Vertigo3d/E+ via Getty Images

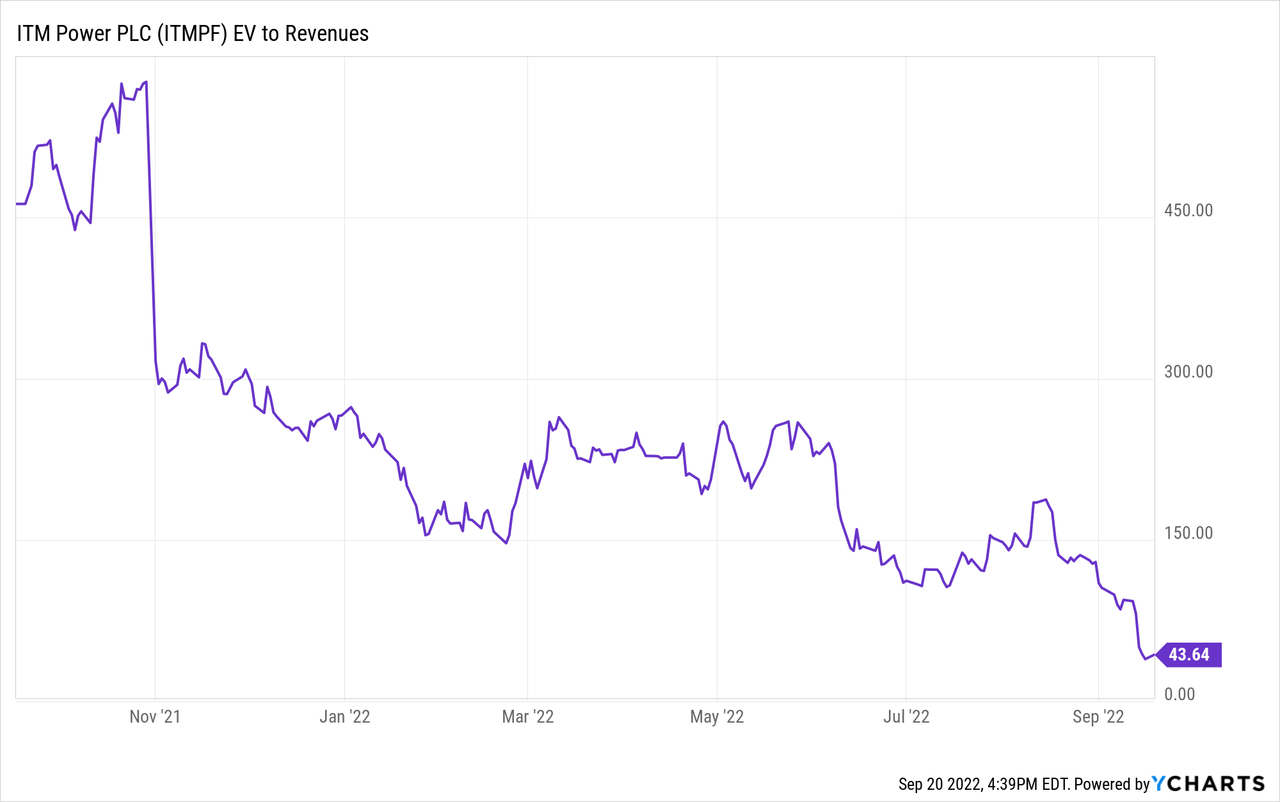

ITM Power (OTCPK:ITMPF) recently reported another negative surprise with its FY22 results – while total revenue of GBP5.7m was in line with the prior trading update, its adj. EBITDA further widened to -GBP39.8m for the full year. While the long-term hydrogen electrolyzer theme is an attractive one, particularly given the current energy crisis globally, the consistent quarterly misses and downward revisions are concerning. With another lower-than-expected revenue guidance for FY23 accompanied by the departure of CEO Graham Cooley (no replacement announced yet), consensus forecasts could be under even more pressure in the coming quarters. The long-term outlook is far from convincing either – the product has lagged on efficiency and supply/demand dynamics look unfavorably skewed amid a pending influx of capacity. Valuation-wise, the lofty ~44x EV/Sales valuation also implies too optimistic a view being priced into ITM, keeping the risk/reward unfavorable at these levels.

A Disappointing FY22 Report

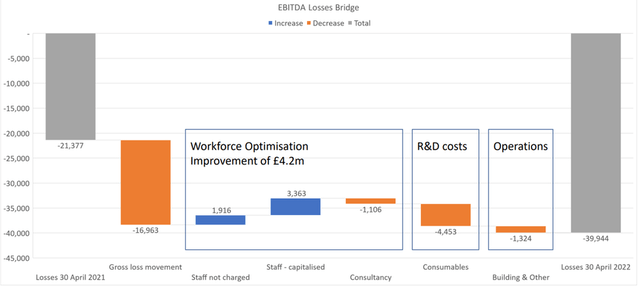

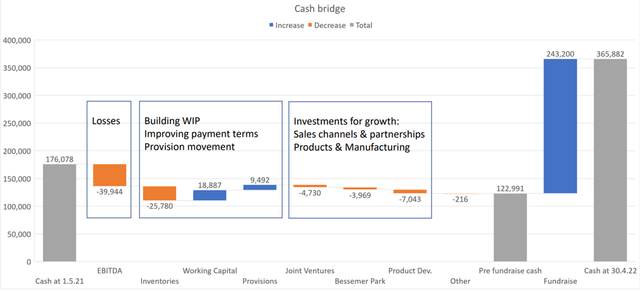

Given ITM’s FY22 results were pre-reported prior to the official release, the downward revision to its adj. EBITDA came as a negative surprise. To recap, adj EBITDA has widened to GBP39.8m from the initial GBP36.5m loss (vs. GBP21.2mn last year), despite the revenue numbers remaining broadly in-line at GBP5.6m (vs. GBP4.3mn last year). The 755 MW contracted backlog was also in line with its last trading update. The revenue for the full year still embeds the 24MW Leuna delivery deferral, though, so ~GBP11m of revenue recognition moves into FY23. Like the EBITDA numbers, ITM’s cash flow is a concern as well – the overall cash burn for the year reached GBP53.3m, driving the overall net cash balance to GBP365.9m (post capital raise). The biggest negative surprise was perhaps the announced departure of CEO Graham Cooley, who cited ITM’s journey to becoming a “global manufacturing powerhouse” and the need for “more experience in this area” as motivating factors. Worryingly, no replacement has been announced, heightening the uncertainty around ITM’s mid to long-term strategy path.

More Downward Revisions to the Guidance

ITM also updated its FY23 guidance, with product revenue set to come in at GBP23-28m and electrolysis shipments pegged at 48-65MW based on a 60-80% conversion of ~77MW of contracted work. The latter is particularly concerning for a high-growth name, given the lackluster low single digits % growth from the ~75MW in April 2022. Similarly, the 755MW backlog of contracts has been worryingly flat over the same period, although management did guide to an increase in the current contracted backlog as more projects reach the ‘final investment decision’ stage in the coming months.

Below the revenue line, adj. EBITDA loss is guided to widen to GBP45-50m, with capex at GBP30-40m, and working capital at GBP40-60m. Given ITM’s step up in capex intensity coincides with soaring cost inflation, the recent revision in the EBITDA loss estimate could be the first of many to come. In the meantime, the company’s ~GBP250m capital raise last year (for its manufacturing capacity expansion) buys it some time. Yet, the updated cash burn guidance of GBP110-135m implies a narrowing runway and thus, further equity raises may be required sooner rather than later.

Intensifying Competitive Pressures Weigh on the Mid-Term Outlook

The momentum behind hydrogen has gained traction over the last year amid stronger policy support following the Russia-Ukraine fallout. Measures such as REPowerEU (i.e., a plan to reduce Russian fossil fuel dependence and accelerate the ‘green’ energy transition) and the US’ Inflation Reduction Act, for instance, feature significant hydrogen subsidies. While incumbents like ITM should benefit from the support on the demand side, the supply side implications are far less rosy given the pending wave of electrolyzer manufacturing capacity expansions entering the industry. The most concerning part is that much of the incremental capacity is set to come from large-scale industrial and engineering conglomerates such as thyssenkrupp (OTCPK:TYEKF) via its Nucera hydrogen unit, Cummins (CMI), and Plug Power (PLUG). The latter has already disclosed a firm order book of >1.5GW this year – a worrying sign for incumbents. Plus, a significant portion of the manufacturing capacity in China is undisclosed, presenting upside to the IEA’s electrolyzer manufacturing capacity estimates.

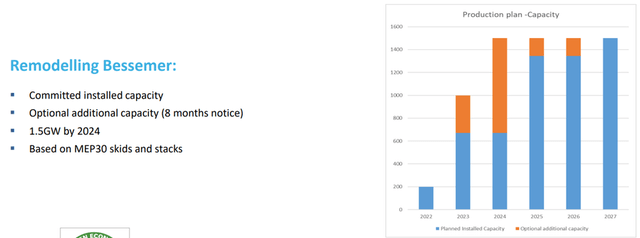

In sum, pure-play electrolyzer manufacturers could face an increasingly competitive environment in the coming years. ITM has already responded to the pressure with its decision to cut back on its expansion – Bessemer is now set to go to 700MW in the next six months (down from 1GW previously), with 1.5GW now pushed back to the next two years (i.e., FY24 or so). Things could get much worse as industry-wide supply ramps up, so the company’s strategy to only expand based on utilization rates makes strategic sense, in my view. That said, slower growth will have material implications for future market share assumptions and pending a material mid-term guidance reset, I would be cautious about buying into the ITM growth story.

More Downside than Upside

ITM may offer investors exposure to an exciting growth theme in clean hydrogen, but there are likely better ways to play the adoption curve at this juncture. For one, the industry looks set to see a significant influx of capacity in the coming years, heightening ITM’s risk profile as the competitive landscape evolves. Thus far, its high-growth strategy has faced setbacks, from supply chain-driven execution delays (e.g., the Leuna project delay) to order weakness (leading to cutbacks of the expansion plans), as well as the recent CEO departure (with no replacement). Coupled with the constant earnings misses and downward revisions to guidance numbers, it’s hard not to see more negative adjustments for the company in the coming quarters. Finally, the stock has underperformed YTD but still embeds optimism at its current ~44x EV/Sales multiple. All things considered, I would remain on the sidelines at these levels.

Be the first to comment