Video game sales broke a 7-month long YoY decline in monthly sales, with March the best of previous March sales in the past 12 years. Electronic Arts (EA) and its diverse portfolio of games have benefitted during the outbreak, with millions stuck at home turning to online entertainment methods to fill free time. Shares are up ~8% YTD, outpacing the market, but future growth potential might not continue this outpacing.

Video Game Sales

March video game sales popped in March to $1.6 billion, led by Switch hardware and Animal Crossing: New Horizons sales. PS4 spending hit a high, while both sales for Xbox One and PS4 consoles rose over 25%. Other top games included Activision’s (NASDAQ:ATVI) Call of Duty: Modern Warfare, Take-Two’s (NASDAQ:TTWO) NBA 2K20, Borderlands 3, and GTA V. None of EA’s games made the top 10 sellers for the month.

EA’s Promotions

As e-sports are beginning to replace traditional sports leagues for the time being, EA has promoted online e-sports tournaments to drive players to continue playing and purchasing content in-game. EA announced a fifth and sixth online tournament for its Apex Legends Global Series, and recently wrapped up its promotion of the Stay and Play Cup on FIFA 20, featuring some of the world’s top footballers. Last month, EA also announced the return of Burnout Paradise Remastered on the Switch, which could benefit off of the large boost in Switch sales from March.

Quarterly Growth

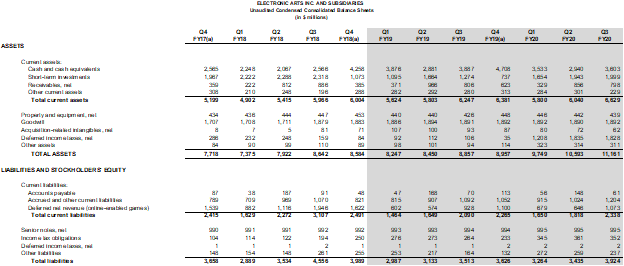

Source: EA Financial Model

Q3 2020 marked EA’s best quarter for net revenues in the past 12 quarters, with revenues just under $1.6 billion. Game downloads and live services jumped $106 million and $104 million from Q2. Packaged goods also rose back to 29% of revenues, after falling to 14% and 13% in Q4 ’19 and Q1 ’20.

With news of video game sales high, EA could see boosted revenues for Q4 2020, although most of that will most likely come from live-services instead of game downloads, since EA did not have any new console/PC releases this quarter. Overall, video game traffic increasing on top of sales might also not last too long, as the uncertainty of the stay-at-home order duration increasing or remaining the same still remains.

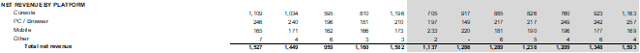

Source: EA Financial Model

Revenues on console contributed to the growth from Q2. Console revenues were still slightly below the $1,196 million posted in Q4 ’18, but showed healthy growth from Q1’s low of $760 million. PC revenues have grown $40 million since Q4 ’19, representing a small net gain compared to overall revenues, but substantial % increase to the current quarter.

Live Services Revenue

Source: Investor Slides

As live services constitute over half of total digital sales, taking a look at the breakdown of the games that provide those revenues is important to see where future potential awaits. Console/PC live services include those derived from Origin and EA Access, across games like Apex Legends, FIFA/Madden/UFC/NHL Ultimate Teams, Battlefield, Sims and Star Wars, where DLC and purchases of in-game currencies are widely available. Mobile is driven by the same categories of sports games, the Bejeweled franchise, Sims, Plants v Zombies 2, Need for Speed and more.

Apex has direct competition with Fortnite and the new Warzone on Call of Duty, where the sports games don’t have the same levels of competition (PES20 for FIFA); mobile games are also highly competitive, with dozens of race games and jewel-matching games available.

One key item for live service revenues is new game releases – FIFA/Madden/NHL 20 all were released in Q2, as players might purchase content and currencies in-game to boost their ultimate teams in the first few weeks. Q3 saw the release of Need for Speed, Plants v Zombies, and a new Star Wars. For Q4, no new releases are planned, so existing live service revenues as well as game downloads are counting on the existing game franchises available to drive spending.

Strong Balance Sheet

Source: EA Financial Model

Cash for Q3 increased to $3.6 billion and short-term investments to $2 billion, giving EA solid short-term liquidity. Current liabilities remain small, with the majority in accrued and other liabilities, and deferred revenues. Senior note obligations remain at $995 million-$600 million due March 2021 and $400 million due March 2026. Total liabilities still remain just below one-third of total assets.

Potential Impacts

The boost in March sales for video games showed promise for EA as well as Activision and Take-Two; however, EA has not had any new game releases this quarter and therefore did not have any games in the top 10 bestsellers for the month. As the economic reopening pends, with a few states willing to reopen amid backlash, April could prove another strong month of sales, while May might fall back to norm again.

Another key driver of revenue is FIFA 20 Ultimate Team and EA has pushed promotions weekly around the game, with the Stay and Play Cup featuring some of the world’s best pro footballers competing, and continuing the release of the yearly Team of the Season, although it has been altered to include what has been played already before leagues were suspended. Player reactions to this will be important for revenues, as thousands of players spend money to try to acquire some of the dozens of players released.

One niche opportunity could lie within streamers, particularly with Twitch and YouTube. Games like FIFA and Apex draw in large viewer bases on both platforms, and spending on in-game content such as player packs in FIFA by YouTubers easily numbers in the thousands of dollars for certain streamers. Twitch has also reported large increases in the number of streamers and the number of viewers, which could help to boost in-game purchases, as Twitch streamers can receive donations and then use that to purchase more content and play more to keep viewers engaged.

A negative impact could also sit within unemployment, as the market still has not fully digested the impact of the jobs lost and how long it could fully take for those jobs to be added back. Millions have lost their jobs and might not have the discretionary income to either continue spending on games or live-services, or purchase new upcoming games the longer that they are unemployed.

Conclusion

EA remains locked between stiff competition from Activision and Take-Two, as those, along with others, led the top-selling games for March. EA’s Fortnite-remake Apex Legends has a new competitor with Warzone in Call of Duty, which could have a negative impact on Apex sales and use as gamers flock to Warzone. EA’s multiyear hit FIFA’s Ultimate Team segment, where revenues are driven by player packs, could either see a boost in revenue from the current “Team of the Season So Far” if user engagement and approval of the player releases is high, but if users shy away from the content, revenues could be negatively affected. Boosts in streaming near the end of March in Twitch could also increase engagement within EA’s games and help to boost in-game content and live-service spending. Shares are up ~8% YTD and could have already priced in future growth potential while possibly overlooking the fact that March’s high video game sales might only extend through the rest of this quarter.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment