Portra

Investment Summary

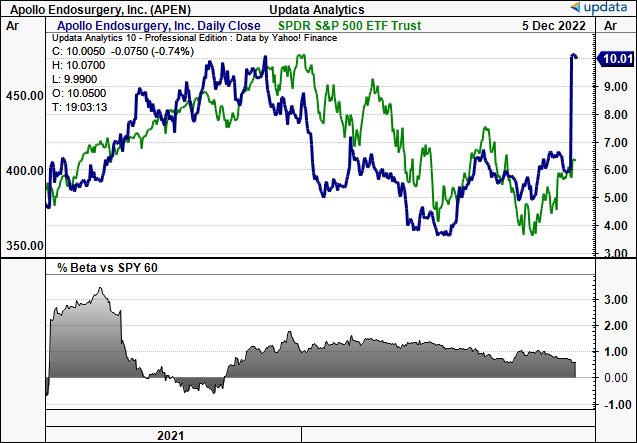

Since our last examination on Apollo Endosurgery, Inc. (NASDAQ:APEN) we can gladly say there’s been a number of developments in its Journey. On November 29th, Boston Scientific (BSX) agreed to buy APEN on a valuation of $10 share, for an all-cash $615mm consideration. The deal is expected to close in H1 FY23.

The market was swift to react with shares racing to the $10 mark immediately after the announcement, where it’s since held the line. Those familiar with M&A activity in the broad healthcare spectrum are adamant that BSX’s deal will be matched or outbid from potential competitors. Our last analysis valued the stock at c.$8 or 4.3x book value, hence BSX is set to pay slight premium on that valuation. To be fair, we are in the camp that thinks there will be another bidder enter the race to acquire APEN. This would be terrific for longs holding the stock, and we’d be looking at a situation where $12–$14 per share could be more appropriate in our view.

Running the scenario where there will be other entrants in the APEN acquisition race, we’re back here today to give a deeper insight into what the emerging player in bariatric surgery has on offer. From this, we believe investors will be able to make a more informed decision on the stock.

Exhibit 1. APEN price evolution vs. S&P 500

Data: Updata

APEN: Novel, innovative procedures in bariatrics’

We had mentioned in our last publication that APEN received FDA approval for de novo marketing of the APEN ESG and Apollo REVISE devices.

Whilst we didn’t go into lengths about the actual procedures themselves, this appears to be the main segment that’s piqued BSX’s interest.

Regarding the acquisition, BSX CEO, Mike Jones said the med-tech giant was aiming to “expand [its] global capabilities” in endoluminal surgery (“ELS”) with APEN’s portfolio.

In order to gauge the market here, we feel it’s prudent to take a step back and understand the market, and the segment APEN operates in.

Obesity is a major global health problem, with nearly 650 million people worldwide affected by the condition. Weight-loss surgery is one of the most effective treatments for obesity, but is associated with a number of risks and potential complications. Enter, APEN and ELS.

Endoluminal surgery is a type of minimally invasive surgery performed within the ‘lumen’ [opening] of the esophagus, intestines, or uterus. Endoluminal surgery typically involves inserting a small device through the lumen of the organ and using various tools to perform the procedure. Endoluminal surgery is commonly used for diagnostic and therapeutic purposes, such as treating obesity, cancer, and digestive system diseases.

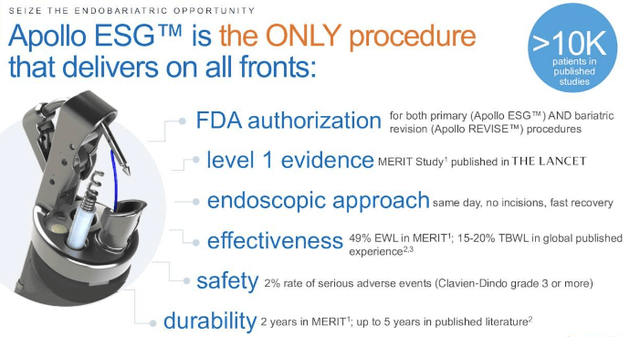

With respect to APEN, it’s endoscopic sleeve gastroplasty (“ESG”) segment is one key offering. ESG is a minimally invasive procedure used to treat obesity. The procedure is performed with an endoscope, a thin tube with a camera and a light at the end. During the procedure, the doctor uses an endoscopic suturing device to reduce the size of the stomach by placing a number of sutures in the stomach wall. This reduces the stomach’s capacity and makes a person feel full faster, helping them to lose weight.

Exhibit 2. APEN ESG statistics

Data`: APEN Q3 FY22 Investor presentation

Apollo ESG is an advanced, single–port endoscopic system. This setup purportedly allows for improved patient access, increased visualization, and increased maneuverability during endoscopic procedures. Additionally, Apollo ESG allows for increased safety and accuracy by enabling multiple instruments to be used simultaneously in the same access port. Furthermore, Apollo ESG was found to reduce procedure times by up to 25%, resulting in cost savings for hospitals and increased patient satisfaction

Meanwhile, APEN’s REVISE device is designed to reduce the risks and potential complications associated with weight–loss surgery by providing a safe and minimally invasive solution. The Apollo REVISE device is a single–incision adjustable gastric banding system. It is designed to restrict the amount of food the stomach can hold, which in turn helps the patient achieve weight loss.

The device is adjustable, allowing the surgeon to adjust the size of the gastric band to ensure it is the most effective size for the patient. It has been extensively studied in clinical trials, with results showing that it is effective in producing significant weight loss. The device has also been found to be safe, with low rates of adverse events and no reports of serious complications.

The device has been proven to be effective in controlling hunger and food cravings, as well as in reducing BMI and waist circumference. Additionally, the device can be used in revisional surgery for a previous weight–loss procedure or to adjust the size of a gastric band.

With this critical information in mind, investors should feel more comfortable about the potential for a higher bid from a key BSX competitor, in our estimation.

Q3 financial results summary

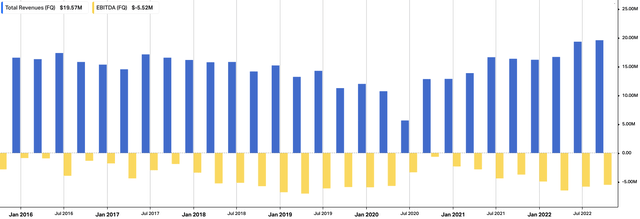

Switching to the quarterly numbers briefly, and we’d note it was a reasonably strong period of growth for APEN. It reported growth of nearly $5mm in its endoscopic surgery system (“ESS”) portfolio in Q3, up 45% in constant currency and 41% on a GAAP basis. This includes the Overstitch segment. In the U.S., this grew by 29%, with the ESS portfolio up $3 million, or 41%, driven by OverStitch adoption in endobariatric accounts, and a contribution from X–Tack defect closure.

We also noted that Orbera intragastric balloon sales saw a decrease of $200,000 due to summer seasonality and macroeconomic conditions.Outside the US., volume increases for OverStitch were offset by higher distributed revenue mix.

Moving down the P&L, gross margin was flat on a constant currency basis versus prior year, and down 150bps on a GAAP basis. Management believe that overhead absorption, direct COGS improvement programs and recent price increases should drive gross margin expansion to mid–60% in the medium term.

OpEx increased with a focus on building capabilities to drive both near and long–term growth. The most significant expense was in sales and marketing in the U.S. running at 42% of revenue in the second quarter. Foreign currency headwinds had a $700,000 impact on year–over–year growth. We’d note that APEN realized a larger forex headwind due to its large O–U.S. footprint.

As seen in Exhibit 3, quarterly revenue continues to lift for APEN whilst core EBITDA remains in the negatives.

Looking ahead, APEN increased FY22 full year guidance to $75–76 million, implying 19–21% growth on GAAP basis and 25% on constant currency.

This is further evidence of APEN’s propensity to generate value above the $10/share offer from BSX in our opinion.

Exhibit 3. APEN quarterly revenue, core EBITDA since FY16.

Data: HBI, Refinitiv Eikon, Koyfin

Valuation and conclusion

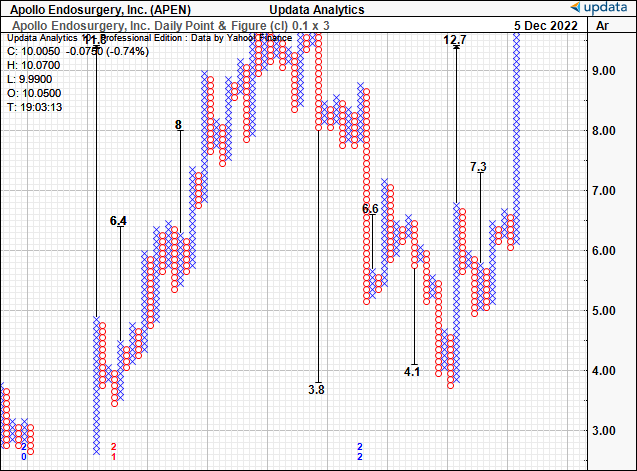

APEN soared past our last price objective of ~$8 on the back of the BSX announcement. It now trades at more than 9.9x book value, and ~5.7x forward EV/sales.

In addition, there’s technical price targets to $12.70 from our point and figure studies on APEN below. Rolling APEN’s FY22 sales estimates forward and assigning the 5.7x multiple sets a target of $10.40, a slight premium to BSX’s offer.

However, if the company can outpace its FY22 revenue forecasts by 10% to $83.6mm, then we’d see the stock more fairly valued at ~$11.45 per share.

Hence, there’s mobility around the valuation debate for APEN, and any upsides on its FY22 revenue forecasts is a bedrock to attract investor attention, in our opinion.

Exhibit 4. Technical upside targets to $12.70.

Data: Updata.

Net-net, we continue to rate APEN a buy following the BSX announced acquisition. We feel there is a solid springboard for additional entrants to make their voice heard in the APEN acquisition race.

Be the first to comment