LYagovy

Introduction

Core Laboratories N.V. (NYSE:CLB) is up about 25% since our last report, so we’re claiming a win. Of course, most of that has come in the last few weeks, so we won’t get carried away. Some of this rally may have been driven by an upgrade from Citigroup to neutral, citing an upturn in offshore, and citing a target price of $17.

In that last report, I called the company a “Speculative Buy.” The speculative part related to the somewhat flakey financial outlook for the company, related to its debt and maturity ladder. It also took into account the mixed record for oil, and the propensity for oil companies to again begin prospecting for oil in deepwaters. (I wonder if the guy at Citi read that article?)

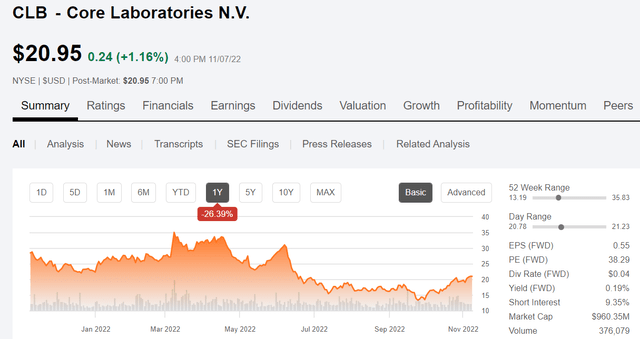

Price chart for Core Labs (Seeking Alpha)

Over the last quarter, the mists have cleared a bit. I think the recovery case for CLB is still in play, but much of the near-term gain may be priced in. As was documented in the Transocean (RIG) article, the deepwater recovery is beginning to gain traction, and this will have a positive impact on Core Labs, but it likely won’t be for a while yet.

In this report, we review Q3 and commentary for Core Laboratories to see if we should stick around. Or cut and run. CLB has shot past the $17 Citi call and appears to be topping out. That would make it a sell at current levels.

The Thesis for CLB

Core Labs future is leveraged to a resurgence in offshore exploration and development. Without that occurrence, the stock will likely stay in the $10-$20 range it’s occupied for the last couple of years. The good news for CLB is that it seems that growth in the need for the sophisticated reservoir and reservoir fluids evaluation services they provide will be on the rise. Gwen Gresham, SVP, commented in regard to Core’s outlook for growth:

Over the long-term crude oil supply is projected to tighten as production growth faces limitation due to prolonged underinvestment in many regions around the globe. As a result, Core expects operators to expand their upstream spending plans into 2023 supporting Core’s outlook for continued improvement in international onshore and offshore activity with projects emerging across most regions. These crude oil fundamentals are leading indicators for what Core sees as a strengthening multiyear international recovery.

Notable commentary from the Q-3 conference call

Earlier this year, significant finds were announced in Namibia’s deepwaters by Shell (SHEL) and TotalEnergies (TTE). Core was called in to evaluate core and reservoir fluid samples from a multi-well exploration program in the deepwater Orange Basin. Conventional core recovered from targeted stratigraphic intervals were scanned using Core Lab’s Non-Invasive Technologies for Reservoir Optimization branded as NITRO. This work is ongoing, and is exactly the type of work that CLB needs to resuscitate their brand.

During the third quarter of 2022, Core Lab continued to build on the success of its proprietary Plug & Abandonment Perforating System called PAC which is used for oil and gas well abandonment programs. Core Lab provides solutions that leverage its expertise in energetics as an alternative to traditional casing milling, which is slower and more costly. Thus far in 2022, Core successfully deployed its PAC technologies in over 30 wells in the North Sea.

Core SpectraStim, SpectraScan, and PackScan downhole imaging technologies were utilized in deepwater Gulf of Mexico Miocene wells to evaluate single and dual zone frac pack completions. In addition to those technologies, Core’s FLOWPROFILER oil diagnostics were used to assess the production in ultra-deepwater Gulf of Mexico reservoirs involving multi-zone completions.

As I have said in the past, logging sand control treatments without making a trip is the holy grail of OFS completion services. This is a premium service that should add significant EBITDA going forward.

Catalyst

The growth in Reservoir Description over the next few years will be the key driver for growth in this stock. You can pretty well track the growth in rig activity for notional geolocations for opportunities in this area. The Middle East was cited in the call for early moves and with larger project sizes than are seen in other places. The South Atlantic margin has been very good for Core Lab for the last number of years and it looks like it’s improving. The company has proactively expanded operations in Brazil. The Gulf of Mexico was also singled out for opportunity. West Africa has been kind of quiet for a while, but the Namibia work changes that dynamic.

Reservoir Description is what people think of in relation to Core Labs. The big colors now do this as well and very competently, but Core Labs has maintained a loyal client base from the time they were pretty much it. As recently as mid-2014, CLB was a $200+ stock, mostly on the strength of their reservoir services and the demand for them at the time.

I am not forecasting a return to $200, but they might be a $30-$50 stock in the next year or so. That said, we need to be cautious about entry points in Core.

Q3 2022 and Q4 Guidance

Revenue was $126 million in the third quarter, up over 4% from $120.9 million in the prior quarter and up almost 7% year-over-year. The sequential increase in revenue was driven by growth in both the U.S. and international markets.

International service revenue was negatively impacted by foreign currency exchange rates versus the U.S. dollar. FX impacts from the strong dollar amounted to about -$9 mm vs. the year before.

Product sales, which are more equally tied to U.S. and international activity, were $38.1 million for the quarter, up over 7% sequentially and up 15% from last year. U.S. product sales for the quarter were up over 22% sequentially and up over 13% year-over-year. Energetic product sales into the U.S. markets continues to be the primary driver and are up over 19% sequentially and up over 27% year-over-year. CLB has done well with this business, but perforating is a commodity service. Schlumberger (SLB), Halliburton (HAL), and a number of other companies provide it.

On a GAAP basis, EBIT was $14.6 million for the quarter. Interest expense ex-items was $2.9 million, up from $2.7 million in the last quarter. GAAP interest expense was $3.1 million, which includes writing off $210,000 of unamortized debt costs associated with renewing our credit facility during the quarter.

Long-term debt was $185 million at the end of the third quarter. And considering cash of $14 million, net debt was $171 million, or a slight decrease from last quarter. The leverage ratio improved slightly and was 2.42 compared to 2.47 at last quarter end.

Looking at cash flow, for the third quarter of 2022, cash flow from operating activities was $5.8 million. And after paying for $2.7 million of CapEx in the quarter, our free cash flow was $3.1 million or up $5.7 million from the last quarter. We expect the growth in working capital to moderate cash from operations to strengthen and for the company to generate positive free cash flow in future quarters. CLB expects capital expenditures to be in the range of $11 million to $12 million for the year.

Guidance for Q4 speaks to flat to modest growth in activity. Core expects U.S. onshore activity to remain steady and modestly grow in 2023 as operators remain focused on capital discipline and availability of additional frac crews and drilling rigs may be constrained. As a result, for the fourth quarter of 2022, Core’s Reservoir Description segment revenue is projected to be flat to up slightly, while momentum in international activity continues to build near-term growth may be affected by two factors: volatility associated with the Russia-Ukraine geopolitical conflict and client-driven project delays.

Production Enhancement segment revenue is estimated to increase by mid-to high single digits as U.S. land activity is projected to remain steady and international growth continues. For the fourth quarter of 2022, Core projects U.S. activity to remain stable and the recent improvement trends in international offshore and deepwater markets to continue. Core projects fourth quarter revenue to range from $126 million to $131 million and operating income of $13 million to $15 million, yielding operating margins of approximately 11%. EPS for the fourth quarter is expected to be $0.17 to $0.21.

Risks

The key risk for CLB shareholders lies in their ATM – At The Market – facility to opportunistically raise cash, which could be dilutive. CFO Chris Hill commented on the ATM in regard to an analyst question:

We have not sold any shares under the ATM. I would say we’re not planning to sell any shares unless we need to. So that was put out there with what happened I think during the first quarter and you see how that impacted us the conflict and whatnot but we’ve recovered partially from that. But keep in mind we do have $75 million of notes that are come in due next year. And we’re working to improve the liquidity in the company and how we’re going to retire that or sort of refinance those. So we’re keeping multiple options open, but we’re going to try to do it without utilizing the ATM.

So there you go. I think the likelihood is that Core utilizes the ATM to meet at least part of this obligation. With a ~44 mm float, that would equate to ~8% dilution for current shareholders.

Your takeaway

Core is a sell at current levels, as the catalyst I mentioned isn’t here yet. Meaning we could have an opportunity in this stock in the low to mid-teens. Entry points are important! To be clear, I think we are in the early phase of a multi-year bull run in oil and gas, but that doesn’t mean it’s always straight up. Take the trading action on Wednesday the 9th as an example. There’s no rush to buy. Be patient, and let it come to you.

Core Laboratories stock trades at 18X OCF. That’s just too high for a company with the issues Core has. Add in the prospect of dilution and you really can’t find a reason to buy them. Analysts are mixed, rating the company as a Hold, and price targets between $13 and $32, with a median of $20.

If you’ve made some money since my speculative buy call, it’s time to consider taking profits in Core Laboratories N.V. and looking for another target.

Be the first to comment