Moussa81/iStock via Getty Images

Part I – Introduction

The Vancouver-based Eldorado Gold (NYSE:EGO) released its preliminary production results for the first quarter of 2022 on April 13, 2021.

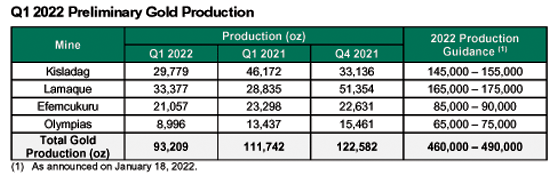

1 – Production Snapshot and 2022 guidance

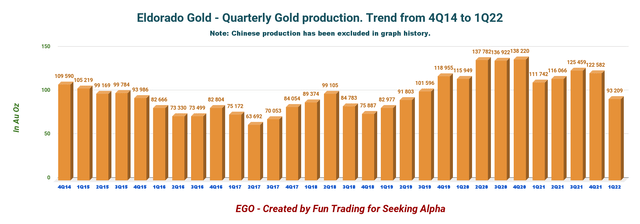

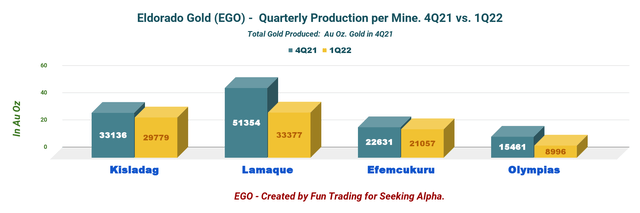

It was a particularly weak gold production this quarter. Gold production came in at 93,209 Oz, down from 111,742 ounces produced in 1Q21 and 122,582 Oz delivered the preceding quarter.

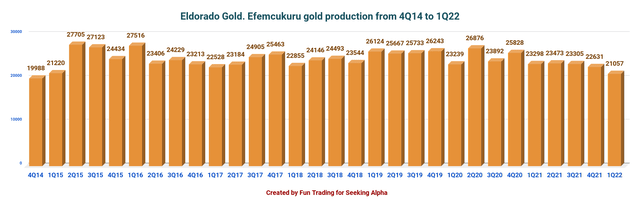

EGO: Chart Quarterly production comparison 4Q21 1Q22 (Fun Trading)

Also, on January 18, 2022, Eldorado Gold released the 2022 guidance.

EGO: 2022 Guidance (Eldorado Gold)

2022 gold production is expected to be between 460K to 490K Au ounces.

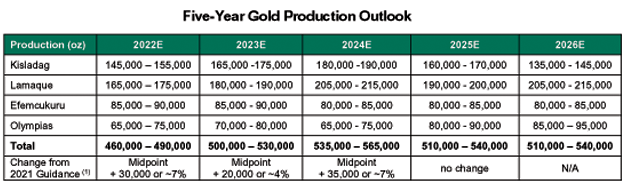

The mid-point of 2022 gold production is 30K Au ounces, or 7% higher than the previous 2022 guidance. Due to increased mining rates at Lamaque, improved recovery rates at Kisladag, and increased throughput and higher grades at Olympias.

Also, the mid-point of annual gold production has increased by approximately 4%, or 21.25K Au ounces per year from 2022 to 2025.

Cash operating cost is expected to be $640 to $690 per ounce, and the average all-in sustaining costs (“AISC”) will be $1,075 to $1,175 per ounce.

EGO: Guidance from 2022 to 2025 (Eldorado Gold)

2 – Investment Thesis

The investment thesis is always a strenuous exercise for this gold miner. As I said in my preceding article, I have been very disappointed with Greece’s painful lack of progress after the company finally received all the necessary green lights from the Greek government in April 2021.

The company has indicated the new feasibility for Skouries, and we are now on track. The question for shareholders is the financing, but with a high gold price, it should not be a problem.

Despite this surprisingly weak production quarter, it is perhaps the time to invest in EGO for the long-term while trading short-term LIFO 40% of your position to profit from the gold sector’s high volatility.

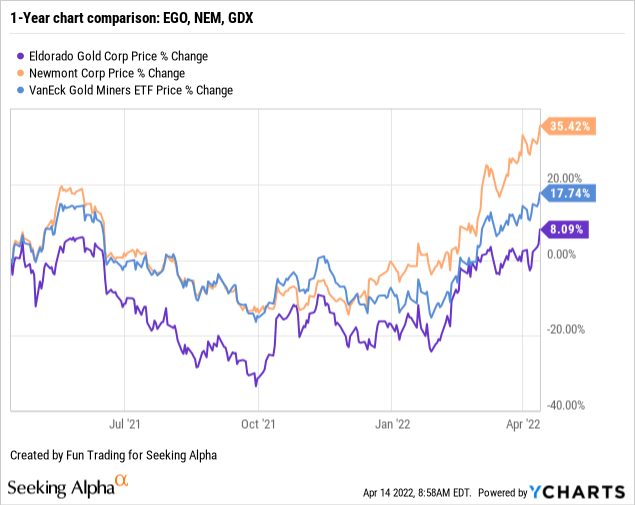

3 – Stock Performance

The stock has underperformed the VanEck Vectors Gold Miners ETF (GDX) and Newmont Corp. (NEM) and is now up 8% on a one-year basis.

Part II – Gold Production Details For 1Q22

On April 13, 2022, the company announced the preliminary gold production for the first quarter of 2022.

EGO: Quarterly gold production history (Fun Trading)

The first quarter of 2021 production came in at 93,209 Au Oz, down significantly year-over-year and sequentially. Production during January and February was impacted considerably by higher-than-anticipated absenteeism related to the surge of the COVID-19 Omicron variant.

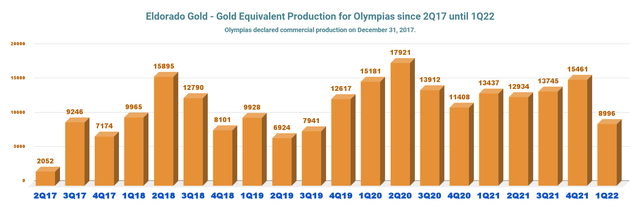

1 – Olympias Mine

The gold production at Olympias was affected by COVID-related absenteeism and power outages related to severe weather patterns in the region. Operations resumed mining to plan and achieve planned tonnage and grades from the mine in March.

Production came at 8,996 ounces compared to 15,461 ounces produced in 4Q21 and 13,437 ounces in 1Q21.

EGO: Chart Quarterly production at Olympias (Fun Trading) The chart showed a steady improvement in 2021.

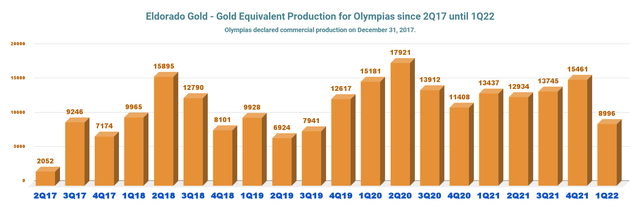

2 – Lamaque Mine

The first quarter’s weak gold production at the Lamaque mine was mainly driven by reduced workforce hours due to COVID-related absenteeism delaying the underground development of high-grade stopes, which led to lower than planned gold grades and tonnage.

However, the mine development progressed, and the planned gold grade and tonnage were achieved in March. Full-year gold production at Lamaque is expected to be in line with guidance.

Also, the Ormaque exploration drift is progressing as scheduled, and resource conversion drilling is expected to commence by mid-year.

Note: The decline connecting the Sigma mill with the Triangle underground mine was completed on schedule and budget in December 2021. The decline will allow direct ore and waste transportation from the Triangle mine to the mill, thereby eliminating the re-handling of ore.

Production came in at 33,377 ounces, down from 28,835 ounces in 1Q21 and down 35% sequentially.

EGO: Chart Quarterly production at Olympias (Fun Trading)

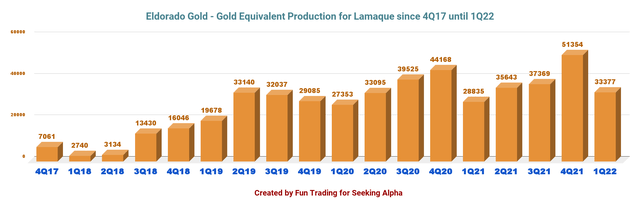

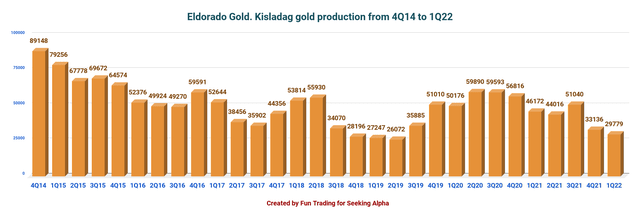

3 – Kisladag Mine

Production was lower than planned due to COVID-related absenteeism, severe weather, and a government-mandated power outage. The harsh weather and freezing temperatures worsened the expected winter impact on the ore conveyance and stacking system productivity on the leach pads. The high-pressure grinding roll is performing to plan, and recovery rates are as expected. The company maintains full-year production guidance.

Production came in at 29,779 ounces, down from 46,172 ounces in 1Q21 and from 33,136 ounces produced in 4Q21.

EGO: Quarterly production history at Lamaque (Fun Trading)

4 – Efemcukuru Mine

Production was in line with expectations. Gold production was 21,057 ounces compared to 22,631 ounces in the same quarter last year.

EGO: Chart Quarterly production at Kisladag history (Fun Trading)

Part III – Recent technical reports for Skouries and Lamaque projects.

On December 15, 2021, Eldorado Gold announced the completion of a Feasibility Study on the wholly-owned Skouries project. Initial CapEx is expected to be $845 million.

- 19% after-tax Internal Rate of Return (“IRR”) and $1.3 billion after-tax Net Present Value (“NPV”) (5%), based on long-term prices of $1,500 per ounce (“oz”) gold and $3.85 per pound copper.

- IRR of 24% and NPV (5%) of $1.8 billion using approximate spot prices of $1,800 per oz gold and $4.25 per pound copper.

- 2.9 million ounce Life of Mine (“LOM”) gold production

- Average annual production of 140,000 oz of gold and 67 million pounds of copper (approximately 312,000 oz gold equivalent) over a 20-year mine life.

- Average annual gold production of 182,000 oz in the first 5 years of production.

- Initial capital costs to complete the Skouries project of $845 million, an increase of 23% over the March 2018 Pre-Feasibility Study1 (“PFS”), primarily related to increased input prices, scope change related to water management and an enhanced execution plan.

On February 24, 2022, Eldorado Gold announced the completion of a new Feasibility Study on the wholly-owned Lamaque mine.

The Study includes an update to the current operation, updated economics on the Upper Triangle zones (zones C1 through C5), and preliminary economic assessments on the inferred resources in the Lower Triangle zones (zones C6 through C10) and the Ormaque deposit.

The company indicated that gold production would increase to over 190K ounces per year based on the Upper Triangle reserves and sustaining over 180K ounces per year with production from Lower Triangle Inferred and Ormaque inferred resources.

Technical Analysis And Commentary

EGO: Chart Quarterly production at Efemcukuru History (Fun Trading)

EGO forms an ascending channel pattern with resistance at $12.25 and support at $11.10.

The gold price momentum is still strong, but the FED could end this rally with a vigorous hiking policy coming in May. Thus, I believe it is crucial to trade LIFO a large part of your EGO position in the short term to take advantage of the volatility that could accelerate significantly.

The trading strategy I suggest is to sell about 25% between $12.25 and $12.15 (trading LIFO). Accumulating on any weakness at or below $11.10 with a possible low at $9.60 makes perfect sense.

However, if the gold price turns even more bullish and retests $2,000 per ounce, EGO could cross its resistance (breakout) and retest $13.50.

Watch gold like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks!

Be the first to comment