MarkSwallow

Investment Thesis

“What if we could repair broken genes?” asks a rhetorical question on the front page of Editas Medicines’ (NASDAQ:EDIT) website. The problem for the Cambridge, Mass.,-based CRISPR gene editing specialist is that several of its rivals already have answered that question affirmatively in the clinic, while Editas’ lead clinical program has just suffered a significant setback.

Last month Editas announced clinical data from its Phase 1/2 BRILLIANCE clinical study of lead candidate EDIT-101, indicated for the treatment of patients suffering from Leber Congenital Amaurosis 10 (“LCA10”).

LCA has an incidence of ~3 per 100k live births worldwide, and the most common form of the disease is LCA10, caused by mutations in the CEP290 gene. EDIT-101, administered via a subretinal injection, is designed to delete the IVS26 CEP290 mutant allele.

Although EDIT-101 presented a favourable safety profile across all dose cohorts, its efficacy was disappointing. Only three of 14 patients dosed met the responder threshold of having experienced clinically meaningful improvements in best corrected visual acuity, and two of these three were homozygous for IVS26 mutation – a population of patients that numbers just 300 in the US.

As such, Editas has opted not to independently progress this program and will only do so if it can find a willing collaboration partner – which seems unlikely given the meager rewards on offer.

Editas was founded by members of the Broad Institute, MIT – Feng Zhang, George Church, Keith Joung and David Liu – and Nobel Prize winner (for her work discovering and developing CRISPR gene editing) Jennifer Doudna – in 2013. The company raised $94m in its 2016 IPO, at $16 per share.

Editas generally traded above its IPO price between 2016 and 2020, before spiking to an all-time high of $70 in December 2020 after the then-celebrated, and now much maligned biotech investor Cathie Wood – Chief Investment Officer at ARK Investment Management – highlighted CRISPR stocks as having the greatest upside potential in the genomics sector.

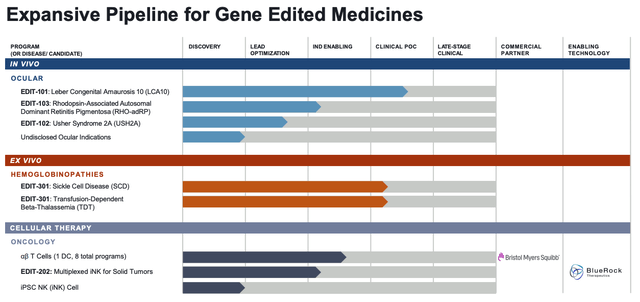

Editas current pipeline (investor presentation)

Studying the company’s current pipeline above, however, taken from a recent investor presentation, it’s hard to argue that Editas has lived up to its early promise as a CRISPR trailblazer.

After the failure of EDIT-101, none of Editas’ ocular therapies have yet made it into the clinic, whilst the company is still awaiting first clinical data from its Sickle Cell Disease (“SCD”) / Beta Thalassemia candidate EDIT-301, and as with the ocular candidates, none of its cellular therapies have made it past the Investigational New Drug (“IND”) enabling stage – IND’s must be approved by the FDA before in-human studies can begin.

Meanwhile, rival Crispr Therapeutics (CRSP) is likely to submit for a full approval of its SCD therapy Exa-Cel, which “functionally cured” 31 out of 31 patients in a pivotal study i.e. these patients became blood transfusion independent, in the early part of next year.

Another rival, Intellia (NTLA), has been able to successfully demonstrate that its lead candidate NTLA-2001 reduced TTR Serum levels in six patients with the disease Transthyretin (ATTR) Amyloidosis in vivo, a medical first.

It’s not too surprising then that while CRISPR Therapeutics stock is +185% since the company’s 2016 IPO, and Intellia stock 42% since its IPO in the same year, Editas stock is down 66%. Is there any reason to believe Editas stock can make a comeback?

I can think of three positives for investors to consider as we head into 2023, although further research suggests that each of these opportunities have their weaknesses. That makes the outlook for Editas – burning through cash at a rate of >$150m losses per annum, and likely years away from a commercial breakthrough, is somewhat gloomy, although a breakthrough with one of its ocular in vivo therapies, or a decisive patent dispute win, could still see the company complete an unlikely reversal in fortunes.

Editas Holds Edge In Patent Dispute

Back in 2014 Jennifer Doudna left Editas to become a Scientific Co-founder at Intellia, and although Intellia has made better progress in the clinic than Editas, especially in vivo, arguably, Editas and its Broad Institute founders are in a more advantageous position when it comes to a long running patent dispute with Doudna, her fellow Nobel Prize winner Emanuell Charpentier, the University of Berkeley, Calif., and University of Vienna – collectively referred to as “CVC.”

Both the Broad Institute and CVC have been involved in a long running patent dispute, over who holds the patent rights to a CRISPR-Cas9 system that works in eukaryotic cells – i.e. cells with a nucleus, which includes humans. At the end of February this year, the Patent Trial and Appeal Board (“PTAB”) of the US Patent and Trademark ruled against CVC and in favour of The Broad Institute, stating that:

We base our decision on the facts that the CVC inventors encountered multiple experimental failures before they recognized any success, even as late as mid-October 2012

CVC will doubtless appeal this judgment since they claim that the Broad Institute could not have progressed their own discoveries without learning from CVC about single molecule RNA guides that are an essential component of CRISPR based editing, and that Broad’s adaptation of CRISPR to target eukaryotic cells represents and obvious rather than inventive alteration, that should not be patentable in itself.

As things stand, however, it ought to be very interesting to see how matters play out should e.g. CRISPR Therapeutics win approval for Exa-Cel next year. A statement in the risk section of CRISPR Therapeutics’ 2021 10K submission reads as follows:

Third parties asserting their patent rights against us may seek and obtain injunctive or other equitable relief, which could effectively limit or block our ability to further develop and commercialize our product candidates.

If we are found to infringe a third party’s valid intellectual property rights, we could be required to obtain a license from such third party to continue developing and marketing our products and technology, or avoid or invalidate such third party’s intellectual property.

These third parties would be under no obligation to grant to us any such license and such licenses may not be available on commercially reasonable terms or at all, or may be non-exclusive.

Editas shares gained in the aftermath of the PTAB’s February decision – shares rose from $14.5 in mid February to a high of $21 by early April. If Crispr Therapeutics were to be unable to market and sell Exa-Cel, or be forced to delay its launch, it would grant Editas more time to attempt to gain approval for EDIT-301.

Today, Editas released some positive data relating to the first two patients with SCD treated with EDIT-301 in its Phase 1/2 RUBY trial. According to the press release, both patients “demonstrated successful neutrophil and platelet engraftment,” and “neither patient has experienced any vaso-occlusive events since treatment.”

Although the follow up period is only five months and 1.5 months for the two patients respectively, it’s not beyond the realms of possibility that Editas could design and bring to market a successful SCD/TDT ex vivo drug in much the same way that CRISPR Therapeutics has. Could it be possible that Editas could bypass its rival and get to market first?

Ultimately I think this may be too much of a long shot for Editas. For one, Crispr Therapeutics has a powerful partner with Exa-Cel in the form of >$80bn market cap Cystic Fibrosis Vertex (VRTX), which will receive a 60% share of all net sales of the drug. Vertex has paid billions of dollars to secure this partnership and management will doubtless have done its due diligence on the patent issues.

For another, the entire CRISPR patent landscape is so complex and nuanced – besides the Broad Institute, CRISPR Therapeutics also has disputes with Vilnius University, ToolGen, Merck KGaA subsidiary MilliporeSigma, and Harvard University – that it simply may not be possible for Editas or the Broad Institute to hinder CRISPR’s progress.

The court cases could easily rumble on for another decade, with CVC launching appeals against the Broad Institute’s attempts to prevent them launching Exa-Cel. CRISPR Therapeutics and the Broad Institute could even agree a licensing arrangement that works out better for Broad than its licensing deal with Editas does.

As such, although Editas does hold a significant advantage over its CVC licensing rivals, and may now be making its SCD/TDT programs top priority, Exa-Cel – and additionally Bluebird Bio’s non-CRISPR gene therapy Lovo-Cel, are a long way ahead in the race to market, and a potential $2 – $4bn peak sales opportunity (see my note on CRISPR Therapeutics for more colour on the market opportunity).

Editas Is Cash Rich

In its last set of earnings (Q322) Editas reported a cash position of $479m and a net loss of $55.7m for the quarter, and net loss of $160m for the first three quarters of 2022.

Management says that funds will last until 2024, which means two things. Firstly, that Editas can throw a lot of financial resources at EDIT-301 next year and make every effort to bridge the gap to CRISPR Therapeutics, Bluebird, and also Pfizer (PFE), whose recent acquisition of Global Blood Therapeutics for $5.4bn gives it control of approved SCD therapy Oxbryta and long-term replacement GBT601, and a peak sales opportunity of $3bn per annum, Pfizer believes.

Secondly, it puts enormous pressure on Editas to deliver some success because its cash burn is undoubtedly high (cash burn is probably the single biggest turn off in relation to gene therapy for investors) and the company will need to raise money again soon – likely via a dilutive share issuance. Management will want to complete such a raise after a positive news event that is share price accretive. If no such catalyst arrives, Editas will be forced to significantly scale down operations in order to remain solvent.

Editas’ R&D expenditures increased from $29.3m in Q321 to $41.3m in Q322, while G&A costs remained stable at $16.2m. There are presently no cost of sales or marketing costs since Editas has no commercial products, but should EDIT-301 enter a pivotal trial and succeed, Editas will need to fund a product launch and make a host of new hires. That won’t be easy if it’s only the third or fourth gene therapy to win approval in SCD/TDT.

Unlike Crispr Therapeutics, Editas does not have a co-development partner with deep pockets, either, so there are no collaboration revenues to speak of. Last year, Crispr received a $1bn payment form Vertex to increase its share of Exa-Cel revenues from 50%, to 60%. Crispr Therapeutics’ working capital currently stands at $1.8bn.

Editas Is Working On Cell Therapies With Bristol-Myers Squibb

The pharma giant Bristol-Myers Squibb (BMY) inherited two pipeline cell therapy assets from its $74bn acquisition of Celgene, both of which they have been able to successfully secure full approval for.

Breyanzi, indicated for B-cell lymphoma, and Abecma, approved for multiple myeloma, are both forecast to make peak sales >$1bn, making them so-called “blockbuster” drugs.

As such, investors can possibly take some positives from the fact that BMY and Editas are collaborating on a program of CAR-T and allogeneic (donor derived) therapies targeting T-cells. According to an Editas investor presentation, Editas has received >$125m in development milestone payments to date from BMY, and BMY has opted into eight programs altogether.

With that said, to date there’s only a single candidate in clinical development. The cell therapy field is finally beginning to turn clinical promise into commercial success, generating some outstanding results in hematological cancers, but again, Editas’ development process seems to have been somewhat slow and the prospect of a first commercial drug in this field likely remains two to three years away.

Conclusion – I don’t See Editas Recapturing $1bn Market Cap Valuation In 2023

I may have been somewhat critical of a gene therapy pioneer in Editas in this post, but unfortunately, when a biotech is forced to shelve development of its lead product candidate, it’s almost inevitable that its valuation will shrink and analysts will ask searching questions about pipeline depth, funding, and management oversight.

It’s no secret that gene editing in vivo is exceptionally hard to achieve – since its breakthrough with NTLA-2001, Intellia has barely made much progress – and after the failure of EDIT-101 – or rather its very limited efficacy, making further development economically unviable – Editas’ Ocular program is under real pressure.

EDIT-103, indicated for rhodopsin-associated autosomal dominant retinitis pigmentosa (“RHO-adRP”), a progressive form of retinal degeneration, brings some new features that EDIT-101 did not have – such as dual adeno-associated virus (“AAV”) knocking out and replacing of a misfiring gene within the same therapy. The development path looks to be a long one, but Editas could still achieve best-in-field results for an in-vivo therapy, which could revive its fortunes overnight.

Shrinking finances won’t help on that front, and may need to be diverted for a push into SCD/TDT with EDIT-301, coupled with a patent challenge against CRISPR Therapeutics. This project is beginning to look like Editas’ best shot at developing a commercial product, although as discussed, the chances of beating rivals to market look remote, which significantly impacts the market opportunity.

BMY is a powerful partner but a partnership that has lasted seven years already has not borne much fruit to date, even while BMY has launched two ex-vivo cell therapies of its own.

As such, my outlook for Editas in 2023 is slightly gloomy. I’m a Crispr Therapeutics long and despite the patent threat I continue to see it as the best CRISPR investment as commercialization beckons for its Exa-Cel therapy.

Nevertheless, so long as Editas has an in-vivo program focused on a field where CRISPR could undoubtedly make a huge difference for patients, and so long as the Broad Institute / CVC patent dispute rumbles on, Editas remains a dark horse on the CRISPR scene.

A breakthrough on either of these fronts could trigger a sudden reversal of fortunes that would drag the share price upwards by triple-digit percentage. That breakthrough needs to happen ideally in 2023, as current funds will begin to become exhausted after 2024.

Be the first to comment