spooh

It has been a while since my previous article on Energy Transfer LP (NYSE:ET), entitled “Energy Transfer Hikes Its Distribution: Expect More to Come” (date of publication 27 January). Things have played out exactly as the title suggests. That said, we are just getting started. Therefore, I am doubling down: expect way more to come than the planned distribution increases!

Energy Transfer is firing on all cylinders. The Partnership is in its best position in its history and investors stand to benefit tremendously over the coming years in terms of total returns. ET is expected to continue hiking its distribution (in a fairly predictable manner) as well as enjoy substantial unit price appreciation. Why? Because the distribution coverage ratio is at sky-high levels, which allows the partnership to retain substantial cash in the business for reinvestment and deleveraging purposes, among other things. In hindsight, it was a wise choice for ET to cut its distribution in half back in 2020 (to $0.1525/unit quarterly, or $0.61/unit annualized), as it enabled the Partnership to deleverage at a rapid pace as well as pursue credit-accretive growth opportunities such as acquiring Enable Midstream (in an all-equity transaction valued at approximately $7.2 billion) and acquiring Woodford Express for $485 million.

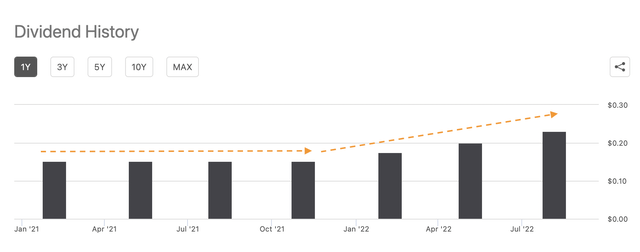

In terms of the cash distribution, the first phase is clear. ET is laser-focused on restoring the distribution back to $1.22 annualized (the level before the aforementioned distribution cut). We are steadily getting there. Last month, ET announced a quarterly distribution of $0.23 per common unit ($0.92 annualized). This distribution represents a more than 50% increase compared to Q2 2021.

We have gone from $0.1525 per unit declared in October 2021 to:

- 0.175 per unit declared in January 2022 ($0.7 annualized)

- 0.2 per unit declared in April 2022 ($0.8 annualized)

- 0.23 per unit declared in July 2022 ($0.92 annualized)

In other words, investors can expect an additional 32.6% increase from current levels just to return to the previous distribution level of $0.305 per common unit per quarter ($1.22 annualized). Based on today’s unit price of $10.97, this implies a pro-forma yield of 11.1%. This is a gift for the following reasons:

- The pro-forma yield is extremely attractive, more than 6 times the dividend yield of the S&P 500 (which is well below 2%). This means that investors can lock in a tremendously lucrative and highly sustainable income stream.

- The income is sustainable because the distribution coverage ratio is at unusually high levels (2.65x as of Q2 2022 earnings report), which provides a strong margin of safety and tremendous financial flexibility for the Partnership to pursue multiple added-value strategic corporate priorities. To put things into perspective, the excess cash flow after distributions in Q2 2022 alone was ~$1.17 billion (up 19% from 2Q’21), implying more than $4 billion annualized!

- Importantly, ET is expected to reach the leverage target range by the end of this year and, going forward, the strong distribution coverage and balance sheet strength will allow them to further prioritize growth within their capital allocation strategy. Growth initiatives will further improve the coverage ratio, which in turn increases the ability to sustain as well as increase the distribution further.

- The underlying business is solid, generating record operating performance with higher volumes and margins. For instance, in Q2 2022, ET achieved record total NGL transportation/fractionation volumes and record processing volumes in the Permian Basin.

Arguably, the future is bright for ET. The pro-forma distribution yield is too high right now, and this cannot last forever. It is as if the market is expecting a distribution cut. But there is no way this is going to happen. In fact, I expect the distribution level to eventually surpass the $1.22 per unit threshold in the coming years, and head toward the $1.5 per unit mark. Applying a 7% yield suggests a unit price in excess of $20. This is not that farfetched.

Also, ET is not an oil dinosaur. The Lake Charles LNG export terminal has come back to life, as global LNG demand grows, and the Alternative Energy Group is gaining momentum. Across the U.S., renewable energy projects will flourish such as the recently announced green hydrogen plant in Texas, a joint venture between Plug Power (PLUG) and New Fortress Energy (NFE). I expect that ET will eventually become a major participant in the green space, when the time is right. Hence the creation of the Alternative Energy Group.

Based on ET’s solid balance sheet, strong underlying business fundamentals (which are going from strength to strength), high distribution coverage ratio and exciting growth projects, I can only conclude that the market is sleeping. How often can you find a company which has guided for substantial dividend increases and delivering a sustainable 11% pro-forma dividend yield? From my experience, as mentioned above, this is a gift.

Eventually the market will come to its senses and give credit where its due. Perhaps investors are still traumatized by the 2020 distribution cut. But things are different now. Things are much better now. In fact, ET increased its 2022 guidance for the second time. Expected Adjusted EBITDA is now $12.6-$12.8 billion, up from the previous guide of $12.2–$12.6 billion. Therefore, knowledgeable and patient investors should expect substantial yield compression, i.e., significant unit price appreciation. What’s more, in addition to future increases to the distribution level, the Partnership is also considering unit buybacks. I endorse ET’s strategy and I am a buyer at these depressed levels.

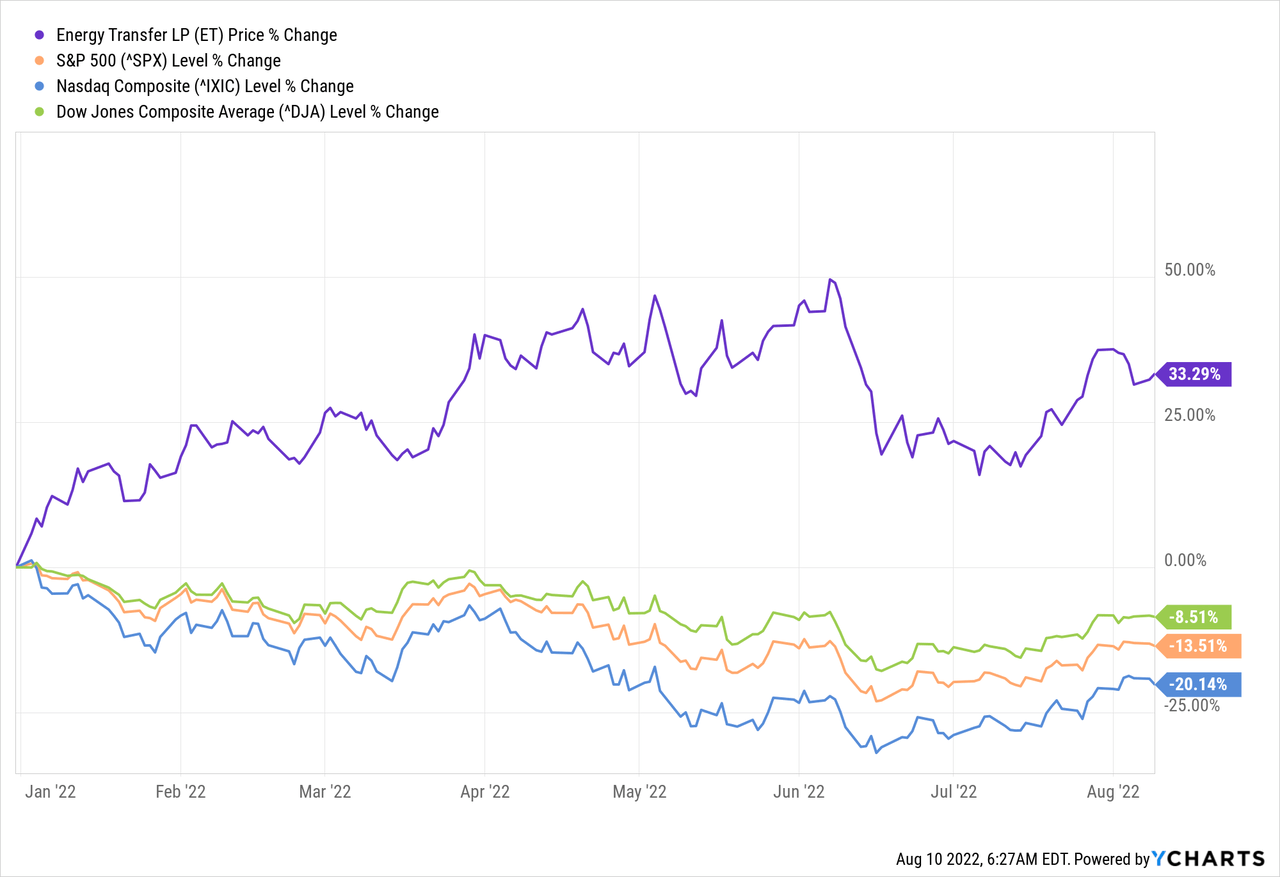

On a YTD basis, ET has significantly outperformed the market. The unit price is up 33.39% whereas all major indices are down. For instance, the Nasdaq Composite index is down a whopping 20.14%!

Going forward, I expect the strong outperformance to continue. ET’s golden decade lies ahead in part due to the Partnership’s capital allocation model, which is superior compared to its competitors, for one simple reason. The distribution coverage is unusually high, which provides tremendous financial flexibility to pursue multiple strategic corporate priorities, as discussed above, and, importantly, the Partnership is not rushing to hike the distribution to unsustainable levels. What good is there in hiking the distribution aggressively and having a coverage ratio e.g. below 1.3x? This is the old MLP model, which excessively relied on the equity markets to raise capital in order to invest in more projects to sustain the distribution.

Luckily, ET is now focusing on a self-funded model, based on internally generated cash flows, and retaining most of the cash in the business for reinvestment and deleveraging purposes. This is healthy. Even though the 2020 distribution cut sparked anger, it was a blessing in disguise. Lastly, it is important to note that the majority of ET’s cash flow is fee-based, i.e., not affected by commodity prices. This provides tremendous stability. DCF (Distributable Cash Flow) for Q2 2022 was $1.88 billion (up 35% from 2Q’21), close to $8 billion annualized. Despite this, the valuation remains depressed, making ET one of the best bargains in the midstream space with a DCF yield in excess of 20%, based on 2022 projections.

Be the first to comment