Funtap

The Vanguard Extended Duration Treasury ETF (NYSEARCA:EDV) offers one of the best options for investors looking to lock in relatively high bond yields in anticipation of a fall in inflation and a downward reversal in interest rates. The long maturity and duration of the EDV means it is highly sensitive to changes in interest rate expectations, and extremely volatile for a bond fund. Compared with US stocks, though, the risk-reward outlook is highly favorable.

The EDV ETF

EDV holds a portfolio of 20- to 30-year Treasury STRIPS, which represents a single coupon or principal payment on a U.S. Treasury security that has been stripped into separately tradeable components. These securities promise a single payment upon maturity in the next 20-30 years without any interim coupon payments. As a result of the lack of coupon payments, the fund has an extremely high average duration relative to most bond market ETFs, at 24.3 years, and an effective maturity of 24.7 years. The current yield to maturity is around 3.9%, which is significantly above long-term inflation expectations, and likely to be above nominal GDP growth over the coming years.

Real Yields Are High And Inflation Expectations Have Plummeted

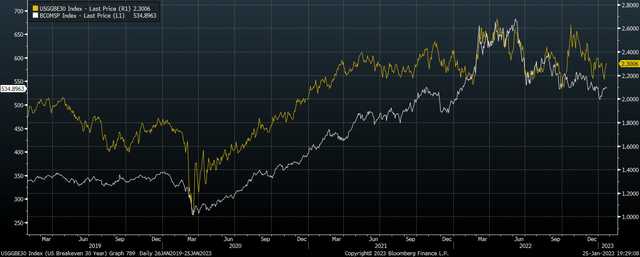

The 3.9% average yield to maturity on the EDV may seem low in the context of 6.5% trailing CPI, but trailing inflation is a very poor gauge of future inflation. Over the past six months headline inflation has averaged just 1.9%, and bond market investors anticipate it to average 2.2% over the next two years based on the yield differential between regular and inflation-linked bonds. So-called breakeven inflation expectations have dropped significantly over the past year in line with the drop in commodity prices, particularly oil. This drop in inflation is not expected to be temporary, with bond market investors expecting inflation to average just 2.3% over the next 30 years. This puts the real yield on the EDV at around 1.6%.

US 30-Year Breakevens Vs Commodity Price Index (Bloomberg)

Inflation Is Moving Back Down To Its Long-Term Average

Many readers of my recent articles on bonds and gold have argued that these inflation expectations are too low, either because bond investors are simply wrong or because they are based on expectations about future official CPI figures, which are not a true reflection of real-world price increases.

Regarding the first point, I do believe that 2.3% average inflation over the next 30 years seems on the low side. It has averaged 2.5% over the past 30 years and rising fiscal spending and persistent deficits suggest inflation will be higher in the future. However, the US TIPS market (Treasury Inflation-Protected Securities) is USD1.5trn in size and should not be taken with a pinch of salt. In fact, breakeven inflation expectations have been an excellent predictor of inflation over the long term. Back in 2013, 10-year breakevens were 2.5%, which is exactly what headline inflation averaged over the past decade.

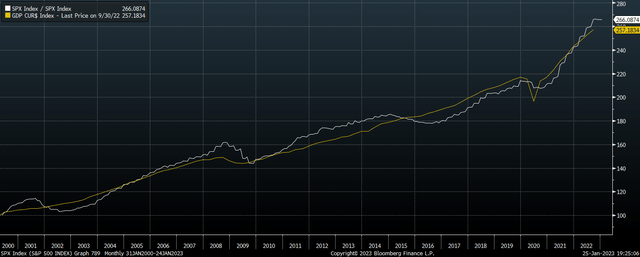

It could still be the case that inflation expectations are lower than reality as they are based on official CPI which is lower than the actual rate. However, there is little evidence to suggest that inflation has been underreported in the past. If this was the case, we would expect to see total revenues of the S&P500 have risen faster than nominal GDP, which has not been the case.

S&P500 Revenues Vs Nominal GDP (Bloomberg)

Back in 2020 the conditions for a sharp rise in inflation were clear to see to everyone but establishment economists. A surge in money supply and a collapse in output meant that a sharp rise in prices was all but inevitable. This ratio of money supply to real output has actually fallen over the past year thanks to an outright decline in money supply and a rise in real output. This means that the rise in inflation over the past year has been driven by so-called rising velocity, or more accurately a decline in the willingness of individuals to hoard cash. The more we see M2 growth slow relative to the size of the economy, the lower will be future inflation potential.

Real GDP Growth To Average Below 1%

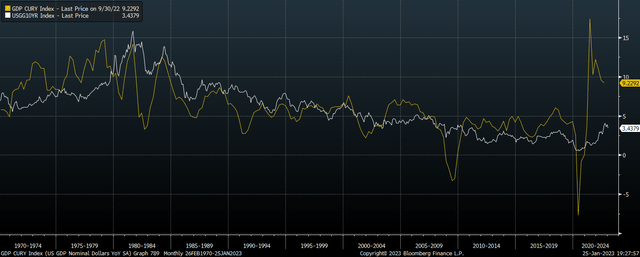

It is not only the inflation outlook that matters to bond holders, but also the real GDP growth outlook. If nominal GDP is higher than the 3.9% yield on the EDV over the long term, investors will likely lose out in bonds relative to stocks which rise in line with the absolute size of the economy. It is for this reason that long-term bond yields have been closely correlated with nominal GDP growth in the past.

10-Year UST Yield Vs Nominal GDP Growth (Bloomberg)

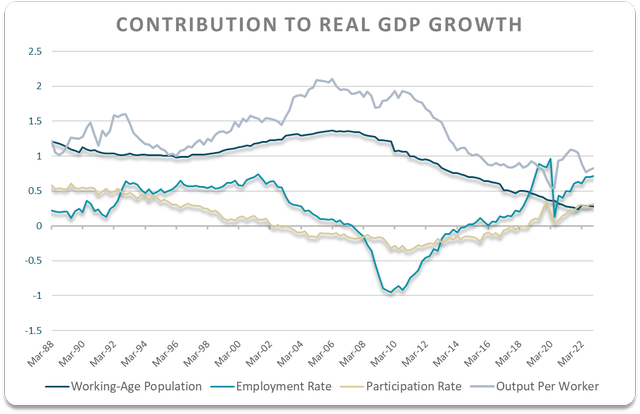

If the bond market is right and CPI averages 2.3% over the long term, it is highly likely that nominal GDP growth averages less than the 3.9% yield on the EDV. I fully expect real GDP to average less than 1% over the long term, down from the 2.1% average seen over the past decade. We can break down the drivers of historical real GDP growth into working age population growth, the rise in the labor force relative to the working age population (participation rate), the rise in the share of the labor force in employment (the inverse of the unemployment rate), and the growth in output per person.

Bloomberg, Author’s calculations

All these four components contributed positively to growth over the past decade. While working-age population and productivity growth continued their long-term decline, contributing a combined 1.1% to real GDP growth, a rising participation rate and falling unemployment rate contributed another 1.0%. With the labor force participation near record highs and the unemployment rate near record lows, it is hard to see any further positive contribution from these cyclical factors over the next decade, and it is highly likely that these actually act as a drag on growth. This means that real GDP growth will be constrained by labor force growth and productivity. The former has ground to a halt and should average around zero over the long term, while productivity is likely to resume its long-term downtrend as economic freedom and financial stability continue to decline.

EDV A Better Risk-Reward Than U.S. Stocks

I would not be surprised to see real GDP average close to zero over the next decade, which would make the 3.9% yield on the EDV extremely attractive, particularly relative to US stocks. The current dividend yield on the S&P 500 is just 1.7% and if payouts grow at the pace of nominal GDP, cash flows are likely to grow at the same pace as income received on the EDV over the coming years.

However, the EDV has a far superior risk-reward outlook as it has a track record of performing well during recessions. While the EDV has actually been more volatile than the S&P 500 over the past 15 years, volatility is not a sufficient measure of risk. The EDV, like most US Treasury funds, has performed well during periods of global economic and financial turmoil, when equity markets have crashed, acting as a vital source of portfolio protection. While both stocks and bonds weakened in 2022 amid the Fed’s aggressive hiking cycle, their long-term negative correlation looks to be returning as investor focus shifts to the outlook for the real economy. I expect to see the EDV post double-digit returns relative to the S&P 500 over the next 12 months, with EDV heading higher and US stocks heading lower.

Be the first to comment