bjdlzx

Now that the final variant of the proposed tax changes, regarding oil companies, in Colombia have become law, it’s worth taking a closer look at the national oil producer – Ecopetrol (NYSE:EC). Benefiting from the high oil price environment, the company has achieved impressive results. Its dividend policy makes it an attractive option for income-oriented investors. Although there’s significant amount of debt on the balance sheet, the cash flow generation capabilities of the company make it manageable. That being said, as considerable portion of it comes due in 2023, if rolled over, interest expenses should increase, due to the higher interest rates environment. Looking at the Colombian oil sector as a whole, Ecopetrol appears to be the most expensive at the moment.

Tax changes in Colombia

Following months of speculations and different variants of the changes, in the beginning of November, the tax reform in Colombia have been approved by Congress. The new law includes additional taxation of oil companies’ profits when international prices surpass US$67.3/barrel. The surcharge will be 5% when prices are between US$67.3 and US$75 per barrel, 10% when between US$75 and US$82.2 and 15% if international oil prices are higher. It appears that the additional taxation won’t be marginal in nature, but will be applied on the entire net income. This could be confirmed by the earnings call of Ecopetrol, where Jaime Caballero, CFO of the company has said:

And depending on your price outlook, you need to add either 5%, 10% or 15% to that. In the highest possible case which is in a scenario where we end up over the $83-or-so per barrel kind of threshold that kicks in the 15% surcharge that tax effective rate is going to go to about 50%, right? And it’s 50% on our total net income in pesos. So that’s the way that you need to calculate it.

Regarding the effects on Ecopetrol, it’s worth mentioning that part of the business, which is not related to oil and gas, won’t be affected by the changes, but it has to be kept in mind that the lion’s share of profit comes exactly from oil and gas.

Company overview

Ecopetrol is presenting itself as a diversified energy company, although the vast majority of the of both revenue and profitability comes from the core business – oil and gas, which is projected to account for 82% of 2022 EBITDA. The transmission segment is forecasted to account for 17% of EBITDA.

Ecopetrol’s business (Ecopetrol)

The company has 41.1B shares outstanding with the majority owner with 88.49% being the Colombian government. There’s a NYSE listing of ADRs of the company, with one ADR equal to 20 ordinary shares.

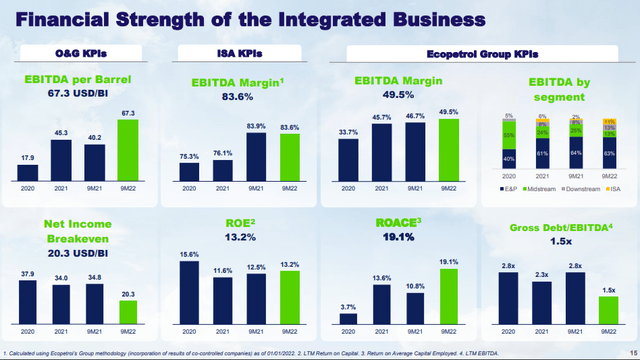

Strong performance in 2022

In Q3’22, production came at 720.4kboe/day (+5.4% YoY). Growth was also recorded in the midstream segment, where the company transported on average 1,074.8kboe/day (+6.2% YoY). The downstream segment increased its production too, which reached 395kboe/day (+11.6% YoY), while refining margins more than doubled YoY to US$20.3/barrel. Average realized prices for Brent were US$97.7/barrel (+33.5% YoY). Revenue for the quarter amounted to US$9.4B (+54.2% YoY), while net income more than doubled to US$2B.

Ecopetrol’s 2022 results (Ecopetrol)

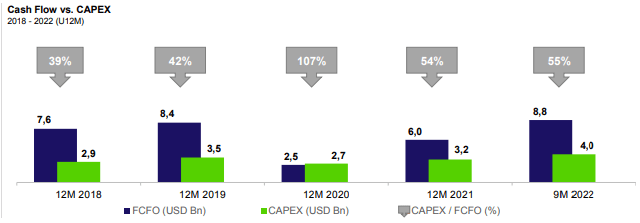

Revenue for the Jan-Sept’22 period reached US$28.6M (+78.7% YoY), while net income for the period advanced 123.2% YoY to US$6.3B. In terms of cash flows, Ecopetrol has generated US$8.8B of cash in the 9M’22 alone, more than for the entire 2021.

Cash flow generation (Ecopetrol)

The company is a regular dividend distributor, as in 2022 US$1.46/ADR of ordinary payment was made, which was followed by US$0.80/ADR of extraordinary dividend. This brings the dividend yield at around 22.6%, which is among the highest in the industry. I don’t expect any major changes to the generous payout going forward, since 88.5% of the shares are owned by the government and it needs the revenue.

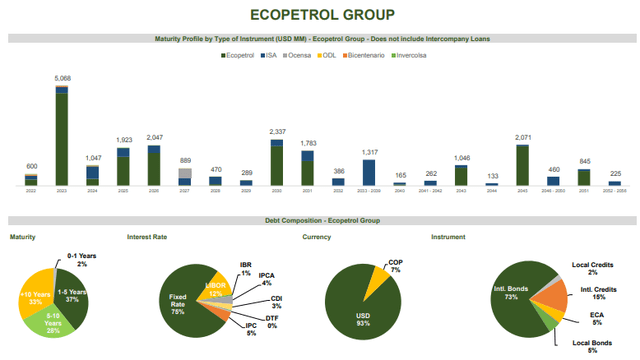

Debt is high, but manageable

Ecopetrol’s debt structure (Ecopetrol)

Turning to the balance sheet, it appears that the company has quite a lot of debt. As of the end of Q3’22, total debt is around US$23.4B, while net debt stands at US$20.1B. For reference, the current market cap of Ecopetrol is slightly below US$21B. With the significant cash flow generation capabilities of the company, the debt looks manageable. However, looking at the maturity schedule, more than US$5B have to be either paid or refinanced in 2023, which could lead to increase of the interest expenses, due to the higher interest rates environment.

Share price and valuation

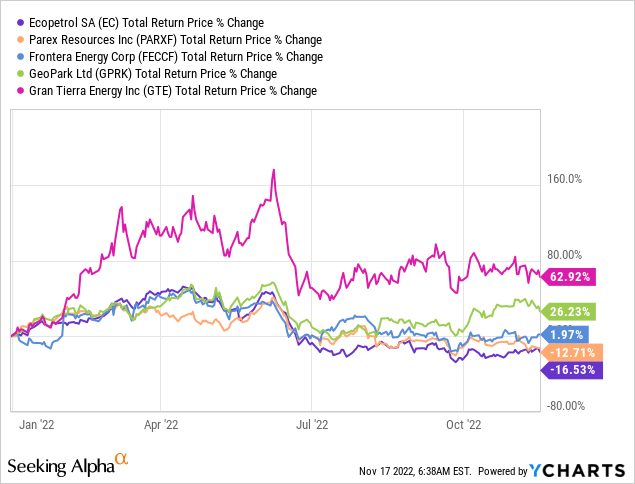

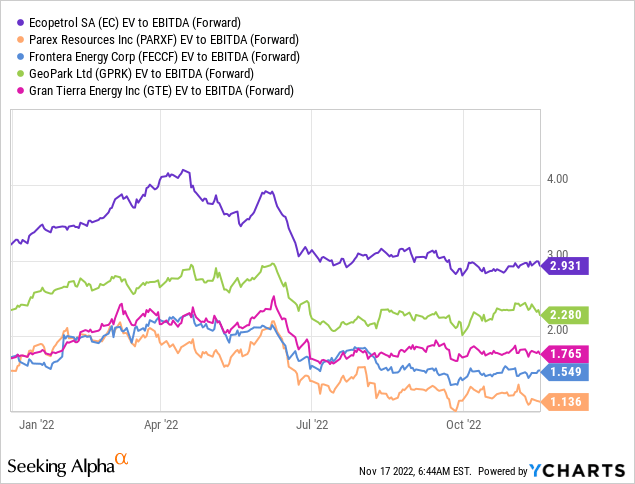

Looking at the YtD performance of Colombian oil companies – Parex Resources (OTCPK:PARXF), Frontera Energy (OTCPK:FECCF), GeoPark (GPRK) and Gran Tierra (GTE), it appears that Ecopetrol had the worst performance so far. In terms of valuation I’ll compare Ecopetrol’s Forward EV/EBITDA to the same peer group.

It turns out, that Ecopetrol’s Forward EV/EBITDA is considerably higher than that of the peer group. A possible reason for that could be the size of the company and the diversification of the business – after all the peers are more or less pure-play oil and gas, while Ecopetrol has other income streams. That being said, oil and gas production contributes to the vast majority of Ecopetrol’s EBITDA, therefore it should largely be valued as an oil and gas company. In addition, I think that the government being the majority owner should come with a discount, relative to peers.

Risks

The main risk towards Ecopetrol, besides falling oil prices would be some radical shift in strategy. The company has laid out a plan for gradual reduction of oil and gas contribution to EBITDA to around 60% of the total, while energy transition is projected to reach 14% share. That being said, the newly elected president of Colombia – Gustavo Petro is famous for his anti-oil stance. And while existing exploration contracts of the companies will be honored, as the largest shareholder in Ecopetrol, the government may force a more radical shift away from fossil fuels on a company level. That could hurt the profitability going forward. That being said, oil and gas revenues are quite important for Colombia’s budget, so reason my prevail.

Conclusion

In the current oil prices environment, Ecopetrol is a cash flow machine. It has manageable debt and pays a large dividend. Now that the tax reform, regarding oil companies, have become law, the uncertainty, surrounding Colombian entities, should decrease. However, looking at the peer group, it appears that there are cheaper alternatives to get oil exposure from Colombia.

Be the first to comment