da-kuk/iStock via Getty Images

The story of natural gas is the story of geopolitics. Last week I wrote an article on Exxon Mobil (XOM), where I discussed how the Russian invasion of Ukraine is about to reshape Europe’s energy markets forever. While that discussion was centered around crude oil and petrochemical fuels, we shouldn’t forget that the export of natural gas is one of the biggest sources of revenue for Russia, and considering the latest developments, it seems that the flow of gas to Europe is going to be disrupted as well in the foreseeable future. Therefore, as investors are looking for ways to profit from the ongoing oil crisis, they should also pay closer attention to natural gas businesses, especially those that will be able to help Europe diversify its energy sources in the long run.

One company that I have in mind is Energy Transfer (NYSE:ET), which is a rising midstream operator that has one of the most sophisticated networks of pipelines that transport natural gas and propane throughout the United States. Not only has the company was able to benefit from the rising natural gas prices that were caused mostly by Russia’s reckless invasion of Ukraine, but it’ll also be able to become a serious player in the export of LNG in the following years, as it’s about to complete the financing for its export LNG facility in Louisiana.

To explain why I think that Energy Transfer is a solid investment in the natural gas business, I decided to split this article into two parts. The first part of the article will describe Russia’s role in the natural gas industry and how its invasion of Ukraine is about to reshape the global natural gas business, while in the second part I’ll highlight how all of those developments will help Energy Transfer to expand its market share and profit from the changing geopolitical landscape. Keep a big picture and a long-term view in mind when reading to better understand the story.

The Changing World Order

The Role Of Russia In The Natural Gas Business

According to various reports, Russia has 47 to 49 trillion cubic meters of natural gas reserves, which makes it the country with the biggest amount of natural gas reserves around the globe. At the same time, it’s also the second-largest producer of natural gas after the United States. Last year Russia produced 762 bcm of natural gas and has exported 210 bcm through its network of pipelines. Most of the pipelines transfer gas directly to Europe and the company that’s responsible for doing so is Gazprom (OTCPK:OGZPY), in which the Russian government has a majority stake. The cash that Gazprom collects from its European customers is later distributed in the form of dividends, which are able to cover portions of Russia’s government deficit. Given the scale of Russia’s natural gas business, it’s safe to say that it plays a major role in the pricing and distribution of natural gas around the globe, especially in Europe, which relied on Russia for around 40% of its natural gas needs in 2021.

Don’t Underestimate The Sanctions

One of Russia’s main weaknesses is that its pipeline infrastructure is built mostly to serve European customers. Out of 210 bcm of natural gas that was exported in 2021, 155 bcm were transferred directly to countries that are part of the European Union. To diversify its portfolio of customers and decrease the risks of over-reliance on one customer, Russia has been trying to increase the export of natural gas to China. Only in 2019, the country has finished building a Power of Siberia pipeline, which should reach its peak export capacity in the next few years and transfer a total of up to 38 bcm per year to China. In addition, there are talks about constructing a second pipeline called Power of Siberia 2, which should have an export capacity of around 50 bcm per year. Even if the second pipeline is constructed, it’ll be able to transfer gas to China at its maximum capacity only by the end of the decade. On top of that, by looking at those numbers, we could conclude that the export of natural gas to China won’t be able to fully replace the possible loss of a European market.

To tackle this issue, Russia has been active in developing its own LNG infrastructure, which should’ve enabled it to serve new customers around the globe and decrease its overreliance on Europe. A year ago, the Russian government has adopted a new long-term strategy that aims to expand the LNG projects, most of which are located in Northern Russia in the Yamal-Nenets Autonomous Okrug and have access to the Arctic Ocean. In the same year, Russia has also exported 40 bcm of LNG and became the 4th largest LNG exporter, accounting for around 8% of the world’s LNG supply. As part of the long-term strategy, Russia was also aiming at exporting 110 bcm to 190 bcm of LNG by 2025.

Given the growth of Russia’s LNG industry in recent years, the country was well on track to achieve its long-term goals. However, once it invaded Ukraine in late February, all of its plans have been trashed in an instant.

The major problem for Russia is that it heavily relies on western technology to build and maintain its LNG infrastructure. Once the European Union enacted the fifth package of sanctions in April, which prohibits the companies from supplying things like the heat-exchanging units that are crucial for the building of LNG plants, Russia’s LNG ambitions have been called into question. The sanctions have also forced western companies themselves to halt their partnerships with Russian counterparts, and businesses like Baker Hughes (BKR) have already left Russia for good and no longer service Novatek’s (OTCPK:NOVKY) Arctic 2 LNG project or provide spare parts for the Yamal LNG plant. What’s also interesting is that some Chinese companies have also halted their work on Russia’s LNG projects due to the fear of sanctions, while FT reports that Russia won’t be able to receive a next-generation fleet of ice breakers that should’ve helped it to expand the transfer of LNG through the Arctic Ocean.

As a result of all of this, Russian experts now believe that it will take several years, if ever, to replace western technology. Even Russia’s own Ministry of Economic Development forecasts nearly no growth in LNG export to other countries for the next five years in its conservative scenario, making it impossible for the country to become a global leader in LNG exports.

The Great Diversification

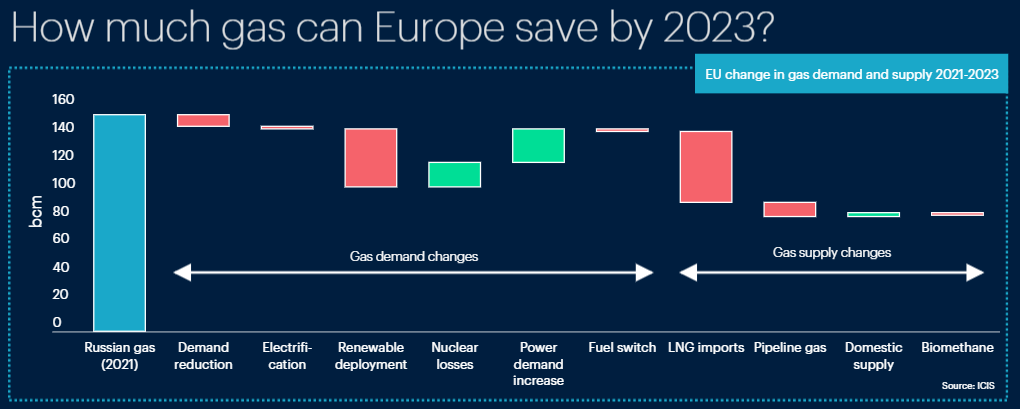

Considering that the Russian LNG won’t enter the market en masse in the following years, it creates an opportunity for international natural gas businesses to fill up the growing demand for LNG for years to come. On top of that, Russia’s invasion of Ukraine has also forced the European Union to rethink its energy security policy, as it no longer can rely on an authoritative government, which has no respect for the sovereignty and territorial integrity of a country that has recently received an EU candidacy status, for its energy needs. While the EU is already working on the seventh package of economic sanctions, the European Commission has already proposed a plan called REPowerEU to decrease its reliance on Russia’s pipeline natural gas as well. The analytical research agency ICIS believes that by 2023 the EU could receive up to 50 bcm of extra LNG, in line with the EU estimates, and decrease its overall reliance on Russia’s imports to only 60 bcm to 80 bcm of natural gas per year. In the long run, the EU will aim to fully decrease its reliance on Russia whatsoever.

EU’s Potential Energy Profile By 2023 (ICIS)

All of these developments in Europe are opening an opportunity to international natural gas players, who will be eager to take Russia’s market share. And as the market is about to experience one of the biggest transformations in decades, it’s safe to say that the higher price for natural gas will be with us for a while. That’s where Energy Transfer comes into play.

The Age Of Global Opportunities

A Midstream Operator Worth Looking At

At this stage of the article, we’ve already established two things that are central to my bullish thesis on Energy Transfer. The first thing is that it’s very likely that the price of natural gas is not going to significantly decrease anytime soon due to the upcoming changes in the European natural gas market, which will greatly benefit Energy Transfer, as it’ll be able to continue to create additional shareholder value in the following quarters. The second thing is that the demand for international LNG is only going to increase and with Russia’s inability to increase its output, Energy Transfer will be able to fill up the demand by completing the financing of its export LNG facility in Louisiana later this year. Right now let’s focus on the first idea before discussing the LNG play.

Since the beginning of the year, Energy Transfer units have experienced a 15% increase in price due to the increase in natural gas prices. This has helped the company to improve its financials and in Q1 its EBITDA was $3.34 billion, above the estimates. Distribution during the period came at $0.20 per unit, which translates to $0.80 annually. At the same time, thanks to reporting solid financial results, the management now forecasts to spend up to $2 billion on capital-heavy projects, mostly on midstream plants and interstate projects along with some refineries.

On top of that, one of the major upsides of the current situation is that most of Energy Transfer’s interest expenses are fixed, which makes it easier for it to deleverage its balance sheet thanks to the growth of earnings and cash flow despite the increase in interest rates. In the last few quarters alone, Energy Transfer decreased its long-term debt obligations by over $6 billion. Earlier this year the company also announced a sale of its majority interest in Energy Transfer Canada, which should help it to reduce its total debt by an additional $450 million.

Going forward, higher re-contracting rates present an opportunity for Energy Transfer, as the price of natural gas is unlikely to significantly deteriorate in the long-term due to the situation in Europe, which could outweigh the possible demand destruction that could be caused by the possible recession. That’s why the management forecasts the 2022 EBITDA to be up to $12.6 billion, an increase of $400 million from the latest forecasts thanks to the exceptional growth of the business, as re-contracting rates are indexed to the inflation rate as well.

As for the long-term targets, during the latest conference call, the management noted that the goal is to return to the distribution rate of $1.22 per unit on an annual basis. This will likely be achieved in the next couple of years and I also think it’s a realistic goal given how the long-term changes in the natural gas industry will positively affect non-Russian natural gas businesses.

What’s also important to mention is that Energy Transfer units currently trade below the pre-Covid levels even though the company has made significant progress in deleveraging its balance sheet. At the current unit price, units trade at a yield of nearly 8%. On top of that, at the forward EV/EBITDA of 7.5x Energy Transfer trades below its own average of over 9x in the last five years, so it does have more room for growth given the current environment. We could easily justify a higher multiple that is closer to the 5Y average, especially since the higher interest rate environment is not that big of a problem for the company given the fact that it pays fixed interest expenses on its debt.

The Upcoming LNG Play

As Energy Transfer continues to benefit from relatively high natural gas prices, it’s also going to benefit from the increased demand for international LNG in the long term. We already see a gradual return of capital to the sector, especially in Europe, which is actively building new LNG terminals to decrease its overreliance on Russia.

At this stage, Energy Transfer is planning to build an export LNG plant in Lake Charles, Louisiana, where it already has import and regasification plants that are connected to the network of its own pipelines. The company estimates that it would take four years to construct the plant and in the recent earnings call, the management said that it could sell up to 75% of the equity in the project to potential partners. Finding a partner at this stage makes sense since Energy Transfer will be able to avoid significantly increasing its debt profile. At the same time, given the changing geopolitical landscape, I believe it won’t be a problem to find a partner for an LNG plant. At this stage, what Energy Transfer is doing is it’s scoring export contracts with potential buyers and will make a final investment decision later this year.

It also makes sense for Energy Transfer to enter an international export business, as natural gas prices historically have been much higher in Europe and Asia, due to their heavy reliance on imports, while the U.S. has an abundance of natural gas. In addition to Europe, China could also become Energy Transfer’s major international client, as the company already has signed a contract with China Gas.

Forecasts show that in 2022 China’s natural gas demand will be 395 bcm, above its 2021 levels. Last year Russia managed to export only 16.4 bcm to China through the Power of Siberia pipeline and via LNG carriers combined. Earlier in this article, I have mentioned that Russia’s pipeline infrastructure will be able to reach a full export capacity only by the end of the current decade if Power of Siberia 2 will be constructed in the foreseeable future. Even at full export capacity, Russia will be able to transfer only around 100 bcm of natural gas through pipelines at the end of the decade, which is still not going to be enough to meet China’s energy demands, which are more than likely going to increase in the following years. Add to this an inability to significantly increase the Russian LNG output due to sanctions, and it becomes clear that even China will be required to look for an additional natural gas on the international markets, which opens up an opportunity for Energy Transfer to expand its business worldwide.

Risks

There are two major risks to the bullish thesis. The first one is the possible peace settlement between Russia and Ukraine. If that’s going to happen anytime soon, then the EU could backtrack on its promise to significantly cut imports from Russia to stabilize the prices of natural gas. This will negatively affect Energy Transfer’s performance in the long term. However, I don’t see this happening in the foreseeable future. President Zelensky clearly stated that Ukraine won’t cede its territory and given the successes of Ukraine’s offensive on the Mykolaiv – Kherson frontline, it’s safe to say that we’re not going to see a truce anytime soon.

The second risk is the drop of sanctions by the EU due to Russia’s intimidation. In the past, I have already explained how Russia uses natural gas to achieve its geopolitical goals and we could witness the possibility that Moscow will begin to blackmail Europe by cutting gas supplies to force it to drop its support for Ukraine. We already see a reduction of supplies to Europe and there’s a reason why the IEA chief warns Europe to prepare for the total shutdown of Russia’s exports. If the EU backs down and drops sanctions, then Russia could return to importing the western technology for its LNG infrastructure and increasing its output over time. This could put the completion of Energy Transfer’s Louisiana LNG export plant under question.

However, I also don’t see this risk materializing anytime soon. In order to drop the sanctions, there should be a unanimous decision by all members of the European Council to do so, and I find it hard to believe that the Baltic States and other member states that don’t rely so much on Russian imports will agree to this before the restoration of Ukraine’s territorial integrity.

The Bottom Line

Russia’s invasion of Ukraine will reshape the global natural gas business forever. The possibility of high prices for natural gas in the foreseeable future along with the increased demand for the international LNG are opening a great opportunity for Energy Transfer to profit from Russia’s demise. The company is poised to use the changing geopolitical landscape to its advantage and this should help it to continue to create additional shareholder value in the long term.

Mark Your Calendars For July 7

I’m happy to announce that on July 7 I’ll be launching my own marketplace service here on Seeking Alpha called BlackSquare Capital. As we’re entering a new geopolitical reality, the goal of the service will be to assist you in building an event-driven portfolio, which can weather any storm and thrive in volatile environments. There will be a very special introductory price for a limited number of the first subscribers, so stay tuned!

Be the first to comment