AscentXmedia

Published on the Value Lab 11/11/22

Enel Chile (NYSE:ENIC) reports another quarter, but rather than the years of bad results that we’ve gotten used to, key things have reversed that are allowing for the return of stronger results that could favour the return of a more ample dividend. Hydrology is recovering, the gas price impact is being reduced, and PPA margin is returning as commodity declines occur. Overall, we are seeing a turn in the cycle for ENIC. It is possible that the price recovers now to a point before the commodity boom of 2021, however, we note the risks around the company’s reliance on hydrology. A tentative buy.

Q3 Review

Let’s blaze through some of the key Q3 evolutions.

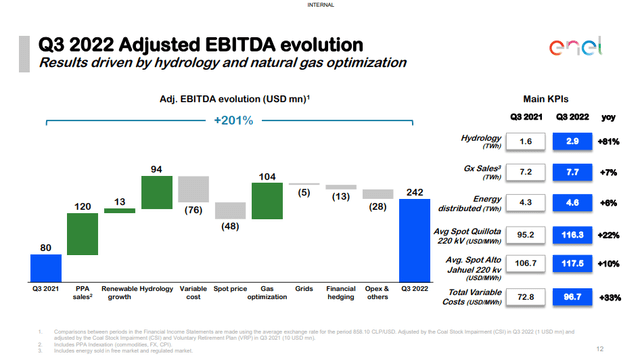

The EBITDA evolution shows in part a weak comp in late 2021, which is when higher commodity prices were decimating results, but also key improvements in business conditions for Enel Chile that restores the results.

Copper Price (tradingeconomics.com)

- PPA Sales have seen a recovery, and what this really means is that negative indexation in the PPA agreements related to increases in the value of the Chilean Peso or the CLP and increases in the price of copper and other commodities, which also correlates heavily to the performance of the CLP, has reversed as commodity prices have come down substantially. Copper prices have fallen and so have energy prices in general, including gas.

- Gas is an important supplement energy source to the Chilean energy system when hydrology sees a shortfall. High gas prices in previous quarters when droughts were also occurring forced ENIC to procure gas at terrible prices. These effects are much smaller this quarter, on one hand, because gas prices have significantly retreated but also because of improvements in the hydrology conditions.

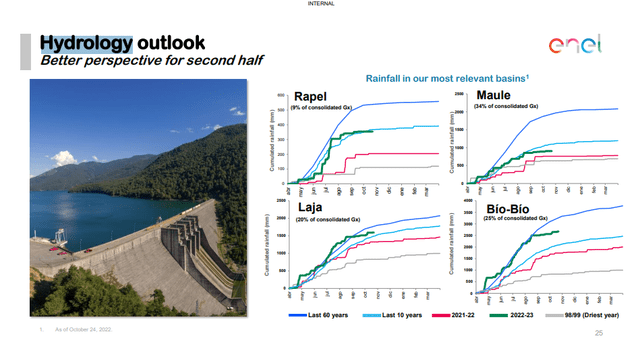

- Rainfall in the basins has recovered from devastating, drought-like levels to multidecade highs this year with an incredible reversion in environmental conditions. Much of the ENIC capacity is hydro, so hydrological conditions being favourable puts value into those assets, and critically eliminates the need for natural gas or other supplemental energy procurement at a time when energy prices are very elevated. These hydrological conditions have limited gas spot price negative effects for ENIC as well as adding incremental EBITDA from energy production from hydro assets.

Bottom Line

ENIC is looking really strong now, and the financials are making a recovery to levels that at the current run-rate almost equate to pre-COVID levels. This also promises the return of the dividend, if these results appear sustainable with the economy equilibriating at these levels. With 2019 dividends, the current yield would exceed 10%.

The issue is that the company is still reliant on consistent hydrology conditions, which are not guaranteed in South America. Moreover, commodities cannot rally, especially copper, which has secular support due to the EV transition. If copper and other commodities rise, the margin in the PPA agreements will fall as negative indexation kicks in again, and we’d return to a 2021 disaster situation. With CPI looking like it’s almost topping, the demand force could begin to return to some of these goods-levered commodities, especially copper, with electronics seeing a glut now that could reverse.

Nonetheless, ENIC is still at very low prices, and some of the political risks that made the stock unattractive have melted. The heavy socialist push was actually not popular, and the socialist constitution was quite soundly rejected, meaning the Pinochet era constitution is still in force. This was not expected after the turnpike protests. The socialist push is anyway much weaker than previously thought. While still rife with unpredictable elements, ENIC is looking good. At the current run rate, the PE is actually less than 5x. Not bad at all.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment