Must add – “Buy Docusign” Linda Raymond/E+ via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Line ‘Em Up

Right now is a glorious time to be alive if you are in the business of buying software companies.

Because, one, you have a big ol’ bag of money sat lying around doing nothing and earning nothing – if you’re a strategic buyer like Microsoft or Salesforce.com then you are awash with money that rolls in from your subscribers with even more predictability than your old-line Berkshire Hathaway insurance premia, and if you’re a financial buyer then in the last couple years the Retired Janitors of America likely just awarded you a fund the size of an exoplanet.

And, two, software stocks just swan-dived off the stage into the orchestra pit and landed on their heads. The audience is hoping they will recover, but they’re still dazed, wandering around and trying to make sense of it all. Should a bigger friend come along to, er, help them out of the Pit of Despair, shareholders will likely grab onto that friend with both arms and never let go. Wrongly for the most part, but fear will do that to the most accomplished of portfolio managers.

Finally, three, the economy is just starting to slow and because of the forward-looking remaining performance obligation measure that can be used to see just a little into the future, you can get a sense of which of these fallen angels are likely to hold up just fine through the tough times, and which will end up in therapy.

So here’s the playbook. Find a solid company with predictable revenue line, so-so-not-really-trying-very-hard cashflow margins, owned and run by folks who lack the zeal to have juiced the numbers already, perhaps with some gaps in the management team that are going to be difficult to fill, and, the cherry on the top, on the shareholder naughty step for the red ink the stock’s decline has inflicted on the portfolio.

Now thanks to the present situation with the Fed, where everyone is pretending that rates have anything to do with inflation (n.b. – Chairman Powell we think knows that rates have nothing to do with this kind of supply-side inflation, and hence his apparent “policy mistake”. We don’t think it’s a policy mistake. We think he knows the truth. But we think he thinks we all can’t handle the truth.), and everyone is saying that rates are going to have to go to 9% because PCI or PCE or the price of the kid at the bus stop’s bus ticket, or something, well, if money is going to cost like 15% to borrow next week and gas is going to be like $10 next month then, nobody wants to buy growth stocks. Right?

And so there is no shortage of candidates of software companies to be bought. But we can tell you that if you are the Microsoft M&A department or you are a budding Master of the Universe, there are a few that smell so good, just so good, they positively radiate the good aroma of free money, you can smell it, you can feel it, heck you can almost touch it already. And one of those tasty morsels, those tickets to a bigger yacht … one of them is DocuSign (NASDAQ:DOCU).

Yup. DocuSign.

Now, we should put the comments field right here. So folks can pile in and say, huh, it’s all over for DocuSign. Commoditized. Adobe gonna eat it alive. If not Adobe then FreeSignature.com. And if not FreeSignature.com then a 100-line script that the self-same kid at the bus stop wrote while he was figuring out whether selling more lemonade or licensing that script would earn him enough money to buy the bus ticket that is going up from $2 to $35 next month. Because, huh, e-signatures, man that was done in like the 1990s. Jeez!

Well, we have news. The dirty secret about a lot of software companies is … software is often not very impressive. Think about it. When did you last use a software product where you were truly wowed about how it made your job easier or quicker or more productive or helped you make money faster? If you own a business, when was the last time you implemented a software product and said, fantastic, sayonara 20% of headcount, it just got automated, no whining employees or contractors for me, pass me another cold one Marjorie?

One day software will be good. It’s a young industry and it has a long way to run. Railroads are still terrible and they’re like 250 years old. If we can all get the sentient Google AI (sorry, not sentient, definitely not sentient, they said so and after all why would they fire the guy for saying it was sentient if it was sentient, sorry not fire the guy, place him on administrative leave, whatever) to work for us for a few electric donuts a day and not go all HAL-9000 with the office air-con, then, the future of computing will be all it was promised to be back in the Dreamtime.

But until then, most software is exceptionally basic, cumbersome, requires you to bend your processes to its processes, and generally not very impressive at all. And very often not very different to its competitors.

The one thing that software has going for it is its resemblance to high-grade cocaine. Because once you get that little taste for free – days, weeks sometimes, better than you ever saw on The Wire – you start to dream about a better life. Where you toss the machine the good donuts and it does your work for you. Or even better, it does Bob’s work for you, and then you can finally fire Bob. MAN that will feel good. So, you sign on the line, electronically of course, and then an army of people arrive at your office to ask you all about your business processes and tell you how seamless it will be that the new application will fit those processes perfectly. And then a year later when you have paid a business process consulting firm to help you to change all your processes to fit how the software thinks you should run your business, and you finally have the thing working, and you’ve trained everyone on it, you settle back into a kind of trance. Long code-vid. Where you are just exhausted all the time and you cannot bear to talk about software not for one minute. And all you have to do is keep paying the subscription, which isn’t your money anyway, it’s shareholders’ money, so, who cares really? Marjorie – MARJORIE – send the check and bring me some donuts. NO NOT THE ELECTRIC ONES. Glazed cherry. With those sprinkles I like.

Can fourteen other companies offer electronic signatures? Absolutely. Is the DocuSign Agreement Cloud a thing? Unlikely. Will it ever be a thing? Probably not. Soon they will call it DocuSign One and that won’t be a thing either, but it will reset the count from announcement to release and everyone will forget about the Agreement Cloud which was never a thing anyway. Or if it was, it’s now legacy.

It doesn’t matter. Because no customers of any scale want to go through all that again, and so most likely they won’t leave unless the vendor gives them a reason to – a big messed-up product release, bungled repricing, that sort of thing.

(Oh by the way – if you are new to software, the above is not in fact fiction but is pretty much a fly on the wall of enterprise software, and has been since, ever. This is what happens when you sell “products” that are ephemeral by nature. The product is whatever the sales team can convince the user-buyer and economic-buyer it is. And a skillful sales team can dream-weave the product to fit exactly what the user- and economic-buyer are looking for to solve their problems. The best ones can do this intuitively, like your regular psychopath. The less skilled ones have all kinds of programmatic sales methods to help them convince otherwise sensible customer executives that their lives will improve by paying the big bucks for word salad).

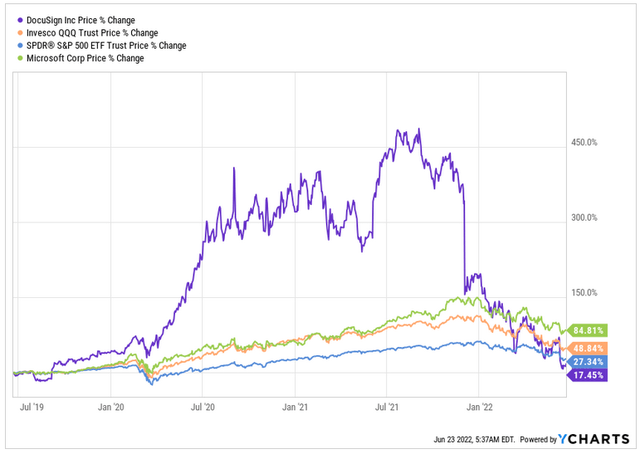

DocuSign stock has undergone the controlled demolition apparent in many corners of the market right now. Here’s the last three years of DOCU versus the S&P, the Nasdaq-100, and the Big Dog.

DOCU vs indices vs MSFT chart (YCharts.com)

If you just left your money with that friendly Mr Nadella in June 2019, then even a global pandemic and then a panic about the future of the West (or a rates tantrum, whatever) hasn’t prevented him from almost doubling your money in return for no effort whatsoever on your part. Thank you Mr N. Thank you.

If you got all fancy with DocuSign then unless you bailed along the way, you’re left with a very sore head indeed. So if a nice buyer comes along and waves a fistful of dollars under your nose, you are probably going to say, phew and double phew, yes please I will take your money and forget all about the Agreement Cloud. And you will be forever grateful to the corporation or the Master of the Universe for giving you the small dollars.

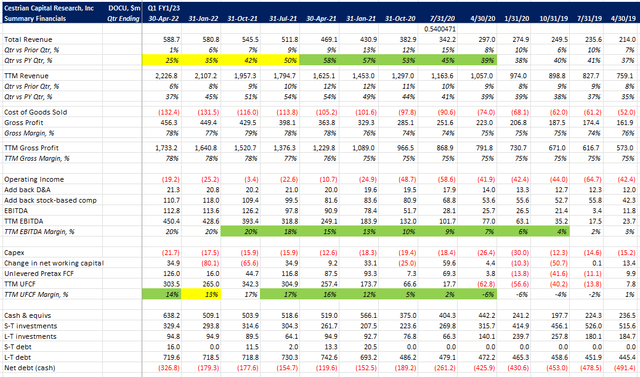

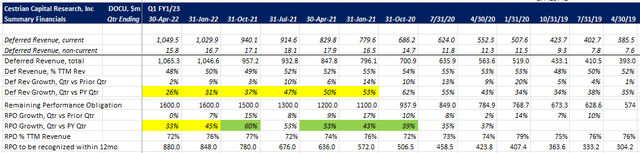

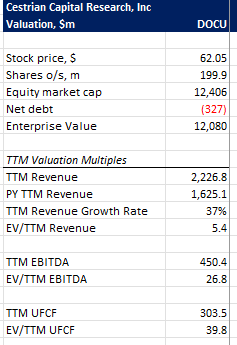

Meanwhile, the corporate or financial buyer takes a look at this set of numbers and goes, yay for me!

DOCU Fundamentals Table I (Company SEC filings, Ycharts.com, Cestrian Analysis) DOCU Fundamentals Table II (Company SEC filings, Ycharts.com, Cestrian Analysis) DOCU Valuation Table (Company SEC filings, Ycharts.com, Cestrian Analysis)

Because whilst what you see is a bailout at not too bad a price, what the buyer sees is an opportunity to pay a muted multiple of revenue for a company that:

- Is growing revenue at 37% on a TTM basis, with the forward contract book growing at 33%, meaning there might be some softness ahead but probably not a big air pocket, and;

- Has a contract book equal to more than two-thirds of last year’s revenue, and is telling everyone that half of last year’s revenue is already in the bag to be recognized next year, even if every dream-weaving sales exec was canned tomorrow, and;

- Is – even on anecdotal evidence – leaving money on the table, at the door, all over the floor, in the parking lot, everywhere. Consider this nugget from one of our subscribers this week, with a only a few words changed by us to protect the guilty:

“Here’s a real-life DOCU anecdote. Doing two giant deals in a row, both with multiple LLCs as counterparties so a gazillion DocuSign signatures. The DOCU sales rep makes contact, says hey, we see you’ve really upped your usage, how about maybe moving up a tier for your usage? We say, sure, send the info and we’ll take a look. We hear nothing. Get our annual renewal at the same, cheap $25/month rate as always, just the basic bottom level. Not a good sign for DOCU!“

That’s right. Not a good sign for DOCU under its current management team. This kind of thing is absolutely standard across the software industry – actually across most all industries. It’s why activist shareholder attention works when it’s done right. But this is a great sign if you acquire DOCU right now, because it means that there is literally free money everywhere. You know the best kind of free money on the revenue line? Price rises and contract restructures. Because the gross margin on a price rise or contract restructure isn’t the 78% at which DOCU is currently running. It’s as close to 100% as you can measure. Know what the unlevered pretax free cashflow margin on a price rise or contract restructure is? Yup. Close to 100%. It is literally free money. And in the example above, as is prevalent, the customer won’t even mind giving you more money if you just ask for it. O – M – G!!!

And don’t even get us started on the cashflow margins. 14% TTM cashflows off of a 78% gross margin business growing revenues at 37% with a book of business that size? Lol. 25% cashflow margins are easy from here; 30% attainable. If you know what you are doing and you actually try. First you have your 100% cashflow margin drop through from your revenue yield tricks; then you can just take the ax to the very many surplus-to-requirements staff, starting with your hey-no-problem account manager detailed in the example above and finishing just before your knife cuts into bone; then you have more real estate than you need, and you can get rid of that, and then … something else and another thing and all told it is quite amazing how much cost is in most businesses that they don’t need.

So. You acquire DOCU, you fix the revenue yield by applying the playbook of crazy-spiral-eyes-nobody-knows-what-they-are-paying-for-what-or-why (you know, like your cellphone contract), you hire a CEO or GM who has done this before a few times, ideally for you so you can just go to work and start chopping wood without having to have any existential discussions about what good looks like and blah. And then you start swinging the ax. Nicely, of course. Helping folks take the next steps in their careers. And then in a few short years you find that this thing is generating major dollars to your corporate cashflows, if you are Mr Nadella or his ilk, or, if Master of the Universe is your chosen profession, that you can sell it on to an even bigger friend, at a whopping realized gain, which has caused you a major problem insofar as you now have more yachts than you have mooring rights.

And for this reason, we say: watch this space. DOCU is on our we-think-this-puppy-is-getting-bot list. And we can always be wrong, often are, but in recent years other stocks on this list have included SAIL (sold), MANT (sold) PSRP (sold), PFPT (sold) and others. DOCU, and for that matter SPLK, we believe are on the block right now.

So, should you buy DOCU? If you’re buying it to make new highs, you could be waiting a long time. If you’re buying it because you think it can get sold at a decent premium to here, we think that can make sense. In staff personal accounts we own DOCU and we’re holding it, not adding, not selling. We’ll rate at Buy for the purposes of this article; in case by some miscalculation the powers that be do in fact end Western capitalism, a stop-loss is probably your friend and you probably want that placed in the low $50s just in case – that’s below the recent lows.

Cestrian Capital Research, Inc – 23 June 2022.

Be the first to comment