Leila Melhado/iStock Editorial via Getty Images

Investment Thesis

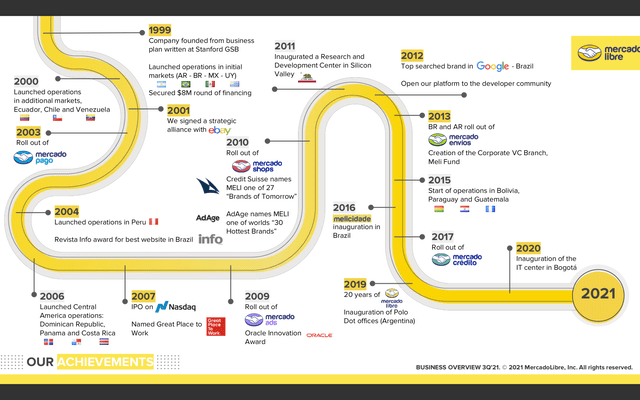

MercadoLibre (NASDAQ:MELI) is an Argentina-based e-commerce company founded back in 1999. The company mainly operates in the LATAM (Latin America) region with a strong presence in countries like Brazil, Argentina, and Mexico. It started off as an e-commerce-only company similar to eBay (EBAY) but has since branched out to other industries such as fintech and logistics. A brief history of the company can be seen in the picture below.

MercadoLibre has been one of the best compounders in the last decade. Since its IPO in 2007, the company has delivered over a 2,000% increase in return for its shareholders. It has grown from a pure e-commerce company to a company with a strong presence in the fintech and logistics industry. It now has over 80 million unique users, with over $2 billion in quarterly revenue. The company is still delivering strong growth quarter after quarter, however, it is getting caught in the broad market selloff amid the fear of high inflation and recession. The share price is now down almost 70% from its peak last year, and I believe it offers a great entry point for investors.

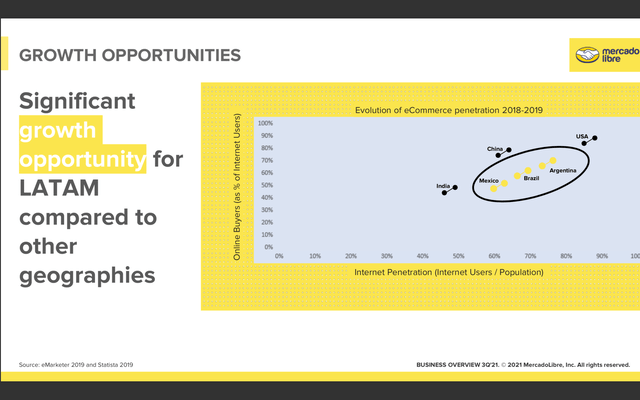

Market Opportunity

The TAM (total addressable market) for MercadoLibre is huge, as e-commerce and fintech are still in their early innings. According to Grand View Research, the global e-commerce market is estimated to grow at a CAGR (compounded annual growth rate) of 14.7% from 2020 to 2027. The growth is even quicker in LATAM as more and more people finally have access to mobile and the internet. According to HKTDC, the current e-commerce sales in LATAM only account for 5% of its total retail sales. This provides a huge opportunity for MercadoLibre, as the shift to e-commerce is still continuing to accelerate.

Alongside e-commerce, the fintech industry is also growing rapidly. Despite the rising presence of neobanks like Nubank (NU), Brazil is still one of the countries with the most unbanked population. According to PagBrazil, there are currently around 16.3 million adults without a bank account, or 10% of the adult population. While another 17.7 million adults have not used their bank account for at least a month. These unbanked adults combined transact over US$67 billion annually, which presents another huge opportunity for MercadoLibre to capitalize on. I believe the growth in e-commerce and fintech will go hand in hand, as the increasing popularity of e-commerce will likely also drive up the usage of fintech services. The low penetration rate will also serve as a tailwind going forward.

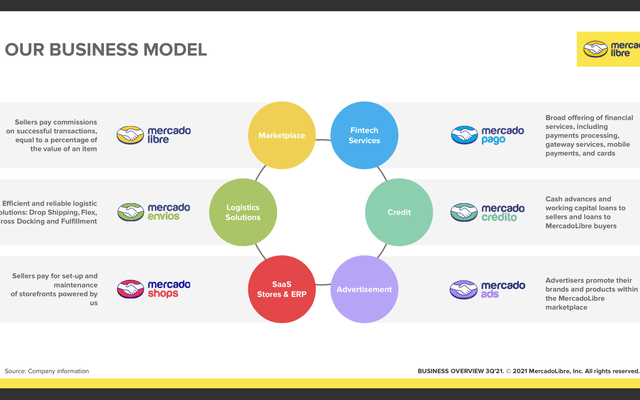

An Ever-Expanding Ecosystem

I believe MercadoLibre has one of the best management teams, and they are always actively seeking opportunities to expand its ecosystem. Besides its core e-commerce market, the company is expanding rapidly into the payment, credit, logistics, and advertising areas. It also recently hinted that they may expand into payroll services as well. These expansions allow the company not only to increase its revenue streams, but also to build out a stronger moat and improve customer engagement rate.

Lissa Schreurs, Head of IR, on MercadoLibre’s ecosystem

The MercadoLibre ecosystem is experiencing a peak of operations growth in recent years and will continue to evolve. In this complex environment, clear priorities and agility will be essential to perform with excellence and to continue to innovate.

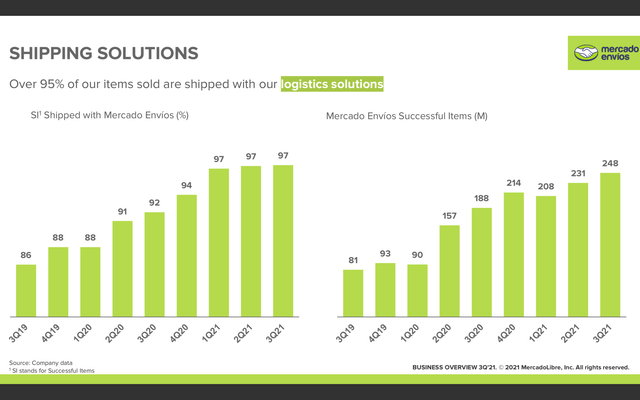

One of the keys to success for e-commerce is having a strong logistics network. From past examples like Amazon (AMZN), it is shown that having its own logistic network provides strong operating leverage and vastly improves efficiency. MercadoLibre’s management team decided to temporarily give up profitability and invest heavily into logistics over the last few years, and it has paid off. The company is now able to offer 48-hour deliveries for 79% of its items, with over 254 million items shipped through Mercado Envíos, their own logistics service.

This is able to vastly improve overall customer satisfaction and experience. It also gives them a strong moat and competitive advantage, as other companies are not able to build out such infrastructure in a short period of time. The company can also have better cost control as they don’t have to deal with price increases from third-party delivery companies.

Lissa Schreurs, Head of IR, on Logistics:

Logistics operations are increasingly efficient, not only due to scale, but also through the use of technology to optimize each step of the process. Our fulfillment continues to grow, driving more same-day and next-day deliveries. We started the year of 2022 with 40% of the volume of delivery by fulfillment. And we already have 20 sites in operation. MELI Places is also growing. There are already more than 5,800 spaces like this in Latin America, offering sellers the ability to drop off and allowing customers to pick up and return packages in a very convenient manner.

The management team is also growing its advertising business successfully by leveraging its wide customer reach. Sellers are able to boost the visibility of their listings by purchasing product ads, while Brands are able to advertise by purchasing targeted ad spaces. This allows the company to grow its revenue with little cost and significantly improve its bottom line, as the ad business has a very high margin profile.

MercadoLibre is also consistently adding new products and services to stay on track with the latest trends. Last December, the company announced that Mercado Pago customers in Brazil would be able to buy, hold and sell cryptocurrencies. In the first quarter of the launch, there are already over one million users that have purchased or sold crypto via its platform. Earlier this month, it also announced a partnership with Mastercard (MA) to enhance the security and experience for its users.

Estanislau Bassols, Mastercard Brazil Division President, on partnership:

“Brazil is one of the hottest crypto markets in Latin America, with high levels of cryptocurrency adoption. By partnering with MercadoLibre, we’re building on our longstanding relationship of working together to solve the needs of our shared customers, helping consumers to pay simply and securely using crypto”

Macro Risks

The recent uncertainty regarding the macro environment may post significant headwinds on MercadoLibre. As an e-commerce and fintech company, it is very exposed to the macroeconomy. In Argentina and Brazil, the two markets that the company focuses heavily on, inflation is skyrocketing. While the U.S.’s inflation rate is at 8.6%, Argentina’s and Brazil’s inflation rates are at 60% and 11.7% respectively. This is significantly decreasing the demand for discretionary items as consumers’ purchasing power continues to decrease. If this level of inflation rate persists, it will very likely cause demand destruction and may even lead to a recession. This will hurt MercadoLibre as it heavily relies on transaction/payment volume. The huge increase in oil prices will also hurt their bottom line as logistics costs will increase substantially. It is also worthy to keep in mind that South America is relatively less developed, therefore, the economy is usually more volatile and vulnerable. Geopolitical risk is also an underlying risk when investing in LATAM companies.

Financials And Valuation

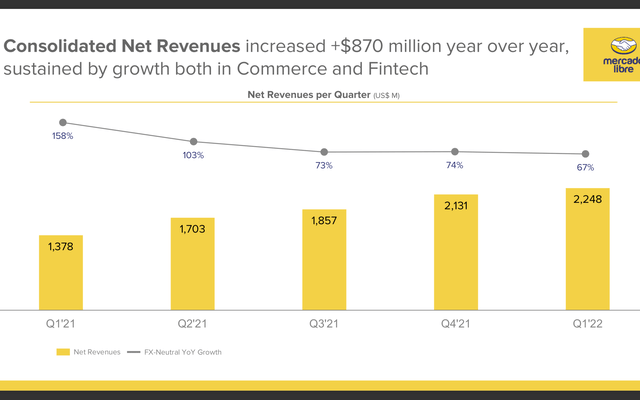

Despite the strong turbulence in the macro environment, MercadoLibre delivered an extraordinary result. For the first quarter of FY22, the company reported revenue of $2.2 billion, up 66% YoY (year over year) on an FX-neutral basis. GMV (gross merchandising volume) was up 32% from $6 billion to $7.7 billion. TPV (total payment volume) was up 81% from $14.7 billion to $25.3 billion. Unique active users for the quarter were 81 million. Fintech is showing very strong growth, with the segment revenue up 113% to $971 million. Its credit segment is also expanding rapidly, with its credit portfolio up 319% to 2.4 billion and credit origination of over $1.7 billion. Advertising revenue is still in its early stages, amounting to around 1.1% of total GMV. The change in revenue mix resulted in a higher gross profit margin of 47.6%, up 483 basis points YoY.

The company is also able to balance growth with profitability. It reported an income from operations of $139 million, representing a 6% margin, while net income was $65 million with a 2.9% margin. I believe margins will improve over time as high-margin revenue streams such as fintech and advertising continue to grow quickly while sales and marketing spending starts to slow down.

Osvaldo Gimenez, CEO, on Margin Improvement

In the first quarter, we also had a significant year-over-year improvement in gross profit margins, reaching 47.7% with a gross profit record of almost $1.1 billion dollars. Our strong top-line growth creates scale in our business, with operational leverage on our cost base that sustains commerce and payments operations. Shipping costs as a percentage of total revenues continues to decline, even in the first quarter which has a seasonally higher shipping unit cost due to lower volume compared to the previous fourth quarter.

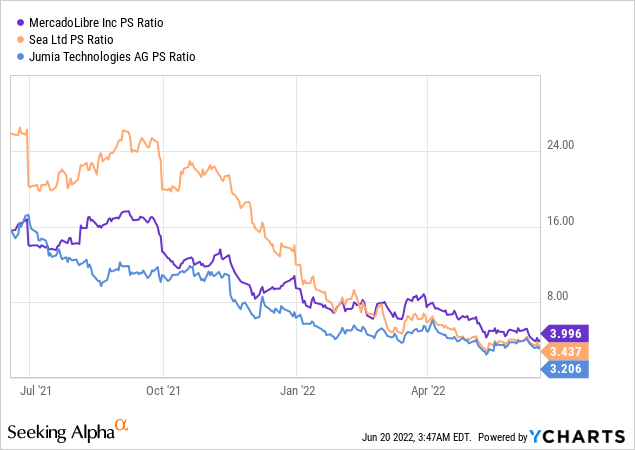

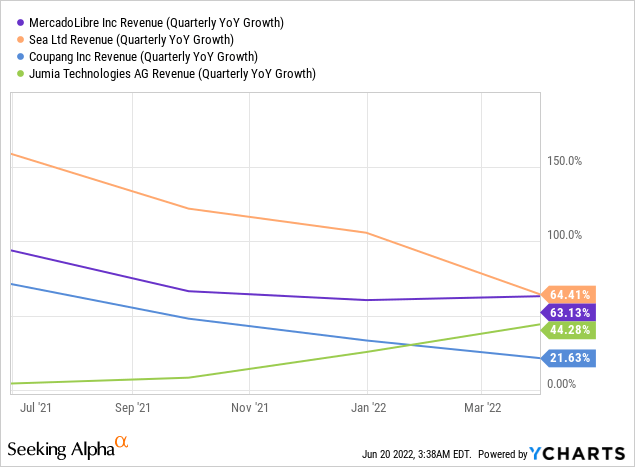

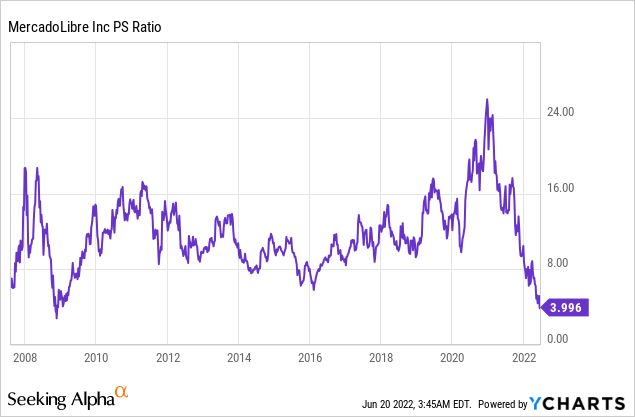

After the massive drop in share price, MercadoLibre is now cheaply valued, trading at a PS ratio of 3.99. From the chart below, you can see that this is similar to other e-commerce companies like SEA (SE) and Jumia (JMIA) at around 3.5x price to sales. However, MercadoLibre is the only profitable company here while still being able to grow revenue at over 60% YoY. If we use EV/EBITDA for valuation, the company is currently trading at 35x EV/EBITDA. This is certainly cheap for a high-growth company with a huge opportunity ahead. As shown in the third chart below, the company has only traded at the current valuation once before, which was during the great financial crisis back in 2009. The business has grown a lot since then, and revenue streams are much more diverse now. Therefore, I believe a higher valuation should be warranted.

Conclusion

In conclusion, I believe the current price for MercadoLibre is compelling. The company is operating in a region that is still in its early innings when it comes to e-commerce and fintech. I believe the acceleration of the shift from offline to online will create a massive tailwind for the company moving forward. MercadoLibre is also actively expanding its ecosystem by entering areas like advertising, logistics, crypto, and credit, which increases its TAM. The company is currently facing a lot of headwinds, such as a weakening economy and a high inflation rate. However, it is still able to report impressive earnings, with its latest quarterly revenue up over 60% YoY. Unlike most high-growth companies, MercadoLibre is also able to grow its top line quickly while maintaining profitability. The company is now trading almost at a historically low valuation if we value it using a PS ratio. I believe a higher valuation is justified as it is posting strong growth while improving margins and expanding revenue streams. Therefore, I rate the company as a buy.

Be the first to comment