ventdusud

Empire State Realty Trust, Inc (NYSE:ESRT) is the owner of the iconic Empire State Building in New York City (“NYC”) and a publicly traded real estate investment trust (“REIT”) that owns a portfolio of other office, retail, and multifamily assets in Manhattan and the greater New York metro region.

Compared to their NYC peers, SL Green Realty Corp (SLG) and Vornado Realty Trust (VNO), they are significantly less diversified in the number of revenue producing assets and are smaller in size, with an enterprise value of less than +$5.0B. Trading volume is also slightly lower with an elevated degree of short interest, at 9%. This, however, is on par with the shorted quantity identified with both SLG and VNO.

Seeking Alpha – ESRT Trading Snapshot

Over the past five years, the stock has performed poorly, down nearly 70% during that time frame. Worse, shares have been on a downward trend even prior to the start of the COVID-19 pandemic. Investors holding since 2013, for example, would have earned a compound annual growth rate (“CAGR”) of less than 1% through 2019 and would be sitting on a negative 7% CAGR if still holding today.

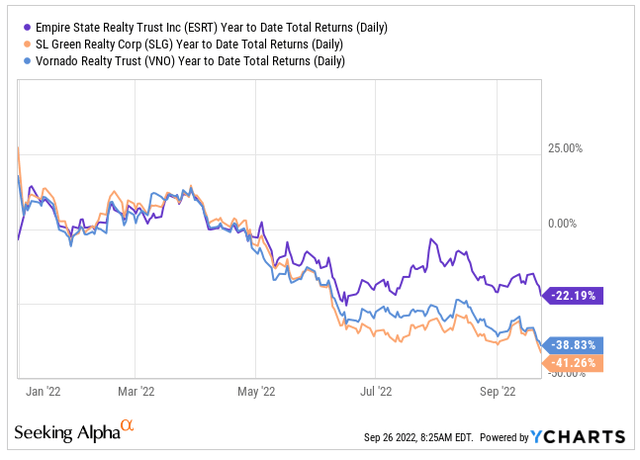

While the stock did make a partial recovery from the pandemic lows, they never fully returned to their pre-pandemic trading levels. On a YTD basis, ESRT is performing better than both SLG and VNO, down just over 22%, but that still provides little solace to long-time investors sitting on significant 5-year losses.

YCharts – YTD Total Returns Of ESRT Compared To Competitors

At present, shares are trading at new 52-week lows and at 8x forward funds from operations (“FFO”). This compares to the 13.5x at the high end of their 52-week range, which represents a spread of just under $5 from their highs and lows.

For many investors, the stock may appear to be dead money. And this wouldn’t be unfounded given their past performance. But for a dead cat, it does bounce high. From its 2020 lows, for example, it gained over 100% on optimism surrounding the reopening trade.

Similarly, ESRT is likely to experience a 15-20% comeback following a broader reversal in market sentiment. A healthy balance sheet, strong visitation trends at the Empire State Building, and significant upside potential in the quarterly dividend are a few fundamental catalysts that could support a rally from present levels. For prospective investors, ESRT is one beaten-down opportunity worth a further look.

A Portfolio Driven By The Irreplaceable Empire State Building

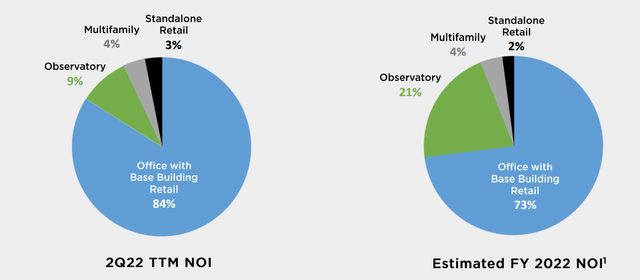

ESRT owns a limited portfolio of office-centric buildings, with the asset class representing between three quarters and 80% of their total net operating income (“NOI”). In addition to the rental revenues of the Empire State Building, ESRT also earns income from the building’s observatory operations, which, through Q2FY22, was just under 10% of total trailing twelve-month (“TTM”) NOI. But as visitation continues to improve, the fees are expected to reach 20% of NOI by year end.

July 2022 Investor Presentation – Breakout Of NOI By Asset Class

Through the date of their earnings release, visitation to the Empire State Building already surpassed one million visitors, or 60% of 2019 levels. From an NOI recapture perspective, however, the rate was 80%, supported by higher pricing power.

Despite the price hikes, tourists are still drawn to what is often dubbed as the world’s most famous office building. In fact, TripAdvisor’s 2022 Travelers’ Choice Award placed the building as the #1 ranked attraction in the U.S. and the third ranked in the world. With plenty of upside remaining on visitation figures, ESRT should experience continued earnings growth in future periods.

One can point to rapidly deteriorating economic conditions as one headwind. But this turbulence is primarily being felt in the equity, currency, and housing markets. Consumers, on the other hand, remain in a stronger financial position than they were during past market downturns. This is marked by an elevated, albeit moderated, savings rate and lower delinquencies. In addition, there continues to be a rotation from the goods-based to a more services-based economy. This should serve as a continued tailwind for ESRT.

Long-Term Lease Commitments At Favorable Leasing Spreads

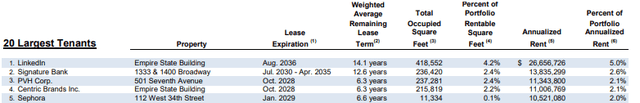

Aside from the tourism aspect, the Empire State Building also serves as a top tier office building in Manhattan, with LinkedIn as a top tenant on a 14-year lease, expiring in 2036. Overall, at the end of Q2, the building was about 84% leased and 80% physically occupied. While this is down significantly from the 95% rate from the end of 2019, it does present an attractive opportunity for organic growth in the periods ahead.

Q2FY22 Investor Supplement – Listing Of Top 5 Tenants

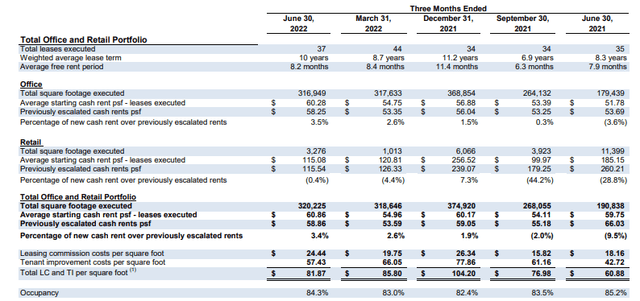

Despite weakened occupancy figures, leasing activity remains strong, with over 320K square feet (“SF”) signed in the current period. This is up significantly from the 190K signed in the same period last year. Additionally, net effective rents were up 25% YOY in their Manhattan office portfolio and 16% on a sequential basis.

Q2FY22 Investor Supplement – Portfolio Operating Metrics

The weighted average lease term also increased to ten years, up from 8.7 years last quarter and 8.3 years in Q2FY21. This provides an indication of the confidence their tenants have in the longevity of the office model, even if current trends support more hybrid working arrangements.

The 350 basis point (“bps”) spread between leased and physical occupancy provides further visibility into future NOI growth. Combined with the burn off of free rent and a solid pipeline of Q3 leasing activity, ESRT is expected to realize approximately +$53M in contractual incremental rent.

A Flexible Balance Sheet With Significant Upside In The Dividend Payout

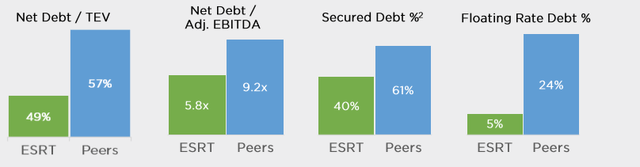

ESRT’s operations are supported by a balance sheet that provides greater flexibility than their peer set, which includes SLG and VNO. Net debt, for example, stands at just 5.8x adjusted EBITDA versus an average of 9.2x reported by their peers. Minimal exposure to floating rate debt is also another competitive advantage, especially in an environment marked with rising interest rates.

July 2022 Investor Presentation – Comparison Of Debt Position Of ESRT Versus Peer Set

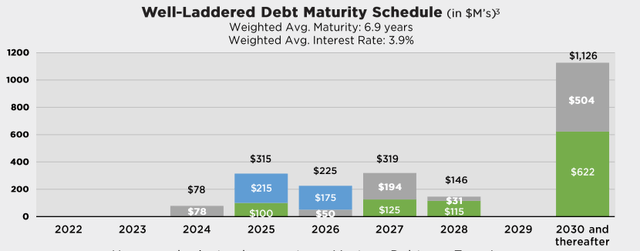

Limited near-term debt maturities also negate any near-term repayment-related risks. Existing liquidity of over +$1.0B, which includes +$360M of cash on hand, also ensures the company has adequate funds to meet their primary reoccurring obligations, which includes interest and their dividend payouts.

July 2022 Investor Presentation – Debt Maturity Schedule

At 5.1x, interest is adequately covered by earnings. And at a core payout ratio of just 23%, the current dividend is well-covered as well. At these coverage levels, ESRT does have flexibility to enact an increase from current levels, which is sitting at just $0.035/share on a quarterly basis, down substantially from the pre-pandemic days. At its former rate, the payout would yield over 6% at current pricing, significantly better than the meager 2% offered at present.

ESRT’s Stock Price Performance Should Correlate With Visitation Figures

The Empire State Building is one of the world’s most famous buildings and a top tourist attraction in the U.S. and abroad. As the primary revenue producing asset in ESRT’s portfolio, strong visitation figures should correlate with stock performance. Instead, the two have significantly diverged, with visitation at 60% of 2019 levels but the stock at new 52-week lows and not too far off their 2020 lows.

The lack of portfolio diversification is one risk that could expose ESRT to material losses, especially if visitation trends mark a stark reversal due to the rapidly deteriorating economic outlook. But there are limited indications that the slowdown is resulting in waning travel demand.

While rising rates has caused turbulence in the global housing, currency, and equity markets, consumers continue to possess a higher degree of savings that is, in part, funding experiences that were missed during 2020. This includes trips to the Empire State Building, which was ranked as the top travel attraction in the U.S. by TripAdvisor.

There is also significant upside potential in ESRT’s quarterly dividend payment, which is set at just $0.035/share, substantially lower than the pre-pandemic benchmark. If the payout were to return to those levels, it would yield over 6% at current pricing levels. This would give income investors an incentive to own the equity as opposed to parking their cash in a savings account that, at current rates, yields more than the rate obtained on the company’s current dividend payment.

Ample organic opportunities embedded in the stock support a rally from present trading levels. A flexible balance sheet and an irreplaceable asset in the Empire State Building at subdued valuations also make the stock a viable buyout target, especially considering mounting frustrations on the stock’s performance from institutional and other long-time investors alike.

All considered, 20% upside from current trading levels is not out of the question. This would bring shares up to about $8 and would represent a pricing multiple of just shy of 10x forward FFO. For prospective investors, those returns should be satisfactorily higher than current risk premiums.

Be the first to comment