Bruce Bennett

In no huge surprise, Verizon Communications (NYSE:VZ) continues to face a difficult time in driving growth. 5G was supposed to usher in a new era of growth, but the U.S. wireless provider has yet to unlock this growth driver despite growing wireless service revenues. My investment thesis continues to remain Neutral on the stock with a solid 5.8% dividend yield now off set by high debt levels.

No Growth

After a strong 2021, Verizon is back to not reporting any wireless subscriber growth. The wireless giant reported Q2’22 retail postpaid phone net adds of only 12K leading to a loss of 24K subs during the 1H of the year.

The completion of the TracFone Wireless deal boosted the wireless service revenue growth to 9.1% growth, but Verizon saw total service revenues dip 3.9% from the $28.2 billion level last year. In total, the company reported total revenues of $33.8 billion, virtually flat with Q2’21 levels.

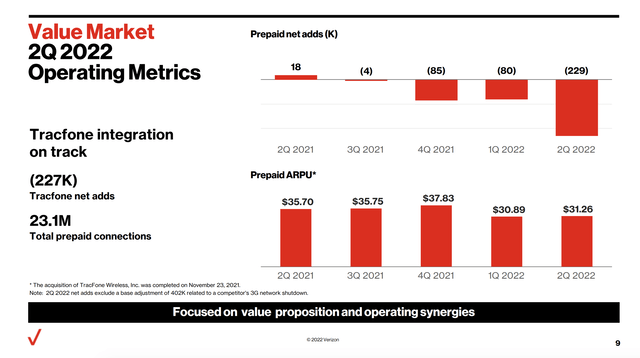

The company bought the TracFone Wireless business at the wrong time with prepaid wireless accounts most likely impacted by the tough economic times. As warned, the business moving away from premium wireless subs and a focus on 5G hasn’t helped the Verizon actually grow organically. The wireless giant already has 47% of the consumer based with a 5G phone.

Verizon reported prepaid net adds down 229K in the quarter and a total of 309K lost in the 1H of the year. In addition, the ARPU is down to only $31.26 after reaching a peak of $37.83 in Q4 shortly after the deal closed.

Source: Verizon Q2’22 presentation

In the quarter, adjusted EPS dipped to $1.31 per share from $1.39 last Q2. The TracFone deal hasn’t created any of the value proposition and operating synergies proposed when the merger was announced last year.

The numbers just get worse heading into the 2H of the year. Verizon pretty much hit Q2’22 earnings targets, but the company cut adjusted EPS targets for the year by $0.30. The wireless giant is now targeting a 2022 EPS of only $5.10 to $5.25 per share.

Along with the sector, Verizon attempted to raise wireless plan prices, but the company is facing headwinds with new customer additions. The recent launch of the budget friendly Welcome Unlimited plan won’t solve the financial problems facing the wireless giant with massive CapEx requirements to build out 5G services.

Debt Surge

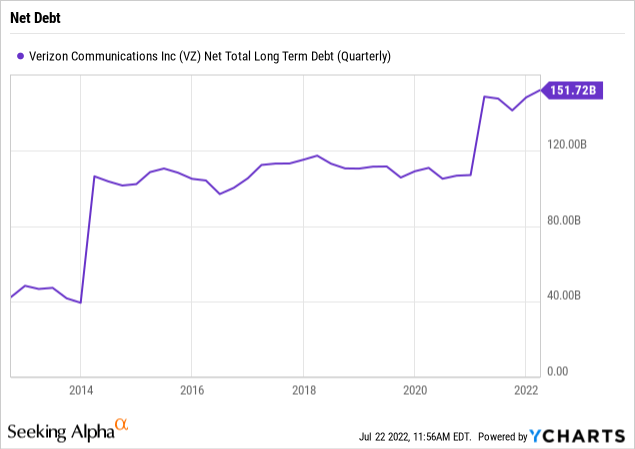

The lack of growth is even more frustrating to long-term investors when contemplating the debt picture. Verizon now has net debt of nearly $150 billion when the wireless giant only had ~$100 billion back in 2020 before completing the TracFone deal and again bidding aggressively on more wireless spectrum.

The TracFone deal cost of $3.125 billion in cash plus the C-Band spectrum left Verizon with net debt of $151.7 billion in March. The company ended Q2 with net debt down to $147.2 billion with free cash flows of $7.2 billion in the 1H of the year offset by $5.4 billion in dividend payments.

The costs continue to mount as Verizon will spend ~$17 billion on CapEx prior to another $5 to $6 billion for the deployment of the C-Band 5G network. Again, the company isn’t spending at least $22 billion in CapEx this year to just report flat revenue growth.

The company has an unsecured debt to adjusted EBITDA ratio of just 2.7x, so Verizion isn’t in any leverage crunch. The problem is that the wireless giant has spent the last decade accumulating debt to end up in a no growth mode.

The additional spending on acquisitions, wireless spectrum or paying large dividends aren’t helping the business or the stock. The company appears to have limited potential to raise prices without running off customers and without aggressive spending Verizon can’t keep customers that appear unwilling to actually pay for the higher CapEx spending.

Takeaway

The key investor takeaway is that the stock isn’t overly expensive trading at 8.5x adjusted EPS targets. Unfortunately, Verizon is unlikely to rally until the company figures out how to grow revenues and actually pay down debt over time.

With the stock falling 8% on earnings, Verizon offers a nearly 6% dividend yield. Investors aren’t likely to get much of a return in owning the stock here outside of the yield, though capital losses remain a threat until the growth issue is resolved.

Be the first to comment