Onfokus

Investment Thesis

BRP (NASDAQ:DOOO) has a low valuation. Despite industry troubles related to supply chain disruptions, they are increasing market share due to effective management and a diversified portfolio of strong brands. Furthermore, core strengths of the business such as its strong and expanding leadership, community-building skills, and leading brands make it a strong player in the powersports industry. As a result, this stock is a buy for me.

Introducing BRP

BRP, also known as Bombardier Recreational Products Inc., is a Canadian company that produces bikes, all-terrain vehicles, snowmobiles, and personal watercraft. It was established in 2003 after Bombardier Inc.’s Recreational Products Division was split off and sold to a group of investors. The Ski-Doo and Lynx snowmobiles, Can-Am ATVs and motorbikes, Sea-Doo personal watercraft, and Rotax engines are among the items made by BRP.

Industry Outlook

As the snowmobile is a matured market, I don’t expect the growth rate to be very high. I expect that most of the growth will be created by trends such as consumer preference for using electric snowmobiles as a sustainable and effective travel option, as well as their capacity to extend the driving range. The worldwide snowmobile market, which was valued at $1.58 billion in 2020, is predicted to grow to $2.12 billion by 2030, with a CAGR of 3.1% from 2021 to 2030, according to a report by Allied Market Research. I’d expect that for motorbikes and personal watercraft the growth rates to be roughly similar.

Supply Chain Disruptions, but Good Management

Growth rates (Year-over-year):

|

Index |

2019 |

2020 |

2021 |

Last 4 Quarters |

|

Revenue |

15% |

-1% |

28% |

17% |

|

Gross Profit |

16% |

1% |

44% |

14% |

|

Net Income |

63% |

-2% |

118% |

-19% |

Source: Seeking Alpha

Margins (% of revenue):

|

Index |

2019 |

2020 |

2021 |

Last 4 Quarters |

|

Gross Profit |

24% |

24% |

27% |

26% |

|

Selling, General & Admin |

10% |

9% |

8% |

8% |

|

Research & Development |

3% |

4% |

3% |

4% |

|

Net Income |

6% |

6% |

10% |

8% |

|

Free Cash Flow Margin |

3% |

11% |

0% |

-8% |

Source: Seeking Alpha

BRP has had great revenue growth. Even in its last 4 quarters, it achieved a double-digit revenue growth rate, despite supply chain disruptions making things difficult in the latest quarter. In the latest earnings call, the CEO stated that BRP outperformed the sector in North America in the latest quarter, where Powersports retail sales were down 9% while the sector as a whole was down 20%. This is an indication of BRP handling the supply chain disruption relatively well.

The disruption already also slowed down the revenue of fiscal year 2021. The management stated in the annual report that they handled it well by:

the advantage of our modular design approach and diversified product portfolio to leverage common components across our different product lines based on seasonality. This strategy allowed us to optimize production output as well as maximize shipments and retail.

This is evidenced by the outpacing of its industry, as stated earlier.

All through the quarter, management anticipates operating in a choppy supply chain environment. Two things to bear in mind: firstly, they have to cope with limited component supply and greater transportation and material prices. Second, the demand in the supply chain is increasing as a result of the situation in Asia. They anticipate that this pressure will last the entire year.

Strong Brands and Leadership Expansion

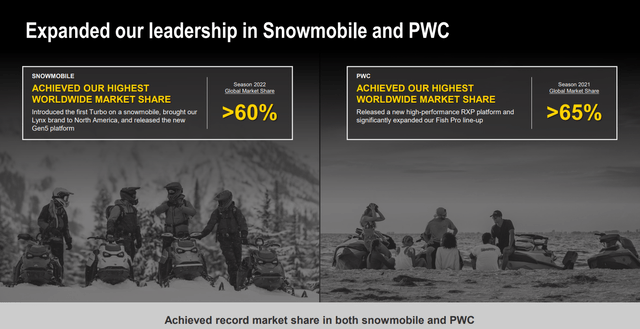

According to the latest annual report, the company expanded its strong leadership position in the snowmobile and personal watercraft industries. Furthermore, they gained roughly three percentage points of market share in retail over FY21 and about 10 percentage points over the previous six years. In their respective industries, Ski-Doo, Sea-Doo, and Can-Am 3WV finished their seasons in the first place. These numbers indicate the strength of its brands and competitive position.

Leadership expansion numbers (Latest annual report)

Unique Ways to Attract New Customers

I noticed that BRP is quite successful in attracting new customers with its seemingly strong community-building skills and brand. An example is its Facebook community “Women of On-Road”, which according to the Facebook page, was created:

by women for women, designed to overcome the barriers that prevent women from experiencing the power of riding through inclusivity and education

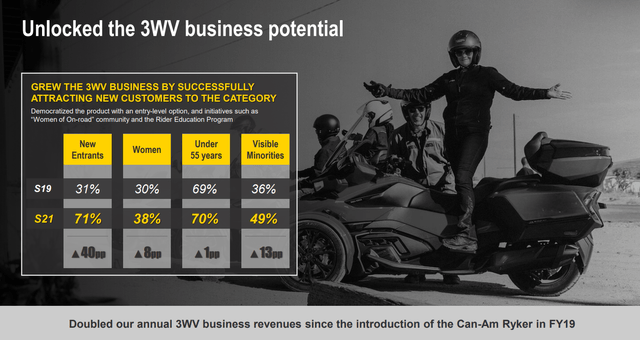

The community’s membership climbed by 70% to 11,800 in the latest years, and the campaign received over 20 prizes from across the world, including those for “Demonstrated Growth” (ANA Multicultural Excellence Awards) and “Engaged Community” (US Effie Awards), according to its Analyst and Investor Day 2022 presentation.

The effectiveness of such initiatives is evidenced by the significant growth of its 3WV (three-wheel vehicle) business growth:

3VW growth numbers (Analyst and Investor Day 2022 presentation)

Valuation and Other Metrics

I computed several valuation and performance statistics of BRP and Polaris (PII). Polaris is another company engaged in the powersports industry:

|

Index |

PS Ratio |

PE Ratio |

Gross Margin |

Price to Gross Profit |

3Y Sales Growth |

|

BRP |

0.9 |

11.44 |

26% |

3.46 |

14% |

|

Polaris |

0.82 |

16.27 |

22% |

3.73 |

9% |

Source: Seeking Alpha

The PE ratio of BRP is relatively low both compared to the comparable company as well as the overall S&P 500 (whose median is roughly 15). Its 3-year sales growth is relatively high as well. While the company already has a very high market share in its industries, combined with the fact these industries are matured, I don’t believe that the company will sustain its high sales growth for the longer term though. Nevertheless, I still expect a robust sales and earnings growth of 3 to 8 percent in the medium to long term.

Final Take

The valuation of BRP is low compared to the market and a comparable company. Factors potentially pressing its valuation are the supply chain disruption, leading to pressed revenue growth. While these issues are expected to press growth for the current year, BRP has been dealing seemingly well with it, even increasing market share significantly. Furthermore, core strengths of the business such as its strong and expanding leadership, community-building skills, and leading brands make it a strong player in the powersports industry. For these reasons, I set the recommendation for BRP to buy.

Be the first to comment