piyaset

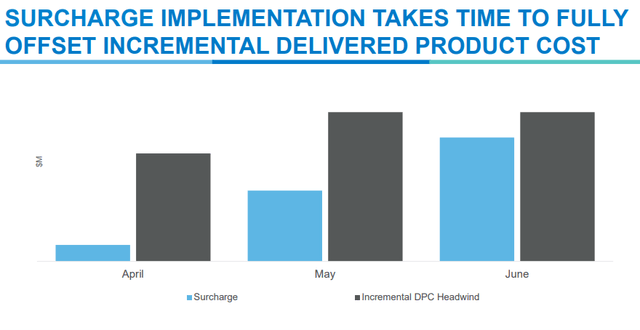

After our initiation coverage of Ecolab (NYSE:ECL), today we are back to comment on its Q2 results. In our previous publication, we highlighted that inflationary cost pressure was not offset by higher selling prices, resulting in lower profitability. This opened a window of opportunity to buy the clear leader in the water treatment industry. As we already mentioned, Ecolab is a perfect mix between growth and value. And to sum up, our buy case recap was based on the assumption of a jet lag between higher cost and pass-through actions, coupled with a “doing good while doing well” ESG company, and a fragmented market in which Ecolab has the financial potential to acquire smaller M&A players and further consolidate its market-leading position.

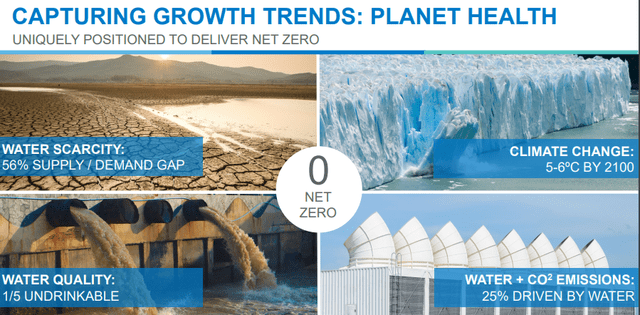

Aside from the typical ESG consideration, we should note that water scarcity is going to be a key secular long-term opportunity within the sector. In Europe, we are having a summer with no rain and many governments are applying rules to limit water usage. This trend coupled with population growth should be a positive catalyst for medium-long term price appreciation.

Q2 results

Looking at the Q2 performance, we can clearly note that Ecolab’s results were in line with the June release. The company delivered a mixed quarter. On a positive note and despite the ongoing cost inflationary pressure, gross margin was stabilized. Concerning the specific divisions, here below are the key takeaways:

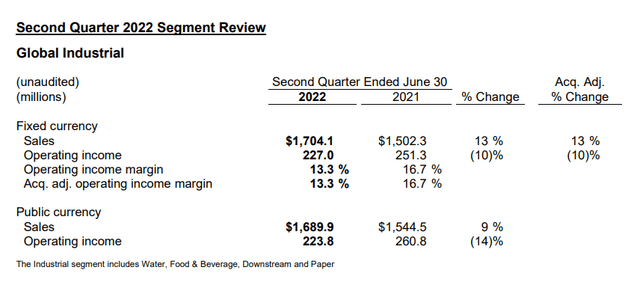

- Global Industrial operating profit declined by more than 10% despite a positive contribution from higher sales that deliver a plus 13%. This was due to higher energy costs. Strong growth was recorded by the paper sub-sector, whereas refinery weighed to the downside;

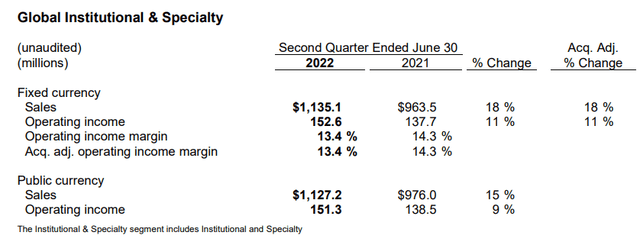

- Global Institutional & Specialty operating profit was lower than the previous year’s results but it was a beat compared to Wall Street analyst consensus estimates. Top-line sales increased by 18% thanks to institutional sales performance;

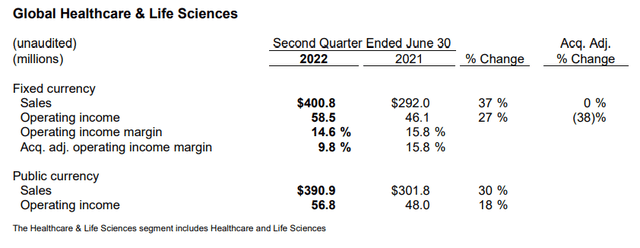

- Global Healthcare & Life Sciences and Other operating profits were mixed. Life Sciences EBIT increased by 10%, but Healthcare operating profit significantly decreased. This was mainly due to a decrease in using hand sanitizer in Europe.

Global Industrial result Global Institutional & Specialty result Global Healthcare & Life Sciences result

Conclusion and Valuation

The next company catalyst is the NYC conference which will be presented on the 13th of September. After the Q2 results and adjusting our internal model, we are now forecasting two headwinds. Thus, we reduced our 2023 EPS from $6.40 to $6.10, this is due to minus $0.10 from currency FX and minus $0.20 for higher energy price and more jet lag time to pass through cost inflation. We are maintaining the same P/E multiple, but we slightly lower our valuation from $185 to $180 per share.

Be the first to comment