Cineberg/iStock Editorial via Getty Images

Enel (OTCPK:ENLAY) is one of the large and leading utility firms in the world. Based in Italy, this firm has a solid and stable foundation from which to grow with a mixture of international operations and the transition to green power. The firm has the potential for some powerful upside movements, given the current prices, while there remain several outstanding risks. With this look at the company and deconstruction of several key elements, I plan to show why I think Enel is a solid BUY at the present levels.

For international investors, a simple, easy option is the 1:1 ADR in the US, ENLAY. The ADR has a reasonable volume and will, for many investors, represent a good option for investment. It is also possible to invest directly in the European markets, but not all brokers offer easy access to a full range of international or European listings.

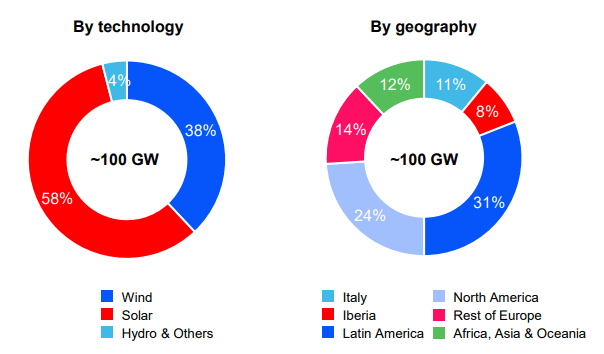

While a legacy player, Enel has an eye to the future and heavy investments in green and renewable power. The company has strong diversification in its Enel Green Power (EGP) program, with the two largest geographic segments being Latin America and North America in general, with the legacy Italian operations representing only 11% (Figure 1). In addition, Enel has a strong range of renewable sources, with most (58%) of the focus on solar, a moderate focus on wind, and wind and solar showing a 17% yoy increase in Q1 2022.

Figure 1. Enel Green Power exhibits strong diversification in source and geography (Q1 2022 Consolidated results (p. 23))

Continued green growth

Despite the challenges in the global geopolitical environment, Enel remains focused on the green transition. The focus remains on a high level of green power as a core part of the mix. 2021 saw strong and continued growth, with a total managed capacity of around 54GW and a 64% increase over the green capacity added in 2020. The 2021 renewable capacity included plants in Europe, Latin America (such as Brazil and Chile), North America (primarily in the US) and Africa, Asia, and Oceania.

As part of the transition, 2021 saw 220 MW of battery capacity added to the Enel network.

What target is the Enel Green Power program moving toward? The existing 2030 Vision sees a total renewable capacity (including batter capacity) of 154GW by 2030, with $236 billion of investments between 2021 and 2030. Alone, from 2022 to 2024, we might expect €19 billion of investments in Enel’s renewable power program.

Rising interest rates and debt in the recent quarter

One of the big challenges is the rising interest rate environment and overall inflation that we are experiencing over the world.

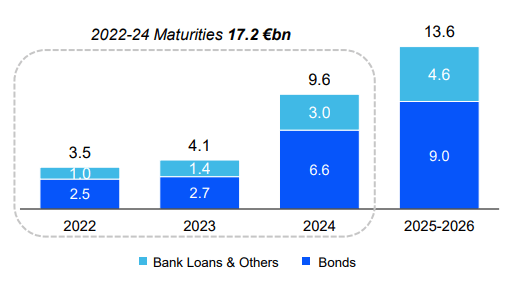

This will impact likely future debt repayments, particularly if there are substantial debt maturities in the near future. From the Q1 2022 results, we can see that in the next few years see relatively low levels of long-term debt maturities, with higher levels in 2024 through 2026, as shown in Figure 2.

Figure 2. Long-term debt and maturities (Q1 2022 Consolidated results (p. 7))

From the Q1 presentation, we can see the picture of ENLAY that there are a few near-term debt maturities. This suggests that for 2021 and 2022 at least, they will be somewhat insulated from rising interest rates unless they need to issue more debt. However, if interest rates are higher in 2024, the maturity of a substantial volume of debt in that year will play a significant role. Investors need to be aware of this and cautious about the prospects going forward. The issue of debt is one that I am watching closely.

While the firm maintains strong cash flows, the 2022 to 2024 period sees an expectation of €45 billion of investments, of which 19b will be for renewables.

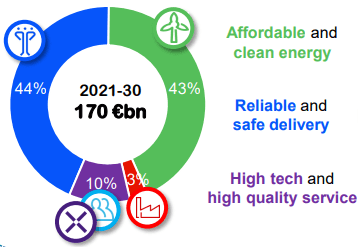

Overall, the plan for 2030 sees a very high level of investment of €170 billion (Figure 3). What does this mean in an inflationary environment? If they spend this planned amount, they will not secure the generation capacity for renewables that they hope to achieve. Either they will fall short of generation capacity with this spend (43% of the €170 billion) or the spending will need to increase to get to the planned capacity levels.

Figure 3. Capex plan by source (Strategic Plan 2022-2024 (p. 13))

Peer comparisons

For an evaluation of how ENLAY sits against its peers, I have used several European utilities. They are less richly valued than their US peers, with lower PE ratios on average. For this purpose, I’ve included the following peers with US-listed ADRs to facilitate global investors. Each is a European utility of a reasonable size.

From the peer comps where I have put the best two in bold for each column, we can see that the quant factor grade for valuation is favorable for Enel while in terms of EV/Sales it is in the middle of the pack. However, these comparisons also highlight the total debt issues for Enel and we see it has the lowest covered ratio in the peer group, which is concerning given Enel’s strong focus on Capex for renewables until 2030 in this inflationary environment.

| Company | Covered Ratio | Total Debt | EV/Sales (forward) | Quant factor grade (Valuation) |

| Enel (OTCPK:ENLAY) | 3.99 | 84.11 | 1.5 | A |

| OTCPK:DNNGY) | 7.4 | 8.60 | 4.74 | D- |

|

Electricité de France S.A.(OTCPK:ECIFY) |

7.14 | 79.00 | 0.9 | NA |

|

Iberdrola, S.A. (OTCPK:IBDSF) |

5.97 | 49.72 | 2.64 | A- |

|

ENGIE SA (OTCPK:ENGIY) |

6.67 | 47.08 | 0.77 | A+ |

|

Fortum Oyj (FOJCF) |

4.48 | 16.65 | 0.16 | NA |

Valuation

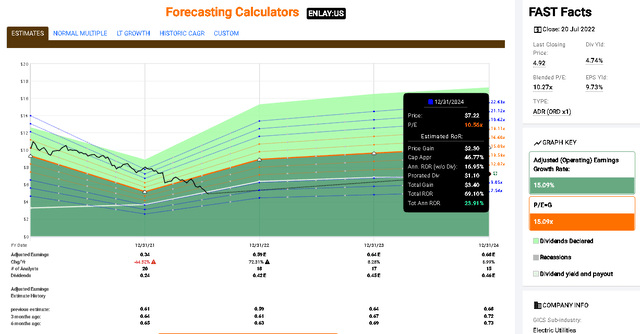

For utilities, I like to make my valuations based on past PE ratios and my expectations that the prices will be guided to PE ratios based on the given earnings at a point in time. The analyst estimates for future earnings, therefore, can be used with a given PE ratio to estimate what the prices should be at that point in time. The FAST Graphs forecasting calculator options can then be used to calculate a possible total annualized rate of return. From Figure 4, we can see that the current prices (black line) are in a decline that has fallen to a PE ratio of approximately 10.3x. This tends to be a low level, even for European utilities, which tend to trade at lower PE multiples than their US counterparts.

If I expect the near-term levels to trade at a very safe and comfortable 10.5x PE (as shown at the end of 2024 in Figure 4), this represents a total annualized rate of return of nearly 24% from the present prices. This has two components – the strong dividends as well as strong earnings growth expected in 2022 with moderate expectations of 8% to 7% growth in earnings in 2023 and 2024, respectively.

As a target PE, this is not ambitious and it should be achievable. At the present price, therefore, this looks like a good buying opportunity at present levels, with a target of $7.22 on ENLAY by the end of 2024.

Figure 4. The recent earnings and PE ratio for ENLAY with the right-hand side showing the analyst estimates of earnings and expected PE ratios (Historical and Forecast Graph – Copyright © 2011-2022, F.A.S.T. Graphs™ – All Rights Reserved)

Given the rosy outlook and the analysts’ expectation for strong earnings in 2022 through to 2024, is this reasonable? With the high inflation levels, as we note, I would expect the analyst expectations to decrease slightly in the coming quarters. As such, while the target here of $7.22 on ENLAY seems muted and cautious, it will probably be reasonable if analysts adjust downwards to reflect the need for additional Capex in the coming years.

Even with reference to Figure 4, we can see that Enel has fairly volatile earnings with the drop in 2021 followed by the expected surge in 2022. There is a risk that these large increases in earnings are not realized. There are other utilities, such as National Grid Plc (NGG) where I have more confidence in a steady, slow growth in earnings. Enel has more upside and also carries with it more risk that is partly compensated for, in my thinking, by the current undervaluation from the recent price declines.

Dividends

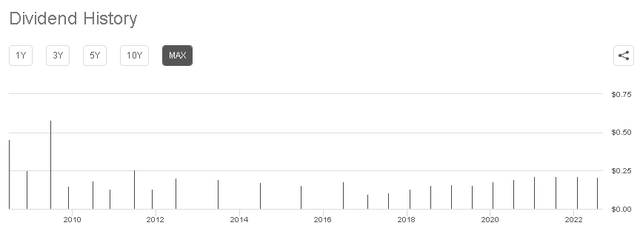

Looking historically, Enel had less focus on shareholder stability in the dividends. While there was a more variable payout of dividends in earlier years (Figure 5) we can see a more stable, considered, and consistent dividend payouts in the most recent five years on the right-hand side of Figure 5. This shows the management’s commitment from several years ago to move toward predictable growing dividends for shareholders.

Figure 5. Dividend history with more sporadic and volatile payouts in the earlier years with more focus on steady growth in recent five years (Seeking Alpha)

Moving forward, we can see that the expected or estimated dividends are expected to grow at a slow and steady rate. Figure 2 provides the analyst estimates of the forward dividends, shown at the bottom of the figure, with steady and slow increases. This steady and slow increase is, from my perspective, fine at this point, given that the company has a good starting dividend yield at this point. Seeking Alpha reports a dividend yield of 8.9% and a 5-year DGR of over 16%. If the dividend growth drops off, the starting yield is more than satisfactory for this company in the place in my portfolio where I hold it.

Risks

In my mind and watching for the next quarterly figures, I am interested in watching the levels of Enel’s Capex and borrowing. Not unsurprisingly, like many utilities, Enel is a heavy spender. While we know that they have reasonable near-term debt maturities that are not particularly worrying, their plans for heavy Capex until 2030 to support the green transition is a worry. While the firm will continue to see strong operating cash flows, the requirement for additional lending seems unavoidable. Given that we are now in a rising interest rate environment, this will be at a high level. Further, as noted, the rising inflation rates mean that to get to the target level of generation capacity, the spending will need to be lifted. Or, with the same level of planned spending, the generation capacity achieved will be lower than the forecast. Given the prominence of the Enel Green Power program, I favor betting that they will hold the capacity target and then need to increase the Capex levels to reach this aim.

Another risk that some investors may be unhappy with is the currency risk. Enel keeps very high levels of geographic exposure both within Europe and also within the Latin American market. As a result, economic headwinds or issues in one region may result in unfavorable currency fluctuations that impact on earnings. In the long run, in my opinion, this is not such an issue for an investor, but those with a shorter term horizon for their investments may find it results in moderate earnings movements. Enel uses swap contracts to mitigate the impact of currency fluctuations on debt.

Governmental intervention is always a risk. Given the strong geographic spread, this is always going to be a concern for Enel. The 2022 Q1 results show a mix with some national governments (e.g., Spain & Italy) having few intervention intentions (such as due to the absence of any windfall profits from Enel) while there are open and continued discussions. While none of these are negligible, they should, overall, not represent a long-term issue for the company.

Thesis

All investing carries risks that vary between firm and region. ENLAY struggles with notable risks but also carries some benefits, such as the high dividend yield.

My overall thesis is that the firm is undervalued based on the recent price declines. Future opportunities for increases in earnings may be at risk due to pressures from rising inflation and debt. The current undervaluation, in my mind, more than outweighs the risks of long-term debt and inflation and the need for additional Capex beyond the expected levels to reach the Enel Green Power objectives by 2030. I will continue to monitor the long-term debt issues and the expectations for Capex in the coming quarters.

Therefore, my thesis is that this is a BUY on an undervalued ENLAY. Investors at this price may see upside price appreciation to $7.22 per share for ENLAY. We must weigh this against the ongoing risk of further downside potential and high debt loads in the inflationary future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment