lindsay_imagery/E+ via Getty Images

Published on the Value Lab 5/4/22

We’ve always liked Energias de Portugal (OTCPK:EDPFY) as a utility company. They’ve had assets whose premium value could be proven by asset rotations, and they’ve traded quite cheaply with a nice dividend for a while now. Indeed, their price has been languishing, even though their gains on asset rotations have been more substantial than usual. We continue to believe in the value of their growing portfolio, and they continue to be an important partner to the government on the network side, winning a new concession in Spain. With regulated utility exposures not being too terrible at the moment, albeit with some risk factors related to the commodity environment, and with a languished price, we think EDP comes across as attractive at these prices.

A Look at the FY 2021

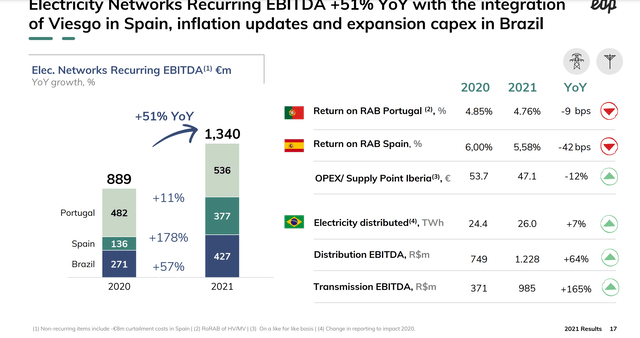

The FY 2021 has come to a close for a host of companies, with EDP of course being one of the many with recent reports that we are mulling over now. The year has been relatively eventful for the company, beginning with the Viesgo concession win. Working now as the operator of this region’s distribution in Spain of course puts more of EDP under the CNMC, the regulatory authority in Spain which we are not such a fan of as they have been pushing to reduce remuneration for regulated utilities consistently. Nonetheless, these concessions are valuable when won, because of course it provides an avenue through which cash can be CAPEXed in order to achieve a regulated rate of return. More geographies in which to propose distribution projects, and more assets to manage, the more income streams the business can count on. The Viesgo business has meaningfully increase EBITDA in networks.

Viesgo Addition (FY 2021 Pres EDP)

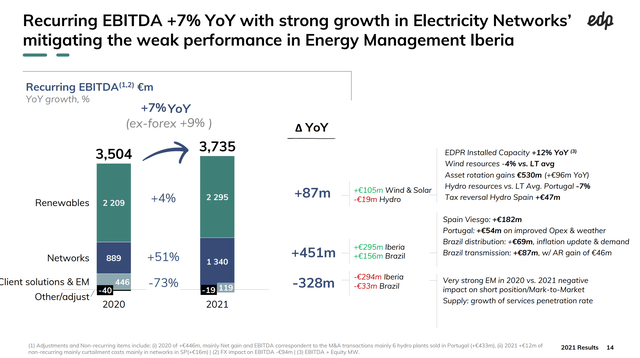

Networks now accounts for a growing portion of the business, while in previous quarters and years, EDP had been focusing on developing its generation asset ahead of networks, where generation is usually a business that more easily commands a multiple due to the possibility to own the assets, and the politicking that exists around concessions and the tariffs.

EBITDA Split (FY 2021 Pres EDP)

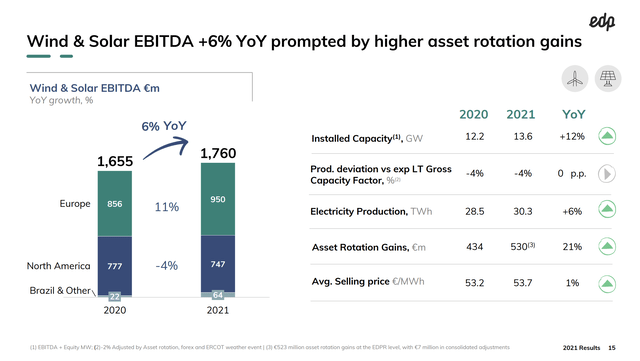

Networks is a little over 35% of the EBITDA, with the rest being essentially the generation assets, which are by the way all renewable. This is typically the segment in which the P/E model most clearly comes into effect as well, with EDP often rotating out of assets in order to monetise them for capital gains. This year has been impressive, with 2.6 billion EUR of proceeds from sales, 0.6 billion EUR was made in capital gains, that’s a yield well over 20%, and indicates very nice returns for assets that would have also been producing EDP income in the meantime. Even some regulated utility lots were sold for some capital gains this year as part of the rotation, although a relatively limited amount. The ability to make a nice profit on assets shows that EDP benefits much like Ørsted (OTCPK:DNNGY) does in monetising its assets at premium valuations in a market that is hungry for renewable deals. It’s good also to see that EDP is making investments in offshore wind like Ørsted, part of its quite rapidly growing wind and solar portfolio, and that new PPA agreements are yet to be pricing in the high energy prices to be paid by offtakers, with minimal increases in average selling prices so far.

Wind and Solar (FY 2021 EDP Pres)

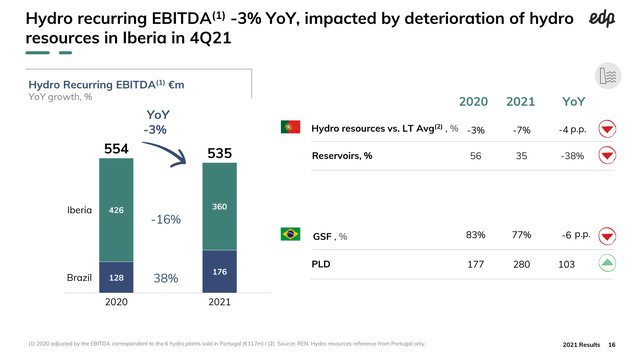

In hydropower, lower resources due to ongoing drought conditions globally has been something that has negatively affected the segment’s performance, but not by much thankfully due to the limited exposure of Iberia compared to geographies like Chile.

Hydrology (FY 2021 EDP Pres)

Valuation and Conclusions

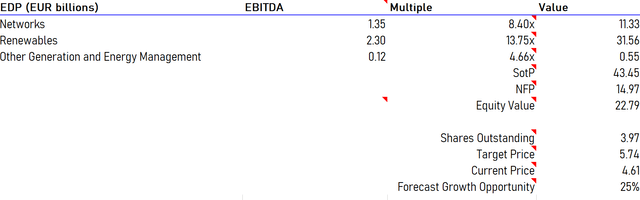

In terms of valuation, EDP’s asset base has only grown, even in its network division with the addition of Viesgo. We can use the blended multiples that we used last time based on their mix of renewable energy sources, as well as the multiple of other CNMC concessions for the network business to lowball it, since CNMC tends to be a less favourable watchdog than the Brazilian regulatory authority as an example.

SotP Valuation (VTS)

The valuation looks favourable at these levels on a SotP basis using precedent transaction multiples on assets of each renewable type, and the valuation would be higher if the hydrology situation was better this year.

What could go wrong? Well several things. Higher commodity prices and shortages could make it difficult to develop assets for the regulated utility businesses. Since they are remunerated on a regulated asset base, proposing projects that might be excessively expensive could be difficult to do, and authorities may redlight things more than usual. With networks being exposed to high prices in nickel and aluminum especially, this is a risk in the regulated business. In generation, the risks are less pronounced in EDP’s case, besides more droughts that might affect the hydrology environment. Crowding of the market limiting capital gains benefits on asset rotations might be a risk, but EDP develops these assets with sufficient skill that it seems they deserve their yields from their value add on the execution side.

EDP also has a nice dividend of 0.19 EUR/share, which does not grow at all as the company continues to execute its P/E model and grow its asset bases in both the generation and the networks business. But it nonetheless provides a stable 4% yield that can be readily relied upon, also because of the business’ inflation resistance. Most remuneration schemes account for inflation in how remuneration is indexed in regulated utilities, and another bunch of business has been hedged through contracts. Altogether, 75% of their business is inflation hedged. With there being an upside on the valuation, nice resilience to the current environment, and a dividend in the meantime, we think EDP is pretty interesting as a prospect, and we always keep our eye on it as a potential utility exposure.

Be the first to comment