains a buy!

Be the first to comment