DNY59/iStock via Getty Images

In times of market volatility, I like to return to one of my favorite investing quotes, delivered by the father of value investing, Benjamin Graham:

The true investor will do better if he forgets about the stock market and pays attention to his dividend returns and to the operation results of his companies.

It can be easy to forget that the stock market’s seemingly endless parade of ticker symbols represents ownership stakes in real businesses managed by real people. To be a stock investor is to be a partial businessowner.

The vast majority of investors would do well to take Benjamin Graham’s advice and take on the mindset of a businessowner – or a landlord, as we like to say at High Yield Landlord. Pay attention to the fundamentals and let the stock price sort itself out over time.

Investing with the mindset of a businessowner or landlord means that temporary bumps in the road don’t deter you from maintaining your long-term thesis in a company, even when those bumps in the road are scary or confusing.

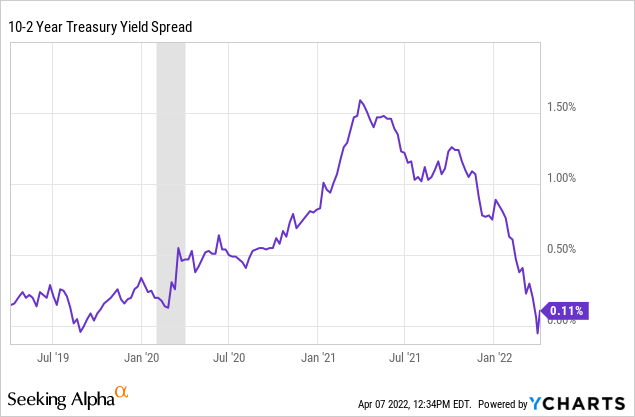

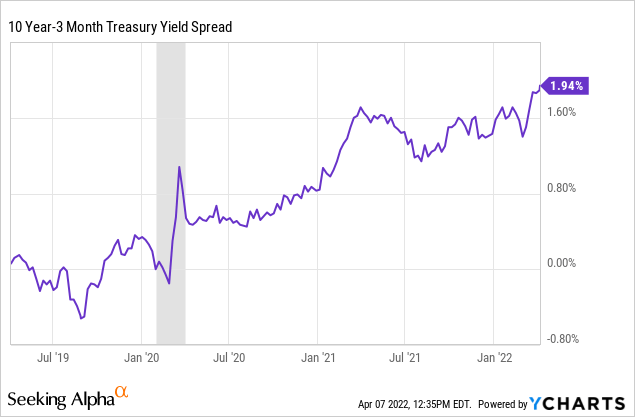

For instance, the 10-year and 2-year Treasury yield curve briefly inverted a few days ago, and such inversions have historically acted as a reliable harbinger of oncoming recessions.

More and more economists are beginning to forecast a recession coming in 2023 or later in 2022, while some are saying we’re already in a recession.

The Wall Street casino flashes conflicting signals to investors: “Buy, buy, buy!” “Sell, sell, sell!” Amid market volatility and varying opinions from thousands of pundits and practitioners, it would be easy for the average investor to be swayed.

Let me present you with another data point that contradicts the inverted 10-2 Treasury yield curve, and that is the 10-year/3-month Treasury yield curve. Some say this measurement of the yield curve is a more reliable indicator of an oncoming recession than the 10-year/2-year curve, and it is moving in the opposite direction of inversion.

Which indicator should we believe? Are we on the verge of a recession because of the Fed’s aggressive rate-hiking plans? Or are we moving further away from one as the Fed moves swiftly (and belatedly) to tame inflation?

Are we entering a bear market as higher interest rates diminish the relative attractiveness of stocks? Or is the current selloff merely a consolidation setting up for higher stock prices ahead?

I am as interested in market prognostication and macroeconomic divination as the next investor, but I admit that I don’t know. The economy has humbled me in the last year or so as high (and rising) inflation has lasted much longer than I thought it would.

I’m still of the view that, due to…

- aging demographics,

- high debt loads,

- deflationary technological innovations,

- and widening wealth inequality,

…the economy will return to a low inflation, low interest rate environment in the long run. But how far out is this “long run”? As the famed economist John Maynard Keynes said, “In the long run, we’re all dead.”

In the midst of all this uncertainty, I must admit to myself that my specialty (and my mission as an investor) is not to discern the future by examining the entrails of economic data. Rather, it is to invest in strong businesses with capable management teams that will compound my invested dollars over time.

Finding businesses that perform well through different economic environments, both individually and as a whole in one’s portfolio, is the goal of the true investor, according to Benjamin Graham.

So, in the spirit of Graham’s style of investing, let’s look at two reliable dividend growth stocks that, in my humble opinion, make excellent core holdings.

1. Agree Realty Corporation (ADC)

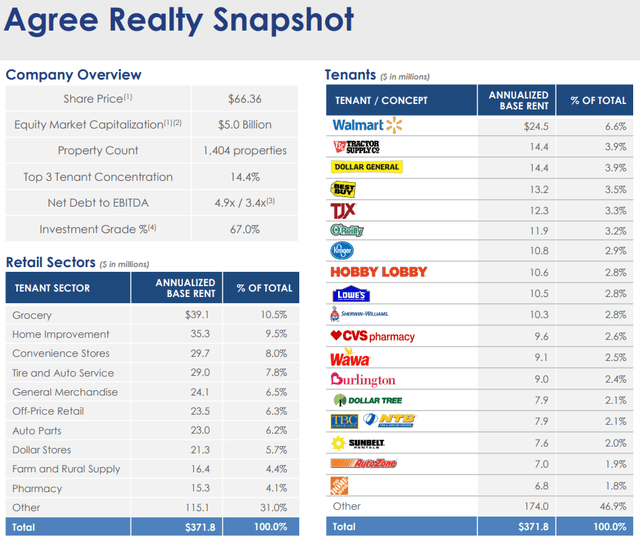

ADC April 2022 Presentation

ADC is a triple-net lease real estate investment trust (“REIT”), which means that tenants are responsible for all or most property maintenance, taxes, and insurance (i.e. rent is net of those three items). The REIT specializes in single-tenant retail properties while focusing on only the largest and strongest retailers in the nation as its tenants.

ADC’s top tenant list includes only the all-stars of the American retail landscape, anchored by omnichannel stalwarts like Walmart (WMT), Tractor Supply Co. (TSCO), T.J. Maxx (TJX), and Kroger (KR).

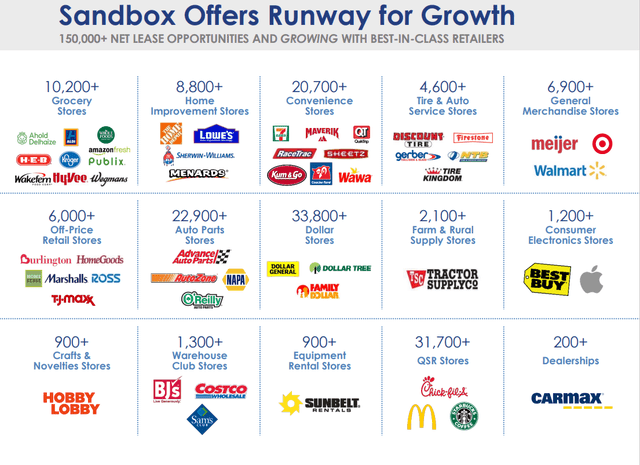

ADC April 2022 Presentation

Worried about a recession? Look at the bottom left box in the image above. ADC’s tenants overwhelmingly operate in recession-resistant industries. This makes the stability and predictability of ADC’s cash flows extraordinarily secure.

Not only do ADC’s tenants operate in recession-resistant industries, they are also the leaders within their respective industries. This narrows the list of potential tenants to the 20-30 strongest retailers in the country, but ADC’s management insists that there are plenty of available acquisition opportunities even within this restricted “sandbox.”

ADC April 2022 Presentation

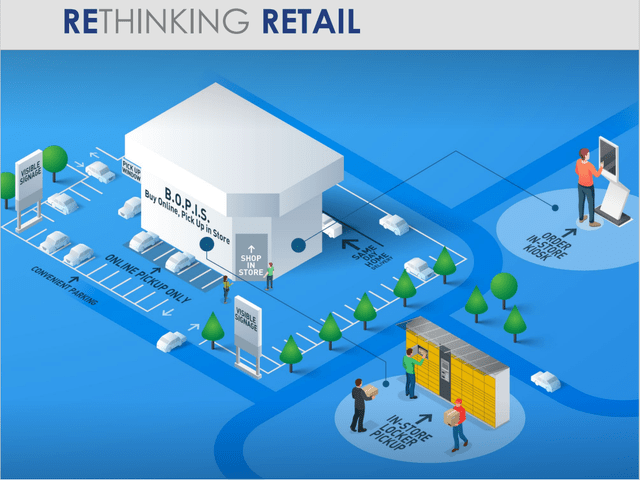

And if you’re worried about Amazon (AMZN) swallowing brick & mortar retail whole and spitting it back out as a package on your front porch, you can rest easy knowing that the forward thinkers at ADC have designed the REIT’s freestanding retail portfolio specifically to survive and thrive in the age of e-commerce.

ADC April 2022 Presentation

As you can see in the image above, the freestanding format typically works best for omnichannel retailers, giving consumers maximum optionality in buying and receiving products.

Morgan Stanley (MS) analyst Ronald Kamdem explained in an April 1st note initiating coverage of ADC at Overweight (emphasis mine):

Agree Realty Corporation has the highest quality portfolio among triple net REITs and a large runway for growth. ADC partners with industry-leading and growing retail tenants to provide them 1) growth capital through sale leasebacks and 2) development capabilities, where ADC builds new stores for the retailer. The growth opportunity and the defensive characteristics of the business remains underappreciated, we think. Indeed, during the post-COVID period, the multiple premium to peers has derated from +46% to +3%. Thus, we see a compelling entry point for this high cash flow, low capex, and defensive business.

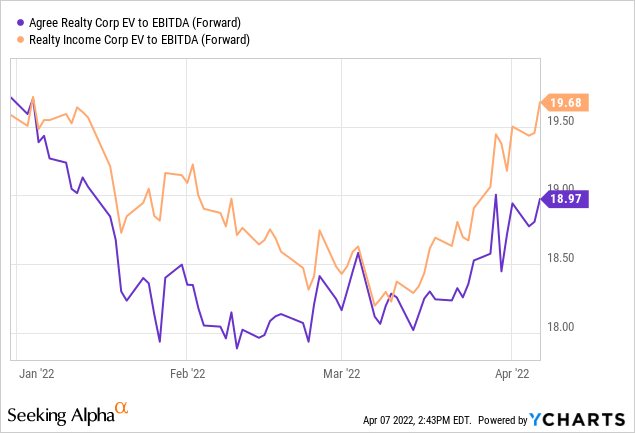

Let’s take a closer look at that last point – ADC’s valuation compared to peers. The peer it makes the most sense to compare against ADC is Realty Income (O), the venerated “Monthly Dividend Company.” Now, I like O as well and own a sizable position in the REIT, but I also recently gave “3 Reasons To Buy Agree Realty Instead of Realty Income,” and all three reasons remain true today.

ADC’s portfolio is far smaller and higher quality than that of O, and its cost of capital is substantially the same. And yet, ADC is cheaper than O by multiple measurements.

First and foremost, using analyst consensus estimates for 2022 AFFO, ADC trades at around a 17.5x multiple, while O trades at around an 18.2x multiple.

Moreover, on an enterprise value (market cap plus debt minus cash) to forward EBITDA basis, ADC is likewise cheaper than O.

As a sign of the REIT’s low valuation, President & CEO Joey Agree recently bought about $225,000 worth of shares in two separate open market purchases. Significant insider purchases like this have historically tended to represent good buying opportunities for investors who follow the insiders.

Over the last decade, shareholders of ADC have been rewarded with average annual dividend growth of 5.5%, and the most recent dividend represented 9.7% year-over-year growth. Oh, and did I mention that ADC now features a monthly dividend payout schedule?

When it comes to reliable compounders, it doesn’t get much better than ADC in my opinion. That is why “Agree Realty Is My Largest Holding.”

2. Main Street Capital (MAIN)

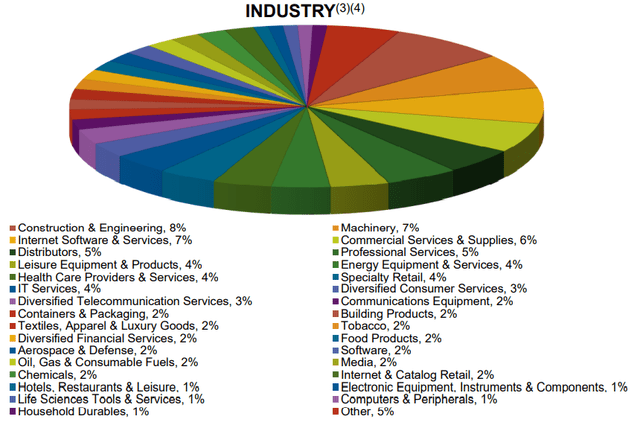

MAIN Q4 2021 Presentation

MAIN is arguably the highest quality, bluest blue-chip business development company (“BDC”) on the market. The company’s business model is to provide mostly debt and some equity capital to private, lower-middle-market companies that are otherwise bank-dependent for the purpose of acquisitions, recapitalizations, or leveraged buyouts.

Since MAIN’s customers are limited on their access to capital, the BDC’s loans typically bear interest at rates between 8% and 12%. Also, about 2/3rds of loans are floating rate, which means that MAIN should be a beneficiary of rising interest rates, all else being equal.

MAIN’s loan book is highly diversified, with its largest investment representing only 3.4% of total investment income.

MAIN Fact Sheet

At the end of 2021, only 9 of MAIN’s 184 portfolio investments, representing 0.7% of the portfolio at fair value, were on non-accrual status. This is impressive, given the elevated risk of making high-yield loans in this space.

MAIN is internally managed, and the management team has significant alignment with shareholders as they own roughly 5% of the company themselves.

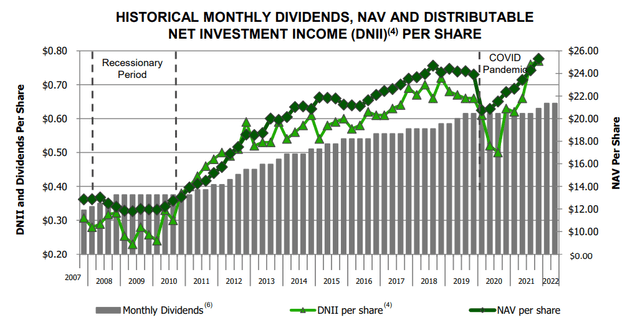

As BDCs go, MAIN is very conservative with its dividend. While many BDCs pay out substantially all distributable net investment income (“DNII”), MAIN maintains a buffer of retained cash flow. In 2021, for instance, monthly dividends totaling $2.475 per share represented a payout ratio of 88% compared to the year’s DNII per share of $2.81.

Having such a buffer is part of the reason why MAIN was able to maintain its monthly payout without a reduction during the two quarters in 2020 when DNII did not fully cover the dividend.

MAIN Fact Sheet

Notice also that MAIN’s net asset value per share has grown considerably since its 2007 IPO. This makes MAIN a rare breed of BDC, one that offers high total returns not only from income but also from capital appreciation.

Bottom Line

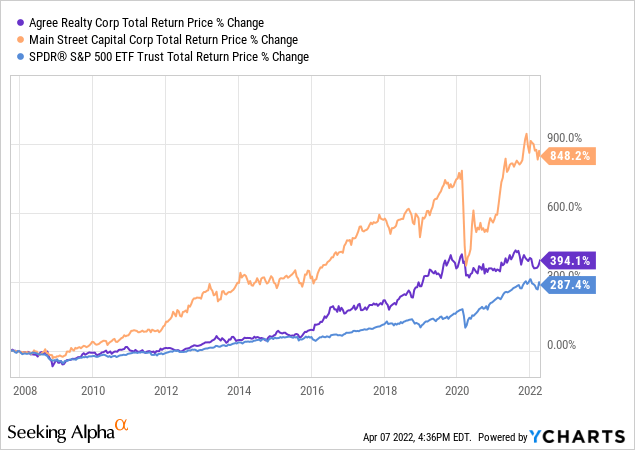

In my estimation, ADC and MAIN make a great pair of reliable compounders to own together. Both are blue-chips in their respective industries, but ADC benefits from falling interest rates while MAIN benefits from rising interest rates.

Through the compounding effect of paying high yields and regularly increasing dividends, both companies have beaten the S&P 500 (SPY) going as far back as MAIN’s IPO in 2007:

For core holdings in a dividend growth portfolio, look no further than ADC and MAIN.

Be the first to comment