metamorworks/iStock via Getty Images

Investment thesis

While I don’t focus on the dividend payout of companies, but rather on the stock price performance, Novartis has a very interesting setup in both aspects. This Swiss pharmaceutical company has maybe finally reached a turning point in which the ongoing strategic optimization will soon show its first results. The pipeline is progressing well, and the company’s portfolio shows strong growth drivers which will even likely improve over the next few years. Although my valuation model is based on rather cautious assumptions, I see the stock price significantly undervalued with over 41% of upside potential, valuing the stock at $117.93.

A quick introduction to Novartis

Novartis AG (NYSE:NVS) is a leading pharmaceutical company that researches, develops, manufactures, and markets healthcare products worldwide. The company operates through two segments, Innovative Medicines and Sandoz. The Innovative Medicines segment is divided into two business units, Oncology and Pharmaceuticals. The Oncology business unit offers prescription drugs in therapeutic areas such as hematology and solid tumors, while the Pharmaceutical business unit is focusing on immunology, hepatology, dermatology, neuroscience, ophthalmology, cardiovascular, renal, metabolism, and respiratory medicine products. The Sandoz segment develops, manufactures, and markets finished dosage form medicines, active ingredients, small molecule pharmaceuticals, biosimilars and biotechnology-based products to third parties and is a global leader in the rapidly growing generics industry, with focus on retail generics, biopharmaceuticals and oncology injectables, and anti-infectives. The company was incorporated in 1996, is headquartered in Basel, Switzerland, and employs over 110,000 employees of more than 140 nationalities worldwide. Its most important geographical region in terms of revenue is Europe, followed by the United States, Asia/Africa and Australasia, Canada and Latin America. In the US the company is listed with an American Depositary Receipt (ADR) at the NYSE, while its primary exchange is at the SIX Swiss Exchange under the symbol NOVN, where it’s part of the blue-chip index SMI.

Actual and future growth drivers

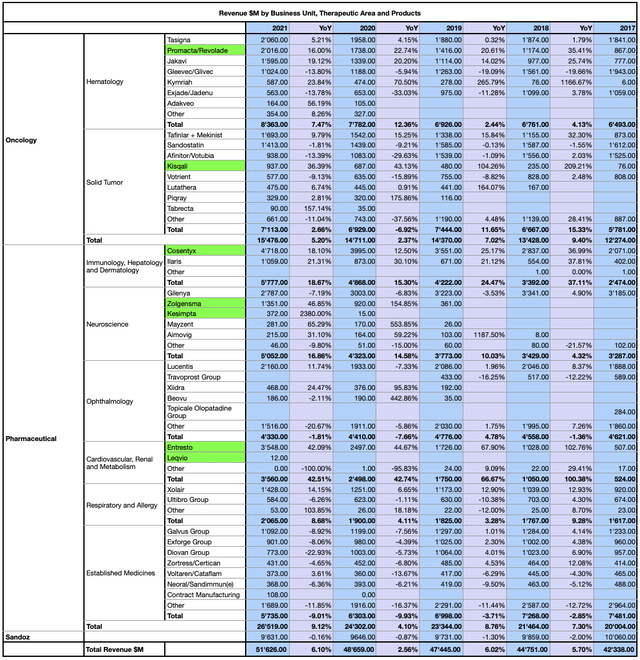

Novartis has a broad product portfolio of well established and newly introduced products with high growth potential. The following table resumes the revenue streams from its actual marketed products.

It’s estimated that Novartis will be left with a $9B hole in sales in 2026 when compared to 2020, since Entresto, which is expected to face higher competition in the US starting from 2025, Roche-shared Lucentis and other drugs will be subject to competitive pressure from generics. While it’s true that the stock has lately been boring from an investor point of view and probably reflected this uncertainty, on the operational side Novartis, shows instead quite significant growth drivers either through new products or by label expansions of existing drugs.

Entresto saw its estimated peak sales boosted to over $5B following an indication expansion granted by the FDA, for patients with a hard-to-treat heart failure. Leqvio, the first marketed siRNA therapy for a common disease in this case for cholesterol-lowering, is forecasted to reach $2.5B in sales by 2027 and has the potential to become the leading product, surpassing sales of both competitive products, namely Amgen’s Repatha (NASDAQ:AMGN) and Sanofi (NASDAQ:SNY) and Regeneron’s Praluent (NASDAQ:REGN) which are forecasted to reach respectively $2.2B and $716M. CEO Vasant Narasimhan underscored the high potential of RNA therapy, cell and gene therapy and radioligand therapy as an advanced platform that could drive Novartis’ growth beyond 2030.

Novartis’ treatment for relapsing forms of multiple sclerosis (MS) Kesimpta is forecasted to reach $3.3B in sales by 2028, mainly due to the strong efficiency it demonstrated in clinical trials and because it can be self-administered with a single monthly dose, while the well established market leading product, Roche’s Ocrevus, is administered via IV infusion in a hospital but only twice a year. Nevertheless, Novartis’s CCO Marie-France Tschudin, sees Kesimpta’s potential in taking 40% of the MS market share.

Together with other well performing and double-digit growing products, such as Promacta/Revolade, Kisqali, Cosentyx, and Zolgensma, those drugs generated approximately 25% or $13B of the total revenue in 2021, up from 20% the year before.

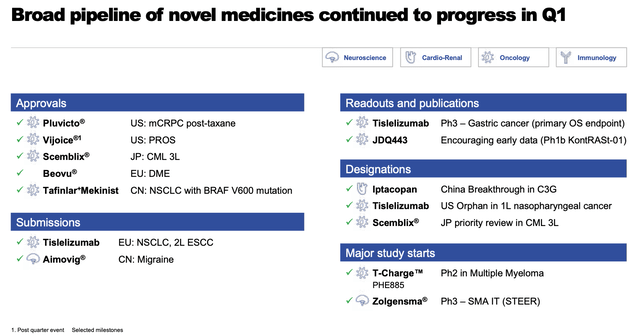

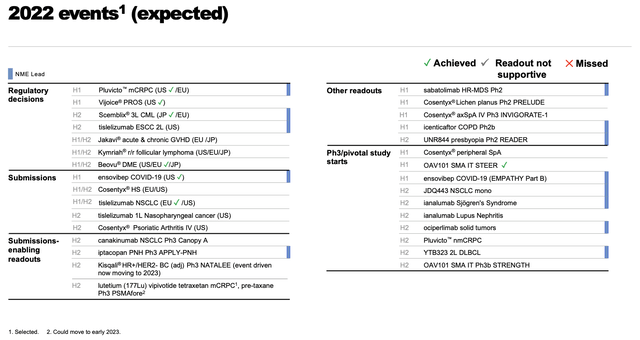

Novartis’ Pipeline has significantly progressed as well and shows many promising candidates for the company’s future growth prospects. Recently on May 28, 2022, the FDA approved Novartis’s Kymriah CAR-T cell therapy for adult patients with relapsed or refractory follicular lymphoma. On June 22, 2022, Novartis received the approval of the European Commission for Tabrecta for the treatment of METex14 skipping advanced non-small cell lung cancer. Tafinlar + Mekinist received FDA approval for tumor-agnostic indication for BRAF V600E solid tumors on June 23, 2022. Scemblix, a novel treatment for adult patients with chronic myeloid leukemia received a positive CHMP opinion on June 24, 2022, and is expected to be approved in Europe in the coming months.

An insight into the industry

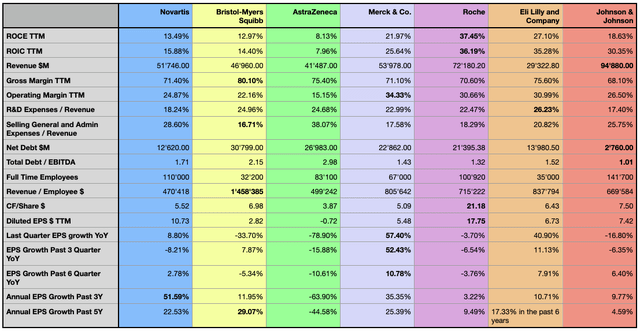

The company reported a slightly increasing gross margin, with a 4.76% CAGR over the past 5 years, standing at 71.40% Trailing Twelve Months (TTM). Its actual gross margin is below the average of the analyzed peers, with Bristol Myers Squibb (NYSE:BMY) leading the peer group in terms of gross margins.

In terms of operating profitability, Novartis reported a significant improvement of 12.30% CAGR over the past 3 years, accelerating from 7.54% CAGR over the past 5 years, and standing at 24.87% TTM. Although some of its peers reported a higher profitability in the last 12 months, Novartis recorded a significant acceleration and is forecasted to continue to improve its operating margin in the coming years.

In terms of capital allocation efficiency, the company could not achieve the high performance of some of its peers, with only Bristol Myers Squibb and AstraZeneca (NASDAQ:AZN) reporting even lower metrics, Novartis reported a Return on Invested Capital (ROIC) of 15.88% in the past 12 months, while the peers’ average stood at 24.97%. Despite this, the company managed to double its capital allocation efficiency when compared to 7.90% reported in 2017. I consider this metric to be a very important element when pondering an investment decision, a company must be able to consistently create value to be a sustainable investment; in this sense, Swiss-peer Roche (OTCQX:RHHBY) is clearly leading the analyzed peer group.

Investments in Research and Development (R&D) are of primary importance for companies in the pharmaceutical industry, Novartis is spending a relatively fair amount of 18.24%, but its competitors are investing even more, as the average stands at 23.12%. The company reported relatively low leverage of 1.71, a metric which was significantly reduced in the past year due to debt-repayment.

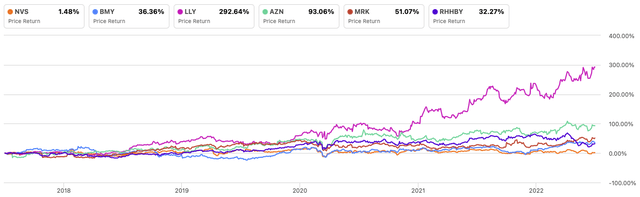

Considering the stock performance of the past 5 years, Novartis performed the worst than most of the analyzed peers stagnating over the analyzed period, while Eli Lilly (NYSE:LLY) significantly outperformed the group with a stellar performance of 292.64%.

Author, using SeekingAlpha.com

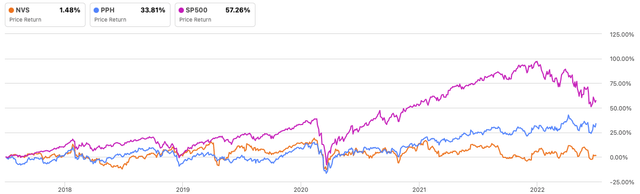

Novartis underperformed significantly the VanEck Vectors Pharmaceutical ETF (NASDAQ:PPH) over the last five years, while showing some sporadic periods of relative strength; when compared to the S&P500, the company greatly underperformed the index.

Author, using SeekingAlpha.com

Novartis is on its way to strategically focus its business and concentrate on specific therapeutics areas and products, as the discussions around the possible spinoff of the generic unit Sandoz, valued at $25B, seems to become the most likely option. Since this business unit is mostly stagnant in sales and affects the profitability of Novartis, it’s probably a good idea in order to boost the core business units and improve the overall profitability. It seems that bigger acquisitions are not a way the company plans to grow right now, but rather acquire specific smaller companies in order to strengthen or develop its product portfolio, as it announced the acquisition of Gyroscope Therapeutics in December 2021, adding a unique gene therapy that could transform care for geographic atrophy, and recently announced the acquisition of Kedalion Therapeutics by further strengthen its ophthalmics portfolio. The company also announced a $15B share buyback program, which should support the stock price, highlighting the company’s capital allocation strategy which combines investing in the core business and returning excess capital to shareholders.

Valuation

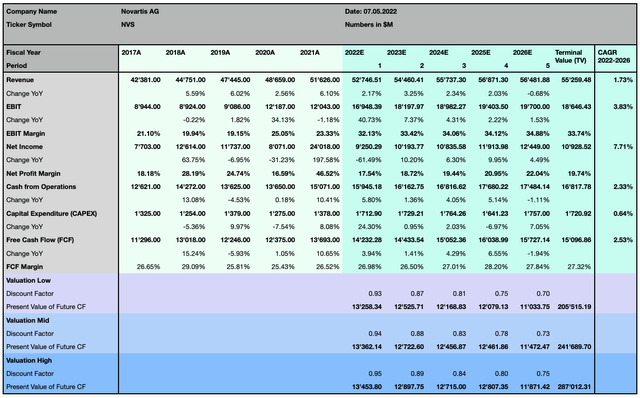

To determine the actual fair value for Novartis’s stock price, I rely on the following Discounted Cash Flow (DCF) model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the Weighted Average Cost of Capital (WACC) and the terminal value. As forecasted by the street consensus, the company is anticipated to generate low 2.53% Free Cash Flow (FCF) CAGR over the coming 5 years, while its revenue is forecasted to grow even slower, at 1.73% CAGR. Despite those rather unimpressive prospects, the consensus is that Novartis will be able to increase its profitability at a faster pace, with its EBIT margin forecasted to grow at 7.71% CAGR.

Author, using data from S&P Capital IQ

The valuation takes into account a tighter monetary policy, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital. As a well established and stable company with relatively low growth margins, I chose a cautious approach when considering the perpetual growth rate in my DCF modelization.

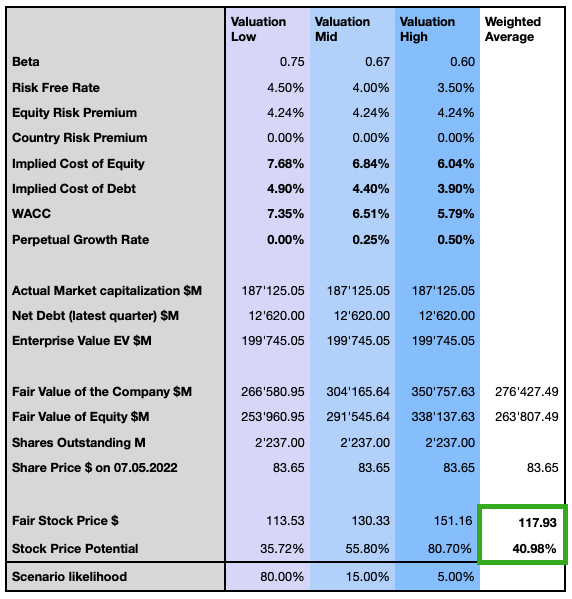

Author

I compute my opinion in terms of likelihood of the three different scenarios, and I, therefore, consider NVS to be significantly undervalued with a weighted average price target with 40.98% upside potential at $117.93.

Risk discussion

Events like the COVID pandemic can impact Novartis’ business in multiple ways. On one hand, the clinical trials can be delayed due to mobility restrictions and health protocols, the production and sourcing of important components can also be impacted due to difficulties in the supply chain, and last but not least the sales force is restricted by limited face-to-face interactions with physicians and customers in the pharmaceutical industry. As a pharmaceutical company Novartis is also subject to the risk of failure of one or more of its products, or to risks that candidates in the pipeline don’t reach the market as may expected. Competitive pressure is another risk factor to evaluate, especially in products and therapies where a generic can significantly decrease the cost for the patient and healthcare insurances may reach out to those products first in order to lower their costs. The company is also exposed to the risk of not being able to transform or externalize the Sandoz generic unit, where it faces significant competition and price pressure. As a consistent part of its business is made in foreign currencies, higher volatility of the USD could affect its finances. Also worth mentioning, the company reported a notable dependency on single customers, as its three most important customers accounted for respectively 17%, 11% and 6% of its net sales in 2021 and the ongoing consolidation in the drug wholesale industry could even increase pricing pressure and exposure to financial risk on single customers.

Market timing

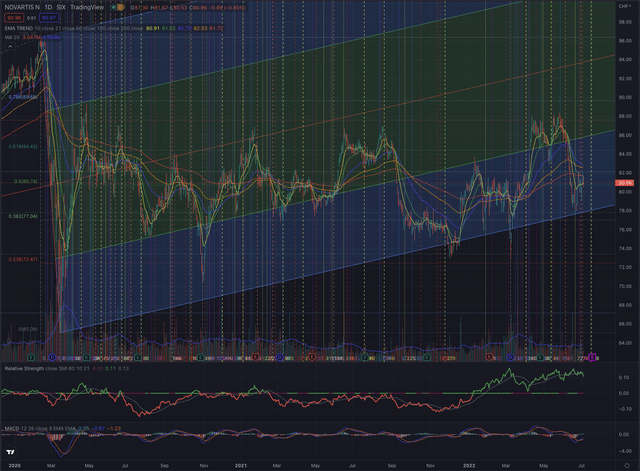

The primary exchange for Novartis is at the SIX and I always perform technical analysis at the main listing of a company’s stock. The stock reached its All-Time High (ATH) at CHF 96.38 or respectively at $99.84 98.27 on February 13, 2020, before crashing 32% the month after until CHF 65.09 or $70.23, a price that marked its low during the COVID pandemic. The stock quickly recovered part of the losses, but never reached the previous level at the SIX. The price successively performed sideways with fluctuations between CHF 75 and 87 (or approximately $80 and 94), while being subject to higher volatility. During this period the stock mostly underperformed both the SMI, as well as the PPH, showing some relative strength only since January 2022. In the US instead, the ADR marked its ATH at $106.84 on July 20, 2015, and the price never recovered until that level since then. From a technical analysis point of view, the stock is still in a side movement with a slightly upside tendency; a great setup for momentum and swing traders. The market is waiting for further positive catalysts, while the strong setup of the company, and the dividend yield, give the stock a strong support, reducing the risk of further losses.

Novartis can count on solid institutional support among its shareholders with 52.02% of the outstanding shares owned by institutions, and a very low short float of 0.29% and just 2.54 days to cover. The street consensus for the ADR given by 7 analysts prices the ADR on average at $98.17 with a buy rating, with the lowest estimation at $91 and the highest at $106. The Seeking Alpha Quant Rating instead qualifies the stock consistently for over 3 years as a hold position. When considering the stock at the SIX, the consensus given by 26 analysts is on average at CHF 90.92, with the lowest rating at CHF 79.57 and the highest rating at CHF 104.65.

The stock has without surprise shown to be more defensive and less affected by the recent market turmoil, and has formed a quite strong bottom. Although the upside is limited by a very strong resistance level at CHF 80 or $94, which is likely also close to the breakeven for many short positions, I see the stock overcoming this resistance level as soon as the general sell-pressure on the markets will be reduced. Technically the stock is in my opinion in a comfortable setup for both long-term investors as well as more short-term traders, which can set their stop-loss in order to limit the downside risk.

The bottom line

During difficult times in the equity markets, it’s a good idea to look after defensive stocks with a high-quality risk profile and a limited downside. While its past performance is not a reason for enthusiasm, its future could look different, since the company is effectively significantly improving its profitability and is forecasted to continue to do so. Novartis is getting back on track and its product portfolio, which was a reason for skepticism for some time, is instead showing strong growth drivers which just started to deliver their returns on investment and are forecasted to add significant value to Novartis’ shareholders. Novartis is certainly not the only and maybe also not the best opportunity in the pharmaceutical industry, but the company has a very low-risk profile and its dividend yield of 3.94% is certainly also an argument for many investors. Both long-term investors as more short-term oriented traders could consider the stock at this price level, which I see as undervalued by 41% from its fair price at $117.93.

Be the first to comment