metamorworks/iStock via Getty Images

Investment Thesis

Elastic (NYSE:ESTC) is a SaaS search platform that is down 50% from the highs it set last year.

Meanwhile, the business is well-positioned to benefit from two key elements. In the first instance, there continues to be a steady increase in enterprises transiting their operations to the cloud.

Secondly, given the ever-increasing data volumes the need to search this data for insights increases.

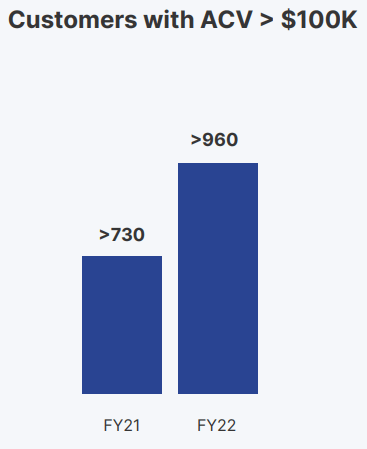

Elastic is well set up to benefit from these key drivers. Indeed, these two driving forces haven’t gone away in the past year. If anything, these two drivers have only intensified, as we can see from Elastic’s $100K paying customers continue to increase y/y by more than 30%.

All in all, I believe that paying 6x forward sales for Elastic is a compelling valuation.

That’s not to say that investors should not be concerned about its lack of profitability. But at the present multiple of 6x forward sales, a lot of negative has already been priced in.

Hence why I’m rating this stock a buy.

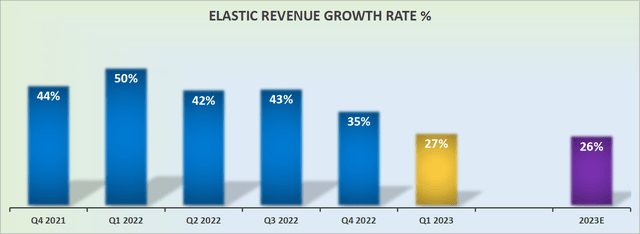

Elastic’s Revenue Growth Rates Remain Enticing

As demonstrated above, Elastic’s revenue growth rates continue to be enticing.

Elastic is notorious for its conservative revenue estimates, meaning that in all likelihood there’s a meaningful potential for Elastic to grow at close to 30% CAGR this year.

Simply put, this is a steady-as-she-goes story.

Elastic’s Near-Term Prospects

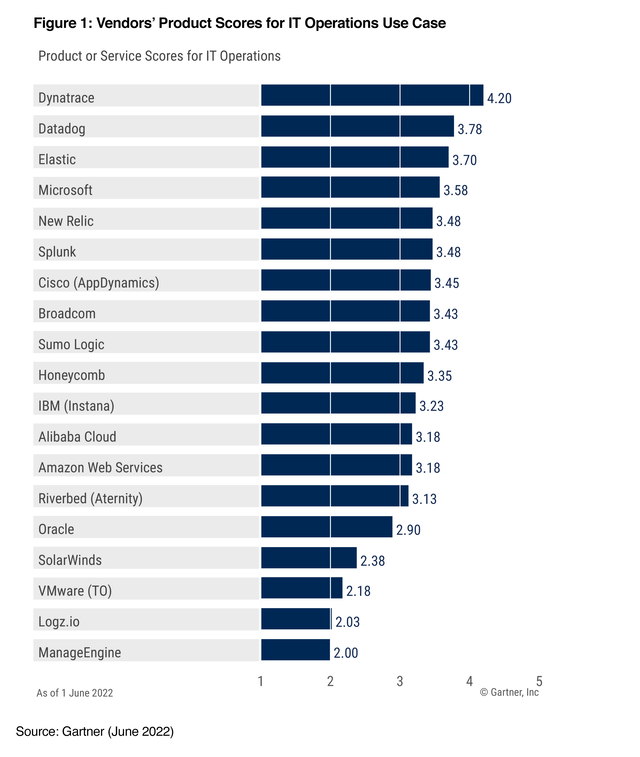

Elastic is a database search engine. While Elastic does have competitors, such as AWS’s (AMZN) Elastic Cloud, Splunk (SPLK), or IBM (IBM), it is also typically recognized by developers as being the leader in this space.

What’s more, as the amount of unstructured data grows the ability to search that data increases.

Unstructured data means data that doesn’t lie neatly in cells but data that comes in different formats, such as textual, numerical, and other formats, being added to and removed in real-time. Data that is fluid and can be searchable with Elastic.

Further, what’s appealing about Elastic is that it doesn’t rely on customers being sold to. Elastic allows its users to embrace the platform via its freemium model.

Moving on, while Elastic is predominantly a search engine, we should also keep in mind its observability functionality.

When it comes to it, Gartner recognizes Elastic as a top 3 vendor for observability capabilities on a unified platform. Through its observability product solution, Elastic’s customers can detect and fix root-cause events quickly with minimal IT support.

Simply put, Elastic marries up its search functionality with observability and security. And in doing so, customers continue flocking to its platform.

Elastic Q4 2021 presentation

As you can see above, compared to the period ending fiscal 2021, the number of customers spending more than $100K on Elastic has increased by 31.5% y/y. In fact, as I often argue, follow the customer because the customer knows best.

If the number of customers embracing a platform is increasing over time and doing so at a rapid clip, that shows you better than most key indications, that the platform is in high demand by those that need it and are willing to pay for it.

Blemish in the Bull Case, Profitability Profile

Throughout 2020 and early 2021, investors were only focused on non-GAAP profitability. However, in 2022, investors are now more seriously focused on companies’ lavish stock-based compensations.

With that in mind, note the following:

- Q4 2021: -21%

- Q1 2022: -16%

- Q2 2022: -18%

- Q3 2022: -20%

- Q4 2022: -25%

What you see above is a business that struggles to report clean GAAP profitability.

Moreover, looking ahead to its fiscal 2023 guidance, it doesn’t look likely that this upcoming year will see a meaningful improvement in GAAP profitability, as Elastic guides for non-GAAP gross margins of breakeven. That is, before stock-based compensation costs.

ESTC Stock Valuation – 6x Forward Sales

Elastic is now being valued at 6x forward sales. There was a time when finding any business growing at north of 20% CAGR being priced at sub-10x sales was an absolute bargain basement investment.

Today I’m not convinced that is all it takes. I believe the market today is more discerning.

That being said, Elastic appears capable of growing closer to mid-20s% or perhaps just under 30% CAGR and is probably priced at closer to 5x forward sales.

The difference at first admittedly doesn’t seem large but it is nevertheless substantial. After all, investing is all about small edges built upon each other, to nudge the odds in one’s favor.

The Bottom Line

Elastic is a versatile platform that doesn’t compete against top cloud marketplaces. Its adoption comes from developers. There’s a very strong sense of community within Elastic’s ecosystems, where its users flag up queries and help each solve solutions.

As organizations move to the cloud and have to search massive volumes of data for insights, Elastic is evidently resonating strongly with its customers.

I believe that at 5x forward sales, investors are already pricing in a lot of its downside potential.

Be the first to comment