Alex Wong/Getty Images News

Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.– Warren Buffett

Written by Sam Kovacs

Introduction

If I have learned anything about markets, is that the pendulum always swings.

I learned this from Howard Marks books, but it is only in the past 3-4 years that I’ve come to fully appreciate how powerful this insight is.

Stocks go from overvalued to undervalued to overvalued again.

But they do not always do this in tandem. This year, energy stocks are up big time, while tech stocks are down. Two years ago, it was the exact opposite.

It is natural that sectors go up and down as our anticipation of where we are in the cycle changes. Individual stocks will also go from overvalued to undervalued and back as analysts predict doom and gloom.

It is a market of stocks, and not a stock market. There is always something to buy, and always something to sell.

The next question is how does one take advantage of this? Certainly some stocks go down, and never recover.

These are mostly bad quality companies with unsatisfying fundamentals. Fundamental research to focus only on quality companies with staying power will weed out a lot of the bad stocks.

As an individual making discretionary decisions, you’re still going to be error prone, and will occasionally get it wrong.

There is nothing you can really do about this. Sometimes events that you hadn’t foreseen, or details that you overlooked backfire. You want to minimize these by focusing on quality companies and fundamentals, but the occasional error will slip in.

This is why you don’t put all your eggs in the same basket. You diversify. This minimizes the impact of any one stock.

This doesn’t need to be time consuming.

In fact I’ve found that there is no difference in managing a 50-70 stock portfolio to managing a 30 stock portfolio.

You should run a diversified portfolio of stocks, and have target prices at which to review the stocks.

We do this with our “Buy and Sell Lists” at the Dividend Freedom Tribe. We cover over 120 stocks.

We will review the stocks when:

- Dividend increases

- Price goes above or below target prices.

- Noteworthy news catches our attention.

Otherwise we wait.

So we now have a good framework for investing:

-Focus on quality stocks.

-Buy when they’re cheap, sell when they’re high.

-Diversify to minimize the cost of unavoidable, occasional errors.

To further reduce the investment universe, we choose to focus on dividend stocks with a track record of increasing their dividends.

Why?

Dividends send multiple good signals:

1. Management more likely to only pursue the most profitable investments and return excess cash to shareholders.

2. They recognize that shareholders own the company, and that the company isn’t their personal piggy bank.

3. They “get” capitalism.

Also, for quality companies, the dividend is a good benchmark to measure value. Earnings go up and down over time. So do sales and cashflow.

So analysts need to “normalize” earnings and cash. This introduces the opportunity for bias and human error.

On the other hand dividends, until they are cut (which if you do your DD doesn’t happen) keep going steadily up. The rate of growth is the unknown, but we can “guestimate this” just as good as analysts “guestimate” earnings and cashflows.

This means that it is much easier to look at a stock’s history of dividend yields and say: is the yield higher, or lower than it historically has been?

We then tie that into our estimate of growth, and figure out if it is cheap or not relative to income.

Then we buy low, get paid to wait, sell high.

What if high never comes? It usually does, but theoretically, it could not happen. Well, then, as long as a stock continues to increase its dividend at a satisfactory rate, we’ll reach our retirement income objectives and never have to sell the stock.

That’s goal 1: live off of dividends in retirement. Robert was able to retire early and I fully plan on retiring earlier.

Buying and selling stocks opportunistically is just a means of getting there quicker.

Here are a couple of “sell this buy that” stocks on our list right now.

Our members have been made aware of these for a while.

Sell Essex Property, Buy Home Depot

You don’t always catch the exact bottom, but with Essex Property Trust (ESS) we did just that.

We first bought shares in October 2020 at $200, which turned out to be the low.

Was this witchcraft?

No, we merely suggested that the price at which they bottomed during the March 2020 pandemic panic, would provide a good entry point.

As the stock continued its climb, we added shares at $240 in January 2021.

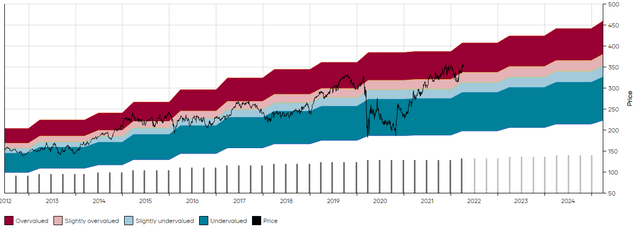

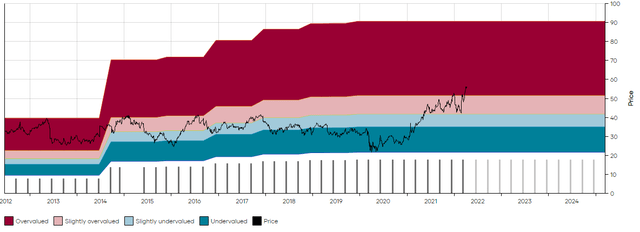

Dividend Freedom Tribe: ESS MAD Chart

In June 2021, I wrote in a note to members of the Dividend Freedom Tribe:

the stock has now gone above our $300 “sell above” target, and only yields 2.75%.

Is it time to sell?

I think so. At least it is time to start the selling process.

As good a REIT ESS is, its price is now getting ahead of itself. Even when factoring in a premium for quality, ESS shouldn’t yield less than 3%.

Here’s the game plan:

We’ll sell about 1 third of ESS now.

The remaining shares, we’ll sell at the following targets: $330, $350.

As Essex Property Trust once again surpasses $350, I think it is good to remind investors that now is a good time to exit the investment.

Why? Income potential at the current price just isn’t appealing.

During the past 10 years ESS has grown income at an annual rate of 7% per annum. This has reduced to 4% per year during the past 5 years.

Even if ESS could achieve 7% (and I believe given the trend it is more likely to grow at 5%) then the stock would not provide attractive income.

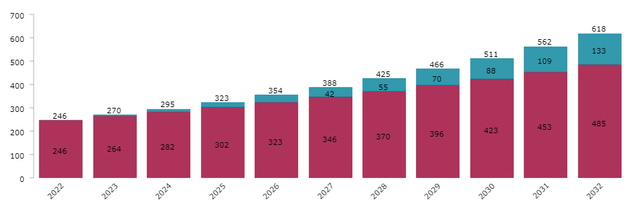

If you invest $10,000 in ESS today, and reinvest dividends while the dividend grows at 7% then in year 10 you could expect to receive $618 in income.

Dividend Freedom Tribe – ESS Income Simulation

This is not great. It amounts to about 6% of the original investment, which is below our threshold for at least 8% to be considered a good income opportunity.

On the other end of the spectrum you have Home Depot (HD). They don’t operate in the same sectors, but they yield similar amounts.

And we exited HD not long ago. In January, we told members of the Tribe that we had sold the last of our HD at $400:

We sold the stock when it hit $400, as sub 1.6% yields had not been seen on HD in over 15 years. The question is, where does HD go from here?

It currently yields 1.7%, which means we need dividend growth in the 15.5% to 18% range to make it a good income opportunity.

And while the dividend grew at 19% per annum during the past decade, I don’t believe they can grow that much again this next decade.

Growing the valuation at that rate would result in a $2.2 trillion valuation in 10 years. That’s not happening. Apple is priced at $3tn today, what makes you think HD can grow to match that in 10 years?

I struggle to see HD growing much higher than 10-12%, which makes it a sell at current prices.

Since then, the stock plunged 25% and the dividend increased by 15%.

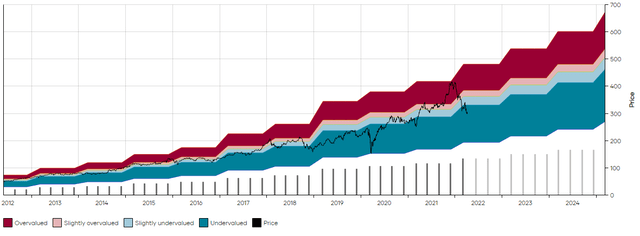

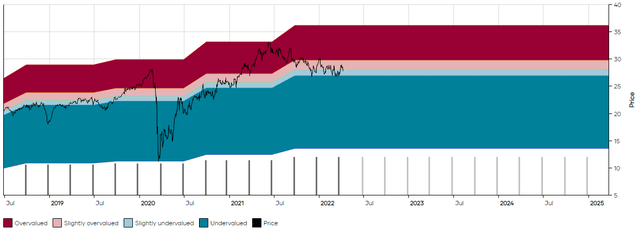

Dividend Freedom Tribe: HD MAD Chart

Now as you can see on the MAD Chart, HD’s price is now once again in the deep blue area. This indicates that the yield is higher than it has been during 75% of the past decade.

The pink and light blue areas delineate the core 50% range of yields, what we refer to as the “fair range”.

For HD, the fair range has been between 2% and 2.3% for the past 10 years.

Lower yield = historically overvalued. Higher yield = historically undervalued.

So while we left the position just 3 months ago, we’re happy to get back in now.

In a very negative outcome, I can see HD go to $250 where it’ll find support. That’s a 1/6th decline which would be acceptable. On the other hand, a $50 where it’ll find support. That’s a 1/6th decline which would be acceptable. On the other hand, a $500 price tag in the next 3 to 4 years seems unavoidable, when the pendulum swings again.

Not only are you buying a stock which has a potential pendulum reversal, you’re getting much better dividend income potential.

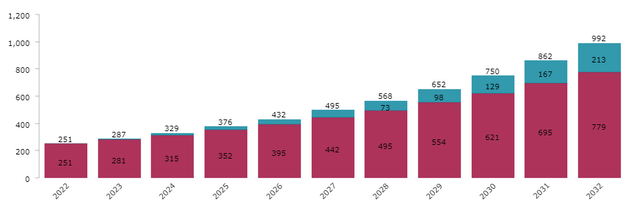

If you buy $10K of HD today, and reinvest the dividend while it grows at 12% per annum then in year 10 you’ll receive $992 in income.

Dividend Freedom Tribe – HD Income Simulation

So buying HD provides you with not only better capital appreciation potential than ESS, but much more income potential.

Sell Iron Mountain, Buy VICI

In the last article, I suggested that investors sell their shares of Iron Mountain (IRM) and buy shares of Realty Income (O) instead. The window to pick up O has closed somewhat in our opinion, but if you want to discard your IRM shares, there is a great replacement just around the corner.

You see, IRM has been on a tear.

We told investors back in 2020, that IRM was a “slam dunk below $30“

Since then, it has returned 3x the S&P 500’s return, when you count dividends.

Dividend Freedom Tribe – IRM MAD Chart

But now the yield is at the lowest it has been since the stock became a REIT in 2014 (and subsequently increased its dividend dramatically).

While the company’s digital storage business does offer a lot of potential, a lot of that is priced now.

Of course it was a deal you should have taken when the stock was yielding 6%+, but it now yields 4.4%.

This is decent, if it wasn’t for the fact that the stock still hasn’t resumed dividend growth since it stopped growing in 2019.

The good news is that if you bought at a great price, you can engineer your own dividend growth.

If you bought $10K worth when IRM was at $30, even if you squandered all the dividends on beer, then you’d have $18K to deploy elsewhere.

The good news is that to derive the same income from the position, you don’t need to buy a speculative 8% + yielding stock (although IRM wasn’t speculative, it was just exceptionally mispriced).

If IRM is in a tax-sheltered account, you can replace the income by buying a 4.4% yielding stock.

If you buy a stock with a higher yield, then you potentially increase your income.

And that’s exactly what you can do with VICI properties (VICI).

The similarity with IRM is that they’re a specialty REIT, the difference is that rather than storage the company operates the real estate which supports various casinos.

It was the first such REIT, pathing the way for many deals in upcoming years which should fuel dividend growth in a sector with extremely high switching costs (you don’t exactly close Caesar’s Palace and open up down the road).

Dividend Freedom Tribe – VICI MAD Chart

The dividend is quite new, but last year it grew 9%. Can VICI pull off similar growth this year? Who knows, but it seems certain to me that management will want to increase the dividend, as they look to establish a track record as a dividend paying company.

In the latest earnings call management said:

An integral part of VICI’s superior total return has been VICI’s dividend growth over the period, with aggregate dividend per share growth of 37.1% since our first full quarter dividend payment in Q2 2018.

How much will VICI grow? Higher than IRM, that is sure.

Switching from the expensive stock to the cheaper one at this point is just common sense.

Conclusion

Stocks will go up and down. During bull cycles transitioning from expensive to cheap makes a lot of sense. This means taking gains, which is fun and easy.

In bear cycles, it might mean rotating from cheap to cheaper, which is not as easy, but still ends up with the same result: increasing your income potential.

Be the first to comment