Sundry Photography

Investment Thesis: While Electronic Arts has continued to see strong growth in net bookings, the stock looks to be too expensive at this time.

In a previous article back in May, I made the argument that while Electronic Arts (NASDAQ:EA) had recently seen a rebound in revenue – the eventual retiring of the partnership with FIFA after the upcoming World Cup could be of concern to investors.

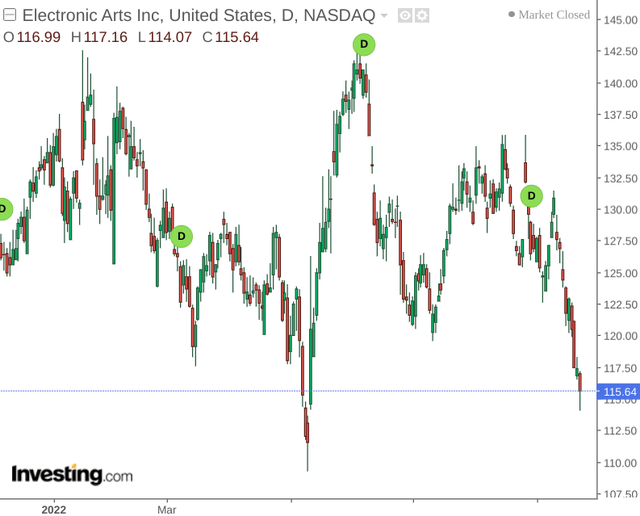

The stock has seen some volatile swings this year, recently declining down to just above the $115 mark.

The purpose of this article is to analyse whether Electronic Arts has the potential to see renewed upside, taking recent performance into account.

Performance

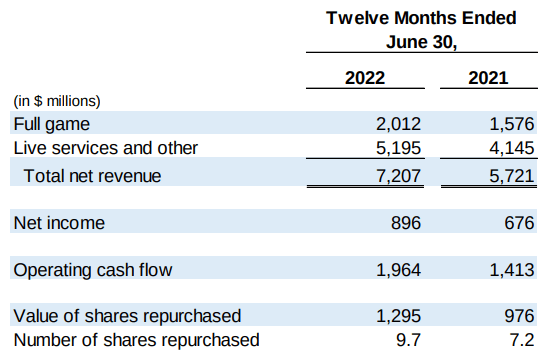

For the twelve months ended June 2022 – we can see that revenue across both full game and live services had risen significantly – up by 27% and 25% respectively:

Electronic Arts Reports Q1 FY23 Financial Results

From a balance sheet standpoint, the company’s quick ratio (calculated as cash plus net receivables all over total current liabilities) has fallen slightly from 0.96 to 0.94 in June 2022. However, with the ratio still near 1 and total current liabilities having also decreased in line with cash and cash equivalents – I take the view that the company is still in a good position to cover its short-term liabilities.

| March 2022 | June 2022 | |

| Cash and cash equivalents | 2732 | 2082 |

| Receivables, net | 650 | 579 |

| Total current liabilities | 3513 | 2833 |

| Quick ratio | 0.96 | 0.94 |

Source: Figures sourced from Electronic Arts Q1 FY23 Financial Results (in $ millions). Quick ratio calculated by author.

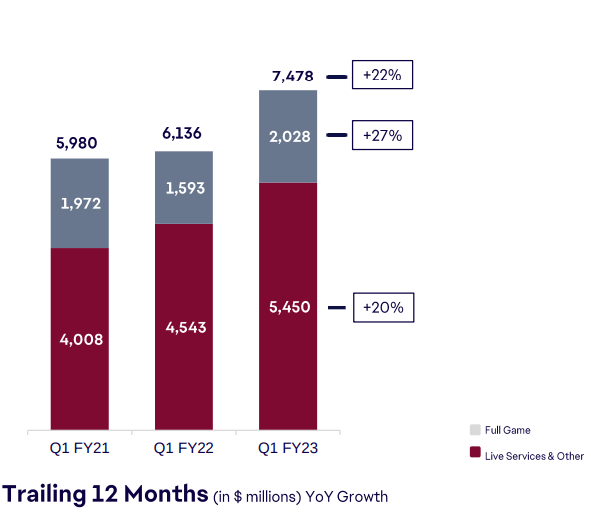

Over the past 12 months, we can see that Live Services & Other have accounted for 73% of total net bookings – and the company cites FIFA Ultimate Team Engagement as having grown 40% year-on-year in weekly and daily average players, along with FIFA Online and FIFA Mobile having delivered record engagements and quarterly DAUs respectively.

Electronic Arts Q1 FY23 Financial Results

From this standpoint, the FIFA title has continued to play a key role in driving overall net bookings upwards.

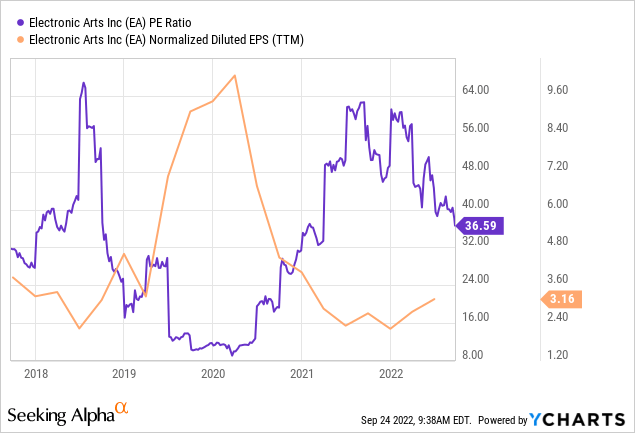

YCharts

From an earnings standpoint, we can see that while the P/E ratio has been trending downwards – it is still substantially higher than levels seen in 2020. Additionally, earnings per share (on a normalised diluted basis) are trading near a five-year low. As such, there is a possibility that the stock might be overly expensive at this time – even with strong net booking growth.

Looking Forward

Going forward, there is a risk that growth in net bookings may not be sufficient to ally investor concerns about the stock potentially being overpriced at this time.

Moreover, given that a significant portion of the growth in net bookings have been driven by sales of the FIFA title – it remains to be seen whether the subsequent rebranding of the would-be FIFA 24 as EA Sports FC will ultimately hold the same appeal to EA’s customer base.

With FIFA 23 launching on September 30, the release of the gaming title could provide a significant revenue boost for Q2. However, the company will be more dependent on the release of other gaming titles such as Need For Speed and PGA Tour in Q3 and Q4 to sustain net booking growth. While Q3 could still see strong demand for FIFA 23 in anticipation of the World Cup towards the end of the year – the subsequent relaunch as EA Sports FC does put the company in uncharted waters somewhat in terms of the degree to which the game will appeal to its existing base.

From this standpoint, Summer 2023 will be a key telling point as to whether the title will continue to be a key revenue earner for the company or whether EA’s alternative gaming titles will need to compensate for a potential drop in interest.

Conclusion

To conclude, Electronic Arts has seen strong growth in net bookings in the most recent quarter.

However, I take the view that while net bookings could continue to see growth on the back of FIFA 23 sales – the stock appears to be too expensive at this point in time. Specifically, the real test for Electronic Arts going forward will be the degree to which EA Sports FC can continue to bolster net bookings and ultimately drive earnings growth.

Until this point, the stock could remain in limbo somewhat – particularly with concerns of inflation potentially dampening gaming demand in the short to medium-term.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment