Jon Kopaloff/Getty Images Entertainment

Endeavor Group Holdings, Inc. (NYSE:EDR) is a $9.5 billion U.S.-based talent agency that is led by Ari Emanuel. He’s impersonated in the show “Entourage” as Ari Gold by Jeremy Piven. He’s played as a very intense and driven guy, and I suspect it is an exaggerated but big-picture accurate representation. I understand he felt flattered by the representation and started to use Ari Gold lines in real life. I’m not sure the culture at the firm is as great as it could be.

The firm also owns the Ultimate Fighting Championship (“UFC”). The UFC is the premier MMA (or mixed martial arts) competition. The UFC is led by Dana White. White is a colorful and outspoken character in his own right. He did seem to have been key to building out the organization from pretty much nothing.

Endeavor Group initially pulled its IPO in 2019 after Peleton’s IPO (PTON) received a bad reception. This wasn’t long after the WeWork (WE) debacle (a supposed IPO that went horribly wrong). Endeavor management of the highly levered company probably regretted it for all of 2020. They went for it in early 2021, seeing a clear window and with its business picking up dramatically.

The valuation isn’t immediately attractive, with revenue of a bit over $4 billion, $368 million of net income, and trailing twelve month EBITDA of $1.31 billion.

Emanuel is very acquisitive and likes to buy businesses that are adjacent or have synergy with what the firm is already doing. He does appear to be quite savvy about it. The company acquired Miss Universe from Donald Trump – a long-time client – in 2015. The shareholder list is fairly impressive, and I believe Silver Lake (who owns 35%) has been a long-time backer and likely extensively discussed and/or greenlighted several strategic investments.

Margins

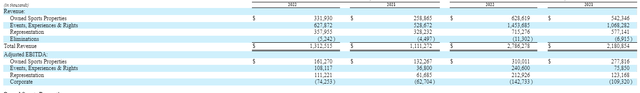

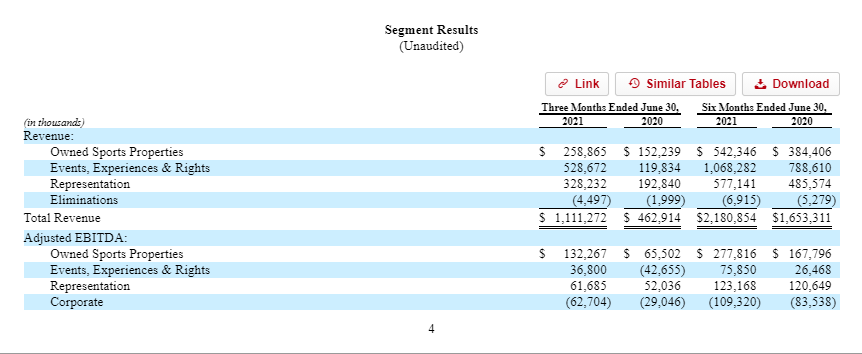

I don’t want to build this write-up around a detailed margins thesis. However, it is useful to highlight how revenue is distributed across owned sports properties (primarily UFC-related), Events, and Representation. The table below shows the most recently released breakdown:

EDR segments (EDR)

and here’s the table I referenced in my original write-up that goes back a bit further:

EDR segments (EDR)

All segments are growing and generate positive EBITDA. The reason I consider the UFC the crown jewel here is that the growth as well as the margins are very attractive. Rights are currently growing very fast but the margins aren’t as great. Growth in rights is likely driven by the changing media landscape. There are giant emerging players like Apple (AAPL), Amazon.com (AMZN) and Alphabet (GOOG, GOOGL) that are taking on more traditional distributors of content. Emanuel commented as follows on the most recent earnings call:

First, as it relates to the growing value and demand for sports rights, there have never been more buyers or greater competition, whether that’s Disney paying a high premium to retain F1 or Apple entering into a 10 year deal worth $2.5 billion for MLS. The U.S. market for rights is at an all-time high. This benefits both our own sports portfolio and the hundreds of sports properties we represent. We’re also seeing strong rights demand internationally for both our represented and owned properties.

On the client side, we continue to broker lucrative deals, like the one for [inaudible] in Latin America and signed new clients having recently struck a 12 year deal with the Rugby Football League to completely reimagine the sport.

Margins in the owned sports properties (UFC being the most important) could improve further. Brazil is home to one of UFCs largest fan bases outside the U.S. EDR is now launching its own OTT offer (FIGHT PASS Brazil) in this market, where 96% of fans watch through streaming services. Per Emanuel:

For the first time we’re owning the customer relationship in one of UFC’s fastest growing international market. Enabling us to continuously evolve our offering to address what fans want most, and to attract new fans. This creates yet another blueprint to consider as we look at all the options available across markets when the rights come up for renewal.

It will be very interesting to watch FIGHT PASS Brazil, as this is a testing ground for other countries. If this is a highly profitable way to exploit UFC rights, expect similar launches in other countries.

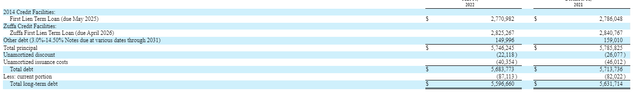

What worries me with Endeavor is a large amount of debt on the balance sheet:

EDR debt stack (EDR)

Unfortunately, quite a large part of this is due in 2025 and another large block in 2026. True, that’s still quite a few years away. However, as I wrote in my last update on Endeavor,

Recessions are likely to decrease Endeavour’s earnings power. If a scenario like that develops it plays out over the next 6-12 months. Officially a recession likely doesn’t hit before 2023. The market will have priced it in by then. By 2023 large debt maturities in 2025 and 2026 could look very awkward. Especially if EBITDA has meaningfully decreased at the same time and the leverage ratio blows back out.

Management is adamant it will bring the debt to EBITDA ratio under 4 soonish. I think it would be wise for management to be quite aggressive about bringing debt down, given the macro backdrop. Especially because over half of the company’s debt is the floating rate type. To be fair, the company also holds $1.82 billion in cash. Its business model is also fairly resilient (although not immune) to inflation as they are often taking percentages of revenue as fees and/or regularly refreshing contracts.

At an EV/EBITDA of 8x, 9x free cash flow, and 18x forward earnings, I think Endeavor is quite attractive given its growth rate and margin profiles. The cash flow is optically high because of some modest asset sales. I’m the first to say it is not cheap. It is one of these instances where I think the price is fair but the asset is really great.

I like the company primarily because of the prize UFC asset. This is a fast-growing sports franchise designed to be sustainably profitable from the ground up, rapidly growing, and with a young global fanbase.

The licensing business is also quite attractive in a world where sports betting is increasingly legalized, and many new competitors are vying to draw eyeballs to their platforms.

I don’t love the maturity and floating rate characteristics of the debt load, given the Fed is on a hiking path. That’s why Endeavor is ultimately just a hold to me. If I were more certain of its ability to deal with the debt load a few years down the line, I’d love to have more UFC exposure.

Be the first to comment