peepo

Overview

On a sum-of-the-parts (SOTP) basis, I believe Embraer (NYSE:ERJ) is grossly undervalued. ERJ 90% stake of Eve Holding (EVEX) has a 40% larger equity value than ERJ’s whole market capitalization. The disparity is unjustified given that ERJ’s primary company is not worth $800 million and EVEX may be worth three to four times more than it is now (19 Sept 2022). The reason for investing in ERJ than EVEX is because it provides investors with a safer way to gain from EVEX’s future upside as its core business is worth something. Whereas for EVEX, if the business fails to take off eventually, it could be worth 0.

Business description

As the thesis focuses on the value of EVEX, I will elaborate more on EVEX’s business than ERJ.

ERJ is the world’s largest maker of jets with up to 150 seats, based on the number of jets delivered over the past ten years. In addition to having a global customer base, this manufacturer also has a franchise footprint. With its wide range of products and services, ERJ meets the needs of the commercial airline, executive jet, and defense and security industries.

As for EVEX, it is a leader in the development of cutting-edge Urban Air Mobility (UAM) solutions. The UAM solution is EVEX’s primary offering, and it consists of electric vertical take-off and landing (eVTOL) design and production, maintenance and support services, fleet operations services performed in collaboration with partners, and a new Urban Air Traffic Management system that is intended to allow eVTOLs to safely and efficiently operate alongside conventional aircraft and drones in dense urban airspace. EVEX has no revenue as of FY21 and is expected to start generating revenue only in FY26.

Investment thesis

Given the importance of the SOTP valuation disparity in this report, the investment thesis discussed below focuses on ERJ’s largest holding, EVEX. Let me state right away why I believe ERJ is vastly undervalued on an SOTP basis. It is likely that ERJ stock has been knocked down due to:

- Recent sell off with a slew of other plane manufacturers

- Recession and supply chain concerns which could delay ERJ’s core operations recovery

- ERJ’s listing in Brazil, which has exposure to FX headwinds and a higher market beta

Huge TAM

EVEX operates in a nascent industry that is estimated to have $760 billion global TAM. The increasing number of people living in cities, the worsening state of traffic, and the development of autonomous vehicle technologies have all contributed to a surge in interest in urban air mobility services. More than half of the world’s population now lives in urban areas, and that number is only expected to grow in the coming decades to 66% by 2050, according to estimates by the United Nations. Because of this, urban transportation systems will be under extreme stress, and novel approaches will be required to alleviate the pressure. More and more communities are turning to air travel as a way to deal with urban traffic congestion, which wastes time and money and is estimated to cost the US economy $88 billion annually.

Improvements in the technology for autonomous ground vehicles, in my opinion, have made unmanned air travel a real possibility in the future. By the year 2040, it is expected that 33 million autonomous ground vehicles will have been shipped all over the world, a number that is significantly higher than the 1 million units predicted to be shipped in 2025.

EVEX 13 Apr 2022 Investor Presentation

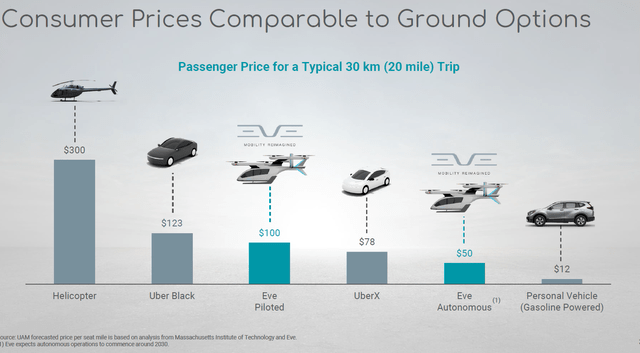

The expansion of the UAM market is also being fueled by the fact that travel times can be cut in half with a mobility service that costs roughly the same as other ground transportation options. Eighty-nine percent or more of over 14,000 consumers polled as part of EVEX’s user assessment study indicated that they intended to make frequent use of UAM services (either daily, weekly, or monthly). In a survey done by EVEX, 83% of people said they would pay at least 1.5 times more for UAM services than for a taxi to save time.

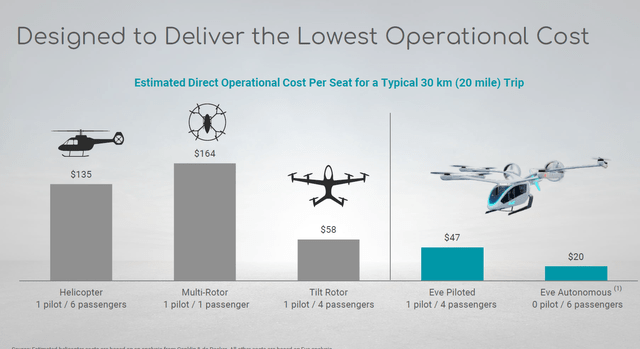

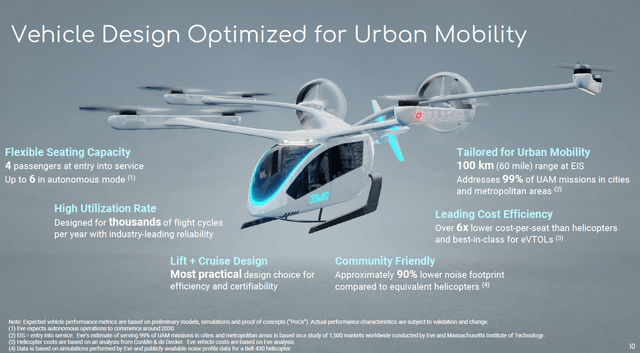

UAM services have the potential to address numerous issues related to rotorcraft operations, bringing the advantages of vertical air transport to the masses in a responsible and cost-effective manner. Direct operating costs for the EVEX’s eVTOL are predicted to be reduced by 65% when compared to conventional helicopters and by an additional 85% when the VTOL is flown unmanned in the future (source: EVEX’s Apr’22 Investor Presentation) . Cheaper tickets for the general public should be possible with eVTOLs due to their lower operating costs. Helicopters are banned from many urban areas due to their disruptive noise levels (see here and ), but EVEX’s eVTOL is planned to have a noise footprint that is 90 percent smaller than that of a helicopter (source: EVEX’s Apr’22 Investor Presentation). Because of this, vertiports can be built in the middle of cities.

EVEX 13 Apr 2022 Investor Presentation EVEX 13 Apr 2022 Investor Presentation

Vehicle design is optimized for Urban Mobility

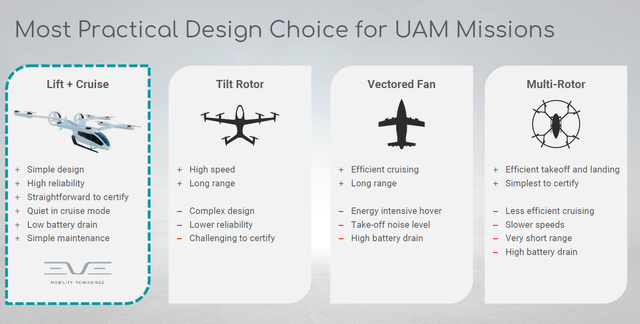

EVEX’s eVTOL has eight rotors for lift in all three flight phases, two propellers for forward motion, and two wings for smooth, noiseless flight. Currently, EVEX’s eVTOL is designed to carry four passengers plus the pilot, but this number could increase to six with the addition of autonomous features. Thanks to its 100km range at takeoff, management believes EVEX will be able to handle 99% of UAM missions in urban areas.

EVEX 13 Apr 2022 Investor Presentation

Strong scalability is backed by ERJ support and strategic partnerships

In my opinion, EVEX’s partnership with ERJ will allow it to rapidly advance and reduce the risk associated with its UAM solution (Source: EVEX S1). The terms of the agreement give EVEX access to ERJ’s extensive resources at a cost. Additionally, EVEX will be given priority access to all 5,000 ERJ employees, including 1,600 identified engineers with significant design and aeronautical expertise, and the ability to scale up or down resource utilization as needed. The royalty-free use of ERJ’s background intellectual property in the UAM market is one of the most valuable benefits to EVEX. Because of the ERJ agreement, EVEX can save time and money compared to competitors and newcomers by not having to build its own infrastructure and by skipping a large part of the learning curve.

EVEX 13 Apr 2022 Investor Presentation

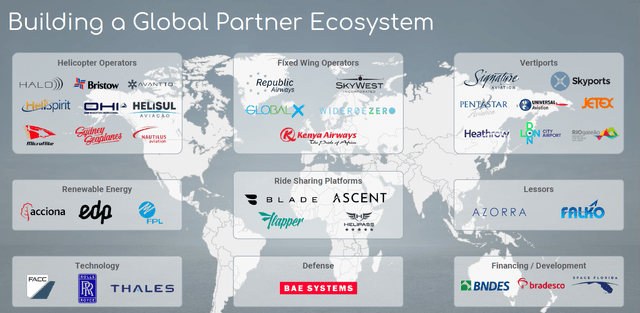

In addition to its robust strategic partnership with ERJ, I believe that EVEX’s global partner network provides the company with significant commercial leverage and extensive market access. From fixed-wing and rotary-wing operators to experts in technology, renewable energy, ground infrastructure, and financing, EVEX has partnered with dozens of prominent companies. Also, EVEX’s network of partners is global, which makes it easier for the company to reach important UAM markets around the world.

EVEX 13 Apr 2022 Investor Presentation

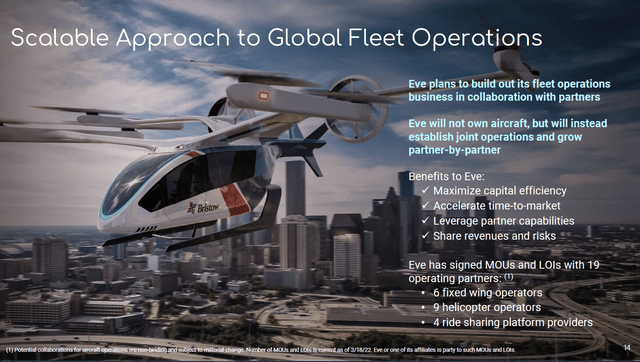

EVEX’s strategy of working with third parties to expand its fleet operations business is particularly ingenious because it reduces the company’s operational and financial risks. While some UAM members have discussed establishing their own flight operations on a city-by-city basis, EVEX has opted to expand its fleet services through partnerships rather than make massive initial CAPEX in order to remain competitive. For example, EVEX has made strategic alliances with Republic Airways and SkyWest to make sure that most cities in North America can be reached quickly and completely.

EVEX 13 Apr 2022 Investor Presentation

Significant revenue visibility and no debt reduce liquidity risks

EVEX has no outstanding borrowing obligations and $176.3 million in net cash as of LTM2Q22. Furthermore, EVEX has received over $5.5 billion in non-binding orders for 2,060 cars from over 21 different customers. It is worth noting that management regards this order funnel as the largest in the UAM sector in terms of both the number of automobiles and the diversity of clients who have placed orders. This speaks well of EVEX’s credibility, and it also shows how much more demand EVEX may receive if the product meets customers’ expectations. The fact that EVEX can invest CAPEX up front with certainty is another reason why pipeline visibility is important.

Forecast

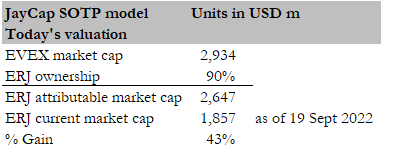

My model’s primary goal is to demonstrate the considerable upside from an SOTP standpoint. First, consider the significant disparity in market capitalization based on how the market now values both companies (as of 19 Sept 2022). ERJ’s 90% stake in EVEX’s current market cap is 43% than ERJ’s entire market cap. This could mean one of two things. At the ERJ level, either the ERJ core operation or EVEX is valued at a negative value of $800 million. It is very unlikely that makes sense.

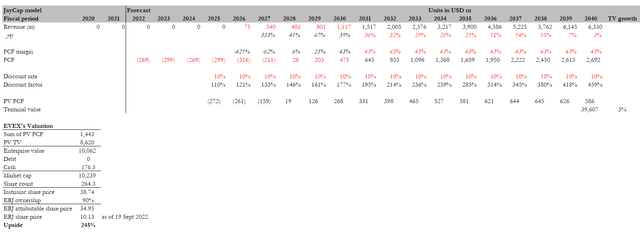

Author’s estimates

Next, we consider how much EVEX could be valued based on management’s original projection (until FY30) and my DCF model. I assumed diminishing growth rates until the inflation level in 2040. Given that I have no better sight than the marginal investor, my assumptions are likely to be far lower than reality. But this is great because, even with my conservative assumptions, ERJ’s portion of EVEX is easily worth 3.4x the current share price (as of 19 Sept 2022).

I do want to remind readers that most of the value is in the out years, which could be one of the reasons the SOTP gap isn’t decreasing. The notion is that EVEX is currently a “show me” tale; investors will only become interested if EVEX begins to show signs of meeting its guidance. In short, this might be a long-term hold before investors reap the benefits.

Red flags

Products are still in the testing phase

Even though EVEX has put their aircraft through some preliminary tests with flying vehicles and components in test rigs, the company’s management still has to rely on projections and models to assess the planes’ expected performance. Although EVEX claims its eVTOL aircraft will perform reliably for its intended lifespan, this claim has not yet been verified. It’s possible that the aircraft’s poor performance is due to design and manufacturing flaws. For instance, perhaps the noise level is higher than expected.

Backlog of orders is non-binding

All current orders for EVEX’s eVTOL aircraft are represented by non-binding agreements with potential customers and strategic partners. Potential customers and strategic partners will not be obligated to place orders until all material terms are agreed upon and EVEX enters into definitive agreements with them. If EVEX can’t reach agreements with its potential customers and strategic partners, or if any aircraft are cancelled, changed, or delayed, EVEX projects might not be finished, which would hurt the equity value.

Conclusion

The ERJ equity value clearly has a huge valuation mismatch. While I do not disagree with the consensus on ERJ’s core operations, investors can make their own assumptions and still come out with a decent upside when EVEX’s value is factored in. I believe it is only a matter of time before the market recognizes the massive mismatch and the ERJ share price reflects this.

Be the first to comment