onurdongel

Great empires are not maintained by timidity. ― Tacitus

Today, we take our first look at a small cap energy producer that has been rapidly growing output and has seen some recent insider purchases. An analysis follows below.

Company Overview

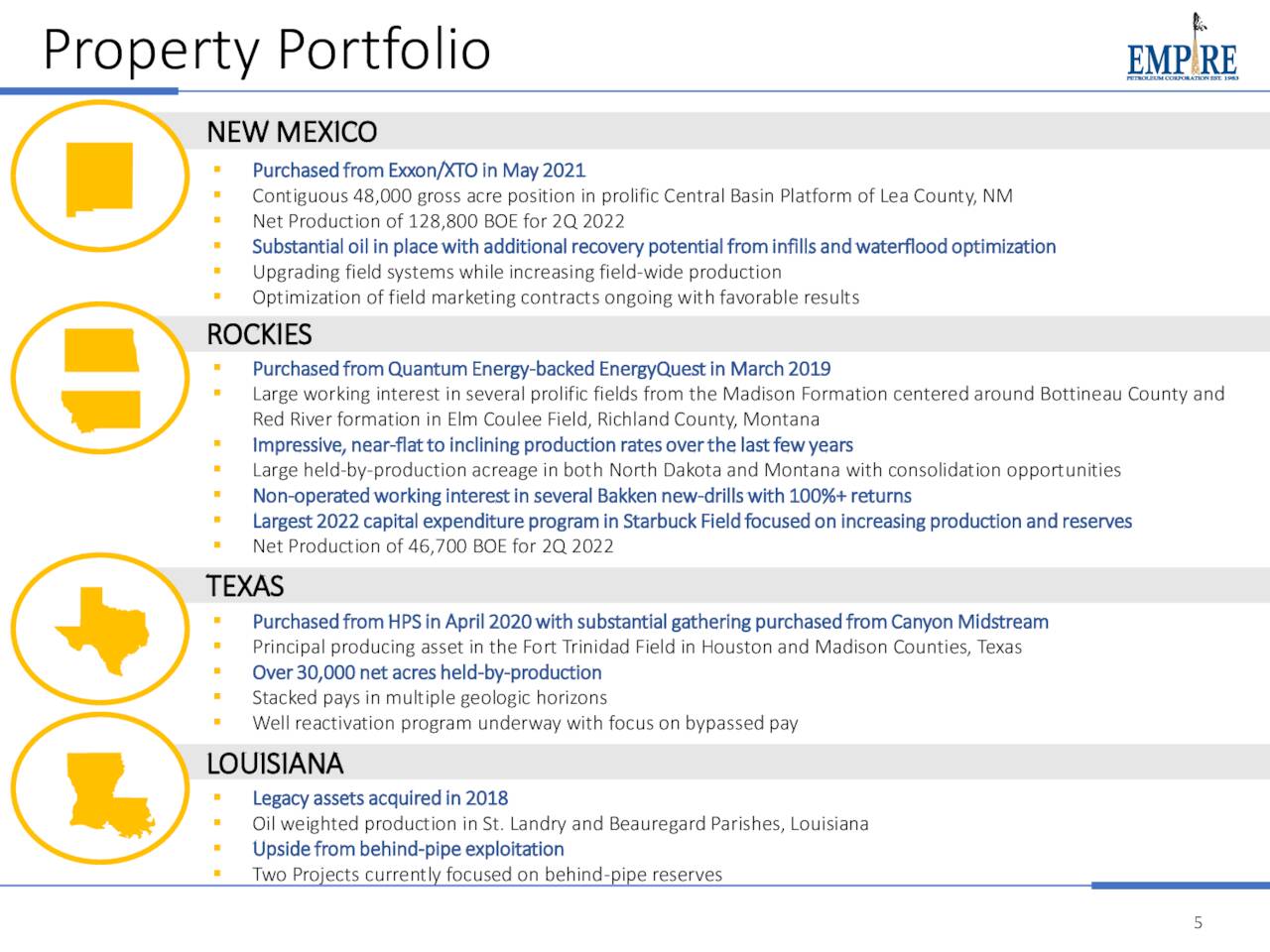

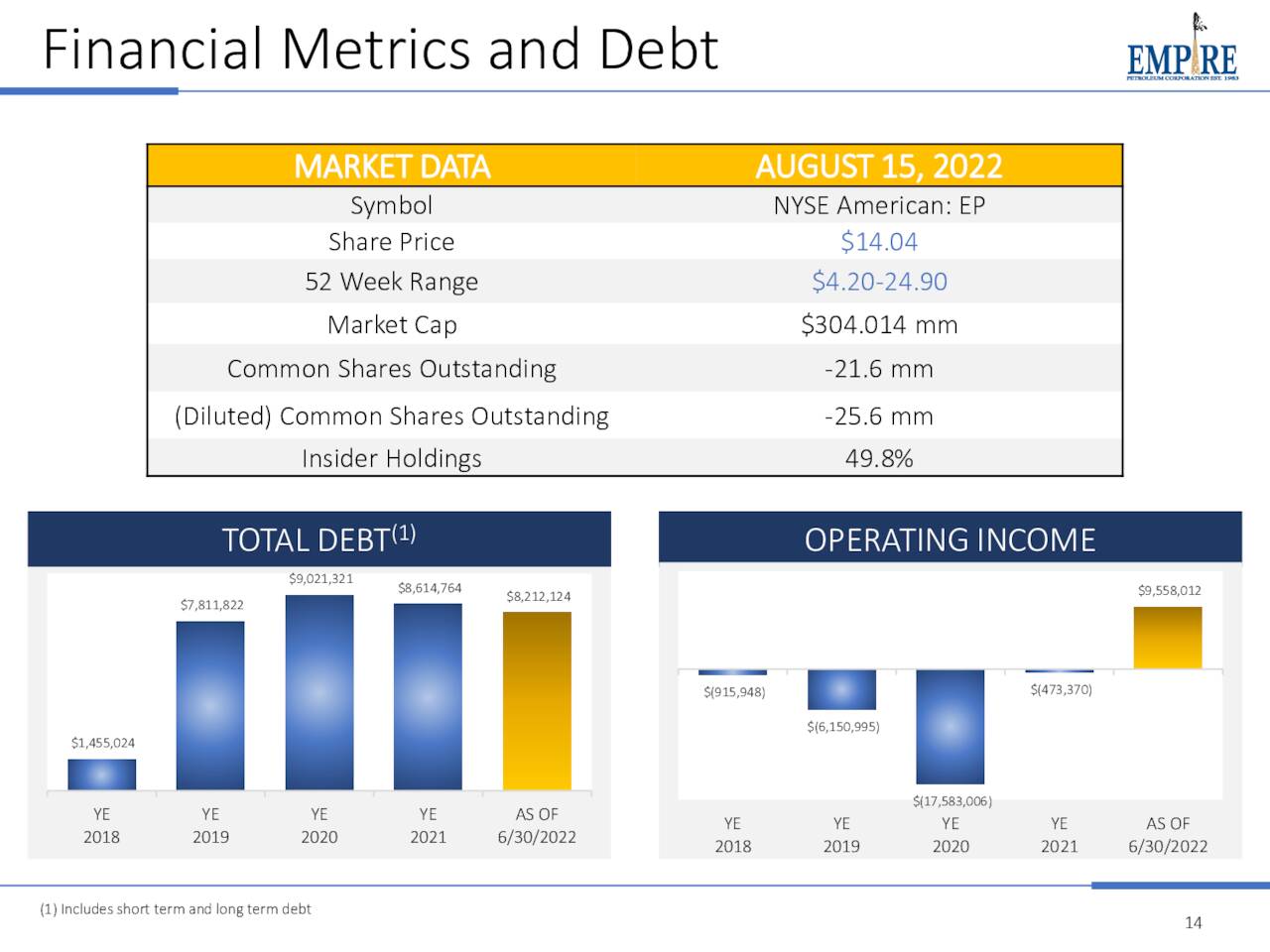

Empire Petroleum Corporation (NYSE:EP) is a Tulsa, Oklahoma based oil, natural gas, and natural gas liquids [NGLS] production company with properties in New Mexico, North Dakota, Texas, Louisiana, and Montana. Through acquisition, the company has grown its operating well count from 9 in 2018 to ~1,100 at YE21 and now has ~8.4 million barrels of proved developed producing oil reserves. Empire was founded in 1983 as Chambers Energy, listed on the OTC Pink Sheets in 1992, changed its moniker to Americomm Resources in 1995, and focused on mining before it merged with and assumed the name of Empire Petroleum in 2001. The company bumbled along for nearly two decades with next to no production until a new management team was installed in 2018. Its stock uplisted to the NYSE American Exchange on March 8, 2022 with its first trade executed at $15.48 per share. Empire now trades for around $16.00 a share, equating to a market cap of approximately $350 million.

History

After accomplishing little during its many decades in existence, Empire onboarded CEO Thomas Pritchard in November 2017. Under his stewardship, the company borrowed $1.2 million and acquired three primarily oil producing properties encompassing ~3,000 acres in Louisiana during 2H18, finishing the year with nine gross and 8.1 net productive wells.

In 2019, Empire purchased two fields in South Dakota and Montana comprising 20,700 acres for a total consideration of $5.6 million, financed primarily by debt. These transactions increased its number of producing wells to 145 (120 operated) at YE19. Production of barrels of oil equivalent [BOE] improved from 6,302 in FY18 to 119,756 in FY19.

In 2020, the company used the pandemic to acquire property on the cheap, adding ~35,000 acres, including 30,397 acres and 139 gross wells in Texas to its portfolio. Its production increased to 188,104 BoE as its debt level only rose from $7.8 million at YE19 to $9.0 million at YE20.

August Company Presentation

Empire’s transformative acquisition occurred in May 2021, when it purchased 40,000 net acres held by production from 730 wells with an average working interest of 72% from Exxon Mobil (XOM) in May 2021. This real estate included the Eunice Monument and Arrowhead Grayburg fields in the Permian Basin of New Mexico and cost $17.9 million. The transaction was initially funded by debt but was paid down through production revenue and the issuance of stock. Output for the year increased 187% to 539,796 BoE.

The company then effectuated at 1-for-4 reverse stock split and uplisted to the NYSE American Exchange in March 2022. The following month, Empire added 2,482 net acres in North Dakota for $1.4 million.

Approach

The company’s strategy is to mitigate the steep decline curves and geologic risks associated with exploration and new well development by acquiring mature assets with slow-decline and long-life production profiles at two to four times cash flow. Empire then enhances their production through field management techniques, such as sonic hammering (high frequency vibration to remove well bore damage) and water injection, amongst others. It also returns to production inactive wells on its acquired properties. In terms of revenue, the company’s oil/natural gas/NGL split in 1H22 was 80/8/12. Empire is attempting to scale up production so its overhead costs per BoE will diminish significantly. To that end, it has lowered operating costs from $63.45 per BoE in 1H21 to $52.27 per BoE in 1H22. The 19% drop is a function of improving G&A costs as a percentage of output, reduced 44% from $26.86 per BoE to $14.97 per BoE over the same period. The company still has a ways to go, as G&A costs in the oil patch typically run in the mid-to-high single digits.

August Company Presentation

Most of its production is not hedged, with what little there is coming in the form of out-of-the-money put option contracts on the price of West Texas Intermediate [WTI] crude oil to satisfy covenants of its bank debt. As such, Empire has been a beneficiary of robust oil and gas prices throughout 2021 and 2022.

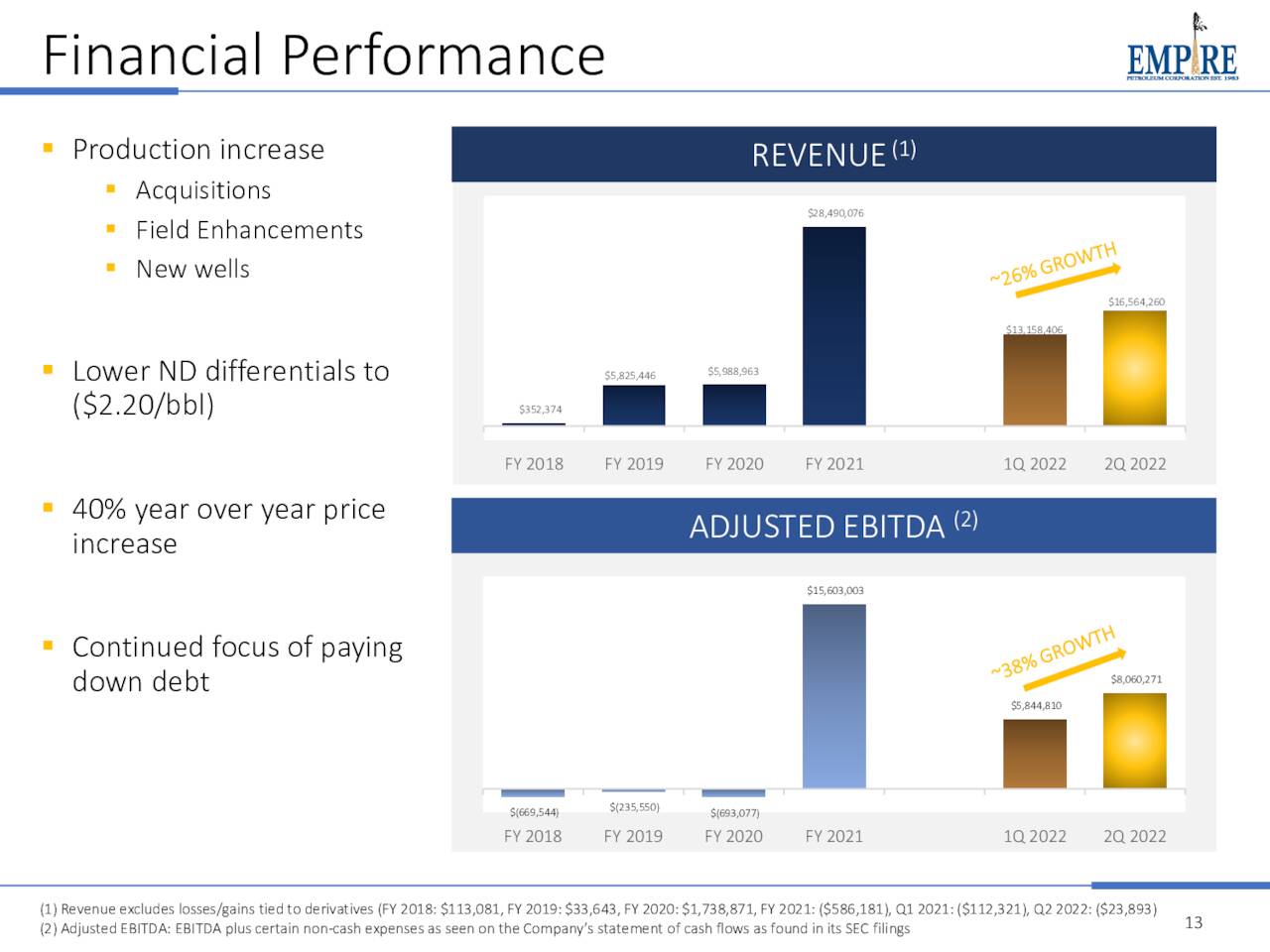

2Q22 Earnings & Outlook

This dynamic was on display when the company reported its 2Q22 financials on August 16, 2022. In its first full quarter as an NYSE American listed company, Empire posted earnings of $0.24 a share (GAAP) and Adj. EBITDA of $8.1 million on revenue of $16.5 million versus a loss of $0.35 a share (GAAP) and Adj. EBITDA of positive $3.3 million on revenue of $4.7 million in 2Q21, reflecting the benefit of higher commodity prices and its New Mexico acquisition. Although daily production actually dipped slightly quarter-over-quarter from 2,163 BoE (1Q22) to 2,159 (2Q22), Empire realized a 26% sequential increase in revenue as the average oil price it sold into market increased from an already elevated $91.17 per bbl to $108.62 bbl while natural gas prices surged from $4.61 Mcf to $6.95 Mcf. Owing to these favorable market undercurrents, Empire generated more revenue in 1H22 ($29.6 million) than in all of FY21 ($27.9 million).

August Company Presentation

The company also announced that it its investing $10 million into its Starbuck Field in North Dakota with an endgame of increasing production by over 500 BoE per day and doubling the field’s reserves count by YE22. Expenses for this project will come out of cash on hand and management anticipates that it will pay back in approximately one year. Between Starbuck and its other activities, Empire expects to exit FY22 producing ~4,000 BoE per day, for a ~1.5 million BoE annual run rate.

Balance Sheet & Insider Activity:

These propitious market conditions also have the company’s balance sheet in excellent stead, holding cash of $12.4 million versus debt of $8.2 million as of June 30, 2022. It also has ~$0.3 million of liquidity available under a revolving credit facility. Still in its growth spurt, Empire pays no dividend, and with only 21.7 million tightly held shares outstanding, it is not repurchasing stock.

August Company Presentation

Owing to its relatively recent up-listing and very small market cap, Empire has no sell side coverage.

Board member Phil Mulacek, representing the interests of beneficial owner Petroleum Independent & Exploration (PIE), is bullish on Empire’s stock below $12, having purchased 138,135 shares of EP at an average price of $11.83 on September 16th and 19th.

Verdict

With essentially no hedging and a high cost structure, Empire is a high-risk way of betting on oil prices. It is currently taking advantage of higher oil prices to add to production and lower its cost structure without getting further into debt. And management appears to have a disciplined approach and is executing on its vision. That said, the market is not providing any sort of discount for its current high cost structure, trading at an EV/TTM Adj. EBITDA of approximately 12 – and that includes two quarters where it sold oil (on average) at ~$100 per bbl. With oil currently near $90 per bbl, the value proposition gets a bit more muddled. This is not a knock on the company or its approach but simply its share price. We’ll keep it on the radar with the hope of becoming more constructive when EV/EBITDA relative to its cost structure and if the price of oil moves back over $100.

The temples of empires come tumbling down, the names of the mighty forgotten. Here is a parable: power never lasts. ― Cliff James

Be the first to comment