Bilanol/iStock via Getty Images

Energy Transfer (NYSE:ET) has consistently been one of the weakest large midstream companies in terms of their recovery. The company has a market capitalization of more than $30 billion, and a debt load of more than $40 billion. However, the company has continued to suffer from an inability to reign in capital spending and instead focus on shareholder returns.

Energy Transfer Updates

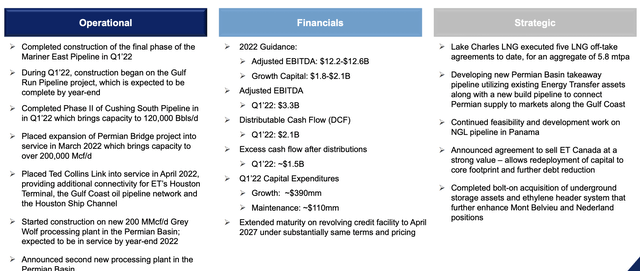

Energy Transfer has changed numerous aspects of its plans from its original guidance 1-2 years ago.

Energy Transfer Update – Energy Transfer Investor Presentation

Energy Transfer has completed several major construction phases, and is beginning to undergo new phases of new projects. Many of these projects are respectable midsize projects providing 100s of thousands of barrels of relevant capacity. The company has also started construction on several new expansion projects it expects to be in-service before year-end.

Financially, the company has dramatically changed its initial 2022 guidance. While adjusted EBITDA is expected to be at roughly $12.4 billion, the company has dramatically increased its growth capital forecast to almost $2 billion. In our view, this is the same mistake the company has previously made, where rather than focusing on levers for shareholder rewards it chases growth.

Growth is nice, but when interest rates are rising, and the market is continuously punishing you for your $40 billion mound of debt, there’s better things to focus on. The company is continuing to look for long-term strategic growth, which we’re excited by, however, again we’d like to see the company deploy its capital in different ways.

Energy Transfer Asset Base

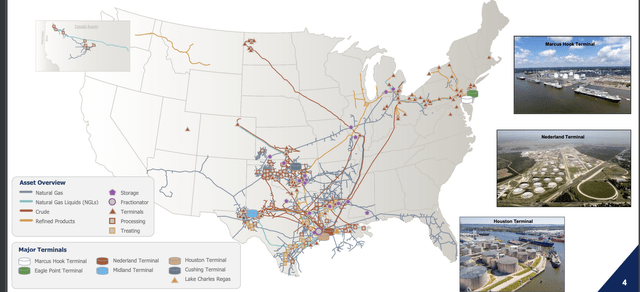

There’s no denying, however, under Energy Transfer is a portfolio of assets that support our modern standard of living.

Energy Transfer Asset Portfolio – Energy Transfer Investor Presentation

Energy Transfer is one of the largest movers of natural gas, natural gas liquids, crude oil, and refined products along with some of the separation, storage, and treatment facilities required. The company touches a substantial % of these products moving throughout the United States, and collects a fee from each of these experiences.

Despite concerns around climate change and changing demand, the company remains supported by certain industries and climate conditions that make a complete move to renewables difficult. We expect that the company will continue to be able to operate in its present form for several decades, before slowly having to adapt, modify, and change assets.

Energy Transfer Growth Capital

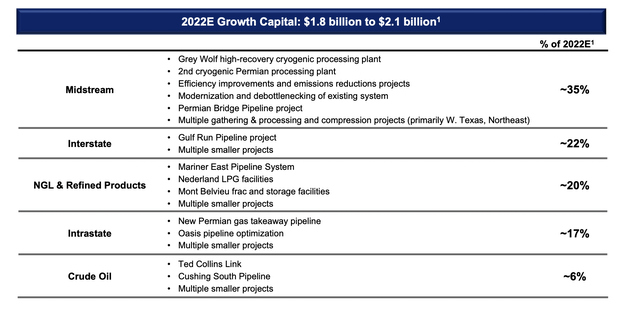

Energy Transfer’s new growth capital will be spent across a variety of projects, with many being bolt-on additions to existing projects.

Energy Transfer Growth Capital – Energy Transfer Investor Presentation

The company expects the $2 billion to add roughly $350 million in annualized EBITDA representing almost 3% EBITDA growth. The majority of this will go towards bolt-on midstream projects however, there were also be new inter/intrastate takeaway assets and a number of projects across the company’s NGL & crude oil segments.

There’s two takeaways here that we want to highlight.

The first is that these projects aren’t “bad” by any metric. They’re strong bolt-on projects that integrate well with the company’s assets. They generate a roughly 16% EBITDA yield and are completely covered by the company’s existing cash flow. With long-term demand for these projects expected to remain strong, that’s exciting to see.

However, the second takeaway is the company’s stock is still cheap. It has a more than 8% dividend yield it can comfortably afford, and it’s equity value of $31 billion is less than its net debt. We feel the company has a lot of levers through increased dividend, share buybacks, and debt pay-down that will provide higher returns than growth capital.

Energy Transfer Shareholder Return Potential

Energy Transfer has the ability to drive substantial shareholder returns.

Energy Transfer is making roughly $8 billion in annual DCF and paying out roughly $2.4 billion in dividends. That leaves it with $5.6 billion. After $2 billion in growth capital that leaves it with $3.6 billion. We’d like to see this entire amount allocated towards shareholder rewards, however, the company hasn’t provided detailed guidance here.

However, there is a key takeaway that the company is generating an almost 30% DCF yield. That yield, regardless of whether it goes towards dividends, debt pay down, or share buybacks is all generating active shareholder rewards, highlighting how the company is a valuable investment for interested shareholders.

Thesis Risk

The largest risk to shareholders is another downturn. The company tends to spend with market cycles, meaning it spends heavily when the market is good and cuts spending when the market is bad. Especially with high interest rates, the company’s massive debt load presents a liability if the company needs to refinance when the market goes down.

These risks are worth paying close attention to.

Conclusion

Energy Transfer is a bargain stock; however, we definitely believe that the company is making some of the same mistakes which have plagued it in the past. The company is rapidly increasing growth capital spending, rather than focusing on other forms of shareholder returns, which we believe could be much more immediate.

More so, as a company that’s struggled with its debt in the past, we’re concerned about its lack of focus on it, given a rapid rise in interest rates could make refinancing much harder in a future downturn. We’re still a fan of the company, and it’s still a bargain, however, we continue to believe management can generate higher returns.

Be the first to comment