ferrantraite/E+ via Getty Images

A Quick Take On DLocal

DLocal (NASDAQ:DLO) went public in June 2021, raising approximately $618 million in gross proceeds from an upsized IPO that priced at $21.00 per share.

The firm provides payment technologies for firms seeking to expand into emerging markets.

DLO is generating revenue and profit growth combined with strong free cash flow.

I’m Bullish on DLO at around $31.40 per share.

DLocal Overview

Montevideo, Uruguay-based DLocal was founded to develop a platform of technologies and APIs to enable companies to accept payments and conduct their financial activities in emerging markets such as those of Latin America, Africa and Asia.

Management is headed by Chief Executive Officer Sebastian Kanovich, who has been with the firm since 2016 and was previously CEO of AstroPay.

The company’s primary offerings include:

-

DLocal API

-

Fraud management tools

-

Compliance

-

Merchant dashboard

-

Marketplace service

The firm seeks relationships with cross border oriented firms via its dedicated sales and marketing team as well as through a third party sales force and partners.

The company’s cloud platform can provide cross border and local-to-local transactions in more than 30 countries via over 600 payment methods.

DLocal’s Market & Competition

According to a 2020 market research report by Juniper Research, the global market for B2B cross border payments was an estimated $27 trillion in 2020 and is expected to reach $35 trillion by 2022.

This represents a forecast growth of 30% over the time period.

The main drivers for this expected growth are a growth in instant payments, where funds settle in 10 seconds or less.

Also, blockchain-based services have significant potential, but require additional development to achieve their ultimate value.

Major competitive or other industry participants include:

-

AstroPay

-

Directa24

-

Adyen

-

Others

DLocal’s Recent Financial Performance

-

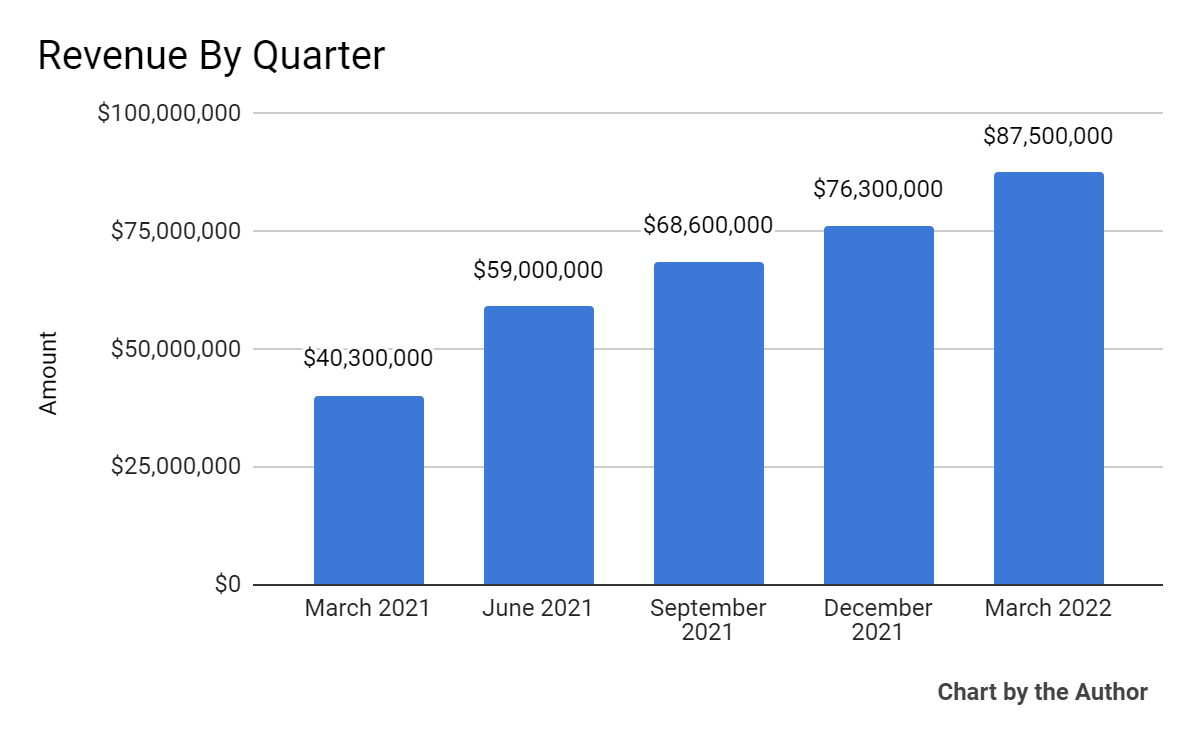

Total revenue by quarter has grown impressively over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

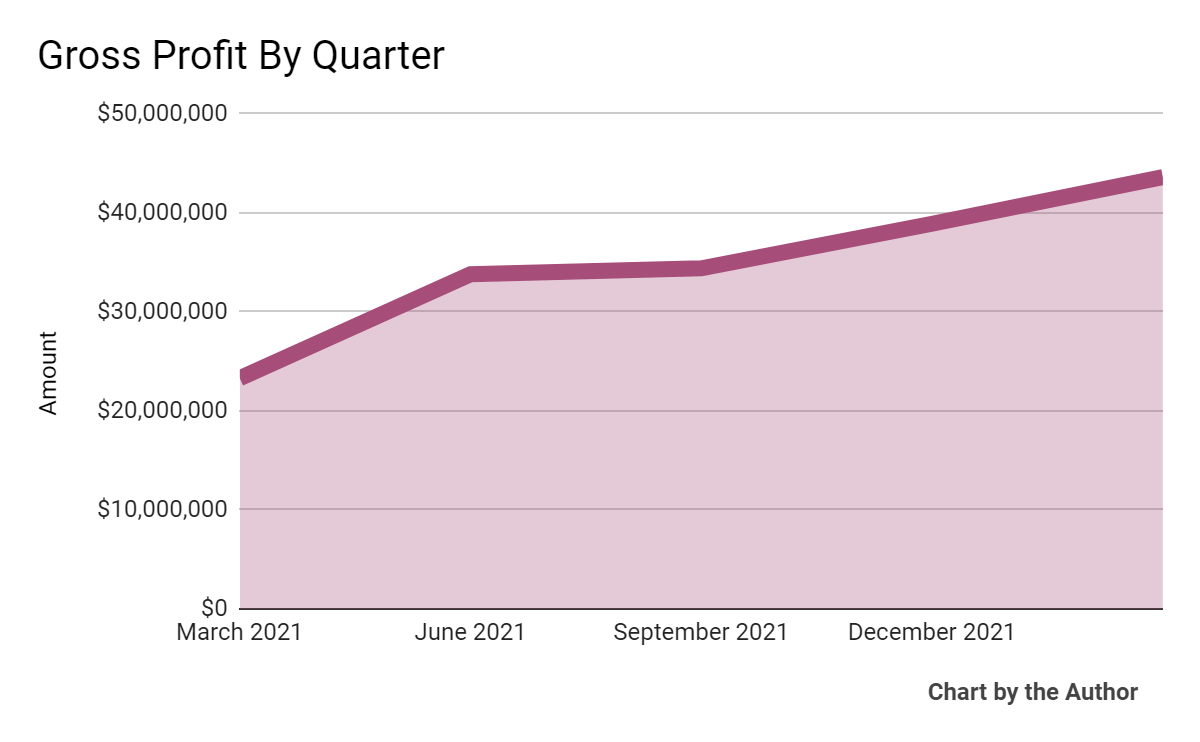

Gross profit by quarter has also risen substantially:

5 Quarter Gross Profit (Seeking Alpha)

-

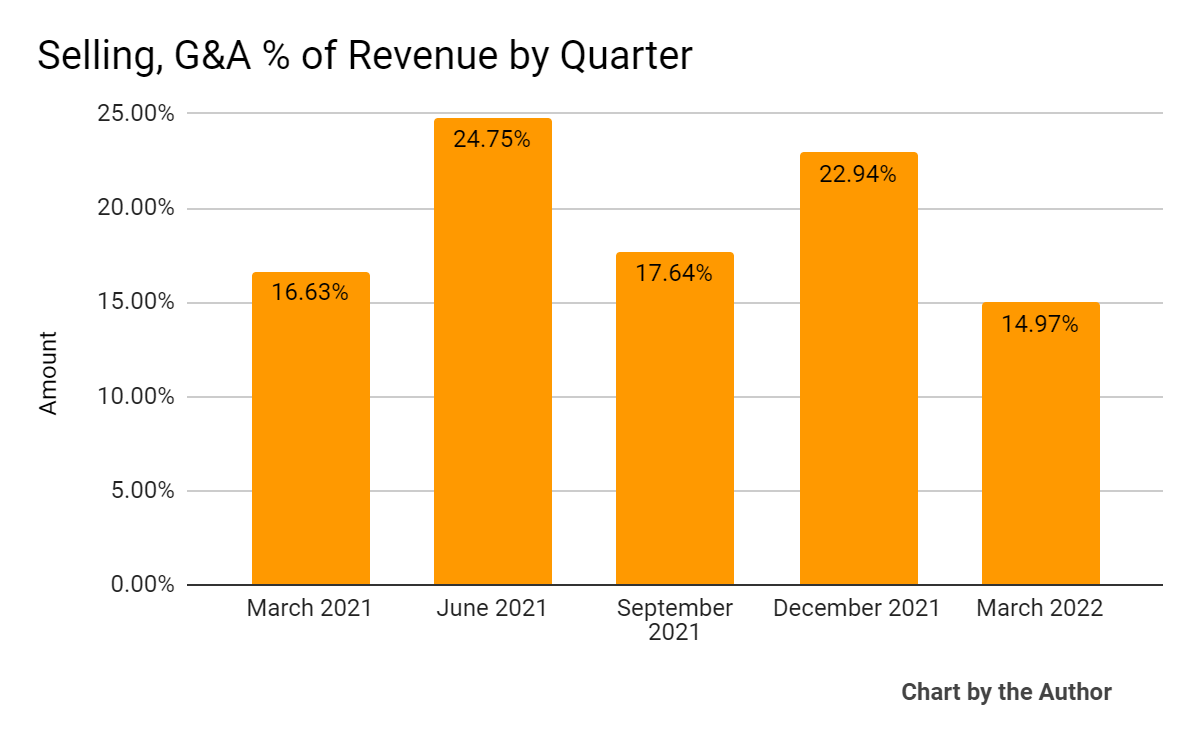

Selling, G&A expenses as a percentage of total revenue by quarter have varied within a range, with no discernible trend:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

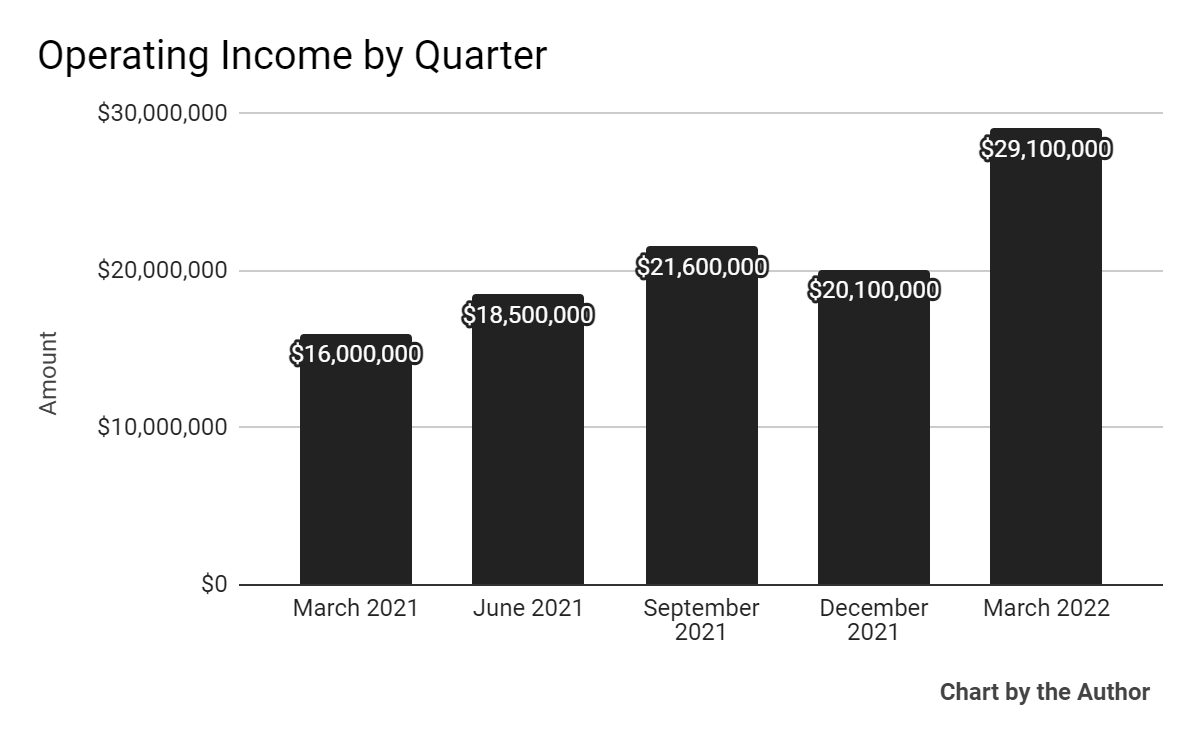

Operating income by quarter has risen in four of the past five quarters:

5 Quarter Operating Income (Seeking Alpha)

-

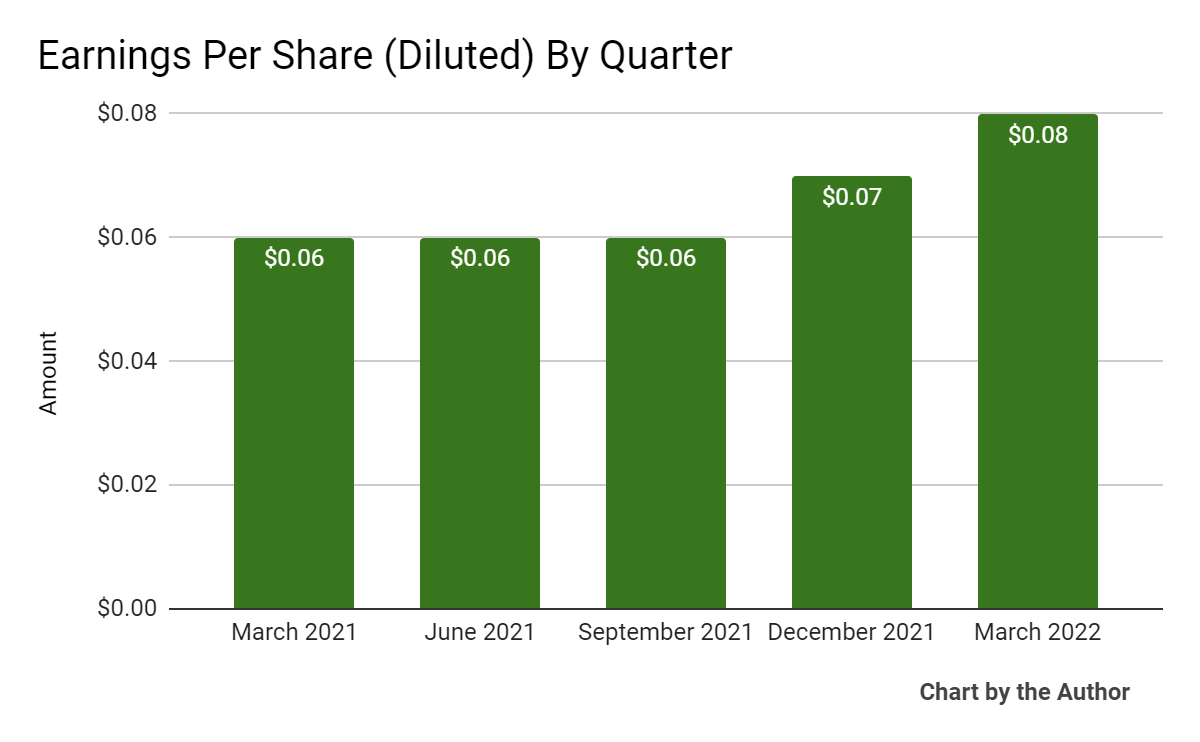

Earnings per share (Diluted) have also remained positive:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

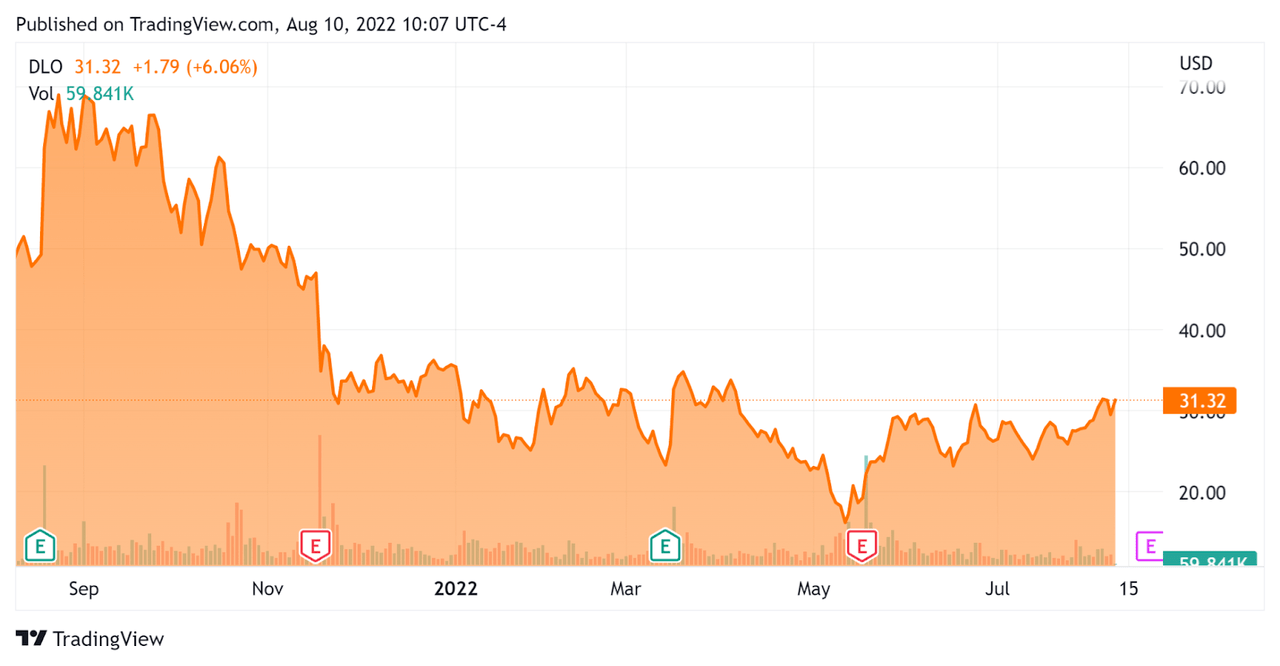

In the past 12 months, DLO’s stock price has fallen 35.2% vs. the U.S. S&P 500 index’ drop of around 5.4%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For DLocal

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$8,310,000,000 |

|

Market Capitalization |

$8,720,000,000 |

|

Enterprise Value / Sales [TTM] |

28.54 |

|

Revenue Growth Rate [TTM] |

130.47% |

|

Operating Cash Flow [TTM] |

$181,000,000 |

|

Earnings Per Share (Fully Diluted) |

$0.27 |

(Source – Seeking Alpha)

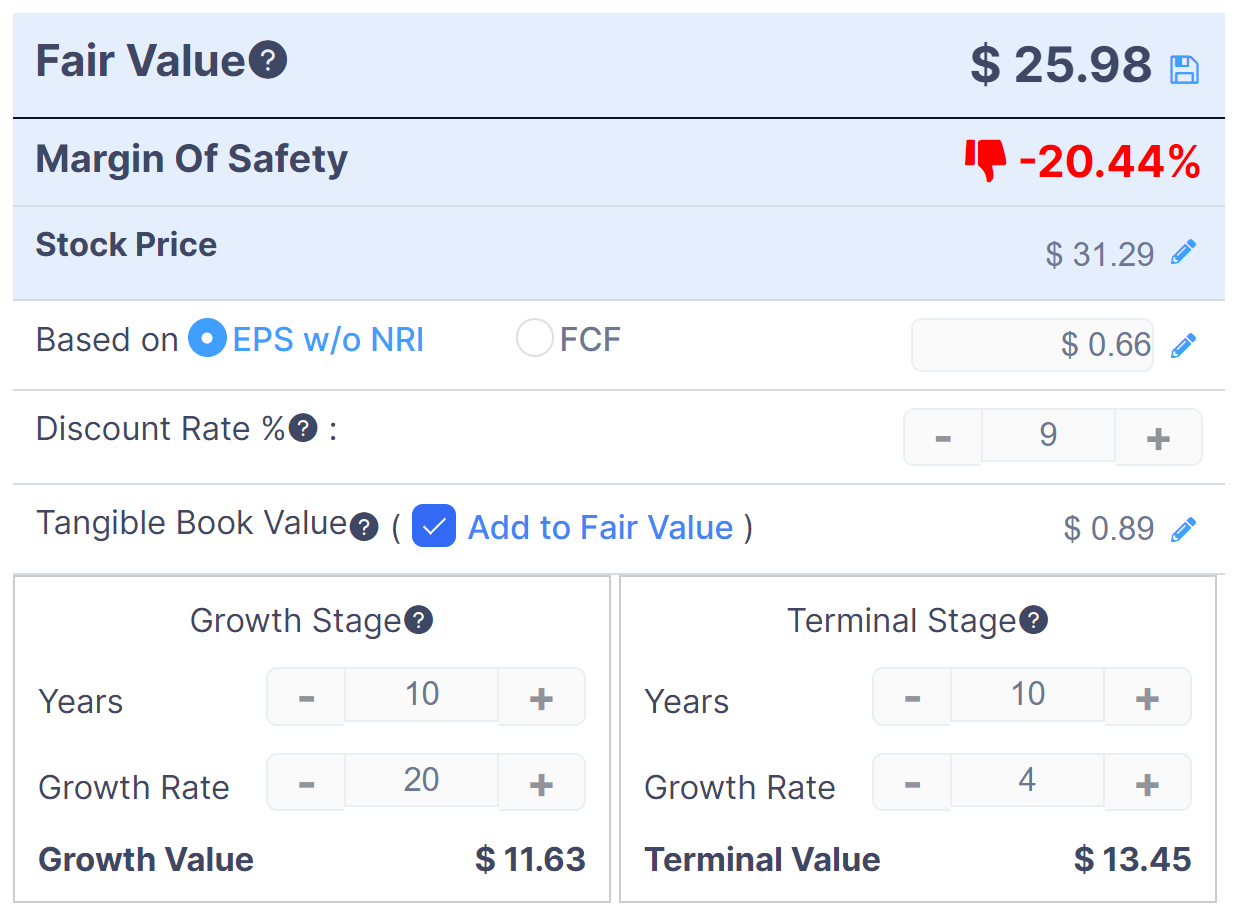

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

DLO DCF (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $25.98 versus the current price of $31.29, indicating they are potentially currently overvalued, with the given earnings, growth and discount rate assumptions of the DCF.

As a reference, a relevant partial public comparable would be Adyen (OTCPK:ADYEY); shown below is a comparison of their primary valuation metrics:

|

Metric |

Adyen |

DLocal |

Variance |

|

Enterprise Value / Sales [TTM] |

7.60 |

28.54 |

275.5% |

|

Operating Cash Flow [TTM] |

$2,070,000,000 |

$181,000,000 |

-91.3% |

|

Revenue Growth Rate |

64.7% |

130.5% |

101.8% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On DLocal

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the lack of its exposure to Russia and Ukraine, enabling it to show continued growth unimpeded by the ongoing conflict there.

The company’s net retention rate was an impressive 190% and management said its overall business benefits by not being overly exposed to merchant concentration, both as to vertical or geography.

Notably, management intends to continue its focus to grow its business outside of Latin America, including Africa and Asia.

As to its financial results, revenue grew by 117% year-over-year and adjusted EBITDA rose by 84%, with margin in line with 2H 2021.

But, operating expenses have increased as the firm added headcount and ramped up in-person marketing events and travel.

For the balance sheet, the firm finished the quarter with $410.1 million in cash and equivalents and generated free cash flow of $75.8 million, although previous quarters have produced much lower free cash flow.

Looking ahead to the full year of 2022 guidance, management reaffirmed its forward net retention rate expectation at around 150% and its EBITDA margin to be above 35%.

Regarding valuation, the market is valuing DLO at an EV/Revenue multiple of 28.5x, which is quite high but not surprising given the company’s revenue growth rate and profitability.

However, a generous discounted cash flow analysis indicates the stock may be overvalued given earnings and growth projections.

The primary risk to the company’s outlook is whether management will be able to replicate its Latin America focus and strategy to other geographies including Africa and Asia.

A potential upside catalyst to the stock could include a reduction in the U.S. interest rate hike trajectory, increasing its valuation multiple in the process as the cost of capital drops.

Still, at a high EV/Revenue multiple of nearly 29x, the company has some proving to do that it can continue its historical high growth and profitability from new geographical regions.

DLO is an attractive growth play and is generating profit growth and strong free cash flow.

Despite my caution about its ability to expand geographically with the same success it has had in its home region of Latin America, the firm is performing impressively.

I’m Bullish on DLO at around $31.40 per share.

Be the first to comment