Alex Wong

TuSimple’s (NASDAQ:TSP) C-suite shakeup continues, as former CEO Cheng Lu, who was removed from his role in March, has been reappointed as CEO following the firing of Dr. Xiaodi Hou. Hou and co-founder Mo Chen – who was indirectly involved in Hou’s removal and the FBI and SEC investigations stemming from his Chinese hydrogen autonomous truck firm Hydron – ousted TuSimple’s board of directors, leaving the company out of compliance with Nasdaq listing rules and at risk of delisting. This executive drama along with a challenging path ahead for commercialization after facing delays earlier in the year presents another headwind to shares.

Board Room Drama And Delisting Risk

In the span of eight months, TuSimple has cycled through two executive leadership teams, first letting go of newly-reappointed CEO Cheng Lu for his now-fired replacement Dr. Xiaodi Hou.

TuSimple’s co-founder Mo Chen founded Hydron, the startup behind the aforementioned investigations for financing and possible transfers of technology between the two; he now has returned as executive chairman of the board of directors and he and Hou voted to remove the other four directors.

Now, TuSimple’s board consists of Hou, and Chen and Lu, who were both appointed by Hou, the sole director for the board. It’s a confusing shift of power that has occurred over the past two weeks following Hou’s firing.

Following the sweep of the board, TuSimple said it is “no longer in compliance with Nasdaq Listing Rules 5605(b)(1), which requires the Board to be composed of a majority of independent directors, 5605(c)(2)(A), which requires the Company’s Audit Committee to be composed of at least three independent directors, and 5605(d)(2), which requires the Company’s Compensation Committee to be composed of at least two independent directors.”

The company does intend to regain compliance with the rules “by or before the end of the applicable cure period,” but intending to do so and actually doing so are two different things. With the board room drama, the c-suite shakeup, and the pending investigations, along with a probable loss of trust from investors in the company and the broader AV industry, TuSimple could struggle to fill its board and regain compliance as it has been marred by these recent developments.

At Risk Of More Delays?

Aside from the pending investigations concerning TuSimple’s alleged relationship with Hydron and the board room drama, the overarching leadership changes occurring within the c-suite may threaten TuSimple’s already-once-delayed commercialization timeline.

Lu said he returns as CEO “with a sense of urgency to put our company back on track,” adding that ” it’s critical that we stabilize operations” and “regain the trust of our stakeholders.” This alone raises questions about execution – TuSimple has already delayed autonomous truck production once, and with this drama stretching on for eight months (since Lu’s removal), it highlights a lack of meaningful progression on the commercialization runway. The word choice again heightens concerns that the company is struggling – “stabilize operations” and “urgency” to be “back on track.”

Back in May, TuSimple announced it “is delaying commercialization of its purpose-built autonomous trucks until 2025 while relying on retrofits of existing Navistar equipment to expand driverless routes from Arizona into Texas.” There’s nothing necessarily inherently wrong about retrofitting trucks, other than that it may restrict the scale of commercialization early on, and delay revenue generation at scale since full commercialization with its own outfitted trucks won’t occur until 2025 or later. FreightWaves said at the time that this “slowdown by the acknowledged leader in autonomous trucking suggests that the 2024 date for commercialization may be too aggressive.”

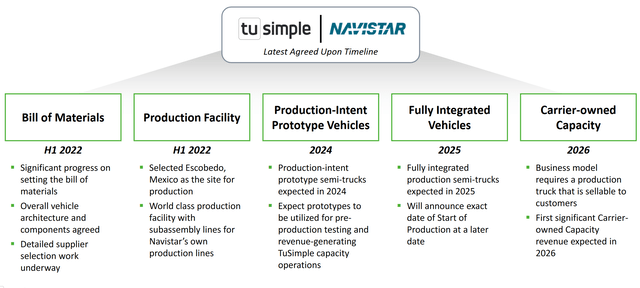

As updated in Q3, TuSimple’s latest agreed upon timeline with Navistar aims to production-intent prototypes ready in 2024, with an exact start of production date for sometimes in 2025. TuSimple expects its first carrier-owned capacity revenues in 2026, such as that stemming from partners like Loadsmith, who has reserved 350 trucks.

Other details gleaned from Q3’s report raise the potential of some stalls in commercialization. Truck reservations showed no growth q/q, remaining flat at 7,485. Revenue miles driven in the quarter increased just 4% to 1.212 million, while revenue per mile decreased slightly. Revenues increased just 2% q/q to $2.7 million. Dealing with multiple investigations while having instability in the c-suite make could continue to hang on commercialization, adding to the risk that commercialization gets delayed once more.

Critical Safety Investigation

A safety investigation from FMCSA and NHTSA also add to the commercialization risk. In April, a TuSimple truck hit a guardrail while traveling on I-10 outside Tucson. TuSimple blamed “human error” for the truck swerving into the center guardrail, saying in a filing that “the ADS was not functional at that moment due to the computer unit not having been initialized, and should not have been attempted to be activated.” An internal report viewed by the WSJ said “a person in the cab hadn’t properly rebooted the autonomous driving system before engaging it, causing it to execute an outdated command.” AV safety expert Philip Koopman said the incident “shows that the testing they are doing on public roads is highly unsafe.”

The incident occurred with two safety drivers in the cab, even as TuSimple is moving forward with driver-out testing on highways, and plans to have active, continuous driver-out operations by the end of 2023. Until the safety investigation’s findings are released, the potential for a deeper safety issue within TuSimple’s autonomous driving software and the risk for delayed driver-out operations remains.

Positive Unit Economics At Scale

Aside from the cloud of headwinds circulating TuSimple, the company has a relatively strong cash position with fair visibility in a burn rate, suggesting about 6 to 8 quarters before capital will definitely be needed.

TuSimple has approximately $1.07 billion in cash, burning about $100 million per quarter, as operating expenses have stayed relatively flat for the past few quarters. TuSimple does not have any debt, and could turn to the debt market for a high-coupon note should it need to raise cash during late 2023/early 2024. However, interest expenses could then total ~$100 million per year moving forward, but could be absorbed by 2027 should commercialization pan out as expected.

With TuSimple’s commercialization plan, operating its own network while charging a subscription to fleets to operate TuSimple trucks in their networks, TuSimple is laying out rather attractive unit economics.

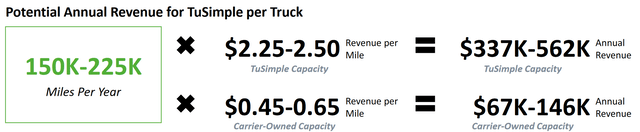

Assuming TuSimple can reach ~200k miles per year per truck, a 500 truck fleet of TuSimple-operated trucks could generate ~$225 million per year; a 500 truck fleet of carrier-owned trucks could generate ~$50 million. These would be early-commercialization targets, given the company’s 7,485 reservations. Assuming TuSimple can fill out ~70% of those reservations by 2027 (for approximately 5,250 trucks), those potential revenue numbers could jump to ~$700 million, assuming 90% of the capacity is carrier-owned.

TuSimple shares have plunged following the c-suite shakeup and pending investigations, leading to shares trading at just over 0.6x cash and an enterprise value likely near ($450 million) as of mid-November at the current cash burn rate. Although meaningful revenues are not expected until at least 2025, the company has a fair bit of dilution and/or bankruptcy potential, given that the AV industry is still coming to terms with the abrupt shutdown of soon-to-be real-world robotaxi deployer Argo AI by Ford (F) and VW (OTCPK:VWAGY).

TuSimple’s potential here lies within its execution – can it overcome a handful of serious investigations relating to its safety and ties to Hydron, and can it successfully commercialize its trucks within the decade? Policy also will play a role in the event of nationwide scaling of TuSimple’s Autonomous Freight Network – much of the revenue potential for TuSimple lies in intra-Texas routes, from Dallas to Houston for example, or connecting Texas to Arizona. Only 28 states allow driver-out AV testing on roads, and linking the Southeast to Southwest corridors will be aided by AV-friendly legislation in Mississippi and Missouri, or on the federal level, which still remains up in the air. California could be a huge key driver due to the Port of LA/Long Beach, but the state’s strict stance on AVs could prevent swift acceptance of autonomous trucks, even as TuSimple has a permit to conduct driver-out tests in the state.

Outlook

TuSimple’s executive shakeup and board room drama have pushed to company into a risk of being delisted from the Nasdaq, due to a loss of compliance with listing rules related to the composition of its board. Delays to commercialization and serious investigations into the company’s safety, along with a separate investigation into ties with Hydron, add significantly to execution risk. Broader developments within the AV industry, highlighted most recently by Argo AI’s shutdown, emphasize that there’s still a very long road before commercialization at scale. TuSimple does have a large reservation book, but that failed to show any growth yet, potentially due to the arising concerns about safety; targeted unit economics are attractive at scale, but the company must reach commercialization and series production without any more major delays or it runs risk of running out of cash.

Be the first to comment