Daniel Balakov/E+ via Getty Images

Energy Transfer LP (NYSE:ET) is one of the largest and most well-known midstream partnerships in the United States. The company has long been a favorite of income-seeking investors, although it has fallen from grace over the past few years due to a distribution cut in 2020 and a few other questionable management decisions. Fortunately, the company has been making some progress at rebuilding the goodwill that it once had as well as boosting its distribution. There could certainly be a few reasons to purchase shares of the company today, including its 9.28% current yield and near-term growth prospects. The company has also been benefiting from the growing demand for natural gas and natural gas liquids from around the world and this is a segment of the company’s business that is likely to keep growing over the coming years. Thus, it may be time to take another look at the company and consider adding it to a portfolio.

About Energy Transfer

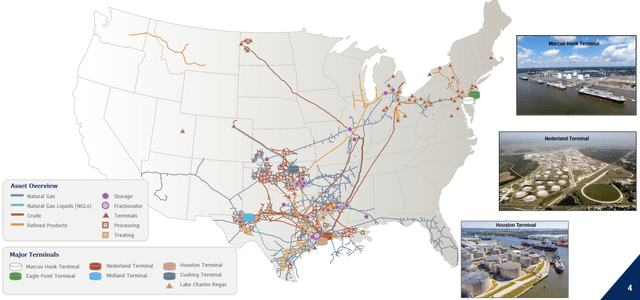

As stated in the introduction, Energy Transfer is one of the largest midstream companies in the United States. The company boasts a network of hydrocarbon storage and transportation infrastructure that stretches across the central and eastern parts of the United States:

The company’s infrastructure is capable of transporting 4.6 million barrels of crude oil and 29.0 trillion BTU of natural gas per day, which easily places it among the largest midstream companies in the nation. In addition to this, the company is capable of exporting 1.1 million barrels of crude oil and 1.1 million barrels of natural gas liquids per day. This is something that was important in the years prior to the outbreak of the COVID-19 pandemic. In September 2019, the United States became a net exporter of crude oil for the first time since records began being kept in 1973. Unfortunately, the country’s status as a net exporter has been challenged in the years since the crash in 2020. In 2021, the United States was a net importer of crude oil. In 2022, it has been a net exporter during certain months and a net importer at other times. Thus, the company’s crude oil export facilities have likely not been as utilized as they may have been had upstream companies not changed their business models away from growth at all costs, which was generally the mantra among shale oil producers prior to the pandemic.

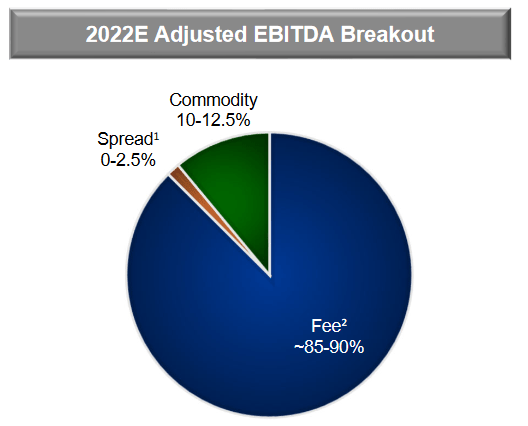

However, Energy Transfer’s infrastructure has still been performing well. In the third quarter of 2022, the company exported record amounts of ethane, a natural gas liquid. The company also gathered and transported record volumes of natural gas. This is important because the company’s business model is focused on handled volumes, with resource prices being a secondary concern. In short, the company operates by entering into long-term (usually five to ten years in length) contracts under which the company transports and stores hydrocarbon resources for its customers. In exchange, the customers compensate Energy Transfer based on the volume of resources that they send through the company’s infrastructure, not on the value of the resources. This provides Energy Transfer with a great deal of insulation against fluctuations in resource prices, despite the fact that its unit price tends to trade somewhat in line with commodity prices. In addition to this, the contracts include minimum volume commitments that require the customer to send a certain volume of resources through Energy Transfer’s pipelines or pay for them anyway. This protects Energy Transfer against production declines that may accompany a low energy price environment. These contracts are responsible for approximately 85% to 90% of Energy Transfer’s adjusted EBITDA:

Energy Transfer

Overall, this provides the company with incredibly stable cash flows regardless of economic conditions, which is exactly what we like to see with an income investment because of the support that these stable cash flows provide to the distribution.

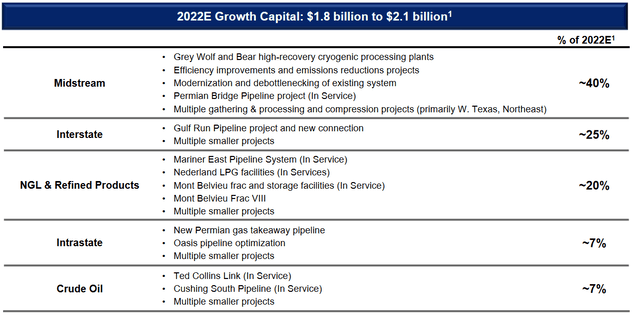

Naturally, as investors, we are interested in far more than simple stability. We also want to see growth. Fortunately, Energy Transfer is quite well positioned to provide us with growth over the next few years. The way that the company is doing this is by constructing new midstream infrastructure. In fact, the company currently expects that it will spend a total of $1.8 billion to $2.2 billion over the course of 2022:

This is necessary because midstream infrastructure only has a limited amount of capacity that it can transport or store. As the company’s growth comes from increasing the volume of resources that it can handle, it needs to increase the capacity of its infrastructure. While there are ways to increase the capacity of existing pipelines or storage tanks, there are limits to how much capacity can be increased without constructing new infrastructure. The nice thing about this new infrastructure is that Energy Transfer has already secured contracts from its customers for the use of the new capacity. This is something that is nice to see because it provides us with an assurance that the company is not spending enormous amounts of money to construct infrastructure that nobody wants to use. In addition, the company will know in advance how profitable a given project will be so it can be certain that it will provide a sufficient return to justify the investment. Unfortunately, Energy Transfer has not stated exactly what the expected return on these projects actually is, which makes it difficult to analyze the exact impact that they will have on Energy Transfer’s cash flow. Usually, midstream projects pay for themselves in four to six years though so that is probably a reasonable estimate for the company’s returns on these projects. We can expect to see the impact on the company’s cash flow once these projects come online, many of which did earlier this year. Thus, some of these projects have been the source of the company’s cash flow growth that we have seen over the course of 2022.

One of the most significant new projects that Energy Transfer is working on is a joint venture with Satellite Petrochemical USA to construct an ethane export facility on the Gulf Coast. The company has already constructed a 1.2-million-gallon ethane storage tank and a 180,000-barrel-per-day ethane refrigeration facility at its Nederland export terminal. Energy Transfer also constructed a pipeline from Mont Belvieu to the Nederland export terminal carrying ethane to fill these new facilities. Satellite Petrochemical USA has contracted with Energy Transfer to purchase 150,000 barrels of ethane per day over an extended period but unfortunately, Energy Transfer has not specified exactly how long this period is. The contract must be sufficiently long-term to justify the cost of constructing these new assets, however. The contract took effect in June 2022 and Energy Transfer has already transported approximately 29 million barrels of ethane to Satellite Petrochemical under this agreement. Thus, we have already seen some incremental cash flow from this agreement in Energy Transfer’s third-quarter results. However, it will enjoy much larger contributions from this joint venture over the course of 2023 than it did in 2022. This is because this agreement will be in place over the full-year 2023 but was only active for about half of 2022. This joint venture also shows proof of the growing global demand for natural gas liquids that I have discussed in various previous articles. It is conceivable that Energy Transfer will have other similar opportunities for growth in this area presented to it over the coming years and months as this international growth continues to grow.

Financial Considerations

It is always critical that we examine the way that a company is financing itself before investing in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. As this is usually accomplished by issuing new debt to replace the maturing debt, a company’s interest expenses may increase following the rollover depending on the conditions in the market. In addition to this, a company must make regular payments on its debt if it is to remain solvent. As such, an event that causes the firm’s cash flow to decline may push it into insolvency if it has too much debt. Although Energy Transfer enjoys remarkably stable cash flow due to its business model, bankruptcies have still occurred with other companies that have the same business model so it is still important for us to analyze the situation.

The usual way that we analyze a midstream company’s ability to carry its debt is by looking at its leverage ratio, which is also known as the net debt-to-adjusted EBITDA ratio. This ratio essentially tells us how many years it would take the company to completely pay off its debt if it were to devote all its pre-tax income to that task. As of September 30, 2022, Energy Transfer had a net debt of $47.926 billion. In the trailing twelve-month period that ended on the same date, the company had an adjusted EBITDA of $12.467 billion. This gives the company a leverage ratio of 3.84x. This is a very reasonable ratio that is well below the 5.0x that analysts typically consider to be reasonable. However, as my regular readers likely know, I usually prefer to see this ratio below 4.0x in order to add a margin of safety to the investment. Energy Transfer easily fulfills even that more restrictive requirement so it does not really appear that the company’s debt is a problem or an especially large risk today.

Distribution Analysis

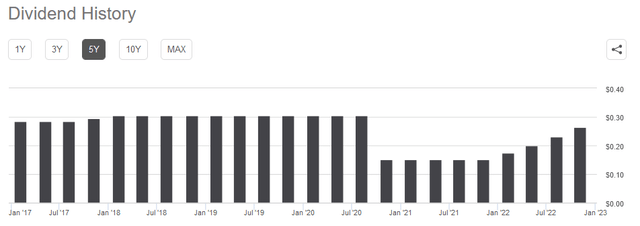

One of the biggest reasons why Energy Transfer has been a favorite of income-focused investors is because of the high yield that it has historically possessed. Unfortunately, the company earned the ire of many investors back in 2020 when it slashed its distribution. It has gradually begun to rebuild its distribution but it still remains well below the levels that it had pre-pandemic:

As of the time of writing, Energy Transfer boasts a 9.28% yield, which is well above the 1.57% yield of the S&P 500 Index (SPY). However, some investors may still get turned off by the company’s recent past. Of course, anyone buying today will receive the current distribution at the current yield so the most important thing for anyone buying the units today should be concerned with the company’s ability to maintain its distribution at today’s level.

The usual way that we judge a midstream partnership’s ability to maintain its distribution is by looking at its distributable cash flow. Distributable cash flow is the money that was generated by a company’s ordinary operations that is available for distribution to limited partners. In the third quarter of 2022, Energy Transfer reported a distributable cash flow of $1.581 billion but the company’s distribution only cost it $819 million. This gives the company a distribution coverage ratio of 1.93x, which is well above the 1.20x that analysts typically consider to be reasonable and sustainable. As is the case with debt, I am more conservative here and like to see this ratio over 1.30x in order to add a margin of safety to the investment. Energy Transfer clearly meets that requirement as well. When we consider the company’s growth prospects for the near term, it seems that this distribution is easily sustainable at the current level. This bodes well for any investor that is seeking a very high yield today.

Conclusion

In conclusion, there is a great deal to like about Energy Transfer today despite the concern that some people have about the company’s management and recent history. The company recently reported one of its best quarters in history and still retains some very strong growth prospects. The firm also has a reasonably low debt load that could allow it to continue raising its distribution as the growth story plays out. That scenario could also cause the unit price to increase somewhat. Overall, there is a lot to like here.

Be the first to comment