dk1234/E+ via Getty Images

EHang (NASDAQ:EH) marked its third year on the NASDAQ yesterday with an incredible rally that would see the common shares of the Guangzhou, China-based autonomous eVTOL firm rally intraday by as much as 55% before closing the day up just over 37% at $10. The last few weeks have marked a dramatic change in investor sentiment in the company whose common shares ebbed at lows of around $4 for months. With shareholders seemingly now anchoring to the December 2019 IPO price of $12.50, enthusiasm around potential certification early next year continues to build.

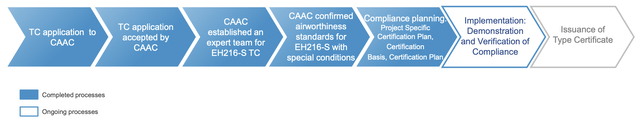

The fiscal 2022 third quarter results ending September 30 were only just released last week but contained operational updates that have reignited eVTOL fervour. The core takeaways are undeniably bullish and help paint a near-term future where the company is able to ramp sales of the EHang 216, its autonomous aerial vehicle. This would represent a marked change from the primarily hype-driven play the company was during the long-past pandemic years. The 216 Type Certification process has entered its final phase with the company currently engaged with the Civil Aviation Administration of China to complete compliance demonstration and verification.

EHang

Management seemed confident in their third quarter earnings call with analysts from Tianfeng Securities and Goldman Sachs that they had the practical data, collected over many years, to support their application for their autonomous aerial vehicle being approved in January. Critically, whether or not certification happens of course remains purely in the remit of the CAAC. What’s important for shareholders is pre-orders, near-term liquidity, and profitability.

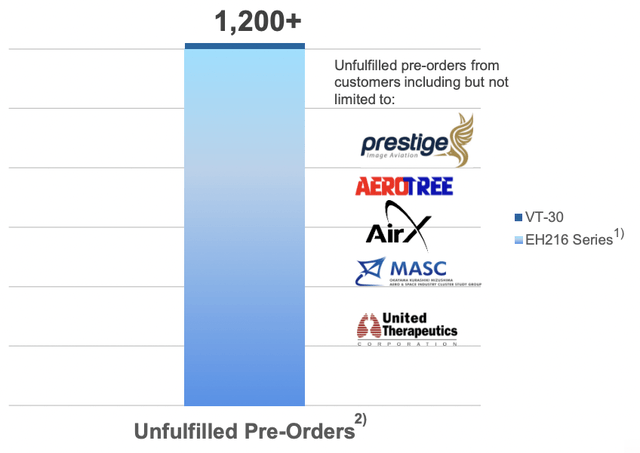

Pre-Orders Come Into View Against CAAC Certification

EHang

EHang has close to 1,200 pre-orders for its 216 series from a number of customers. Two Indonesian companies AEROTREE and Prestige Aviation placed pre-orders earlier this year for 60 units and 100 units respectively. Silver Spring, Maryland-based United Therapeutics (UTHR) forms the largest source of pre-orders with 1,000 units over a 15-year period to help the biotechnology firm to autonomously move around lungs and other organs. Whilst a search for “EHang”, “aircraft”, “eVTOL”, or “drones” on United Therapeutics’ last seven quarterly earnings calls returned no results, United’s founder CEO Martine Rothblatt had made public comments on their strategy to build a North American eVTOL-based organ transportation network since the deal was signed with EHang back in 2016.

It’s important to note that the order was with United’s subsidiary Lung Biotechnology, an ambitious idea to print lungs using specialized 3D printing techniques and then transport them to where they are needed via air autonomously. Hence, with 80% of EHang’s total pre-orders being from a single company, shareholders are exposed to a meaningful level of risk.

EHang will also have to achieve certification in the US and Canada before it can begin selling to United, a process that will likely take materially longer than potential approval with the CAAC. Critically and of relevance, China-based DJI has been blacklisted by the US Defense Department due to fears that the unmanned aircraft could pose a national security risk. This forms the hostile backdrop that EHang would face to pursue US certification.

Liquidity Looks Limited Against Net Losses

EHang’s fiscal 2022 third quarter earnings saw revenue come in at $1.2 million, a decline of 40% over the year-ago quarter and a miss of $1.49 million on consensus estimates. What’s interesting, perhaps somewhat unexpected was the positive gross margin of 65.9% during the quarter. Whilst this was a small decrease of around 120 basis points versus the prior second quarter, it looks completely outsized for an aircraft manufacturer that only sold and delivered 4 units of its 216 over 3 months.

Further, with cash and equivalents of $29.4 million as of the end of the quarter versus a net loss of $10.8 million, the company will likely have to find external sources of capital to expand its runway. Uncertainty around this liquidity position is heightened ahead of what’s likely to be a flurry of operational activity in the event of certification in January. However, I don’t think EHang will run into difficulty raising debt in China or elsewhere against the broader vision of eVTOLs. This vision could see the 216 or other aircraft from its peers become a visual feature of cities of the future to open up a new dimension of travel from the sky. eVTOLs could help enable truly multimodal transportation in a way that genuinely facilitates new use cases from smart city management to aerial tourism and logistics.

However, even against CAAC certification, the company faces huge barriers to realizing most of its pre-orders. The recent price run seems strange against what’s essentially an unassimilable pre-order book and a declining liquidity position. This enthusiasm could very much be carried into the new year so I won’t recommend this as a short. I’m staying on the sidelines on this and I’d recommend the same position to others not invested.

Be the first to comment