JHVEPhoto

Autodesk, Inc. (NASDAQ:ADSK) has a better portfolio now and is well positioned in today’s digitalization. It has numerous catalysts that may boost demand, such as the growing global construction market and trends in the sustainable world. Continuing to provide strong profitability makes this drop a good opportunity to buy ADSK.

Overview

Autodesk is a worldwide leader in CAD software, providing productive solutions in architecture, engineering, and construction. It provides services for the manufacturing, design and entertainment industries, making it well positioned in today’s digitalization. The company has been investing in improving its portfolio to ensure that it provides its customers with more efficient services and enhances its competitive advantage in the targeted low-carbon future environment.

In fact, ADSK has been shopping companies, enhancing services in each of its focused industries. This year, the company acquired Extended Reality for undisclosed terms, supporting its AEC industry to improve real-time collaboration and help design and build greener cities and cars. On top of this, it also acquired Prodsmart, improving its manufacturing portfolio by enabling manufacturers to achieve connected factories and shop floors.

ADSK is one of the few companies that has successfully transitioned to 100% renewable energy to power up its business operation. According to the management, they have an unmatched end-to-end water infrastructure solution.

And our position now with Innovyze, we already have the sort of construction bit to the chain. We had the design bid with our existing design bids. And what Innovyze does is gives us the planning phase, the sort of pre design phase. And then it also, through their digital twin, gives us the operations and maintenance space. So, we’re the only operator now that has end-to-end workflows in water and infrastructure. Source: Citi 2022 Global Technology Transcript

Due to its market-leading portfolio, it is unsurprising to see a positive catalyst in the following quarterly reports. ADSK aspires for dominance in the Middle Eastern electricity and water utility sector. If this effort turns positive, this will provide an outstanding opportunity for ADSK and may translate to continued growth in its remaining performance obligation.

Strong Customer Base

Despite the slowing economy, ADSK showed resilience this Q2 and boasted a strong top line amounting to $1,177 million, up from $1,014 million, with a double-digit growth rate of 16.07% YoY. According to the management, they saw strong renewal rates and maintained a strong net revenue retention rate between 100% and 110%. This implies a continued strong customer base, contributing to the company’s growing total RPO of $4.69 billion, up 13% YoY.

Strong Margin

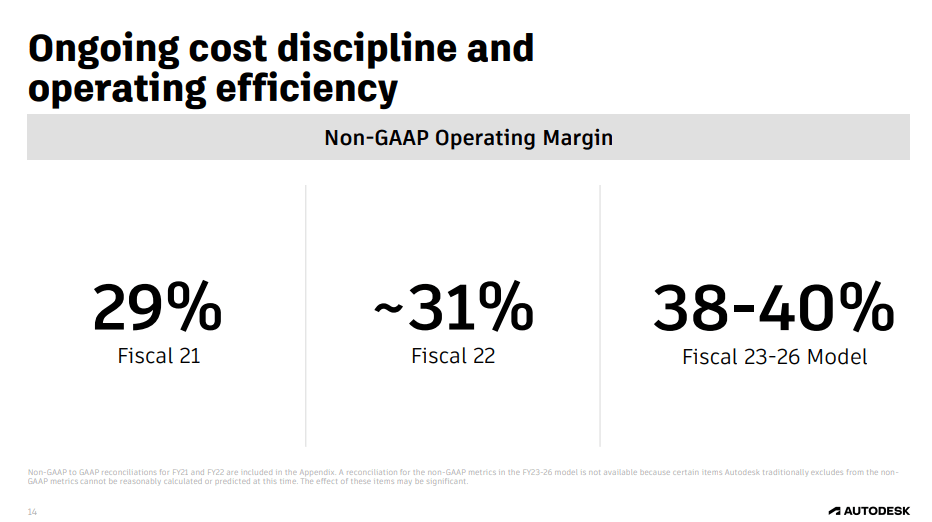

ADSK is still in the process of optimizing its operating facilities worldwide, and as part of this strategy, it incurred impairment and accelerated depreciation charges amounting to $103.7 million in FY22. The management expects approximately $25 million additional this FY23. In fact, this is one of the reasons why we can see some disruption in the company’s operating margin trend.

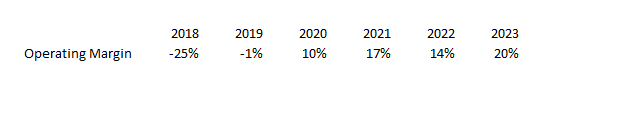

ADSK: GAAP Operating Margin Trend (Source: Company Filings. Prepared by InvestOhTrader)

During FY22, ADSK recorded a GAAP operating margin of 14%, down from 17% in FY21. Despite the supply chain and inflationary issues today, the management provided a reassuring GAAP operating margin of approximately 20% in FY23. This implies an effective cost-efficiency strategy making this stock attractive in today’s weakness.

Strong Workforce, But

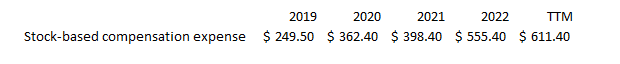

One of Autodesk’s assets is its employees, and despite the great resignation trend during the pandemic, it maintained a growing employee base of 12,600. According to Glassdoor, ADSK is ranked among the top 25 best workplaces. However, this leads to growing stock-based compensation expenses, which may pose a concern if the company experiences a demand slowdown.

ADSK: 5-year Operating Margin Trend (Source: Company Filings. Prepared by InvestOhTrader)

On the other hand, strong buyback catalysts reduced the risk of potential dilution for now, especially in the first half of 2023, when they repurchased 3.5 million of their own shares. Looking at the strong guidance from management, we can assume that they will have enough liquidity to continue acquiring companies and use their remaining 5 million shares authorization in FY23, with GAAP EPS expected to grow to $3.4 to 3.59 in FY23, up from $2.24 in FY22. Additionally, FCF is expected to grow to $2,000 million to $2,080 million in FY23, up from $1,464.8 million in FY22.

Fairly Valued

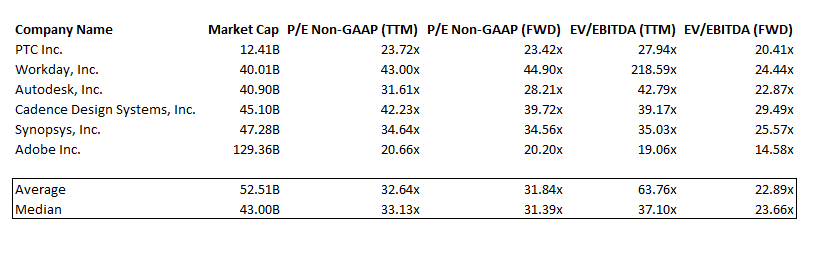

ADSK: Relative Valuation (Source: Data from SeekingAlpha.com. Prepared by InvestOhTrader)

PTC Inc. (NASDAQ:PTC), Workday, Inc. (NASDAQ:WDAY), Cadence Design Systems, Inc. (NASDAQ:CDNS), Synopsys, Inc. (NASDAQ:SNPS), Adobe Inc. (NASDAQ:ADBE)

ADSK is currently trading fairly against its peer group median. As of this writing, it is trading at a trailing Non-GAAP P/E of 31.61x, not much discount compared to its peer group median of 33.13x. ADSK was formerly valued at an extremely high multiple of 74.22x Non-GAAP P/E 5-year average,

With its current performance, where its ROE of 53.97%, up from the rest of the peer group, especially compared to its bigger peer ADBE of 33.44%, I believe there is a considerable value discrepancy between its historical and trailing figure. Hence, historically speaking, we can argue that ADSK is cheap right now. Its trailing EV/EBITDA multiple of 42.79x can provide the same conclusion compared to its 5-year average of 107.35x.

With its improving profitability and moat, I believe $10.87 target earnings per share in FY27 is achievable, especially considering the company’s growing TAM from $62 billion in FY22 to $78 billion in FY26 and today’s improving margin.

Using the analyst estimate of $10.87 EPS at an implied 33.13x P/E and discount rate of 10%, we can arrive at a conservative fair price of $223. This implies a considerable upside potential compared to its current price and potential improvement at its further drop.

Trading Near Support

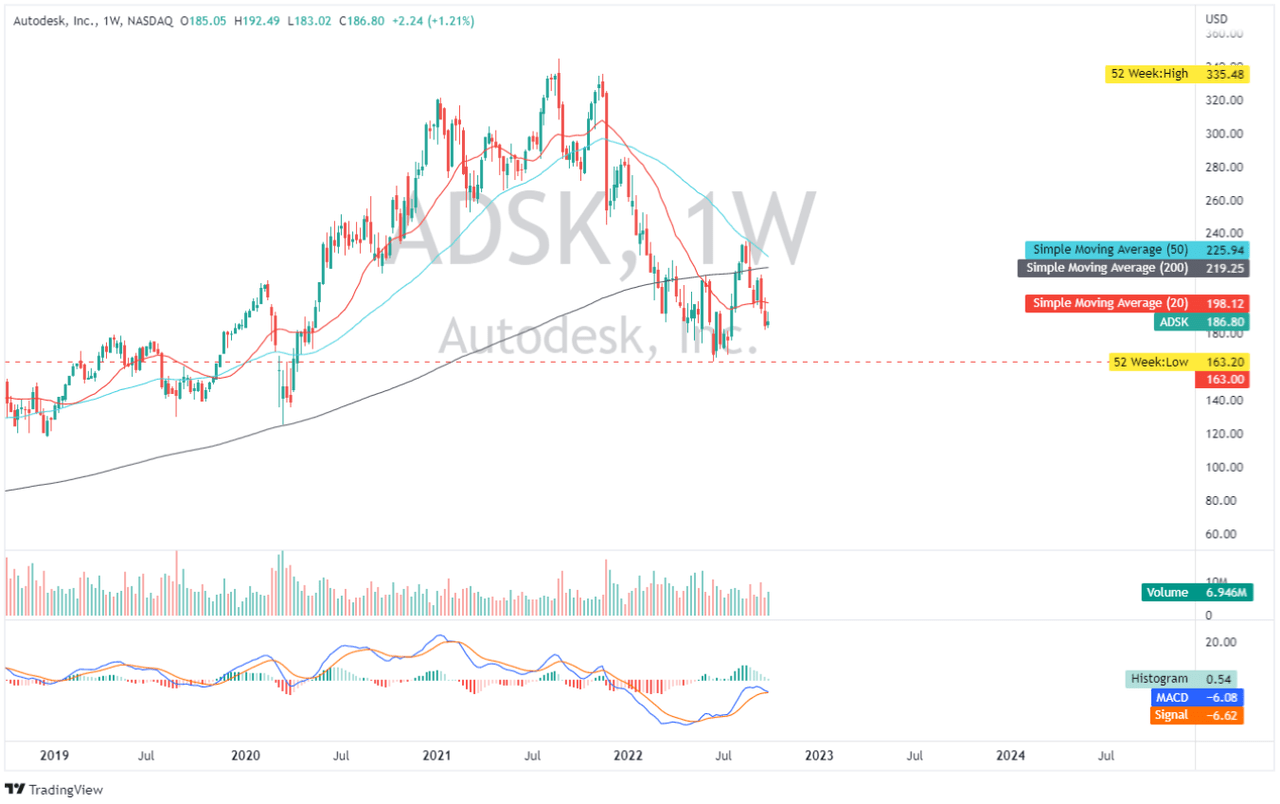

ADSK: Weekly Chart (Source: TradingVIew.com)

ADSK is trading at significant support after breaking its 20- and 50-day simple moving average. If bearish momentum continues, I believe a retest on its 52-week low of around $163 will provide a good buying opportunity.

Conclusion

ADSK Long-term Targets (Source: Investor Presentation)

Despite the economic slowdown, ADSK provides a growing top line and FCF. With its strengthening moat, I think the company is well positioned to meet its margin expansion targets. As previously mentioned, ADSK remains liquid, especially with Moody’s upgrading its unsecured credit rating to A3 and a stable outlook. Autodesk is fundamentally attractive, making it a stock to buy at today’s weakness.

Thank you for reading and good luck to everyone this month!

Be the first to comment