Irina Gelwich/iStock Editorial via Getty Images

Dear readers/followers,

Gas and gas utilities have come to the forefront in Europe due to the war. Enagas (OTCPK:ENGGF) is no different in this context. My last article on this company generated a surprising amount of interest from investors, no doubt due to the attractive, 9% yield that was available, and higher available here.

There’s still a lot to like about Enagas – let’s see what we have here.

Revisiting Enagas and its assets

I still love infrastructure and utilities. Doesn’t really matter what it is, as long as it’s considered a necessary part of life. Telecommunications, Water, Gas, Sewage, Electricity, Railroads, Roads, Waste Management. Out of that list, I have major investments in almost all of those segments.

If you own necessary infrastructure of some sort, you’re bound to usually get a fairly good interest and return on your investment, provided the company is properly managed.

That’s unfortunately where there is some risk here – not because Enagas is poor quality, but because of some of the specifics. The company has a long history at this point – it was privatized back in 1994, but the state-owned holding company SEPI still holds a few percent of the shares here. Around 95% of the shares are available on the open market at this point.

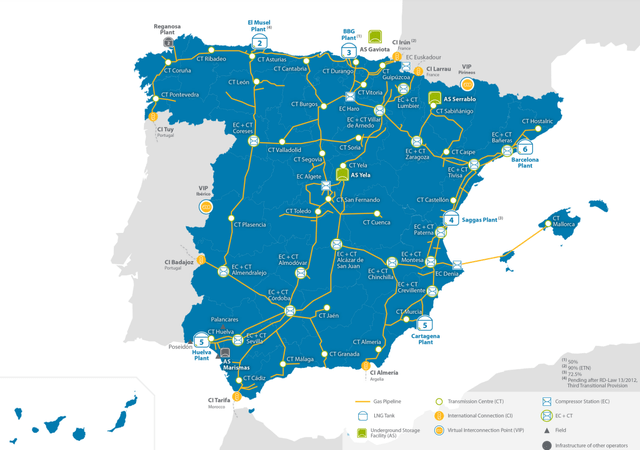

It’s not just Spain either – Enagas operations include areas in Mexico, Chile, Peru, Albania, Greece, Italy, and even the USA. It has taken stakes in Regasification across the world. Its legacy infrastructure covers all of Spain and goes into Portugal as well as France. These are extremely critical infrastructure assets and networks that aren’t going anywhere – especially with geopolitical macro as it is right now.

The company owns 11,000 km of pipelines and 3 massive storage facilities while servicing several international connection points. The company is also the main stakeholder of certain LNG terminals outside of Spain. Enagas has a 16% stake in the trans-Adriatic Pipeline, known as TAP. This 878 km connects Turkey and Italy through Greece and Albania and is one of the most integral parts of the southern gas corridor, which supplies natgas from the Caspian Sea.

The company’s US partner is Blackstone (BX) Infrastructure, GIC, and USS to own Tallgrass Energy L.P. Enagas has a 30.2% stake in the company. Tallgrass owns three inter-state gas pipelines with around 11,000 km of transmission pipelines, 2,400 of gas, and 1,300 km of oil. Tallgrass Energy is, since April 2020, no longer a publicly traded stock.

More information on the company’s operating specifics can be found in my original article. The point here is that Enagas is a very high-yielding sort of stock, and the current operating environment is likely to see this continue to continue to enjoy good operational results.

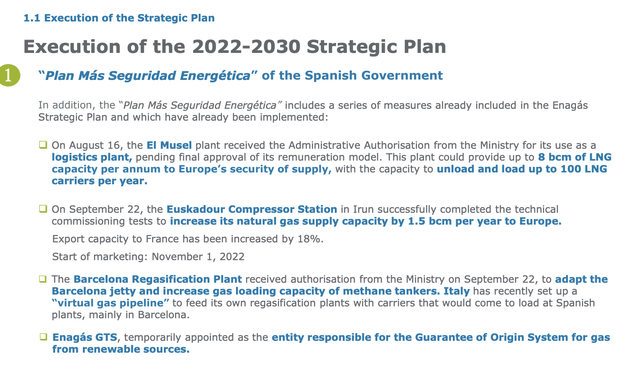

For the latest results, which are the 3Q22 results, the Spanish government has published its strategic plan and review for up to 2030, with six clear targets for the nation and its energy system. There is also an agreement for a Green Energy Corridor, between the governments of Spain, France and Portugal, calling for interconnecting Spain and Portugal, as well as a maritime pipeline connecting Spain and France.

Western Europe has never been as reliant on Russian gas and crude as eastern – but with these new targets, what few percent that were supplied out of Russia are being replaced.

These strategic plans are going forward.

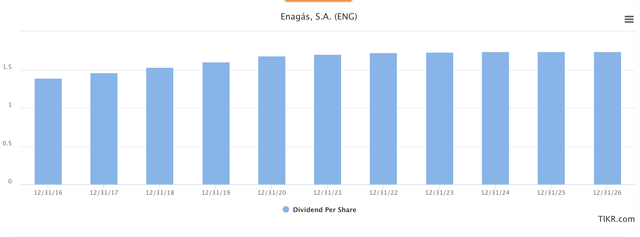

I want to remind you also that the company is BBB rated – its investment grade, with a very high sort of yield. And the dividend the company pays can be considered rock solid with the following foundation and forecast.

We have a bit of a “What you see is what you get” sort of problem, where the dividend isn’t exactly estimated to grow more. But even considering only the €1.7 that the company pays today with a couple of cents in increases in the next few years, that’s still a current YoC of almost 10% based on today’s share price, which is extremely solid when you consider the quality of the underlying assets on play here.

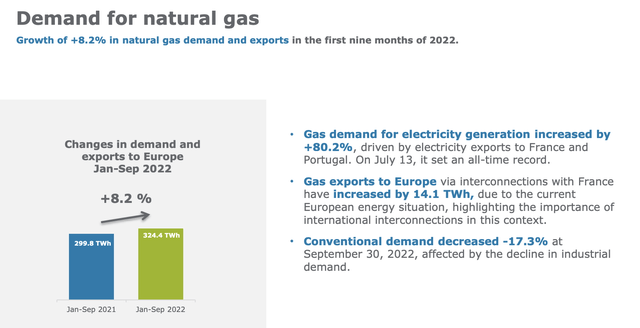

Enagas contributes to European-wide gas exports through a network of EU interconnections, reaching 26.6Twh, which equals 26 LNG carriers, and 100% of the total capacity with France, for instance, is currently contracted. The company’s supplies come from 18 different geographies, and it’s filling underground storage facilities are 93% full at this time.

The demand for natgas, Europe-wide, is substantial.

Straight results are relatively flat in terms of top-line, with increased expenses driving down profits, which is also why the company’s share price has been declining. For 3Q22, the company’s revenues are down about 1%, but expenses are up 22.1%, with EBITDA down nearly 10%. However, net profit is still 15% higher due to a substantial amount of financial income in this period’s quarter – even excluding the gross capital gain from the sale of GNL Quintero, which was about a quarter billion euros.

Net debt is down over half a billion as well due to divestments, good FFO, and affiliate dividends. And despite its 10% yield, the company’s liquidities and safeties continue to impress here. The financial cost of debt is less than 2% for the company, and its leverage is around 4.5x, down from 5.1x on a net debt/adjusted EBITDA basis.

Enagas has the massive advantage of having near-zero Russian exposure. In this environment, this has made certain that despite a drop, Enagas continues to operate far safer than many other European energy businesses – and I am not in the least worried as things stand here.

The company, due to macro, has had very positive 9M22 results, and they’re nearly guaranteed to reach 2022E targets here. Controlling operating expenses is the name of the game going forward, and debt isn’t an issue because over 60% of the company’s debt is fixed, which means that Enagas manages to currently mitigate the interest rate impacts.

Its gas infrastructures saw significant demand increases on a YoY basis, up almost double digits, and availability of the company’s legacy networks has been 100%.

Natural gas demand reached peak demand during mid-2021, at almost 185TWh – and looking at potential 4Q21, it’s likely that this went even higher. Conventional demand for gas represents nearly 83% of the total, and this has grown close to double digits in Spain, with double-digit Residential demand growth.

The Trans-Adriatic pipeline has been doing well ever since deliveries started in 2020, with now average utilization of 100% – and this is almost guaranteed to not drop down now, as things stand with macro.

The thing is this.

Just don’t expect this company to bump their dividend. And by that I mean, on a 10-year forward basis. I don’t expect the company to cut it – as is expected by S&P Global here starting in a few years. More specifically, I don’t expect them to cut it unless something with one of their primary JVs goes horribly wrong.

Potential realistic catalysts for a dividend cut for Enagas – and I see only one – is a serious and long-term reversal for the energy market as a whole – and I don’t see that happening in the near term.

For that reason, this becomes a value question – and a question of your risk tolerance.

Revisiting the Company Valuation

Valuing a company such as this remains tricky, especially when historical multiples are based on wildly different assumptions and fundamentals compared to forward ones.

The best we can do is discount the company’s estimated cash flows, view public comps, and see where this gets us.

However, one distinct advantage to Enagas remains that the company doesn’t really share the wild volatility of the midstream and energy companies you might be used to. Even the latest drop isn’t as much “volatile” – it’s only down about 9% since I wrote about it last.

Enagas also hasn’t yet seen a full recovery to pre-pandemic or high-energy price valuations – which means there’s still a lot “baked in” for this company in terms of overall upside.

As I wrote about earlier, we can’t really use peer multiple. Finding public comps is not easy for Enagas, because, in Europe, gas transmission is usually integrated into other utility operations.

The absolute closest peer to Enagas is Italian Snam (OTCPK:SNMRY), which is a direct 1:1 comparison for operating the Italian gas transmission network. I don’t currently own Snam, and I consider it far higher risk in terms of asset exposures and sources for its gas.

If we ignore integration, closer comps are E.ON (OTCPK:EONGY), Engie (OTCPK:ENGIY), and National Grid (NGG) – all of which I own. However, these also operate electricity transmission and distribution, which clouds multiples somewhat. This also gives them a very different risk profile to Enagas and Snam.

Enagas does have similarities to Snam in terms of its operating model – as it is fully regulated and resilient in terms of business. Enagas FCF covers the dividend despite its drop in EBITDA, which is a massive positive as well, and I prefer its focus on taking international assets and JV’s where it can find them.

The company’s political exposure and limited ability to squeeze more profit margin from legacy are really the two main risks here – and they need to be lined up to what the valuation is here. Because these facts mean that the dividend is very unlikely to go up – but it also seems very unlike that it’s going down.

The last time I wrote on Enagas, we were talking about a share price of around €18.5. Today, we’re down to around €17/share. The analyst targets have been impacted somewhat by the company’s expense increases, which means we’re at a low of €13 and a high of €25, with the average down about €1.5/share to around €17/share since my last piece, essentially considering Enagas fair value here.

I would say these analyst are impairing the company’s valuation too much, and ignoring the company’s market position and safety in an unsafe world. Enagas still trades below a 15x NTM P/E, and below 11x to EBITDA. I believe the company is at least worth 15x, which gives me a slight upside here of around 7% conservatively considered.

Enagas to me is a clear case of bond-like buy & hold safety for someone looking for a good interest rate. Don’t look at the long-term share price, look at the yield and performance over time. You get inflation protection at an excellent interest rate.

I will put myself at €18.5/share for Enagas, shifting my target down around €1/share, and ending here with the following thesis.

Thesis

-

Enagas is a classic bond-type play. You’re essentially paying the Spanish government your investment, and relying on legacy and a few growth assets to deliver a ~8-10% interest rate. You get inflation protection, and you get some safety.

- I would consider such a play to be a very attractive deal in the right environment and at the right price. The right environment is today. The right price, that’s something I believe we also have.

- For that reason, I’m going with a “BUY” here, and I’m staking more of my money in Enagas at a yield of 10% with a PT of €18.5

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

This is one of the safer energy stocks out there in Europe, as I see it, and I’m happy to say it fulfills all of my current criteria.

Be the first to comment