LewisTsePuiLung

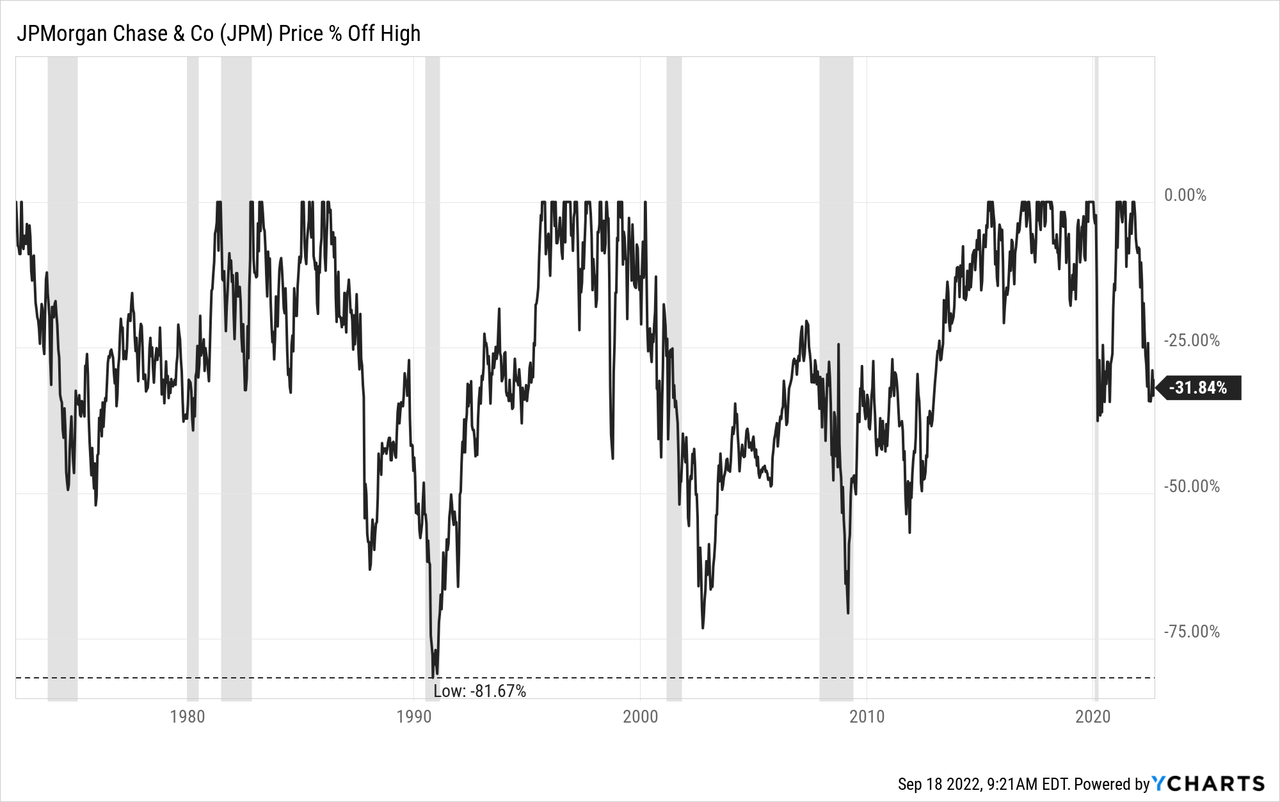

When writing about companies in the last few months, increasing stock prices was rather an exception as the S&P 500 (SPY) declined about 19% from its previous all-time highs and many stocks declined as well (year-to-date, only 124 stocks could report a gain). So, it should be no surprise that JPMorgan Chase (NYSE:JPM) declined as well in the last few months. But while the S&P 500 declined only about 19%, JPMorgan Chase declined 32% from previous highs – and losing about one-third of its previous value is often making stocks very interesting and might seem like a buying opportunity.

In my last article – published one year ago – I probably sounded more bullish and – what is even more important – I sounded more bullish at a time when the stock was trading for a much higher price. Of course, I pointed out some risks and rate the stock only as a “Hold” but now I would be much more careful as there are way more dark clouds on the horizon than one year ago.

Risks

And let’s start with the risks right away. While higher interest rates are positive for banks – as it is easier to make money – the economy seems to be in trouble. The combination of rising interest rates, extremely high inflation, still high asset prices (stock market and housing market would be two examples) and high debt levels are creating the perfect storm and a huge risk. And while higher interest rates are positive for banks long-term, the Fed raising rates will rather create troubles short-to-mid-term.

It seems obvious that JPMorgan Chase is trying to improve its balance sheet and is preserving capital and is overall moving very cautiously. During the last earnings call, management announced the suspension of share buybacks for the near term:

At Investor Day, we said that we expected SCB to be higher and made it clear that in the near term, share buybacks would be significantly reduced in order to build capital for the increased requirements. In light of the SCB coming in even higher than expected, we have paused buybacks for the near term.

And we should also not forget the “hurricane comment” Jamie Dimon made about four months ago during at Bernstein 38thAnnual Strategic Decisions Conference:

It’s, we — right now it’s kind of sunny, things are doing fine, everyone thinks the Fed can handle this. That hurricane is right out there down the road coming our way. We just don’t know if it’s a minor one or Superstorm Sandy or — yes, Sandy or Andrew, or something like that. And it’s — see, you better brace yourself. So, JPMorgan is bracing ourselves, and we’re going to be very conservative in our balance sheet. And with all this capital uncertainty, we’re going to have to take actions. And I kind of want to shed non-operating deposits again, which we can do in size to protect ourselves so we could serve clients in bad times. And so, that’s the environment we’re dealing with. And I’m — I think it’s okay to hope that it will all end up okay; I hope it, that’s my goldilocks, I hope, who the hell knows.

All in all, I assume Jamie Dimon and its management team are expecting difficult times ahead and we can assume that JPMorgan Chase will operate very carefully in the coming quarters – especially as management knows its business is not recession-proof (is true of almost every bank).

Biggest Risk: Recession

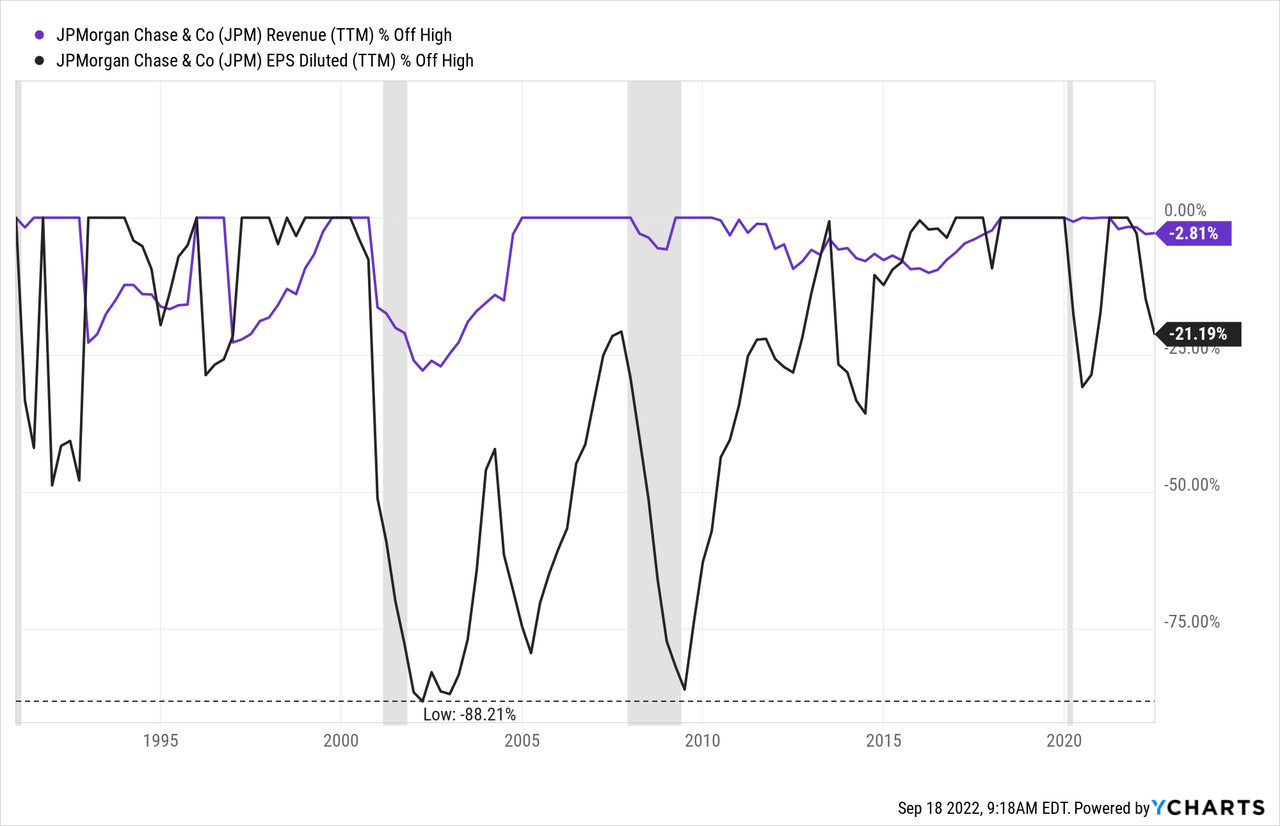

The biggest risk ahead for JPMorgan Chase – as for most other banks – is the looming recession. When looking at past recessions, we can clearly see that JPMorgan Chase is reacting to recessions. While the company was often able to keep revenue quite stable, earnings per share clearly reacted to recessions.

Although JPMorgan Chase was profitable in every single year since 1989 when looking at annual results (which is an impressive statement for banks), we also see steep declines during recessions. Especially during the Dotcom recession and again during the Great Financial Crisis, EPS declined steeply. And we must take into account the possibility of earnings per share declining steeply once again.

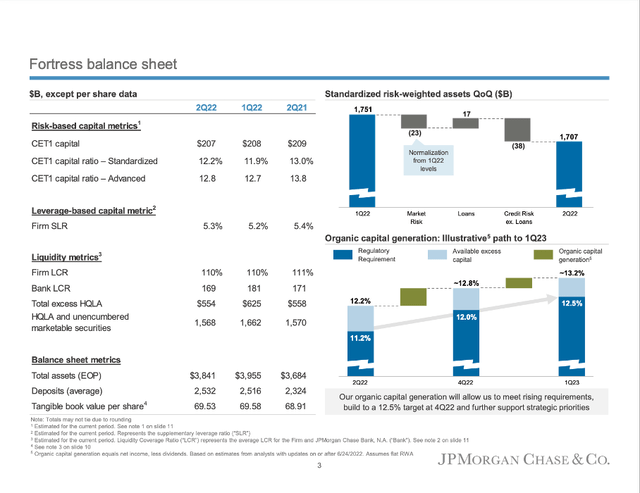

Fortress Balance Sheet

And when taking into account the potential negative impact of a recession, a solid balance sheet is even more important. Right now, JPMorgan Chase has $1.6 trillion in liquidity resourced, including high-quality liquid assets (assets with the potential to be converted easily and quickly into cash) and unencumbered marketable securities. Overall, JPMorgan Chase has a CET 1 Capital Ratio of 12.2% right now.

JPMorgan Chase Q2/22 Presentation

Still Solid Quarterly Performance

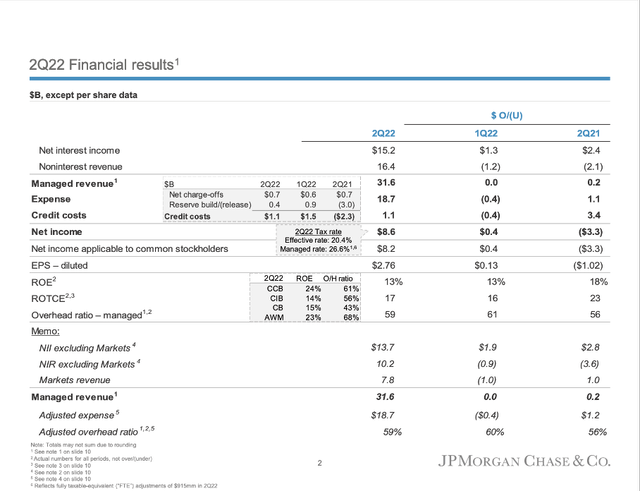

Despite talking about all these dark clouds on the horizon, we should not overlook the solid performance of JPMorgan Chase so far. In the second quarter of fiscal 2022, overall revenue increased slightly from $30,479 million in Q2/21 to $30,715 million in Q2/22 – resulting in 0.8% YoY increase. And while noninterest revenue declined 12.1% year-over-year to $15,587 million, net interest income increased 18.7% year-over-year to $15,128 million.

While revenue could increase slightly, diluted earnings per share declined 27.0% year-over-year from $3.78 in the same quarter last year to $2.76 this quarter. The main reason was the high provision for credit losses. While JPMorgan actually reduced its provision for credit losses by $2,285 million in Q2/21 – similar to many other banks – provision for credit losses was $1,101 million in this quarter – including $657 million of net charge-offs as well as $428 million in reserve building.

JPMorgan Chase Q2/22 Presentation

And as management pointed out during the earnings call, the business remains healthy:

Credit is still quite healthy, and net charge-offs remain historically low. And there continue to be positive trends in loan growth across our businesses, with average loans up 7% year-on-year and 2% quarter-on-quarter.

And not only JPMorgan Chase sees its own business as healthy, it also sees the economy still in very good shape:

Spend is still healthy with combined debit and credit spend up 15% year-on-year. We see the impact of inflation and higher nondiscretionary spend across income segments. Notably, the average consumer is spending 35% more year-on-year on gas and approximately 6% more on recurring bills and other nondiscretionary categories. At the same time, we have yet to observe a pullback in discretionary spending, including in the lower income segments, with travel and dining growing a robust 34% year-on-year overall.

Low Valuation Multiples

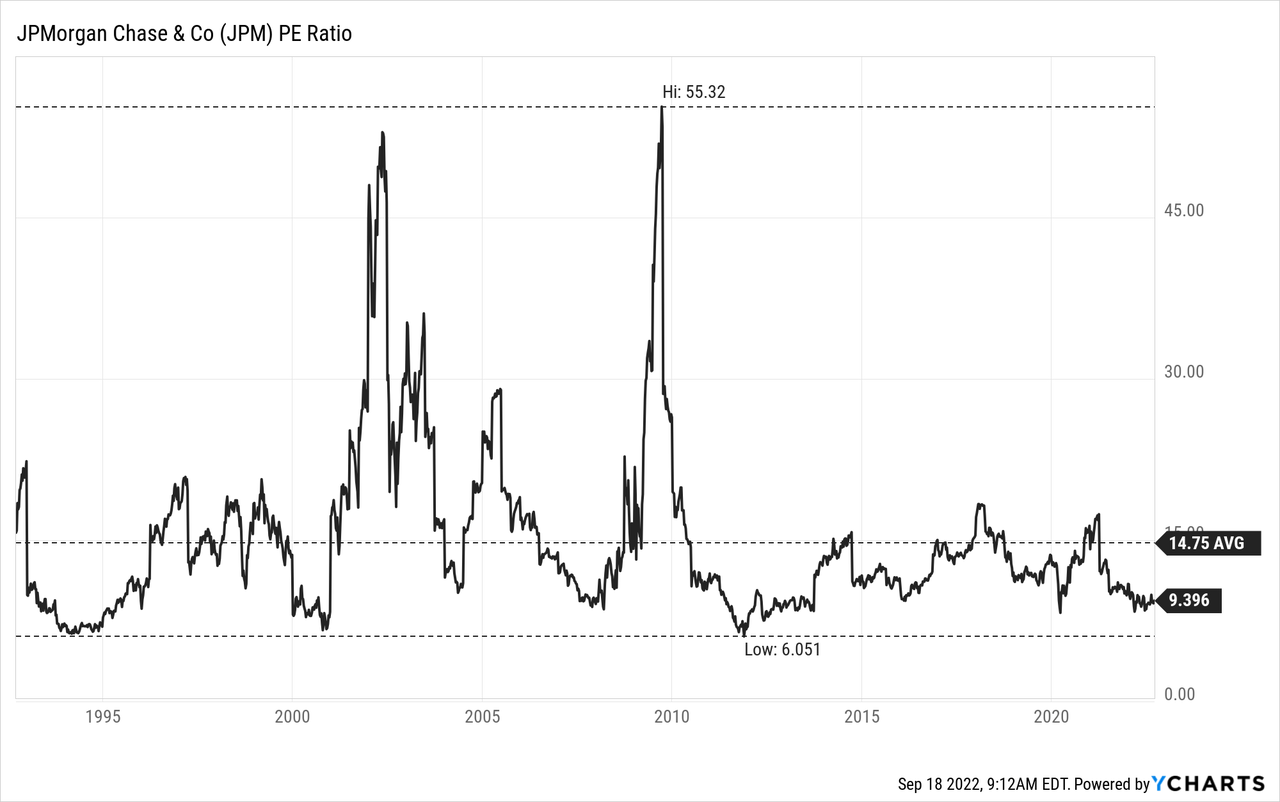

And we should also point out that JPMorgan Chase is trading for low valuation multiples. Right now, JPMorgan Chase is trading for 9.4 times earnings per share, and this is not only below the average P/E ratio of the last 30 years (which was 14.75), it is also coming close to the lowest P/E ratio JPMorgan was trading for during the last three decades (the stock was never cheaper than 6 times earnings but was available several times for that low valuation multiple).

And when one is arguing that we are headed towards a recession, it is dangerous to look at the results of the previous quarters as we must expect lower earnings per share in the coming quarters. But when using the estimates for fiscal 2022 (with expected earnings per share being $11.15), the stock would still be trading for only 10.5 times earnings per share.

Without much doubt, JPMorgan Chase seems cheap right now. But we should not forget that JPMorgan Chase was trading for only 6 times earnings several times – and when using expected earnings per share for fiscal 2022 and a valuation multiple of 6, we get a price target of only $67.

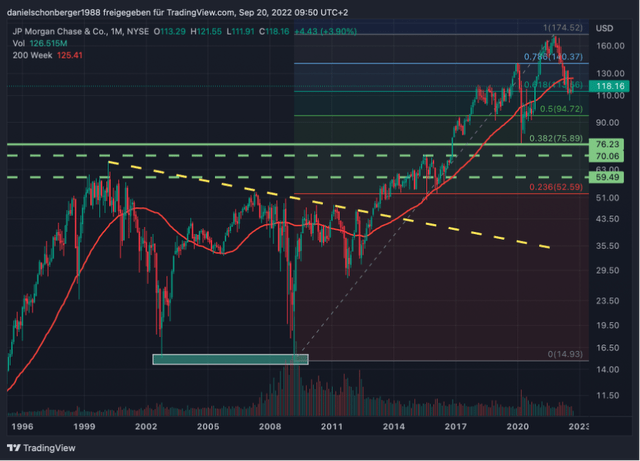

Technical Picture

And although a price target of $67 might seem too low for many investors and analysts right now – as we often can’t imagine what can happen during a bear market if we haven’t experienced a bear market for quite some time – my price target at which I would start buying JPMorgan Chase is in a similar range.

We could state that JPMorgan Chase is getting interesting below $75 – at that price level, we find the lows of the COVID-19 recession. And when going even a little lower, we have strong support levels between $60 and $70 and therefore a great buying range. Not only can we find the highs of the Dotcom bubble, but also the highs from the years 2014 and 2015 before JPMorgan Chase finally broke out of its long-lasting consolidation and moved higher.

And when one might argue that $75 or lower seems unrealistic, let me remind you this would only reflect a 55% decline from the previous all-time high, and when looking at the performance of JPMorgan Chase during recessions in the last few quarters, this is a “normal recession scenario” and the stock declined much steeper on several occasions (about 70% in the years following the Dotcom bubble and more than 80% during the early 1990s recession). And let me ask you what is making you so optimistic JPMorgan Chase will perform much better this time?

Don’t Buy Into A Recession

At this point, I would like to repeat my warning not to buy banks right before a recession. I already mentioned this in my last article about U.S. Bancorp (USB) as well as Wells Fargo (WFC). As we demonstrated above – exemplified by JPMorgan Chase – banks are usually hit hard by recessions. Almost every bank is suffering during a recession, and when thinking about the basics of a recession, it is not really surprising: disposable income for people is lower during recessions, which leads to lower deposits for banks; companies are investing less, and people are buying less, which leads to a lower credit volume; and bankruptcies and unemployment led to higher delinquencies and higher charge-offs for banks. At this point, it is easy to see why banks are often reporting much lower earnings per share during recessions.

And while we should be cautious about banking stocks in particular, we should also be cautious about investing in stocks in general. We – as fundamental investors determining an intrinsic value based on estimates about earnings per share and free cash flow – assume that a stock can be bought when it is reaching the calculated intrinsic value (plus some additional margin of safety). But this perspective is ignoring psychology, sentiment, and the irrationality of market participants.

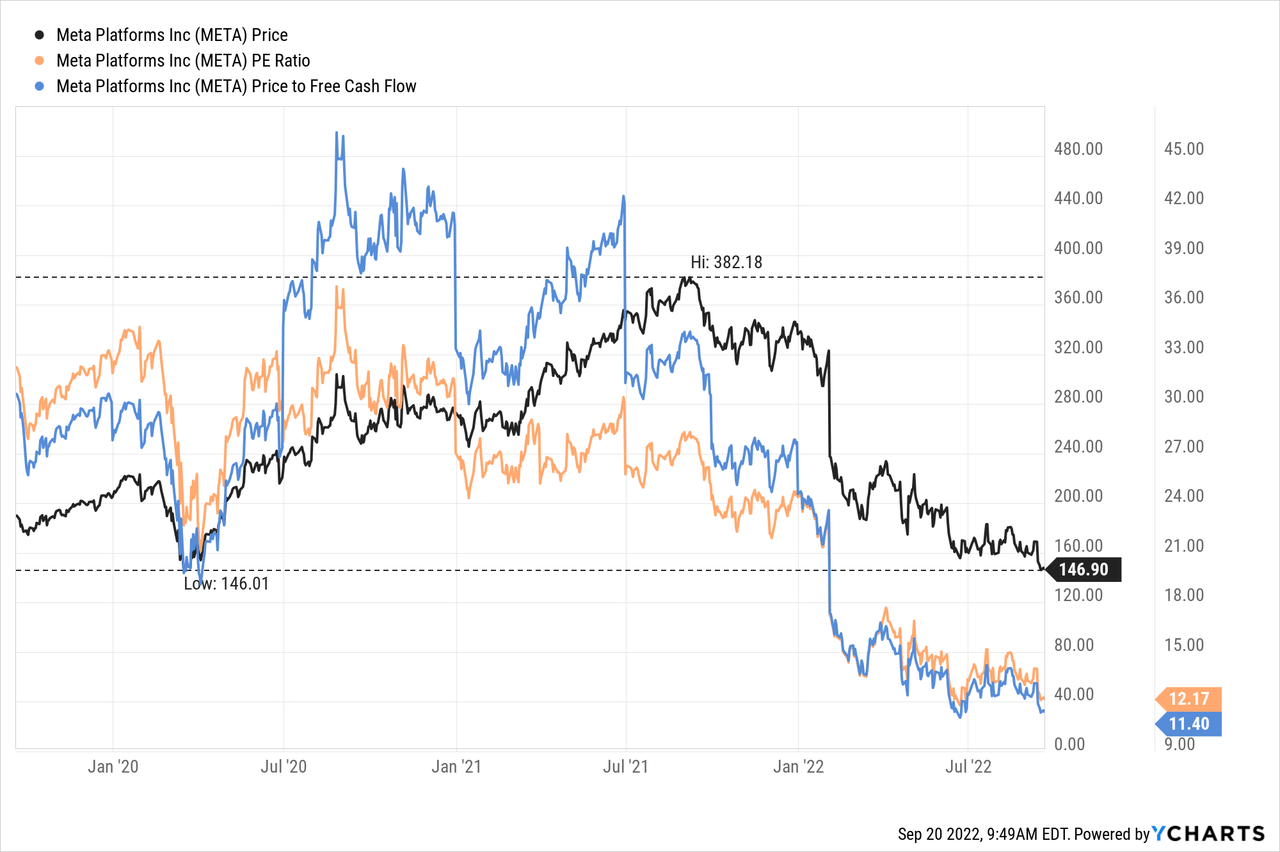

One good non-banking example might be Meta Platforms (META). The stock is clearly trading below its intrinsic value and there is hardly any reason for the stock to continue declining (I know there are different opinions). Nevertheless, Meta Platforms is falling and falling, and the stock lost more than 60% of its previous value. Usually, a 10% to 20% decline is often considered a great buying opportunity. And while these declines happen frequently (maybe every year or every two years) we are used to them. Steep declines of 50% or more maybe happen once every decade and it seems tricky for investors to imagine this could happen again – although we know it will happen several times during the average investor’s life.

The main message is to be cautious during recessions and bear markets as even undervalued stocks can continue to decline. Like we are seeing irrational exuberance during bull markets and exaggeration to the upside, we see the same in bear markets – just in reversed direction.

Conclusion

In my last article, I argued that JPMorgan Chase is the best U.S. bank and JPMorgan Chase with its solid balance sheet and Jamie Dimon as CEO might be well suited for what is about to come: difficult times. And although we can purchase the stock for a much cheaper price than last year, I would still wait.

To me, it seems like the stock market is pricing in a similar scenario as in 2020: A recession, which is followed by a quick recovery and a strong bull market rally. The next bull market will come, but the bull market will not begin with the S&P 500 trading close to 4,000 points. Before the next bull market begins, we must see a total capitulation in the market. It seems like everybody is expecting a very mild recession and that is the scenario which seems to be priced in. But a steep and long-lasting recession is not reflected by stock prices (is true for JPMorgan Chase as well as most other stocks). And before I start buying banks, asset managers, or insurance companies, I would like to see the market capitulate and blood in the streets (and aside from the already ongoing war in Ukraine, I sincerely hope it will only be a figure of speech).

Be the first to comment