Just_Super

This article first appeared on Trend investing on October 11, 2022, but has been updated for this article.

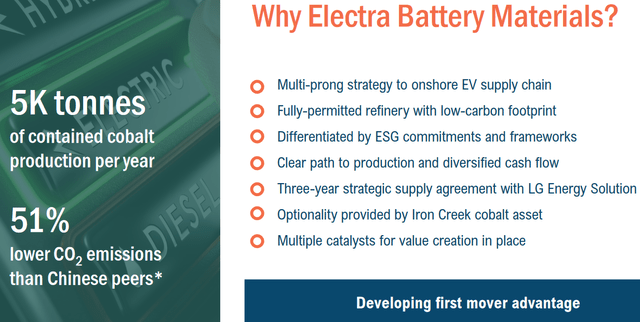

Today’s company is in a leading position as North American OEMs look to reduce reliance on battery materials processed in China. The Inflation Reduction Act (“IRA”) may be a huge potential positive for this company, as it supports and rewards auto OEMs for using materials ‘refined’ in North America, or mined from USA free trade agreement countries.

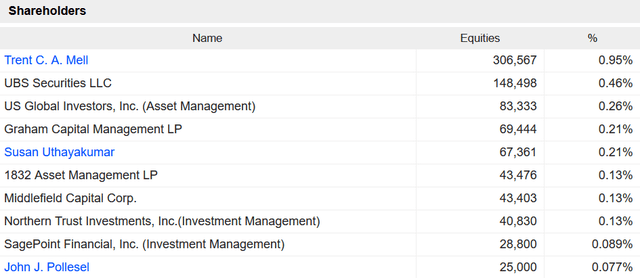

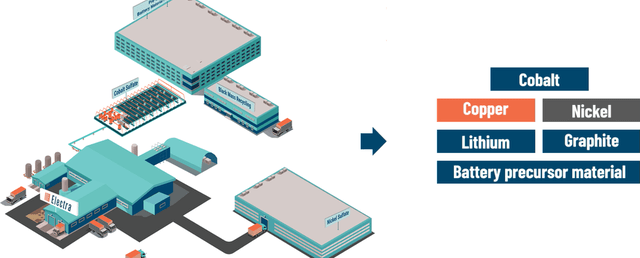

The Company is set to open their cobalt refinery beginning in Spring 2023, a lithium-ion battery recycling refinery in 2023-24 and a nickel & manganese refinery in 2024-25; all at their Battery Materials Park in Ontario, Canada.

Electra Battery Materials [TSXV:ELBM] (NASDAQ:ELBM) Price = CAD 3.45, USD 2.59

Electra Battery Materials price chart (source)

Yahoo Finance

Electra Battery Materials [TSXV:ELBM] (“Electra”) is a Canadian junior (previously known as First Cobalt) with a focus on its Canadian battery materials park/refinery to produce cobalt (later nickel & manganese) and to recycle Li-ion batteries black mass for valuable battery metals. They also have a quite advanced stage cobalt-copper project in Idaho, USA.

Electra will have North America’s first cobalt sulphate refinery in 2023 (source)

Electra’s two key projects are:

- Electra’s Battery Materials Park (also called the Ontario Hydrometallurgical Refinery).

- The Iron Creek Cobalt-Copper Project (Idaho, USA) – Indicated Resource of 2.2mt at 0.32% cobalt equivalent (0.26% cobalt and 0.61% copper) for 12.3m lbs contained cobalt and 29m lbs of contained copper. Inferred Resource of 2.7mt at 0.28% cobalt equivalent (0.22% cobalt and 0.68% copper) for 12.7m lbs of contained cobalt and 40m lbs of contained copper.

This article will focus on the Electra Battery Materials Park (refinery) with planned refining operations set to begin in Spring 2023.

Electra’s Battery Materials Park (includes the Ontario Hydrometallurgical Refinery)

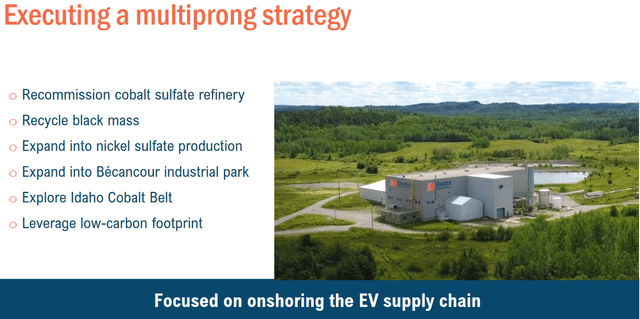

The Ontario, Canada Battery Materials Park currently hosts a permitted cobalt and nickel refinery which has a 10-year operating history. Electra plans to restart the cobalt refinery in Spring 2023.

Electra state on their website: “The only asset of its kind in North America, Electra’s commercial scale refinery, located in Ontario, Canada…”

In 2023 the refinery will initially be fed by ore from Glencore which it will refine to produce 5,000tpa of cobalt (in cobalt sulfate form).

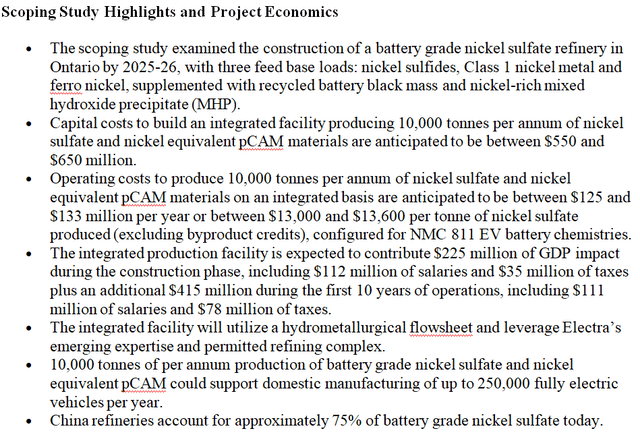

In 2024-25 a refinery will be built to produce battery grade nickel sulfate and manganese. Electra stated on Sept. 22, 2022: “… the construction of a battery grade nickel refinery and a manganese refinery, to establish a fully integrated battery materials park with a third-party cathode precursor (pCAM) manufacturer.” In 2025 the refinery plans to partner to produce cathode active materials (“CAM”).

Concurrently to the above a separate part of the Battery Park will work on recycling lithium-ion battery black mass to produce battery metals, with commercial operations targeted to start in 2023-24. The facility will have recycling capabilities to recover lithium, nickel, cobalt, graphite, and copper.

Electra’s Battery Materials Park timetable to production (source)

Schematic showing the refinery and metals planned to be produced (source)

Electra is executing a multiprong strategy (source)

Refinery business – Off-take agreements, source of raw materials

Cobalt sulphate refining

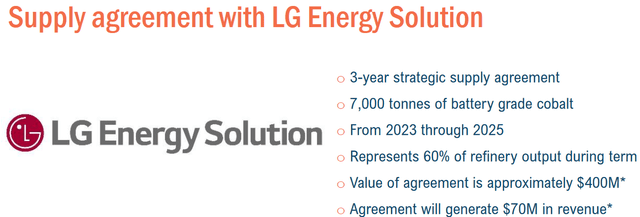

Electra has an off-take agreement with Glencore to receive their cobalt ore and a sales off-take agreement with LG Energy Solutions (“LGES”) to sell the processed cobalt sulphate (equivalent to 7,000t of battery grade cobalt from 2023 to 2025). Financial terms of the LGES off-take agreement were not revealed; however Electra states in their company presentation that the “Agreement will generate $70M in revenue” (assuming current spot price of cobalt sulfate at the time of the agreement, announced Sept. 22, 2022).

The only problem with the above is that Glencore’s cobalt is sourced from the DRC, which would disqualify it from the IRA incentives. To help counter this in August 2022 it was announced: “Fuse Cobalt signs raw material supply agreement with Electra. The cobalt raw material will be supplied to Electra-owned cobalt sulfate refinery… The cobalt raw material is planned to be sourced from either one or both of the Fuse’s Teledyne and Glencore Bucke Cobalt exploration projects located in Cobalt, Ontario.” At this stage it is only a MOU and the transaction is subject to the two companies signing a definitive agreement. Conditions for Fuse Cobalt include “the development of a processing flowsheet to produce a cobalt material ideal for further processing to battery-grade cobalt sulphate at Electra’s refinery and the completion of a bankable feasibility study.” So this will take some time.

Valuation

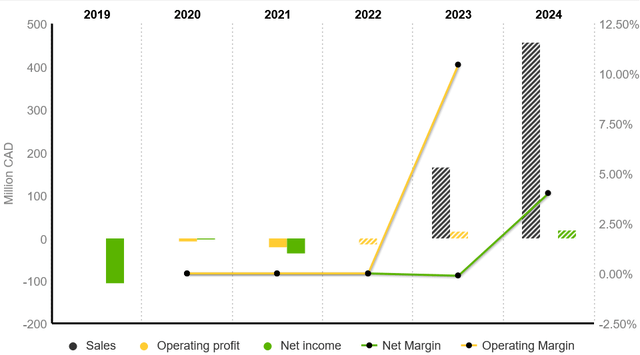

Electra’s current market cap is CAD 111m. Market screener shows 2022 estimated net debt of zero. Cash was C$19.7m as at September 30, 2022.

2022 and 2023 PE’s are negative as the Company is not yet expected to be profitable; however 2024 PE is forecast at 6.9 with a net profit margin of 4%. Some concern over such a small profit margin but the hope is this would improve in future years as operations scale and they source materials more cheaply. Also it is possible they can achieve a premium price being a North American sourced product, or at least some of their products.

Current consensus analyst rating is a ‘buy’ with a price target of C$10.31, representing 199% potential upside. Yahoo Finance also shows a price target of C$10.31. That’s roughly a 3x forecast upside over the next year, so very appealing.

Electra’s financials and forecast financials (source)

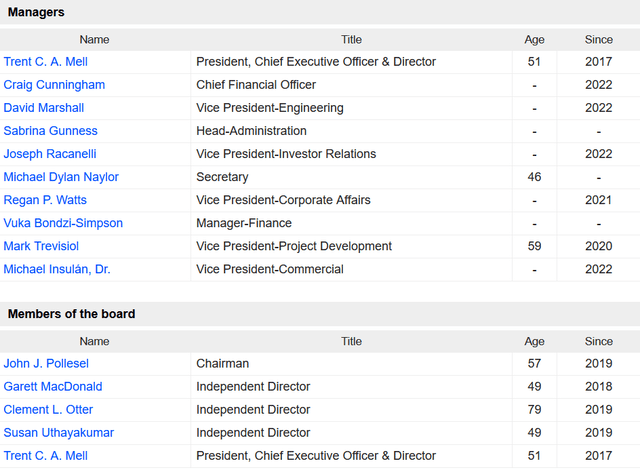

Management and top shareholders

Management has been impressive to date with very significant news flow, plans, and execution. Electra is led by Chairman John Pollesel and CEO Trent Mell.

John Pollesel has an impressive mining operations background including previously COO and Director of Base Metals Operations for Vale’s North Atlantic Operations.

Trent Mell has more than 20 years of international business and operational experience. His mining career includes mine permitting, development and operations with Barrick Gold, Sherritt International, North American Palladium and AuRico Gold.

You can read more details on the board and management here.

Insider share ownership is ~1.24% which is rather low.

Management, board and shareholders (source)

Market Screener Market Screener

Latest news

- Nov. 9, 2022 – Electra Q3 results and update on Cobalt Refinery Project and Black Mass Recycling Demonstration… “completed more than 85% of the recommissioning of existing brownfield equipment at our battery materials refinery complex.”

Some key points from the Nov. 9 update (source)

Note: Spring in Canada is from March to May

- Nov. 8, 2022 – “Electra Announces Marketed Offering of Units for Proceeds of up to approximately US$8 Million to Finance Commissioning of Cobalt Refinery.”

- Oct. 13, 2022 – “Electra Starts Commissioning of Battery Materials Recycling Demonstration Plant at its Ontario Refinery Complex.”

- Oct. 5, 2022 – Electra Confirms Cobalt Mineralization at New Target in Idaho

- Sept. 28, 2022 – Electra Makes Continued Progress on Cobalt Refinery Project and Prepares for Black Mass Recycling Demonstration

- Sept. 22, 2022 – Electra and LG Energy Solution Sign Three-year Cobalt Supply Agreement – Marks Electra’s first commercial agreement in EV supply chain… “Electra has agreed to supply LGES with 7,000 tonnes of battery grade cobalt from 2023 to 2025. Electra will supply 1,000 tonnes of cobalt contained in a cobalt sulfate product in 2023 and a further 3,000 tonnes in each of 2024 and 2025 under an agreed pricing mechanism. In addition to the supply agreement, Electra and LG Energy Solution have agreed to cooperate and explore ways to advance opportunities across North America’s EV supply chain, including, but not limited to, securing of sustainable sources of raw materials. Financial terms of the supply agreement were not disclosed… To meet growing customer demand, the Company announced on June 22, 2022 that it is evaluating a second refinery in the province of Quebec by 2025-26, which could source cobalt from Electra’s Idaho cobalt and copper project.”

- Sept. 8, 2022 – Electra’s Study on Integrated EV Battery Materials Facility in Ontario Demonstrates Compelling Economics – Provides path to growing nickel refining capacity in North America.

Scoping study for a nickel refinery (source)

- June 22, 2022 – Electra Evaluates Development of Second Battery Materials Refinery in North America; Appoints 30 Year Industry Veteran to Lead Study.

- April 6, 2022 – Electra Announces Offtake Agreement for Recycled Battery Material… “Under the agreement, Glencore AG will purchase the nickel and cobalt products until the end of 2024 on market-based terms.”

- March 1, 2022 – Government of Canada to Fund Electra, Glencore and Talon Metals Study.

- Jan. 19, 2022 – Electra signs Battery Recycling and Cobalt Supply Agreement with Marubeni… “Marubeni’s wide network of battery recyclers in Asia and elsewhere will assist in the sourcing of lithium-ion battery material for Electra’s hydrometallurgical recycling operation in Ontario, Canada.”

- Dec. 30, 2021 – Electra Announces Commercial Agreements with Glencore… “Glencore will have an option to toll approximately 1,000 tonnes of contained cobalt at Electra’s refinery and Electra will have an option to purchase an additional undisclosed quantity of cobalt hydroxide feed material from Glencore… Glencore will use its extensive network to market Electra’s premium cobalt sulfate globally.”

- Jan. 2021 – First Cobalt Achieves Key Milestone with Refinery Feedstock Arrangements… “4,500 tonnes per year of contained cobalt to be provided from Glencore’s KCC mine and CMOC’s Tenke Fungurume mine…

Cobalt hydroxide will be purchased at prevailing market prices, providing First Cobalt investors with exposure to the cobalt market and, by extension, a growing EV market. Together the arrangements will provide 90% of the Refinery’s annual contained cobalt capacity of 5,000 tonnes per annum. The Company plans to purchase an additional 500 tonnes per annum of feed at a later date through contract or spot market purchases.”

Upcoming Catalysts

- Spring (March to May), 2023 – Commercial production to begin from Electra’s cobalt refinery.

- 2023-24 – A black mass battery recycling facility to begin.

- 2024-25 – A planned battery grade nickel refinery and a manganese refinery, to establish a fully integrated battery materials park with a third-party cathode precursor (pCAM) manufacturer.

- 2025/26 – A possible second battery materials refinery in Bécancour Quebec, which could source cobalt from Electra’s Idaho cobalt and copper project.

Risks

- A global and/or EV sales slowdown may reduce demand for Electra’s products in the future (notably nickel and cobalt). LFP battery share growing rapidly may cause less demand for cobalt and nickel (for now the U.S market is heavily focused towards NMC that uses cobalt and nickel). Falling cobalt and nickel prices may impact Electra’s refining margins.

- Production/refining risks. Cost blowouts in CapEx or OpEx.

- Competition. Chinese refiners can usually produce more cheaply. The counter is that Electra will establish itself as a North American quality supply source.

- Company risks (management, funding, debt, liquidity and currency risks).

- Sovereign risk – Electra’s refinery is in Ontario, Canada so a low country risk.

- Stock market risks – Dilution, lack of liquidity, market sentiment.

Further reading

- Jan. 2022 – Electra Battery Materials (TSX.V: ELBM): Providing Battery Grade Nickel & Cobalt (video with CEO Trent Mell)

- Electra company presentation – Oct. 2022

Conclusion

Electra ticks many boxes for investors including a safe location (Canada), refining valuable battery metals (cobalt, later nickel & manganese), recycling batteries black mass to produce lithium, nickel, cobalt, graphite, and copper; and the uniqueness of being North America’s first cobalt refinery. They also have a USA cobalt project in Idaho with plans for a second refinery in Quebec by about 2025-26. All of this supports Electra as a key future link in the North American EV metals supply chain, with IRA benefits (noting DRC cobalt ore feed would likely be an issue). Electra also has an MOU for Canada sourced cobalt from Fuse Cobalt, but that may be some years away.

The key near term catalyst is the beginning of cobalt production from their Ontario refinery in Spring (March-May) of 2023 as well as progress at their other projects.

Valuation looks very attractive assuming they can succeed with their plans and become a profitable Canadian battery metals refiner. The IRA may help them obtain a premium for their eligible products and support margins.

Risks revolve around successfully starting the cobalt refinery, the black mass recycling facility, the nickel-manganese refinery, and getting their Idaho Cobalt-Copper Project to production. Please read the risks section.

Expect a bumpy road but Electra is certainly forging ahead quite rapidly with significant determination from their management team.

We rate Electra Battery Materials as a unique spec buy, best suited for a 5 year+ time frame.

As usual all comments are welcome.

Be the first to comment