Darren415

This article was first released to Systematic Income subscribers and free trials on Dec. 3.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the first week of December.

Be sure to check out our other Weeklies – covering the Closed-End Fund (“CEF”) as well as the preferreds/baby bond markets for perspectives across the broader income space. Also, have a look at our primer of the BDC sector, with a focus on how it compares to credit CEFs.

Market Action

BDCs were, unusually, down this week despite a strong market across the broader income space. Only two companies in our coverage finished the week in the green.

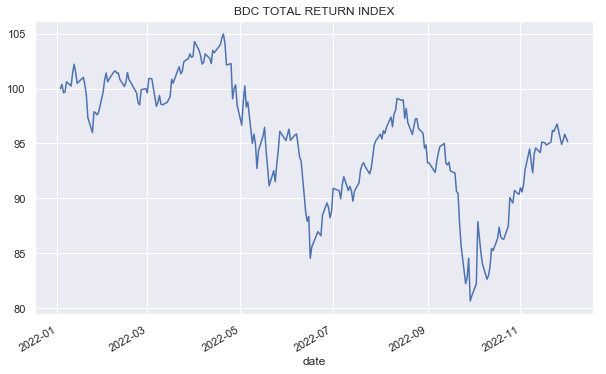

BDCs have recovered most of their drop over September. Interestingly, this most recent rally looks very similar to the previous rally we saw over the summer.

Systematic Income

Investors are likely balking at valuations that are only a few percentage points from book value on average in a deteriorating macro environment for loan borrowers. While there are occasional opportunities (with Blackstone Secured Lending Fund (BXSL) as highlighted below), we have mostly been downgrading our BDC holdings from Buy to Hold in response to this most recent rally. We expect more attractive opportunities in the coming year for new capital allocations.

Systematic Income

Market Themes

There was a recent Barron’s article that warned investors away from BDCs. The logic is that 1) BDCs are leveraged vehicles of highly-leveraged companies (i.e. not a good idea entering a recession), 2) NAVs have not moved a whole lot compared to publicly traded loans and 3) discounts to book value are tight with many BDCs trading at premiums to book. They end up recommending investors look to loan CEFs rather than BDCs. These are all reasonable complaints however the narrative does miss a couple of key points.

One is that it assumes that we are definitely going to experience a tough recession. This certainly seems plausible; however, it’s important to have a sense of humility about macro forecasting. Forecasters don’t have a great track record either forecasting recessions or expansions so we don’t actually know what will happen. Even if we experience a recession we don’t know whether it’s going to be mild or severe and long or short. It is not implausible for BDCs to perform well if we see a fairly mild recession.

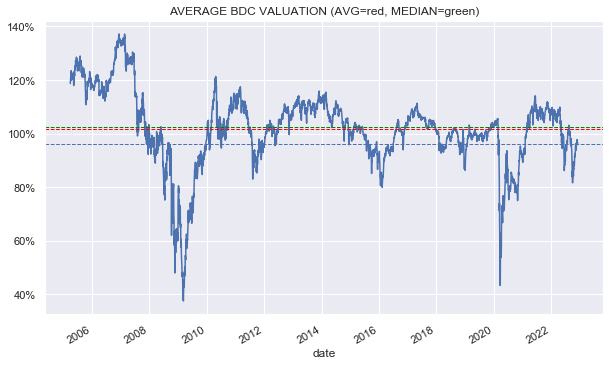

It also matters where current valuations are and how much of a recessionary environment is priced in. Sector valuation of 80-90% which we have seen any number of times this year offers a decent margin of safety over the medium term. Separately, remaining on the sidelines does also carry an opportunity cost, particularly when yields are reasonable as they are now.

Two, as many investors know, BDC NAVs simply don’t adjust a whole lot, nowhere near the level of bank loans despite their leverage. For example, NAVs fell only 10% during the COVID quarter i.e. an implied drop in private loans of around 5% on an unleveraged basis versus much bigger falls in publicly traded bank loans. That certainly seems odd however you could also easily argue the reason traded loans drop a lot more is due to reduced market liquidity and this factor is not something that private loans are faced with which is why their valuations hold up better. We should also remember that NAVs don’t only reflect loan valuations. Many BDCs have additional NAV tailwinds via net realized gains from equity upside as well as prepayment fees, some of which is often retained. We should also remember that this BDC NAV stability carries big benefits and makes it much harder for a BDC to undergo a forced deleveraging (i.e. keeping it from locking in economic losses) while loan CEFs may deleverage at a drop of a hat simply due to market volatility.

Three, it’s true that BDC holdings tend to be in higher-leveraged companies, however this also misses the point that historical BDC loss rates have been pretty low. Net realized losses have been around 1% per annum which is on par with the supposedly higher-quality bank loans. There are key factors that minimize BDC loss rates such as sponsor support, support from the BDC itself, additional documentation factors, equity upside that offsets losses etc. In fact many BDCs have net cumulative realized gains – not something you would expect if you think of BDCs as static portfolios of loans to highly-leveraged companies. We should also remember that BDCs have delivered a total NAV return of around 8.8% CAGR over the last 10 years versus 4% for loan CEFs which is something investors ought to keep in mind when allocating between these two types of loan vehicles.

Four, the rise in BDC yields provides an additional margin of safety, potentially offsetting future losses. BDCs have benefited from rising short-term rates to a greater extent than loan CEFs as about half the liabilities of an average BDC are fixed-rate while most loan CEFs have 100% of liabilities that are floating-rate.

Five, recent dips in BDCs valuation to around 80-90%, as discussed in any number of weeklies, is a level that has only been lower during existential crises such as the GFC and COVID. We don’t think it’s anyone’s base case that the next recession will be anything like that. The Barron’s article appears to have been written when the sector valuation was around 90% (versus 96% now) – a level we would find attractive historically.

Six, the view that loan CEFs are more attractive because they have lower leverage and lower fees does not really stand up. Although loan CEFs do carry lower levels of leverage they are much more liable to a forced deleveraging because the volatility of their underlying holdings is much higher. And while loan CEFs do have lower fees, arguably their fees are too high relative to how much work loan CEF managers do (shuffle securities in the portfolio) versus BDC managers whose tasks extend to originating and documenting new loans as well as closely managing the borrower relationship and potentially extending operational support to the borrowers.

Finally, avoiding BDCs into a recession implies either that you’d be able to acquire them at much better prices in a recession or that you can buy them on the other side of the recession after the BDC suffered a bunch of losses already. These are not impossible scenarios but they’re not really fact-based. The first one implies you can time bottoms consistently and with accuracy – stop reading this article if you do. And the second one is problematic because many BDCs move back to their pre-recessionary NAVs fairly quickly, meaning there are often no losses to avoid.

What matters a lot more is the level of valuations. At sub-90% sector valuation (which we saw a bunch of times already this year), the sector looked very attractive. The current sector valuation of 96% is on the high side and it’s why we have been downgrading BDC holdings in the Portfolio. At the same time it’s not a reason to avoid the sector entirely and certainly not to rotate wholesale into loan CEFs which don’t have many of the benefits of BDCs.

Stance and Takeaways

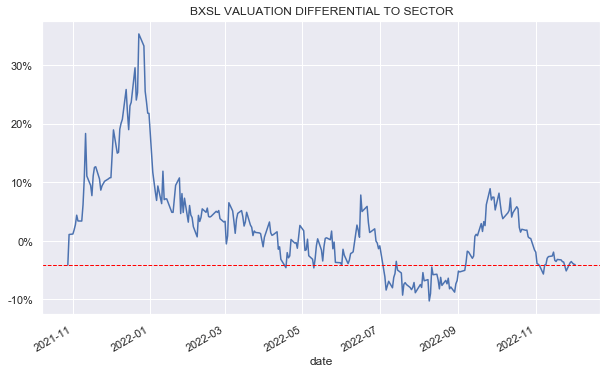

This week we added to our Blackstone Secured Lending Fund allocation by rotating capital from a credit CEF which has moved to trade at a premium. BXSL is trading cheap to the broader sector by about 4% as the following chart shows.

Systematic Income

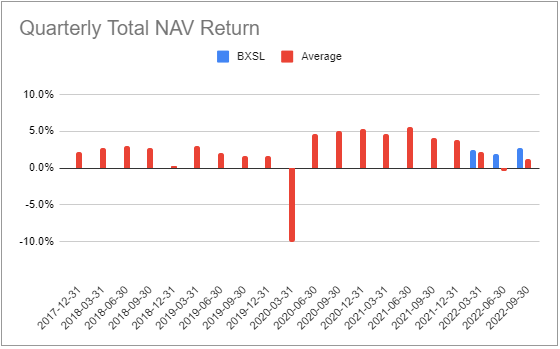

The company has outperformed the sector each quarter this year as the following chart shows. BXSL does not have a long life as a public entity though its track record as a previously private entity is strong.

Systematic Income BDC Tool

Its higher-quality portfolio, net realized gains, high dividend coverage, zero non-accruals and a high net income beta to rising rates makes it one of the most attractive holdings in the sector in our view. BXSL trades at a 10.1% yield and a 92% valuation. It remains in our Core Income and High Income Portfolios.

Be the first to comment