Mike Coppola

Thesis

Warner Bros. Discovery, Inc. (NASDAQ:WBD) is trading very cheaply – and I think most Seeking Alpha readers will agree with this thesis. But how cheap? How should investors think about valuing WBD stock?

While every investor might want to address the above questions differently, in this article I will explore 3 different ways to value Warner Bros. Discovery: (1) a relative multiple comparison, (2) a sum-of-the-parts-valuation, and (3) a residual earnings valuation.

Notably, no matter how an investor chooses to price WBD, the stock appears to be a strong bargain opportunity.

Relative Multiple Comparison

Arguably, WBD’s multiples are too cheap to ignore. The multiples that Seeking Alpha readers can find on Seeking Alpha are either pre-M&A (TTM) or amidst the restructuring. To get an accurate reference, I advise to use the analyst consensus estimates, as available on the Bloomberg Terminal, for the year 2024. That said, WBD’s estimated P/E multiple for 2024 is x7.9 and the estimated P/B is x0.4 respectively.

True, WBD is strongly levered. Accordingly, a valuation based on enterprise value might be more accurate. I advise to use the EV/EBITDA, which according to analyst consensus estimates is x4.6 for the year 2024 (Source: Bloomberg Terminal, EEO, as of September 8). This is very cheap.

Investors should consider that the current EV/EBITDA multiple for WBD’s major competitors is significantly higher. For reference, Netflix (NFLX) trades at a one-year forward EV/EBITDA multiple of x17. The same multiple for Disney (DIS) is x17.8.

Accordingly, an investor might argue that WBD trades at a greater than 70% discount to the sector. And we are talking about a sector that has seen strong derating in 2022.

Given that WBD is arguably higher risk than DIS and NFLX, given that WBD has high debt and there is still uncertainty relating to the M&A restructuring, I believe it is fair that WBD trades at a discount. But, in my opinion, anything below x10 EV/EBITDA should be unreasonable. Consequently, a 2024 enterprise value of approximately $170 billion should be a good anchor – which after accounting for $53.19 billion of net debt and a 10% discount rate should translate into a $102 billion market capitalization, or $42.9/share.

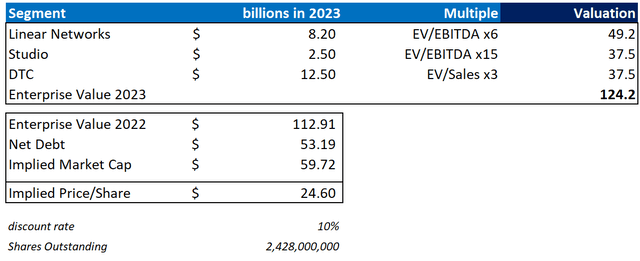

Sum Of The Parts Valuation

Warner Bros Discovery operates 3 key segments: linear network, studio, and direct-to-consumer. The idea behind the sum-of-the-parts-valuation is, that if an analyst can find a reasonable independent valuation for all these segments, and add up the numbers, he could accurately estimate a company’s intrinsic worth.

But finding a reasonable anchor for the single segments, e.g., which multiple to use, can be challenging. That said, here is how I would value the segments:

For the linear network business, I anchor on an estimated 2023 EBITDA of $8.2 billion and further think that a x6 multiple is reasonable.

For studio, I assume that a $2.5 billion EBITDA (again 2023) could be possible. The relevant multiple is x15 EV/EBITDA, which according to Bloomberg Intelligence is close to the average historic M&A valuation of similar businesses.

Finally, I anchor on a x3 EV/Revenue estimate for WBD’s direct to consumer business and an estimated 2023 segment revenue of $12.5 billion.

Given these assumptions, and after accounting for $53.19 billion of net debt, as well as for a 10% discount rate, I calculate a fair implied share price of $24.6.

Analyst Consensus; Author’s Calculation

Residual Earnings Model

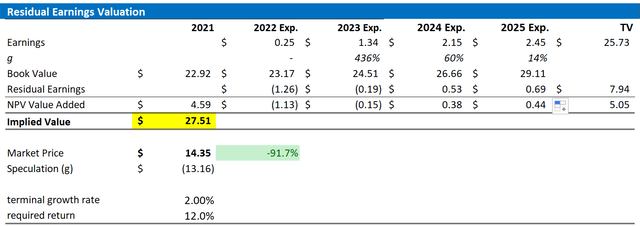

The residual earnings model is my favorite tool to value a company, as I find this framework is the most accurate and has served me well in the past. But arguably, a residual earnings model is also the most complex. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

I have constructed a RE model with the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise. EPS for Warner Bros. Discovery are estimated at $0.35, $1.34, $2.15, and $2.45 for 2022, 2023, and 2024, respectively.

- For the equity capital charge, I argue 12% is reasonable – given the M&A uncertainty.

- For the terminal growth rate, I apply 2%, which is conservative in my opinion, given that nominal global GDP growth is estimated at about 3.3%.

Given these assumptions, my calculation returns a base-case target price for WBD of $27.51/share.

Analyst Consensus EPS; Author’s Calculation

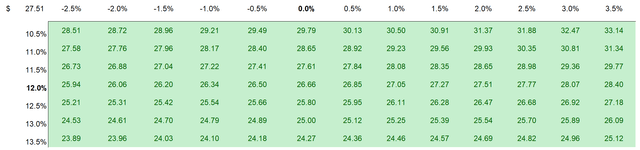

Investors who would like to apply different assumptions with regard to “cost of capital” and “terminal growth” rate may reference the table enclosed. Notably, no matter the assumptions, the risk/reward for WBD stock looks very favorable.

Analyst Consensus EPS; Author’s Calculation

Why is WBD So cheap?

(1) A relative multiple comparison, (2) a sum-of-the-parts-valuation, and (3) a residual earnings valuation – they all imply material upside for WBD stock. Investors might thus ask, why is WBD stock so cheap?

Arguably, there are a few things to consider. First, WBD is a streaming/movie entertainment company. And like Disney and Netflix, this industry experienced a sharp valuation rerating YTD. Second, WBD has a lot of debt. And in a rising interest rate environment, algorithmic thinking implies that WBD stock should be sold. Third, as a consequence to the merger, approximately 70% of the new entity’s shares were distributed to AT&T (T) shareholders, of which many are dividend investors. As WBD does not pay a dividend, many T shareholders likely sold – adding selling pressure. Finally, WBD’s Q2 results have highlighted that the integration of Warner Bros. will be more challenging and costly than what management had previously assumed. Accordingly, investors demand a material risk premium.

Conclusion

Warner Bros. Discovery is simply too cheap to ignore. In this article, I have highlighted three valuation models, all of which indicate more than 100% upside for WBD. Accordingly, as a function of valuation, no other rating than “Strong Buy” would be justified for Warner Bros. Discovery.

However, I would like to add that investors should feel free to challenge my personal premises and apply their own assumptions to the respective valuation frameworks.

Be the first to comment